Harnessing Carbon Markets for Sustainable Development in Pakistan

Understanding the significance of carbon markets, this content delves into the interplay between economic growth and environmental sustainability, emphasizing the urgency to limit unsustainable practices. It explores mechanisms such as carbon pricing and cap-and-trade systems in the context of clima

0 views • 17 slides

Carbon Pricing Overview and EU Green Deal Agenda

The overview of carbon pricing inside the EU highlights key aspects such as the EU Green Deal, revision of the EU ETS, and the Carbon Border Adjustment Mechanism. The EU aims for carbon neutrality by 2050 with a 55% reduction target. The Fit for 55 initiative emphasizes relevance for the Energy Comm

4 views • 16 slides

Overview of California's Carbon Removal Initiatives

California's Carbon Removal Innovation Support Program (CRISP) aims to incentivize Direct Air Capture (DAC) development in the state. The program includes research test centers, small-scale demonstrations of DAC technologies, community engagement, technical assistance, and more to enhance carbon rem

0 views • 5 slides

Understanding EVE Model for Indirect Taxes Using Household Data

The EVE model developed by PBO analyzes household expenditure to estimate taxes paid on goods and services, facilitating the assessment of policy proposals' cost and impact. Utilizing microsimulation, EVE covers a range of indirect taxes like VAT, excises, and carbon tax, providing valuable insights

0 views • 19 slides

Understanding the Carbon Cycle: Reservoirs, Dynamics, and Importance

Earth's carbon cycle plays a crucial role in sustaining life, with carbon moving through various reservoirs and processes. This cycle involves short-term terrestrial and marine cycles, as well as long-term cycles influenced by volcanic activity and rock weathering. Understanding carbon reservoir dyn

6 views • 45 slides

PROPERTY TAXES 101

Property taxes in Ohio are levied in mills, with a mill equaling $1 in taxes for every $1,000 of assessed property value. The base tax of 10 mills is applied to all residents, with additional taxes requiring voter approval. House Bill 920 controls property tax growth, ensuring revenue remains steady

0 views • 10 slides

Understanding the Purpose of Taxation: Financial, Social, Legal, and Ethical Perspectives

Taxation is a crucial method governments use to collect funds for public services. This chapter delves into the principles of a fair tax system, exploring how taxes should be related to income, predictable, cost-effective to collect, and convenient for taxpayers. It also discusses the redistribution

0 views • 19 slides

Taxing the Wealthy in Lower-Income Countries: Research Evidence and Policy Implications

The world is facing various crises, with lower-income countries disproportionately affected. To boost revenue without new wealth taxes, effective taxation of the wealthy is crucial. Existing taxes in LICs are inadequate compared to HICs. Wealth inequality is stark in LICs and Sub-Saharan Africa. Imp

0 views • 20 slides

Understanding Carbon-Based Nanomaterials and Their Technical Applications

Carbon-based nanomaterials, including fullerenes and carbon nanotubes, have revolutionized various industries with their unique properties. These materials, classified based on their geometrical structure, have applications in fields such as electronics, gas storage, biotechnology, and more. Fullere

0 views • 12 slides

Understanding Tax Tables, Worksheets, and Schedules for Federal Income Taxes

Explore the concept of tax tables, worksheets, and schedules for calculating federal income taxes. Learn how to express tax schedules algebraically and compute taxes using IRS resources. Examples featuring single and married taxpayers provide practical insights into determining taxable income and ca

0 views • 11 slides

Tracing Carbon Atoms in Ecosystems: Understanding the Organic Matter Pyramid

Explore the journey of 500 carbon atoms through producers, herbivores, and carnivores in an ecosystem. Discover how carbon atoms move through photosynthesis, cellular respiration, and biosynthesis, ultimately contributing to the organic matter pyramid. Follow the pathways of carbon atoms as they cyc

0 views • 7 slides

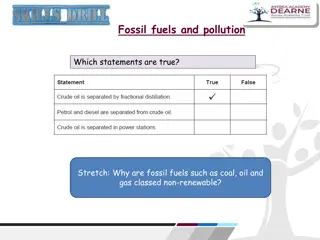

Understanding Fossil Fuels and Pollution: A Comprehensive Overview

Fossil fuels such as coal, oil, and natural gas are non-renewable energy sources that release heat energy when burned, but also contribute to pollution when not burned completely. This leads to the release of harmful pollutants like carbon dioxide, carbon monoxide, sulfur dioxide, and carbon particu

2 views • 9 slides

Understanding Taxes and Government Spending: A Comprehensive Overview

This comprehensive overview delves into the fundamental concepts of taxes and government spending. It covers topics such as the definition of taxes, the power of Congress to tax, limits on taxation, tax structures, characteristics of a good tax, and the burden of taxes. Exploring these concepts prov

1 views • 29 slides

Overview of Gross Receipts Taxes in Louisiana and Other States

Gross Receipts Taxes, a resurgence in state revenue-raising mechanisms, are examined in Louisiana and other states, highlighting similarities and differences in approaches. The presentation delves into the structure and implications of gross receipts taxes, providing insights on legislation and fisc

