Loans for Short-Term Cash Financial Assistance for Various Emergencies

Despite your bad credit history, you can always obtain cash support with short term cash loans. Many lenders are willing to give you the money without requiring credit verification. You therefore have bad credit factors, such as bankruptcy, insolvency, foreclosure, arrears, late payments, CCJs, and

3 views • 1 slides

Payday Loans Online Same Day Quickly applies and receives Fast Cash

You can easily obtain payday loans online same day without having to deal with the tiresome chore of credit checking, even if you have adverse credit factors like foreclosure, late payments, CCJs, IVA, missed payments, foreclosure, or even bankruptcy.

2 views • 1 slides

Get Quick Money in a Congenial Way with Short Term Loans UK Direct Lender

You are not needed to submit to a credit check in order to borrow money with short term loans direct lenders in the UK. A sum is authorized based on the previously stated loan requirements! Therefore, in order to benefit from the money, bad credit concerns such as foreclosure, bankruptcy, arrears, C

1 views • 1 slides

Payday Loans Online Same Day Easily Be Accepted for Them

A payday loans online same day People who suffer from negative credit causes such as individual voluntary agreements, bankruptcy, missing payments, arrears, defaults, nation court judgments, and so on are said to benefit greatly \n\/\/fastpaydayu.com\/\n

0 views • 1 slides

The Path to Financial Recovery Bankruptcy

To assist you in taking back control of your finances, TakechargeAmerica.org provides compassionate debt assistance programmes. Allow us to assist you in moving towards a more prosperous future.\n\n\n\/\/ \/debt-help\/

8 views • 1 slides

Impact of Treaty of Versailles on Germany up to 1923

Germany faced immediate harsh consequences from the Treaty of Versailles, including huge reparations, loss of resource-rich lands, and political turmoil. The treaty led to economic bankruptcy, hyperinflation, and social unrest, with right-wing extremists attempting coups and assassinations. The occu

1 views • 8 slides

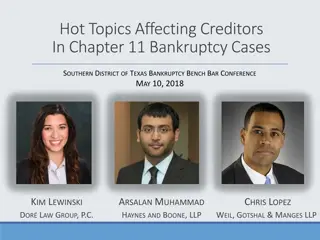

Understanding Claim Objections in Bankruptcy Proceedings

Explore the essential aspects of claim objections in bankruptcy proceedings, covering the burden of proof, forms of objections, and necessary elements in support of objections. Learn about the duties of debtors in objecting to improper claims and the importance of proper declaration in claim objecti

1 views • 12 slides

Bankruptcy Motion Practice Essentials

Dive into the key aspects of bankruptcy motion practice, from contested matters to adversary proceedings. Learn about the rules and guidelines, required documents for motions, and best practices for drafting motions in bankruptcy cases.

0 views • 12 slides

Understanding Third-Party Releases in Chapter 11 Bankruptcy Plans

Chapter 11 bankruptcy plans often include provisions for third-party releases, releasing non-debtor entities from claims held by creditors. These releases can impact various stakeholders, from insiders to affiliates, and involve consent through opt-out mechanisms. In the Third Circuit, such releases

3 views • 8 slides

Understanding Judgment Liens in Maryland: Importance of Lien Priorities

In Maryland, judgment liens automatically attach to a debtor's property for a specific duration. Understanding lien priorities is crucial, as mismanagement can lead to financial losses for lenders and title companies. Factors like divorce, death, and bankruptcy can affect lien attachments, emphasizi

0 views • 6 slides

Liquidation of Companies: Procedures as per IBC 2016

The process of liquidating a company involves collecting and selling its assets to pay off debts, with remaining funds distributed to shareholders. Under the Insolvency and Bankruptcy Code (IBC) 2016, specific procedures must be followed, including initiation by either creditors or debtors within se

0 views • 16 slides

Zoom for Government Meeting Guidelines and Resources

Discover the requirements for participating in a Zoom for Government meeting, including the necessary devices and access details. Access valuable resources such as training slides, name change instructions, and excusal forms on the Bankruptcy Administrator's website. Learn how to join, update your s

0 views • 15 slides

Understanding Financial Management of Sick Units in Industries

Thousands of crores of bank funds get locked up in sick industrial units due to mismanagement and external factors. Learn about the causes of sickness, internal and external factors contributing to industrial failure, and the importance of effective financial management in preventing corporate bankr

0 views • 9 slides

IRS Bankruptcy Issues in Subchapter V of Chapter 11 Explained

This content discusses the IRS bankruptcy issues in Subchapter V of Chapter 11, focusing on tax return filing requirements and payment of post-petition taxes under both standard Chapter 11 and Subchapter V. The responsibilities of debtors, trustees, and governmental units, as well as the compliance

2 views • 7 slides

Privatized Bankruptcy in Shipping: Financial Distress Resolution and Industry Comparisons" (75 characters)

This study explores how financial distress in the shipping industry is managed through private institutional arrangements, minimizing economic costs. It compares unique contractual innovations in shipping to traditional corporate bankruptcy processes, highlighting shipping's outlier status and the e

0 views • 18 slides

Webinar on Judicial Pronouncements in IBC and NCLT Case Presentation

This webinar covers judicial pronouncements in Insolvency and Bankruptcy Code (IBC) cases and essential preparations for presenting a case before the National Company Law Tribunal (NCLT). It includes insights and case discussions regarding debt assignment, related party transactions, and disputes ov

0 views • 37 slides

Understanding Disposition of Assets for Less Than Fair Market Value in Affordable Housing

In affordable housing, applicants are required to disclose if any family member disposed of assets for less than fair market value within two years of certification or recertification. This requirement, mandated by HUD, aims to prevent asset divestment for housing eligibility. Involuntary dispositio

