Tally on Cloud Service in Kolkata by BsoftIndia.

Link : https:\/\/bsoft.co.in\/tally-on-cloud-kolkata\/\nCall Us For Demo : 91 9990-46-9001, 91-11 7186-2838\n\nBsoftIndia Technologies Pvt. Ltd. has stood out as a one-stop destination for a wide array of IT services since 2008. The commitment to offering a complete suite of services has solidifie

1 views • 1 slides

Pest control in Kolkata

Are you looking for professional pest control services in Kolkata? Socspl.com is here to provide the most reliable and efficient pest control services in Kolkata. We have extensive knowledge and experience in handling all kinds of pest infestations such as termite control, cockroach control, ant con

1 views • 8 slides

Impact of NVIDIA Stock Surge on Mutual Funds and Passive Funds Exposure

NVIDIA's stock surged by 16% following strong financial performance, impacting various mutual funds and passive funds. Mutual funds like Motilal Oswal, Mirae, and Franklin have significant exposure to NVIDIA, while non-broad-based passive funds also hold substantial positions. The exposure of broad-

4 views • 10 slides

Tax Considerations for Incentive, Recognition & Safety Programs

This presentation provides guidelines on tax implications, exemptions, and reporting obligations related to incentive, recognition, and safety programs. It emphasizes the importance of understanding tax considerations for program sponsors and participants to ensure compliance with applicable laws an

3 views • 14 slides

Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary

The public hearing on the 2023 Tax Rates and FY 2024 Schedule of Fees highlighted the importance of real estate taxes as the major revenue source for the Town's General Fund. The proposed tax rate of 16.25 per $100 assessed for FY 2024 was discussed, along with the impact on residential units and ta

1 views • 9 slides

How can the best Mutual Fund Distributor in Kolkata help you pick the right fund

INV Rajat Finserve is the best Mutual Fund Distributor in Kolkata. Our financial advisors provide stock broking, insurance, & tax saving services for your goals.

1 views • 2 slides

Charting Careers: The Impact of Manpower in Kolkata

In Kolkata, Manpower is more than a recruitment agency\u2014it's a career navigator, empowering job seekers and businesses alike. Through personalized services and strategic workforce solutions, Manpower connects talent with opportunity, driving economic growth and fostering sustainable careers. Exp

1 views • 4 slides

Lowering the Burden: Tax Deduction Strategies for NRIs in England from India

Discover efficient tax deduction strategies tailored for Non-Resident Indians (NRIs) residing in England but originating from India. Our comprehensive guide, 'Lowering the Burden,' explores nuanced tax-saving approaches, ensuring NRIs maximize benefits while meeting legal obligations. From understan

4 views • 3 slides

Empowering NRIs: Indian Tax Services for England-Residing Individuals

Empowering NRIs: Indian Tax Services for England-Residing Individuals\" embodies our commitment to providing comprehensive tax solutions tailored specifically for Non-Resident Indians (NRIs) living in England. At NRI Taxation Bharat, we understand the unique challenges faced by NRIs abroad and striv

6 views • 11 slides

Professional Tax Assistance for NRIs in Canada from India

If you are a non-resident Indian (NRI) in Canada, we are here to help you with your tax needs. Our team of experts can handle all the international tax complexities to make sure you are compliant and get the maximum tax benefits. We offer NRI\u2019s tax filing, tax planning, and tax advisory service

0 views • 12 slides

Exploring the CFA Course in Kolkata_ Your Guide to CFA Coaching in Kolkata (1)

This article delves into the intricacies of the CFA course in Kolkata, emphasizing the importance of finding the right CFA coach in Kolkata to ensure success.\n

3 views • 8 slides

Navigating Career Opportunities: Manpower Agencies in Kolkata

\"Navigating Career Opportunities: Manpower Agencies in Kolkata\" explores how manpower agencies in Kolkata help job seekers find rewarding positions both locally and internationally. These agencies offer expert guidance, extensive networks, and personalized services to match candidates with suitabl

0 views • 6 slides

Seeking Relief Dr. Arnab Pathak Best Psychologists in Kolkata

Feeling overwhelmed, stressed, or out of balance? Kolkata's leading psychologists can help. Get matched with a qualified therapist who understands your needs and goals. Confidential care, flexible appointments, and online consultation. Start your journey to better mental health today. Dr. Arnab Path

0 views • 19 slides

Tax Benefits and Double Tax Treaties in Cyprus

Cyprus offers an attractive tax regime, with a corporate tax rate of 12.5%, exempt capital gains, and favorable personal tax rates for residents. Additionally, Cyprus has double tax treaties with numerous countries, making it an ideal location for individuals and businesses seeking tax efficiency.