0 views • 27 slides

Understanding the Carbon Scenario Tool for Climate Change Management

The Carbon Scenario Tool (CST) is a valuable resource developed by the University of Edinburgh and the Scottish Funding Council to manage, report, and forecast carbon emissions for university estates and operations. It enables the calculation of the impact of carbon reduction projects and the develo

2 views • 18 slides

Understanding Carbon Movement in the Environment

Explore the intricate processes of carbon movement in the biosphere, atmosphere, oceans, and geosphere. Learn how plants absorb carbon dioxide, animals utilize carbon for tissue building, and the impacts of human activities like burning fossil fuels on carbon distribution. Discover the critical role

0 views • 6 slides

Understanding Taxes and Income in India

Explore the concepts of taxes and income in India, including direct and indirect taxes, the Income Tax Act of 1961, government revenue, and the administration of income tax. Learn about the various components of income, tax laws, and the importance of proper tax administration for the country's fina

0 views • 12 slides

Understanding the Biological Pump and Carbon Cycle in the Ocean

The biological pump in the ocean involves photosynthesis by phytoplankton, which removes carbon dioxide from the atmosphere, and respiration, where some CO2 is released back. Phytoplankton are crucial in the ocean's carbon cycle, with primary consumers like zooplankton depending on them for energy.

0 views • 20 slides

Understanding Organic Chemistry: Carbon Atoms and Molecular Diversity

In organic chemistry, carbon atoms can form diverse molecules by bonding to four other atoms, leading to molecular complexity and diversity. The versatile nature of carbon allows for the formation of various carbon skeletons, contributing to the vast array of organic compounds. Hydrocarbons, consist

0 views • 12 slides

Understanding Federal Taxes in the United States

Explore the key aspects of federal taxes in the United States, including individual and corporate income taxes, Social Security, Medicare, and unemployment taxes. Learn about tax brackets, withholding, tax returns, and more. Discover the economic importance of taxes and how they support the function

1 views • 15 slides

Evolution of Legal Process Taxes in County Clerk Offices

Explore the historical progression of legal process taxes related to marriage licenses, property conveyance, and other transactions as mandated by KRS 142.010. Delve into the changes in tax rates and base over time, along with the reliance on these taxes for revenue generation. The receipts of legal

0 views • 9 slides

The Impact of Cigarette Taxes and Indoor Air Laws on Prenatal Smoking and Infant Death

This study examines the effects of cigarette taxes and indoor air laws on prenatal smoking and infant death. It discusses how cigarette taxes can increase smoking cessation during pregnancy and reduce the probability of smoking, while comprehensive smoking bans can decrease the likelihood of smoking

1 views • 27 slides

Innovative CPC Futures Contract Program for Agribusiness Sustainability

The Commodity Plus Carbon (CPC) Futures Contract Program integrates agricultural commodity prices with carbon valuation to incentivize good agricultural practices and reduce carbon footprint. By combining ag commodity prices with carbon reductions, CPC contracts offer hedging opportunities and incen

0 views • 8 slides

Overview of Carbon Accounting in the UK: Progress and Challenges

The project aims to test the feasibility of producing SEE-EEA style Carbon Accounts, assess data sources, and lay a path for further development. Carbon accounting in SEE-EEA identifies carbon as a key theme, supporting ecosystem measurement. The UK's carbon accounts cover geosphere, biosphere, ocea

0 views • 15 slides

Policy Responses to Global Climate Change: Alternative Carbon Taxes and Impacts on Fossil Fuels

The chapter discusses the implementation of alternative carbon taxes on fossil fuels and their effects on retail prices of gasoline, coal, and natural gas. It provides insights into the impact of carbon pricing on emissions, retail prices, and consumption patterns, emphasizing the importance of carb

0 views • 15 slides

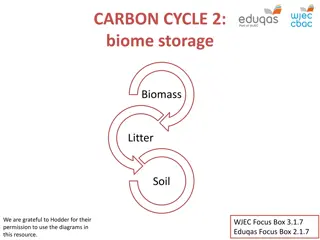

Understanding Carbon Storage in Biomes and Ecosystems

Explore the intricate carbon cycle within terrestrial ecosystems, focusing on carbon storage in biomass, litter, and soil. Delve into the differences in plant characteristics among various biomes and their impact on carbon sequestration. Gain insights into the distribution of tropical rainforests an

0 views • 13 slides

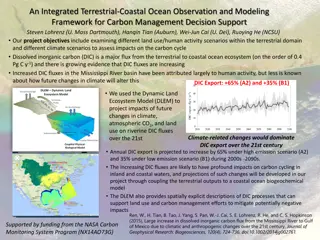

Integrated Terrestrial-Coastal Ocean Framework for Carbon Management

An advanced framework integrating terrestrial and coastal ocean observations and modeling is developed to support carbon management decisions. The study focuses on assessing the impacts of land use, human activities, and climate scenarios on the carbon cycle, particularly dissolved inorganic carbon

