Understanding Financial Markets in India

Financial markets play a crucial role in connecting lenders and borrowers, providing avenues for investment and capital generation. In India, the financial system includes money markets and capital markets, offering diverse financial products and opportunities for investors. Money markets deal with

2 views • 106 slides

CAPITAL STRUCTURE

Capital structure refers to the mix of a firm's capitalization, including debt, preference share capital, equity share capital, and retained earnings. Choosing the right components of capital is crucial based on the organization's function and risk level. Different patterns/forms of capital structur

1 views • 6 slides

Theories of Capital Structure and their Applications

The theories of capital structure explore the relationship between debt and equity in a firm's financing decisions. By optimizing the mix of debt and equity, a company can minimize its cost of capital and maximize its value. The Net Income Approach highlights the benefits of using debt to lower the

1 views • 7 slides

Factors Influencing Economic Growth: Human Capital and Capital Goods

Factors such as investment in human capital, capital goods, natural resources, and entrepreneurship play a crucial role in determining a country's economic growth. Human capital encompasses the skills and abilities of workers, while capital goods are the tools and equipment used to produce goods and

2 views • 28 slides

Aditya Birla Capital Scholarship for Classes 1 to 8.

The Aditya Birla Capital Scholarship is run by the Aditya Birla Capital Foundation and is designed to help students in Classes 1 to 12 and undergraduates with financial aid for their education. The program provides a one-time scholarship of up to INR 60,000 to cover academic expenses. \nTo Know More

0 views • 5 slides

Aditya Birla Capital Scholarship for Classes 9 to 12.

The Aditya Birla Capital Scholarship:\nThe Aditya Birla Capital Scholarship, run by the Aditya Birla Capital Foundation, aims to help students in school and college by offering financial aid and educational support. The scholarship provides up to INR 60,000 (one-time) for academic expenses, and st

1 views • 5 slides

Explore Irish Traditional Instruments and Music

Discover the diverse world of Irish traditional instruments such as the Flute, Fiddle, Tin Whistle, Low Whistle, Uilleann Pipes, Accordion, Concertina, Bodhrán, and Harp. Learn about the history and unique characteristics of these instruments, as well as the evolution of Irish music to include mode

0 views • 12 slides

Understanding Various Instruments of the Capital Market

Equity shares, preference shares, debt capital, equipre, sweat equity shares, and global depository receipts are key instruments in the capital market. Each type offers unique features and benefits for investors and companies alike, influencing ownership, dividends, voting rights, and trade facilita

0 views • 6 slides

Mutual Capital Investment Fund: Addressing Capital Needs in the Insurance Community

Mutual Capital Investment Fund, LLC, aims to provide capital to mutual insurance companies facing capital needs without converting to stock form or selling minority interests. Led by Mutual Capital Group, the Fund seeks commitments up to $100 million and offers a unique investment opportunity for mu

0 views • 8 slides

Types of Securities: Owned Capital vs Borrowed Capital in Business Financing

Owned capital, contributed by owners, provides permanent risk capital to a business with high returns but lacks withdrawal flexibility. Borrowed capital, obtained through loans, offers fixed-period finance with tax advantages and flexible repayment options, but involves fixed interest payments and i

1 views • 9 slides

Understanding the Negotiable Instruments Act, 1881: Types of Instruments and Holders

The Negotiable Instruments Act, 1881 was enacted to provide legal recognition to credit instruments easily transferable as money. It defines negotiable instruments like promissory notes, bills of exchange, and cheques, including local usages. Instruments can be negotiated multiple times until maturi

0 views • 25 slides

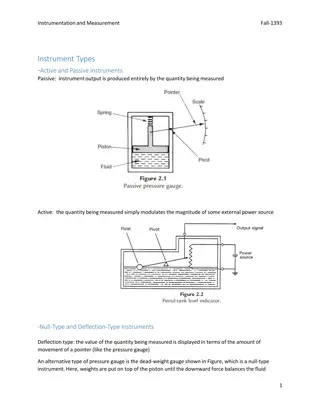

Understanding Instrument Types and Performance Characteristics

This content discusses different types of instruments, including active and passive, null-type and deflection-type, analog and digital, as well as smart and non-smart instruments. It delves into the static characteristics of instruments such as accuracy, precision, tolerance, linearity, and sensitiv

2 views • 39 slides

EBA Opinion on Legacy Instruments Monitoring Implementation Overview - Feb 2022 Meeting