0 views • 21 slides

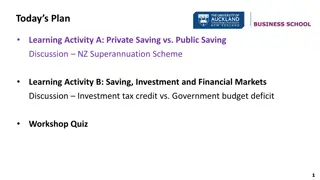

Understanding Private vs. Public Saving and Financial Market Dynamics

Explore the concepts of private and public saving in relation to national income, expenditure, and government fiscal policies. Delve into the analysis of saving, investment, financial markets, and the impact of real interest rates on loanable funds. Gain insights into the relationships between savin

0 views • 36 slides

Understanding Saving and Investing Money

This chapter delves into the importance of saving money for various purposes such as future expenditures, emergencies, and retirement. It also covers factors to consider when saving, including risk, reward, liquidity, and taxation implications. Furthermore, it discusses the safety of savings, the co

0 views • 25 slides

Understanding Taxes for Ministers

Explore the complex world of taxes for ministers, covering topics such as denial, anger, bargaining, depression, and acceptance. Learn about current and future tax obligations, including federal income tax, state income tax, Medicare tax, Social Security tax, and self-employment tax. Discover key di

2 views • 32 slides

Understanding Saving and Investing Money

Exploring Chapter 7 on saving and investing money covers the reasons for saving, differentiating between saving and investing, major savings products, tax implications, and factors to consider when saving. Topics include risk, reward, liquidity, and withdrawal ease. The chapter emphasizes the import

0 views • 25 slides

Understanding Taxation in Macao SAR: A Comprehensive Overview

Delve into the intricacies of taxation in Macao SAR with a virtual seminar featuring prominent speakers. Explore topics such as tax administration, profits tax framework, and tax declaration processes. Gain insights into the role of the Financial Services Bureau in ensuring tax compliance and the va

1 views • 25 slides

Understanding Fund Codes and Types at Southern Oregon University

Fund codes at Southern Oregon University categorize money sources and restrictions. General Funds support academic programs, while Agency Funds are for individual benefits. Internal Service Funds serve departments, Designated Funds are isolated operations, and Auxiliary Funds support non-instruction

0 views • 16 slides

Evolution of Progressive Income Tax Systems

The concept of modern progressive income tax, developed in the early 20th century in countries like the UK, US, France, India, and Argentina, is based on the principle of a comprehensive tax base encompassing various income categories. The system involves effective vs. marginal tax rates, different

0 views • 19 slides

Understanding Tax Morale and the Shadow Economy in Greece

Tax morale plays a crucial role in determining the size of the shadow economy in Greece. Factors such as unemployment, tax burden, and self-employment also influence the shadow economy. Tax compliance decisions are driven not only by enforcement but also by tax morale. Various determinants of tax mo

0 views • 21 slides

Understanding U.S. Income Tax for Nonresident Students

This presentation provides an overview of U.S. income tax requirements for nonresident alien students in the United States. It covers topics such as federal and state taxation, income tax treaties, tax filing obligations, and exemptions. Nonresident aliens may be subject to tax on income received in

0 views • 23 slides

Understanding Tax Transparency and Revenue Cycles

Exploring the complexities of the tax gap, this piece highlights the hidden aspects of revenue cycles and tax evasion. It emphasizes the need for a new approach to assess tax expenditures and spillovers for a balanced tax system, contrasting it with the repercussions of poor tax design. Richard Murp

0 views • 11 slides

Exploring Reasons Behind Psychiatric Disorders in Kolkata

Mental Health in Kolkata: Exploring the Reasons Behind Psychiatric Disorders in Kolkata. The Growing Concern in Kolkata Reasons Behind Psychiatric Disorders. In recent years, Kolkata has witnessed a notable increase in reported cases of psychiatric d

0 views • 3 slides

Top Manpower Consultancy in Kolkata for Your Hiring Needs

A specialist manpower consultancy in Kolkata has the experience and bits of knowledge expected to take advantage of this different ability pool successfully.\n\n\/\/ \/manpower-consultancy-in-kolkata\/

2 views • 6 slides

Tax Arrears Collection Methods in Liberia

Explore the tax arrears management practices in Liberia as per the Liberia Revenue Code. Learn about the legal provisions, tax treatment, and debt collection procedures, including adjustment in tax credit, closure of businesses, seizure, and sale of goods. Understand when tax arrears arise and the a