0 views • 5 slides

Composition of Ohio's State and Local Taxes Revealed

Ohio relies heavily on sales taxes for state and local government tax revenue. In FY 2019, Ohio's combined state and local tax revenue sources included property taxes, individual income tax, and sales taxes. Sales taxes accounted for the highest percentage of revenue, followed by property taxes and

0 views • 4 slides

Understanding State and Local Sales and Income Taxes

Delve into the intricacies of state and local sales and income taxes in Lecture 10 of State and Local Public Finance. Explore topics such as efficiency, equity, administrative issues, design of federal tax, link to state income taxes, and design of local income taxes. Uncover how sales taxes create

0 views • 42 slides

Achieving UK Net-Zero: Strategies for Carbon Capture and Low-Carbon Fuels

Explore the pathways to achieving UK net-zero carbon emissions through carbon capture, low-carbon alternative fuels like hydrogen and bioenergy, and sustainable bioenergy practices. Learn about the importance of zero-carbon hydrogen production and the challenges and benefits of utilizing bioenergy f

0 views • 12 slides

Understanding Peatlands and Carbon Storage in the Carbon Cycle

Peatlands are vital landscapes where peat accumulates, storing large amounts of carbon. Learn about peat formation, anaerobic conditions, different types of peatlands, and the significant role peatlands play in carbon storage globally. Explore the link between water cycle and peat formation, emphasi

0 views • 12 slides

Importance of Recurrent Property Taxes for Fiscal Sustainability

Recurrent property taxes play a crucial role in enhancing fiscal sustainability by reducing dependency on inter-governmental transfers, increasing local government accountability, and promoting equity in taxation. This article discusses the benefits of recurring property taxes, emphasizes the need f

0 views • 19 slides

Mapping Soil Organic Carbon Fractions in Australia: Stocks and Uncertainty

This study by Mercedes Román Dobarco et al. focuses on mapping soil organic carbon fractions across Australia, including mineral-associated organic carbon, particulate organic carbon, and pyrogenic organic carbon. The research involves prediction of soil organic carbon fractions using spectral libr

0 views • 17 slides

Carbon Forestry and Poverty Alleviation: The Case of REDD in Nigeria

Global carbon forestry programs like REDD aim to alleviate poverty but face challenges in empowering forest-dependent communities. The paper discusses the role of key actors in maintaining the status quo, presenting research findings from a REDD program in Nigeria. Carbon forestry involves market-ba

0 views • 15 slides

Insights from Orbiting Carbon Observatory-2 (OCO-2) on Global Carbon Cycle

Orbiting Carbon Observatory-2 (OCO-2) offers precise measurements to understand sources and sinks of CO2 in the atmosphere, providing valuable data on carbon uptake by plants and global carbon emissions. OCO-2's findings shed light on the impact of extreme climate events like droughts and fires on t

0 views • 8 slides

Carbon Modification by Seabirds in Fjords: Implications and Patterns

The study investigates the impact of seabirds on carbon burial in fjords, showcasing factors such as wind stress patterns, terrestrial vegetation biomass, and various carbon sources in the ecosystem. It delves into the distribution and fate of carbon in two fjords, Hornsund and Kongsfjorden, sheddin

0 views • 7 slides

Understanding Taxes, Charitable Giving, and Legislative Impacts

Explore the intersection of taxes, charitable giving, and pivotal legislative acts such as the Tax Cuts and Jobs Act of 2017. Learn about key considerations, planning tools, and changes in federal income taxes under the Biden Tax Plan. Discover how estate taxes, donor-advised funds, and retirement a

0 views • 59 slides

Property Taxes and Local Decision-Making in Texas

Texas relies on property taxes and sales taxes as major revenue sources for state and local government funding. The majority of property taxes fund public schools, with the burden increasing due to unfunded mandates from the Texas Legislature. Student funding is impacted by property value growth, be

0 views • 24 slides

Trends in Iowa Property Taxes: Past and Future

Property taxes in Iowa have decreased as a source of local revenue over the years. The decline is more significant when looking at own-source revenue excluding state and federal grants. Other revenue sources like charges and sales taxes have become more important. Different trends are observed for c

0 views • 18 slides

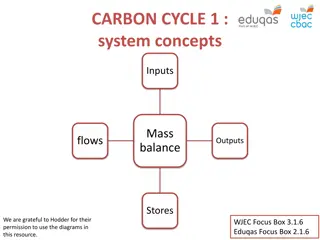

Understanding the Carbon Cycle: System Concepts and Pathways

The carbon cycle involves the movement of carbon between different stores in the global system, such as the atmosphere, oceans, and biosphere. Flows, inputs, and outputs play crucial roles in this cycle, with processes like photosynthesis and respiration impacting carbon levels. Explore how mass bal

0 views • 13 slides