Understanding TDS/TCS Issues for AIN Holders in Taxation Seminar

Explore key topics such as AIN application process, AIN 24G remittance, and challenges with bogus TAN holders misusing AINs in filing tax returns. Learn about the implications of incorrect Form 24G entries and the need for vigilance in TDS procedures.

2 views • 29 slides

Achievements of the Reserve Bank of India

The Reserve Bank of India has achieved significant milestones including implementing a flexible monetary policy, maintaining a stable structure of interest rates, modernizing banking and credit structures, offering cheap remittance facilities, effectively managing public debt, and ensuring exchange

2 views • 14 slides

The Crucial Role of Compliance in Payroll Management Software!

Payroll management software is essential for businesses of all sizes, automating processes like wage calculation and tax deduction. Compliance ensures adherence to legal frameworks, safeguarding against penalties and fostering trust. Key features include robust security measures, tax compliance capa

3 views • 9 slides

Understanding Inductive and Deductive Reasoning

Inductive reasoning involves drawing general conclusions from specific observations, while deductive reasoning starts with general premises to derive specific conclusions. Induction uses experience or experimental evidence to make broad conclusions, while deduction follows from general to specific.

5 views • 7 slides

Lowering the Burden: Tax Deduction Strategies for NRIs in England from India

Discover efficient tax deduction strategies tailored for Non-Resident Indians (NRIs) residing in England but originating from India. Our comprehensive guide, 'Lowering the Burden,' explores nuanced tax-saving approaches, ensuring NRIs maximize benefits while meeting legal obligations. From understan

4 views • 3 slides

Analyzing Inferences from Visual Cues

Explore a series of visual scenarios and make inferences about the individuals depicted based on their grocery lists, interactions, activities, and emotions. From discerning personal habits to predicting future events, each image provides a unique context for observation and deduction.

0 views • 57 slides

section 16 (2)

When an individual earns a salary of more than Rs 2.5 lakhs per annum, Tax Deducted at Source or TDS is applied to the income received. This deduction is applied every time your salary is credited to you. Over the course of a financial year, there will be 12 TDS deductions on your salary only.

0 views • 7 slides

Estimation Mystery: How Many Discs in the Container?

Explore the mystery of how many discs are in a container by analyzing clues and narrowing down possibilities. Through estimation and deduction, arrive at the final answer of 44 discs. Test your estimation skills with this interactive challenge.

0 views • 6 slides

Structuring Mergers, Acquisitions, and Private Equity Recaps: Tax Implications for S Corporations

Explore the tax implications for S Corporations in mergers, acquisitions, and private equity recaps, focusing on changes brought by the Tax Cuts and Jobs Act of 2017. Topics include income tax rate changes, dividends received deduction, and the Corporate AMT.

0 views • 95 slides

Interactive Esti-Mystery Chart Activity for Classroom Engagement

Engage your class with interactive Esti-Mystery charts to enhance math skills through estimation and deduction. Choose from different sets based on your classroom needs for in-person or distance learning. The activity involves narrowing down possibilities based on clues provided as students estimate

1 views • 19 slides

Functions of Commercial Banks Explained

Commercial banks provide a range of services beyond their primary functions, acting as agents for customers in collection and payment of credit, purchase and sale of securities, trustee and executor roles, remittance of money, and representation and correspondence. Additionally, they offer general u

0 views • 7 slides

Engaging Math Activity with Esti-Mysteries: Interactive Charts and Clues

Dive into an engaging math activity utilizing Esti-Mysteries, where students work on narrowing down possibilities based on clues to determine the number of erasers in a vase. Choose from different sets of slides depending on your classroom setup, from traditional writing methods to interactive digit

0 views • 19 slides

Esti-Mystery: The Melting Ice Cubes Puzzle

Explore the Esti-Mystery of determining the number of ice cubes in a glass with a series of clues narrowing down the possibilities, leading to the final revelation of 41 ice cubes. Engage in estimation and deduction to solve this fun and challenging puzzle presented in a creative way with food color

0 views • 6 slides

Understanding Deductions in Taxation

Explore the essentials of tax deductions in Module 5, including how to calculate taxable income, lower taxable income plus income taxes, differentiate between Standard and Itemized Deductions, select the appropriate deduction for a client's return, and identify expenses covered by Itemized Deduction