The European Banking Authority (EBA) provided an opinion on legacy instruments monitoring at their Feb 2022 meeting. The presentation covers the monitoring in 2021, surveys, letters to competent authorities, and the overview of monitoring results. It discusses calls for input on the implementation o

0 views • 20 slides

Understanding Instruments in Instrumentation and Measurement

Passive and active instruments play key roles in measurement, with null-type and deflection-type instruments providing different ways to display values. Analogue and digital instruments offer varying outputs, while indicating instruments and those with signal outputs serve different purposes. Smart

2 views • 12 slides

Overview of EBA Opinion on Legacy Instruments Monitoring Implementation Results Feb 2022

In February 2022, the European Banking Authority (EBA) conducted monitoring on legacy instruments implementation. The presentation covers surveys, input from competent authorities, and outcomes. Efforts to address infection risks posed by legacy instruments were highlighted, with actions taken by in

1 views • 20 slides

Features of an Appropriate Capital Structure and Optimum Capital Structure

While developing a suitable capital structure, the financial manager aims to maximize the long-term market price of equity shares. An appropriate capital structure should focus on maximizing returns to shareholders, minimizing financial insolvency risk, maintaining flexibility, ensuring the company

2 views • 5 slides

Understanding Risk, Cost of Capital, and Capital Budgeting in Corporate Finance

Explore the concepts of risk, cost of capital, and capital budgeting in corporate finance, including the Capital Asset Pricing Model (CAPM), cost of equity, beta estimation, and cost of capital. Learn how to reduce the cost of capital and understand the impact of reducing the Weighted Average Cost o

0 views • 20 slides

Understanding Capital Market Development and Ethics in Africa

Explore the nexus between capital market development, ethics, and the role of professional accountants in Africa's Agenda 2063 for inclusive and sustainable economic growth. Delve into the importance of ethical foundations, transparency, and trust in fostering fair and efficient capital markets. Lea

1 views • 46 slides

Statistical Treatment of Islamic Financial Instruments

Explore the classification and examples of Islamic financial instruments, such as Restricted Mudaraba and Waqf Funds. Understand the scope, process, and economic substance of these instruments, along with their classification in terms of financial assets and liabilities. Learn how to analyze and cla

0 views • 10 slides

EIB Venture Debt as Growth Capital Overview

Venture debt provided by the EIB serves as growth capital for high-growth SMEs and MidCaps post Series B/C equity rounds, aiming to accelerate growth. The financing terms under the European Growth Finance Facility involve quasi-equity debt instruments with a maximum co-investment of 50% of project c

0 views • 14 slides

Understanding the Classification and Importance of Capital in Business

Capital is crucial for businesses, whether for promotion, functioning, growth, or expansion. It can be classified as promotional, long-term, short-term, or development capital. Factors influencing capital requirements include business activity, size, product nature, technology, business cycle, and l

2 views • 13 slides

Capital Gains and Assets Overview in Income Tax Law and Accounts

This content provides an overview of capital gains and assets in income tax law and accounts, covering topics such as types of capital assets, assets not considered capital assets, kinds of capital assets (short-term and long-term), transfer year of chargeability, computation of capital gains, and c

0 views • 15 slides

Fiscal Year 2022 Capital Budget Presentation Overview

In the presentation to the Board of Finance, the Capital Committee outlines the Fiscal Year 2022 draft capital budget, emphasizing the importance of the Capital Improvement Program and the history of the capital program investments. The proposed budget addresses the critical need for reinvestment in

0 views • 11 slides

Understanding Financial Instruments and Markets

Explore asset classes like fixed income securities, money market instruments, and capital market instruments. Learn about different financial instruments in various markets including money market, bond market, equity markets, and derivative markets. Dive into money market instruments like Treasury b

0 views • 47 slides

Development of Methodologically Robust Agricultural Capital Stock Statistics by FAO

In November 2015, the Food and Agriculture Organization of the United Nations (FAO) initiated a project to enhance Agricultural Capital Stock statistics, focusing on inclusive and efficient agricultural and food systems. The project involves developing methodologies for measuring capital stock and m

0 views • 38 slides

Estimating the Cost of Capital in Corporate Finance

Explore the process of estimating the cost of capital essential for discounted cash flows models in corporate finance. Learn how to determine the cost of debt, equity capital, and the Weighted Average Cost of Capital (WACC) by combining different sources of financing. Gain insights into capital stru

0 views • 59 slides

Analyzing Opposition to Musical Instruments in Worship

The opposition to using musical instruments in worship is based on beliefs stemming from biblical references that emphasize singing, the lack of explicit authorization for instruments in the Bible, and arguments regarding the essence of worship as prescribed by God. Various scriptures and interpreta