0 views • 45 slides

Analysis of State Tax Costs on Businesses: Location Matters

Explore the comprehensive analysis of state tax costs on businesses in "Location Matters." The study reveals varying tax burdens across different states, with insights on the impact on business operations. Findings highlight the significance of location in determining corporate tax liabilities and p

0 views • 32 slides

Tax Workshop for UC Graduate Students - Important Tax Information and Resources

Explore essential tax information for UC graduate students, featuring key topics such as tax filing due dates, IRS tax forms, California state tax forms, scholarships vs. fellowships, tax-free scholarships, emergency grants, and education credits. This informational presentation highlights resources

0 views • 18 slides

Tax Saving Strategies for Real Estate Agents in 2017

Explore effective tax-saving techniques for real estate agents in the 2017 tax year, including insights on income fluctuation, tax planning, S-Corp setups, deductions, and expenses. Learn how to optimize tax efficiency and reduce liabilities through strategic financial planning and entity structurin

0 views • 18 slides

Finding Reliable Manpower in Kolkata - A Guide

Manpower Kolkata fills in as a critical asset for organizations looking to further develop their enrollment procedures.\n\n\/\/ \/manpower-consultancy-in-kolkata\/

1 views • 6 slides

Understanding the Interaction Between Criminal Investigations and Civil Tax Audits in Sweden

The relationship between criminal investigations and civil tax audits in Sweden is explored, highlighting how tax audits and criminal proceedings run concurrently. The mens rea requirement for criminal sanctions and tax surcharge, as well as the integration between criminal sanctions and tax surchar

0 views • 13 slides

Overview of SRVUSD Parcel Tax: Why It Matters and Its Impact

The SRVUSD Parcel Tax plays a crucial role in supporting educational programs amidst fluctuating state revenues. This tax, approved by local communities, helps safeguard core services and enhance educational opportunities within the district. Learn about its history, purpose, and the responsibilitie

0 views • 12 slides

Understanding the Basics of Income Tax on Death for Estate Planning

This informative content explores the essentials of income tax implications upon death, including notional sales triggering capital gains, inclusion of income in the deceased's final tax return, and considerations for minimizing tax burdens. It also highlights which assets trigger income tax on deat

0 views • 8 slides

Understanding Sales and Use Tax in Arizona

The University in Arizona is not tax-exempt and sales made to the University are subject to sales tax as per the Arizona Revised Statutes. This guide explains what is taxable under sales and use tax, the difference between sales tax and use tax, exceptions to tax rules, and reporting use tax on P-Ca

0 views • 13 slides

Guide to Reducing Tax Withholding for Nonresident Aliens

Learn how to reduce or stop tax withholding as a nonresident alien by completing the Foreign National Tax Information Form and following the steps outlined by the Tax Department. This guide includes instructions on logging into the Foreign National Information System, tax analysis, signing tax forms

0 views • 21 slides

Expert Psychiatry Service in Kolkata Find All Dr. Arnab Pathak & Clinics here

clinic for expert psychiatry service in Kolkata. Find clinic location, contact details. Call 9804509480 for book an appointment. Looking for expert psychiatry services in Kolkata? \ud83c\udf1f Dr. Arnab Pathak is here to help with a wide range of men

0 views • 3 slides

Dr. Arnab Pathak A Leading Psychiatrist in Kolkata, Dedicated to Holistic Mental Health Care

9804509480\nAccuhealth diagnostic, sandhyadeep 16\/A, Gold Park Road Rajdanga Kolkata, West Bengal 700107 India\nMail: arnab.pathak@gmail.com \nPsychiatric disorders in Kolkata,\nMental health issues in Kolkata,\nCauses of psychiatric disorders,\nMen

0 views • 3 slides

Overview of Minnesota State Airports Fund Revenue Sources

The Minnesota State Airports Fund, overseen by Aeronautics Director Cassandra Isackson, is funded through various sources including Aviation Fuel Tax, Airline Flight Property Tax, Aircraft Registration Tax, Aircraft Sales Tax, and more. Revenue sources like Aircraft Sales Tax, Airline Flight Propert

0 views • 11 slides

Overview of Goods and Services Tax (GST) in Nagaland

GST in Nagaland was introduced on July 1, 2017, with the aim of simplifying the tax structure by subsuming multiple indirect state taxes. It is a destination-based tax system that promotes ease of doing business, reduces tax burden, and creates a common market across India. The tax is levied on the

1 views • 18 slides

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)