0 views • 20 slides

TransferWise Strategic Analysis for Dominating the Remittance Services Market

In this detailed strategic analysis by EAST COAST GLOBAL CONSULTING, the focus is on how TransferWise can dominate the remittance services market and achieve a zero-fee target. The analysis covers key issues, objectives, recommendations, challenges, and the international remittance environment. It h

0 views • 38 slides

Achievements of the Reserve Bank of India

The Reserve Bank of India has achieved significant milestones in areas such as implementing a flexible monetary policy, maintaining a stable structure of interest rates, modernizing banking and credit structure, providing cheap remittance facilities, and successfully managing public debt. Additional

0 views • 14 slides

Evolution of Computer Logic: From Axioms to Natural Deduction

Delve into the fascinating pre-history of computer logic, starting from David Hilbert's foundational problems in mathematics to the development of the Dedekind-Peano axioms for natural numbers. Explore Hilbert's finitist consistency program and the evolution of logic systems from Hilbert's axioms to

0 views • 26 slides

Impact of 2018 Tax Act: Key Changes Explained

Explore how the new 2018 tax act impacts taxpayers, including changes to deductions, tax brackets, and the SALT deduction. Learn about the standard deduction increase, personal exemptions elimination, new tax brackets, and more insights from a CPA.

0 views • 34 slides

Navigating Disruption: TransferWise's Path to Market Leadership

TransferWise, a key player in the remittance industry, faces challenges from disruptive technologies and regulatory issues. To maintain its competitive edge, TransferWise must address concerns like money laundering, embrace blockchain innovation, redefine banking relationships, and aim for zero tran

0 views • 27 slides

Role of Institutional Quality on Remittances and Economic Growth in Sub-Saharan Africa

The study explores the impact of institutional quality, both financial and non-financial, on the relationship between remittances and economic growth in Sub-Saharan Africa. It delves into how factors like control of corruption, political stability, rule of law, and democratic accountability influenc

0 views • 18 slides

Exploring Modern Political Ecologies and Resilience Landscapes

Dive into the intersection of social, ecological, and political dynamics shaping modern landscapes, with a focus on remittance economies, land use, governance, and sustainability. Analyze the impact of diverse socio-environmental organizations on local, regional, and global landscapes, recognizing t

0 views • 17 slides

Code Assignment for Deduction of Radius Parameter (r0) in Odd-A and Odd-Odd Nuclei

This code assignment focuses on deducing the radius parameter (r0) for Odd-A and Odd-Odd nuclei by utilizing even-even radii data from 1998Ak04 input. Developed by Sukhjeet Singh and Balraj Singh, the code utilizes a specific deduction procedure to calculate radius parameters for nuclei falling with

1 views • 12 slides

Evolution of Legal Process Taxes in County Clerk Offices

Explore the historical progression of legal process taxes related to marriage licenses, property conveyance, and other transactions as mandated by KRS 142.010. Delve into the changes in tax rates and base over time, along with the reliance on these taxes for revenue generation. The receipts of legal

0 views • 9 slides

Strategic Recommendations for TransferWise in the Banking Industry

TransferWise faces the challenge of defending against the Blockchain threat to become the top FX remittance provider globally. Recommendations include creating a Digital Financial Ecosystem named Argent, hiring key executives in Compliance and IT Security, and engaging Consensys Blockchain Consultin

0 views • 24 slides

Swift Worker Remittance Solution for Mobile Financial Services

SWIFT provides a comprehensive solution for worker remittances enabled for mobile channels, offering secure financial messaging services for international migrants. The market overview showcases the significant industry revenue and annual transactions in the worker remittance sector, highlighting th

0 views • 11 slides

Youth Employment and Remittances in Macedonia: A Study of Opportunities and Challenges

Investigating the impact of remittances on youth employment in Macedonia, this research explores the motivations, challenges, and potential solutions in light of high unemployment rates and significant remittance inflows. Issues such as job creation, credit constraints, and consumption patterns are

0 views • 22 slides

Overview of Association of Fundraising Professionals (AFP) and Charitable Act Impact

AFP comprises 27,000+ members across 180 chapters globally who raise over $115 billion annually for charitable causes. Members must adhere strictly to the AFP Code of Ethics, promoting honesty, integrity, and transparency in fundraising efforts. The Charitable Act (S.566/H.R.3435) aims to renew the

0 views • 5 slides

Financial Arrangement Proposal for ENC Distribution by EA-RECC in Bali, Indonesia