0 views • 19 slides

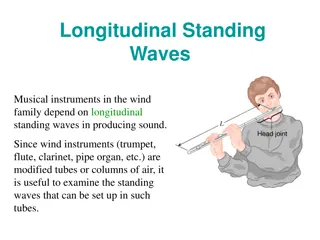

Understanding Longitudinal Standing Waves in Musical Instruments and the Human Ear Canal

Musical instruments in the wind family rely on longitudinal standing waves to produce sound, with wind instruments like trumpet, flute, clarinet, and pipe organ being modified tubes of air. This article explores the concept of standing waves in open tubes of air and their relevance to instruments an

0 views • 4 slides

Understanding Credit Instruments and Negotiable Instruments

Credit instruments play a crucial role in modern business by facilitating the transfer of money between lenders and borrowers. These instruments, such as Payroll Credit, Book Credit, and Documentary Credit, come in various forms like oral agreements and written documents. Negotiable instruments, on

0 views • 11 slides

Understanding Net Investment in Capital Assets and Its Importance

Net Investment in Capital Assets is a critical component of an entity's financial position, reflecting the value of capital assets owned. It represents the portion of the net position that is not spendable as it is invested in assets. Calculating Net Investment in Capital Assets involves subtracting

1 views • 17 slides

Understanding Timbre in Musical Instruments

Explore the concept of timbre in musical instruments, including how different instruments produce unique sounds through vibration. Learn about woodwind, brass, and string families, and use descriptive words to describe timbre qualities. Enhance your knowledge of how instruments such as clarinet, obo

0 views • 12 slides

Advancements in Plasma Instruments for Space Weather Monitoring

Explore the latest developments in plasma instruments for space weather monitoring, including the PLA Plasma Instrument and MSSL Heritage in Plasma Instruments. These instruments enable precise measurement of plasma parameters in deep space, supporting missions to study solar wind, ion densities, an

0 views • 22 slides

Understanding Research Instruments in Academic Studies

Research instruments play a crucial role in academic research by helping researchers collect data effectively. These instruments need to be valid, reliable, and usable to ensure accurate results. Different types of research instruments exist, including questionnaires, interviews, and checklists. Val

0 views • 25 slides

Understanding Financial Instruments in IFRS: Key Concepts and Overview

This content provides an overview of financial instruments under IFRS, focusing on their classification as assets, liabilities, or equity. It explains the presentation of compound financial instruments and outlines key concepts related to financial assets, financial liabilities, and equity instrumen

0 views • 28 slides

Driving Economic Recovery with Recapitalisation Instruments for Smaller EU Corporates

Amid the aftermath of the Covid-19 pandemic, the need for recapitalisation instruments for smaller EU corporates has become apparent. These instruments, such as equity and hybrid options, can provide essential fresh capital for companies to invest in innovation and drive economic growth. AFME's expl

0 views • 12 slides

Understanding Negotiable Instruments: Law and Characteristics

The Negotiable Instruments Act of 1881 governs the law related to negotiable instruments in India. These instruments are transferable written documents entitling the holder to a certain sum of money. Characteristics include free transferability, title free from defects, transferee's right to sue, an

0 views • 34 slides

Understanding Venture Capital: Key Concepts and Regulations

Venture capital is a form of financing provided to startup companies with high growth potential. It involves high risk and requires a long-term horizon, often coming in various forms like equity, conditional loans, and participation in management. The process includes stages such as seed capital, ex

0 views • 10 slides

Understanding Capital Adequacy Ratio (CAR) in Banking

Capital Adequacy Ratio (CAR) is a crucial metric in banking that measures a bank's capital against its risk. Also known as CRAR, it enhances depositor protection and financial system stability worldwide. The CAR formula involves dividing a bank's capital by its risk-weighted assets, comprising tier

0 views • 7 slides

Financing Decision and Cost of Capital in Business

Explore the interdependence and inter-relationship between investment and financing decisions, including managing the debt-equity mix for optimal capital structure. Learn about the concepts and measurement of cost of capital, operating and financial leverage, and planning capital structure. Delve in

0 views • 51 slides

Understanding Contingent Capital and Bail-In for Financial Stability

Presentation by Walter Engert discusses the need for better tools to deal with failing large banks, introducing Non-Viability Contingent Capital (NVCC) and Bail-In Debt (BID) as financial instruments issued by Canadian DSIBs. These instruments aim to recapitalize failing banks with private capital i

0 views • 28 slides