Factors Influencing Working Capital Management

Factors influencing working capital include the nature and size of the business, demand of creditors, cash requirements, time for manufacturing goods, volume of sales, terms of purchases and sales, and the business cycle. The nature of the company, creditor demands for security, cash needs, and the

0 views • 7 slides

Understanding Termination of Obligations in Civil Law

Termination of obligations can occur voluntarily through legal agreements or involuntarily through factual occurrences. There are two main types of termination: by the will of the parties (such as legal transactions) and independently of the parties' will (due to certain legal facts). The cessation

3 views • 25 slides

Garnishment Basics and Process Overview

Understanding garnishment basics and the process involved in handling creditor writs, timelines, proper service requirements, and the role of the Attorney General's Office. Learn about the types of creditor writs, filing requirements, and how the garnishee is named, along with details on different 6

1 views • 34 slides

Understanding Debentures and Charges in Company Law

Debentures play a significant role in company law, representing various types of securities issued by a company. They are defined under the Companies Act and have specific characteristics, such as being under common seal, repayment terms, interest payments, and charges on movable property. Debenture

0 views • 21 slides

Understanding Insolvency Accounts and Laws in India

Insolvency accounts come into play when a debtor is unable to pay debts fully, leading to a legal process supervised by the government for debt resolution. Various scenarios constitute an act of insolvency, such as transferring property to defraud creditors or notifying them of debt payment suspensi

0 views • 38 slides

Understanding Contractual Liability in Construction Contracts

Contractual liability in construction contracts involves the obligations and responsibilities of parties such as investors and contractors. The liability of investors and contractors is defined by specific regulations in the Civil Code. Investors are responsible for actions like preparing the constr

0 views • 38 slides

Understanding Third-Party Releases in Chapter 11 Bankruptcy Plans

Chapter 11 bankruptcy plans often include provisions for third-party releases, releasing non-debtor entities from claims held by creditors. These releases can impact various stakeholders, from insiders to affiliates, and involve consent through opt-out mechanisms. In the Third Circuit, such releases

3 views • 8 slides

Understanding Judgment Liens in Maryland: Importance of Lien Priorities

In Maryland, judgment liens automatically attach to a debtor's property for a specific duration. Understanding lien priorities is crucial, as mismanagement can lead to financial losses for lenders and title companies. Factors like divorce, death, and bankruptcy can affect lien attachments, emphasizi

0 views • 6 slides

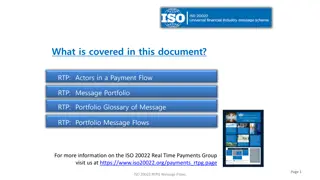

Real-Time Payments: Actors and Message Flows Overview

This document provides an overview of the actors involved in a payment flow and the message portfolio in Real-Time Payments (RTP). It includes details on various actors like Instructing agent, Forwarding agent, Ultimate Debtor, Reimbursement agents, and more. The provided message flows illustrate th

1 views • 12 slides

Understanding Ratio Analysis in Financial Statements

Ratio analysis is a crucial process in interpreting financial statements by deriving accounting ratios from the balance sheet and profit and loss account. It involves assessing short-term liquidity, long-term solvency, activity ratios, and profitability ratios. Liquidity ratios like current ratio, q

2 views • 41 slides

Understanding the Banker-Customer Relationship

The relationship between a banker and a customer is defined by the provision of banking services such as fund transfers and cheque issuance. It is primarily a debtor-creditor relationship but also involves trust, agency, bailment, mortgage, and leasing aspects. Regulations are governed by laws like

0 views • 14 slides

Understanding Marshalling of Securities in Mortgage Law

Marshalling of Securities, as per Section 81 of the Transfer of Property Act, addresses the scenario where a property owner mortgages properties to different individuals. This doctrine ensures subsequent mortgagees are entitled to have debts satisfied from properties not mortgaged to them while prot

0 views • 20 slides

Understanding Banking Relationships and Responsibilities

Explore the intricate relationships and responsibilities in banking, from the roles of bankers as debt creators to customers as buyers of services. Learn about debtor-creditor relations, creditor-debtor relationships, and the dynamics of beneficiary-trustee interactions in the banking sector.

2 views • 11 slides

Understanding Garnishee Orders in Civil Procedure Code

A Garnishee Order, issued under Order 21, Rule 46 of the Code of Civil Procedure, allows a court to direct a third party (garnishee) holding the debtor's assets to pay the creditor directly. This article explains the concept, process, and implications of Garnishee Orders in debt recovery procedures

0 views • 18 slides

Webinar on Judicial Pronouncements in IBC and NCLT Case Presentation

This webinar covers judicial pronouncements in Insolvency and Bankruptcy Code (IBC) cases and essential preparations for presenting a case before the National Company Law Tribunal (NCLT). It includes insights and case discussions regarding debt assignment, related party transactions, and disputes ov

0 views • 37 slides

Overview of Valuation Requirements under Companies Act, 2013 & IBC 2016

This text provides insights into the valuation requirements stipulated by the Companies Act, 2013 and the Insolvency and Bankruptcy Code, 2016. It includes sections demanding valuation reports from registered valuers, such as for share capital issues, audit committee terms, director transactions, cr