The proposal outlines the financial arrangements for the distribution of Electronic Navigational Charts (ENCs) by EA-RECC in Bali, Indonesia. It covers the role of EA-RECC in ENC distribution, levy for ENCs services, agreements with distributors, remittance arrangements, and more. EA-RECC aims to ef

0 views • 12 slides

Understanding Logic in Research: Abduction, Deduction, and Induction

Explore the fundamental concepts of logic in research including abduction, deduction, and induction. Learn about hypothesis testing, material implication, and the relationship between theory and data. Gain insights into how knowledge is generated through accumulating data and the self-correcting pro

0 views • 28 slides

Enhancing Remittance Data through Price Comparison Websites

This document discusses the potential role and benefits of using remittance price comparison websites like World Bank's Remittance Prices Worldwide (RPW) database, GeldtransFAIR.de, and RemitRight.com. It covers the types of data provided, pricing trends, user profiles, and provider choices. The RPW

0 views • 17 slides

Ohio Small Business Investor Income Deduction Overview

Ohio offers a 50% Small Business Investor Income Deduction for individuals, allowing up to $250,000 of small business investor income to be deducted at 50% for taxable years 2013 and beyond. This deduction is reported on Schedule IT SBD and Form IT1040 Schedule A. The deduction is favorable for busi

0 views • 46 slides

Supporting Remote Cash Projects in Emergencies - Insights from NRC's Operations in Syria

NRC's initiatives include the Remote Cash Project, writing a handbook for cash programming in remote emergencies, and conducting surveys to map remittance flows in Syria. Methods used were diverse, including surveys, focus groups, and online surveys. Key constraints included limited data access, tru

0 views • 8 slides

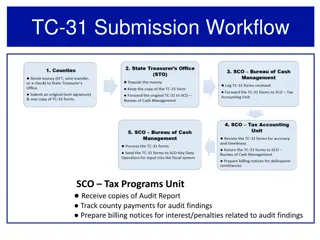

TC-31 Submission Workflow for Tax Programs Unit

Receive copies of audit reports, track county payments for audit findings, and prepare billing notices for interest/penalties related to audit findings. Additionally, find TC-31 forms for remittance to the State Treasurer, explore trial court revenue distribution guidelines, access helpful tips for

0 views • 17 slides

Updates and Reconciliation Information for WRS Central Benefits

This document provides updates on earnings codes, deduction remittance, and December 2019 remittance reporting for WRS Central Benefits. It outlines new processes, deadlines, and responsibilities related to annual reconciliation and reporting. Key points include the creation of new earnings codes, a

0 views • 18 slides

Local Church Treasurer & Finance Training Highlights 2020

Explore the roles of key church financial positions, conference budgeting processes, apportioned giving strategies, remittance procedures, and payment pointers for pensions and insurance. Learn about the resources available, job descriptions, and the importance of accurate financial management withi

0 views • 68 slides

Challenges and Strategies for TransferWise in the Remittance Services Industry

TransferWise is facing challenges such as imbalance in outflow vs. inflow, threat of blockchain technology, and reaching zero transfer charges. The presentation suggests strategies like customer scale, new technologies, and developing a student customer strategy to tackle these challenges. Internal

0 views • 29 slides

Enhancing Literature Analysis Skills Through Inference and Deduction

Explore a lesson plan focused on developing inference and deduction skills in literature analysis. Students will engage with texts, answer differentiated questions, and work collaboratively to analyze themes, characters, language, and structural features. The lesson includes practice in selecting qu

0 views • 17 slides

Understanding the Impact of Mortgage Interest Deduction on the Housing Market

The Mortgage Interest Deduction (MID) is a significant tax expenditure in the U.S., often associated with promoting homeownership. However, research suggests that its impact on increasing affordability and homeownership is limited, particularly for high-income households. The regressive nature of th

0 views • 6 slides

Insights from Household Surveys on Migration and Remittances in Africa

Household surveys conducted between 1990-2006 revealed that migration and remittance data are scattered across survey sections. The surveys collect details on migration history, remittances, and more. Challenges include comparability issues, sampling frame absence, and fieldworker capacity. Coverage

0 views • 25 slides

Central Benefits Annual Reconciliation Updates and Reporting Strategy

Updates and revisions related to the annual reconciliation process have been outlined, including the introduction of new accumulator and earnings codes, adjustments in December 2018 remittance reporting, and details on STAR and WRS reporting process. These changes aim to enhance accuracy and ensure

0 views • 18 slides