Strategies for Effective Debt Management

Understand debtor psychology and demographics to create tailored approaches for debt repayment. Utilize behavioral economics principles such as the Default Effect and framing to encourage timely payments. Offer pre-commitments, consolidate debts, and provide regular overviews to empower debtors. Implement strategies like debt lotteries, charitable giving parallels, and automatic daily payments to enhance debt payment outcomes.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

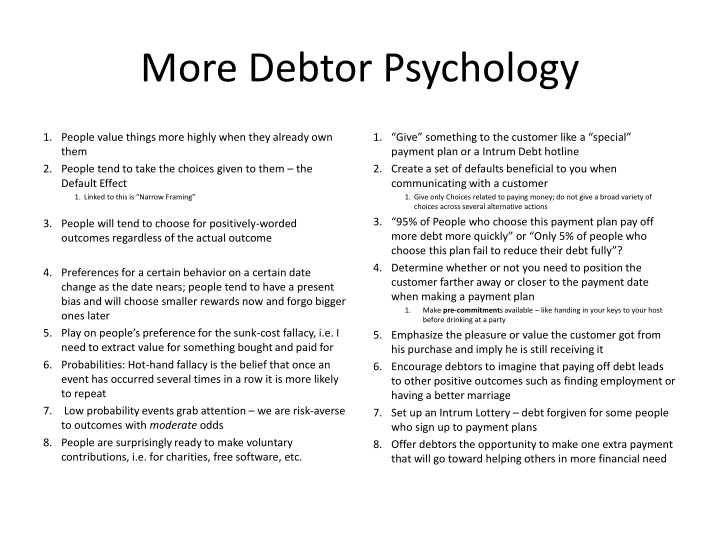

More Debtor Psychology 1. People value things more highly when they already own them 2. People tend to take the choices given to them the Default Effect 1. Linked to this is Narrow Framing 1. Give something to the customer like a special payment plan or a Intrum Debt hotline 2. Create a set of defaults beneficial to you when communicating with a customer 1. Give only Choices related to paying money; do not give a broad variety of choices across several alternative actions 3. 95% of People who choose this payment plan pay off more debt more quickly or Only 5% of people who choose this plan fail to reduce their debt fully ? 4. Determine whether or not you need to position the customer farther away or closer to the payment date when making a payment plan 1. Make pre-commitments available like handing in your keys to your host before drinking at a party 5. Emphasize the pleasure or value the customer got from his purchase and imply he is still receiving it 6. Encourage debtors to imagine that paying off debt leads to other positive outcomes such as finding employment or having a better marriage 7. Set up an Intrum Lottery debt forgiven for some people who sign up to payment plans 8. Offer debtors the opportunity to make one extra payment that will go toward helping others in more financial need 3. People will tend to choose for positively-worded outcomes regardless of the actual outcome 4. Preferences for a certain behavior on a certain date change as the date nears; people tend to have a present bias and will choose smaller rewards now and forgo bigger ones later 5. Play on people s preference for the sunk-cost fallacy, i.e. I need to extract value for something bought and paid for 6. Probabilities: Hot-hand fallacy is the belief that once an event has occurred several times in a row it is more likely to repeat 7. Low probability events grab attention we are risk-averse to outcomes with moderate odds 8. People are surprisingly ready to make voluntary contributions, i.e. for charities, free software, etc.

Demographics They rent instead of own They have Belongingness needs (Maslow) High need for achievement = lower debt Lower educated? Immigrant? Older pays more and more quickly Children higher non-payment Positive attitude toward debt = more debt paid off Self efficacy (can do attitude) = more debt paid off How to get people to pay by encouraging them to believe in themselves? Closer to total debt repayment = more enthusiasm for paying it off Give debtors a regular overview of how much they owe and have been paid? Debt account aversion consolidate the debt so they only have one to foucs on; Prospect theory would lead us to believe that it is easier to pay off one large debt than the psychologically more difficult paying off of many smaller debts People spend a disproportionate amount of time paying off the smallest debts Can we stagger debt so that it becomes the smallest? 500 = 5 processes of paying off 100. External Locus of Control Chronic debtors identify with other debtors So tell them other debtors are trending toward paying off their debts Charitable giving is up, so why not debt repayment?

Move to weekly or daily automatic payments e.g. pay 2,50 per day

Framing Identity Affirmation - individuals affirmatively process information consistent with their cultural values Understanding is frame-based not fact-based Play to customer biases Framing Strategy Includes Connecting issue w/ valued frame Thematic not episodic context Simplifying model or metaphor Messengers Visuals Tone

Framing Levels Level One Level One Big ideas, like freedom, justice, community, success, responsibility Level Two Issue types, like the environment or child care Level Three Specific issues, like rainforests or earned income tax credits Examples: We want to live in a society that is Authentic Orderly Caring Committed Community focused Competitive Connected to others Increasing Knowledge Nurturing Positive in Outlook Responsible Safe/ Secure

Level Two Level 2 frames can focus on issues like children, elderly, education, friendship, or EU Level 2 can also be a new or novel way of grouping issues together Prisons and education Children and EU Hazardous materials and social responsibility

Building a Framed Story Connect your issue to a Level 1 value Ask what kind of world people want to live in Ask what would that world look like? Level 2 connected to level 1 Many issues can fit into Level 2 for different purposes Level 3 specifies how Level 2 is achieved Tell a story linking levels 1 to 2 to 3

Gain vs. Loss Framing If certain of outcome Gain framing is more effective If uncertain of intervention outcome Loss framing is more effective Pointing out problems Creates negative reaction Cultural targeting Enhances effectiveness with right frame Not more effective if combined with wrong frame