0 views • 54 slides

Understanding Liquidation Estate and Key Asset Components

In the process of liquidation, the liquidator forms an estate comprising various assets of the corporate debtor for the benefit of creditors. These assets include ownership rights, tangible and intangible assets, proceeds of liquidation, and more. However, certain assets owned by third parties or he

0 views • 39 slides

Understanding Hiwalah: Debt Transfer in Islamic Finance

Hiwalah is a form of debt transfer in Islamic finance where a debtor transfers their debt to another party. This process relieves the original debtor of financial obligations, with the creditor able to demand repayment from the new debtor. The legality and process of Hiwalah, along with the Prophet

0 views • 17 slides

Working Capital and Current Ratio in Accounting

Understanding indicators like net current assets (working capital) and current ratio is crucial in accounting. Net current assets reflect the ability to settle current liabilities and the capital required for operational functions. Managing working capital effectively involves factors like stock man

0 views • 12 slides

Understanding Limitation of Claims in Polish Civil Law

In Polish civil law, time limits for bringing legal actions are divided into two groups: expiration and prescription. Expiration results in the extinction of rights, while prescription allows claims to be rejected only if the debtor raises the plea. The general regulation in the Civil Code stipulate

0 views • 12 slides

Recent Developments in Unfair Preferences Law

The law on unfair preferences, particularly under Section 588FA of the Corporations Act, addresses transactions where a company favors a creditor, resulting in the creditor receiving more than they would in a winding up process. Recent cases like Cant v. Mad Brothers and Re Emanuel highlight the com

0 views • 27 slides

Benefits and Process of Cashless Banking in Schools

Explore the advantages of cashless banking in educational institutions, including enhanced security, cost savings, and quicker transactions. Learn about electronic payments like BACS and CHAPS, how to set them up, process BACS payments, and considerations for BACS transactions. Discover the importan

0 views • 11 slides

Dealing with IRS Assessments: Options for Challenging Unfair Tax Claims

Learn how to address erroneous IRS assessments through various options like audit reconsideration, doubt-as-to-liability, offers in compromise, refund litigation, and bankruptcy. Make an informed choice based on factors like refund eligibility, ability to pay, receipt of the Notice of Deficiency, an

0 views • 5 slides

Understanding the Intersection of Bankruptcy and Family Law in Property Identification

Explore the complexities of estate property identification in bankruptcy proceedings and family law, including what is considered as part of the estate, what is excluded, and the determination of property interests under state law. Learn about community property, sole-managed community property, and

0 views • 20 slides

Understanding the Relationship Between Banker and Customer

Exploring the dynamics of the relationship between a banker and a customer, including definitions, types of relationships, features, and the roles of debtor/creditor, bailee/bailor, and trustee/beneficiary in the banking context.

0 views • 42 slides

Ethical Considerations in Involuntary Bankruptcy Cases

This content discusses three scenarios involving ethical dilemmas in the context of involuntary bankruptcy filings. From managers filing against fellow LLC members to lenders initiating bankruptcies for strategic reasons, the scenarios highlight complex issues such as creditor solicitation, usury de

0 views • 6 slides

Recent Legislative Amendments to Personal Insolvency Acts & Court Review of Arrangements

The recent legislative amendments to the Personal Insolvency Acts introduced new provisions for court reviews of arrangement proposals, including changes to eligibility thresholds for Debt Relief Notices (DRNs) and increased regulation of Personal Insolvency Practitioners (PIPs). The Court Review un

0 views • 41 slides

Asset Protection Strategies for Families: Tips and Insights by Daniel Timins, Esq.

Learn about important asset protection strategies for families, including safeguarding assets from creditors, understanding the protection of Social Security benefits, navigating retirement plan implications in divorce cases, preventing fraudulent conveyances, and identifying creditor protections in

0 views • 14 slides

Current Issues in Secured Transactions Law in the United States: Licenses and Security Interests

This article discusses the current issues in secured transactions law in the United States, focusing on whether a debtor can grant a security interest in a statutory or contractual license, how syndicated financiers can perfect a security interest in a deposit account, and the collateral over which

0 views • 28 slides

Understanding the Centre of Main Interests in EU Insolvency Regulation

Centre of Main Interests (COMI) plays a crucial role in determining the jurisdiction for insolvency proceedings within the EU. This concept, defined by the Regulation 1346/2000, ensures that the debtor's administration of interests is ascertainable and objective, regardless of national legislation.

0 views • 9 slides

European Account Preservation Order and National Instruments Overview

The European Account Preservation Order (EAPO) is an optional cross-border instrument for freezing bank accounts in EU member states, providing quick enforcement without the need for multiple parallel proceedings. It allows for the seizure of funds in debtor accounts with specific jurisdictional and

0 views • 10 slides

Guide to Collecting Judgments: Procedural Insights and Strategies

This comprehensive guide covers the post-judgment process, including discovery, liens, garnishments, and more. Learn about debtor examinations, filing procedures, and dealing with uncooperative debtors in the context of judgment collection. Gain valuable insights from legal experts and a nationally-

0 views • 73 slides

Strategies for Effective Debt Management

Understand debtor psychology and demographics to create tailored approaches for debt repayment. Utilize behavioral economics principles such as the Default Effect and framing to encourage timely payments. Offer pre-commitments, consolidate debts, and provide regular overviews to empower debtors. Imp

0 views • 8 slides