0 views • 8 slides

Insolvency and Bankruptcy Code, 2016- Boon and Curse

The Insolvency and Bankruptcy Code (IBC) 2016 provides a unified framework for resolving insolvency in India, aiming to streamline processes, reduce resolution time, and protect creditors. While it enhances financial stability and transparency, chall

0 views • 4 slides

Debunking Bankruptcy Myths: Consumer Insights & Realities

Consumer bankruptcy is defined in the Bankruptcy Code as debt incurred for personal, family, or household purposes, distinct from business debt. This article debunks common myths surrounding bankruptcy, such as its impact on credit, individuals' financial status, and its role in society and the econ

1 views • 14 slides

Challenges Faced by Banks in Adopting IBC

Banks face challenges in adopting the Insolvency and Bankruptcy Code (IBC) due to stringent provisioning norms, additional costs, and complexities in referring cases to the National Company Law Tribunal (NCLT). Secured NPA accounts older than 2 years, unsecured NPA accounts in the second year, and c

0 views • 20 slides

Overview of Valuation Requirements under Companies Act, 2013 & IBC 2016

This text provides insights into the valuation requirements stipulated by the Companies Act, 2013 and the Insolvency and Bankruptcy Code, 2016. It includes sections demanding valuation reports from registered valuers, such as for share capital issues, audit committee terms, director transactions, cr

0 views • 54 slides

Understanding the Insolvency and Bankruptcy Code of 2016 in India

The Insolvency and Bankruptcy Code of 2016 in India replaced various existing laws to streamline the process of corporate restructuring, insolvency, and liquidation. Enacted to resolve bad debts efficiently, attract investors, and strengthen the economy, the code offers benefits like quicker resolut

0 views • 31 slides

Comprehensive Guide to Post-Confirmation Trusts and Plan Agents

Learn about the importance and necessity of post-confirmation trusts and plan agents in bankruptcy cases, the selection process for trustees/fiduciaries, choosing the right post-confirmation vehicle, creating trusts through agreements, and understanding the role of litigation/liquidation trusts in m

0 views • 32 slides

United States Attorney's Office, Southern District of Texas - Helping with Bankruptcy Matters

The United States Attorney's Office in the Southern District of Texas, led by Civil Chief Daniel Hu and AUSA Rick Kincheloe, assists with bankruptcy matters, representing the government in such cases. They work alongside other components of the U.S. Department of Justice, such as the Tax Division, t

0 views • 34 slides

Causes Behind the Decline of the Mughal Empire

The decline of the Mughal Empire was influenced by weak successors after Aurangzeb, degeneration of Mughal nobility, inefficiency of the army, economic bankruptcy, foreign invasions, wars of succession, and court factions. The empire faced challenges such as incompetent rulers, weakened military, fi

2 views • 5 slides

Liquidation Process and Costs under Insolvency and Bankruptcy Code

The process of passing a liquidation order under the Insolvency and Bankruptcy Code is detailed, including scenarios for passing the order and the steps involved in the liquidation process. The costs associated with liquidation, as defined under Section 5 and Regulation 2(ea), cover various expenses

0 views • 28 slides

Key Judicial Precedents on Insolvency and Bankruptcy Code, 2016

Key judicial precedents under the Insolvency and Bankruptcy Code, 2016 are discussed, including rulings on insolvency pleas, distribution of profits during Corporate Insolvency Resolution Process (CIRP), obligations of unrelated parties, the 90-day period for filing claims, and the interaction of mo

1 views • 21 slides

Fast Cash Loans Online Get Help from a Friendly Lender Quickly

Lenders don't look at credit ratings, so you can apply for fast cash loans online and get the greatest financial assistance without stressing out about defaults, arrears, foreclosure, late or missed payments, CCJs, IVAs, bankruptcy, and so on.\n\n\/\

2 views • 1 slides

Understanding US Corporate Reorganizations and Insolvency Law

Explore the key players in the US bankruptcy system, including bankruptcy judges, Debtors-in-Possession, and Creditors Committee in Chapter 11. Learn about basic bankruptcy concepts such as claims and priority, and the priority scheme outlined in the Bankruptcy Code. Gain insights into the legal obl

1 views • 13 slides

Guidelines for Purchasing Cars During Chapter 13 Bankruptcy

Understanding the considerations and financial implications when buying a car while in Chapter 13 bankruptcy. Exploring factors such as the need for a new vehicle, budgeting, financing options, and realistic car choices. Emphasizing the importance of reliability over luxury during this financial pha

0 views • 36 slides

Importance of 341 Meetings in Bankruptcy Proceedings

The 341 meeting is crucial in bankruptcy proceedings as debtors must appear under oath to answer questions from the trustee and creditors. Failure to prepare can have serious consequences, and important deadlines stem from this meeting, affecting various aspects of the case.

0 views • 29 slides

Understanding the Indian Bankruptcy and Insolvency Code (IBC) of 2016

The Indian Bankruptcy and Insolvency Code (IBC) of 2016 was introduced to streamline the resolution process for companies and individuals, aiming to improve recovery rates and ranking in insolvency matters. It consolidated existing laws, creating a time-bound framework to handle insolvency cases eff

0 views • 19 slides

Analysis of Consumer Bankruptcy Research Papers at 2021 CFPB Conference

Explore insights from three papers on consumer bankruptcy, discussing topics such as racial disparities in bankruptcy outcomes, benefits of mortgage principal cramdown, and the role of judges and trustees. The research delves into moral hazards, shadow debt, and the impact of race/ethnicity on bankr

0 views • 18 slides

Steps to File a Proof of Claim in Bankruptcy Proceedings

Learn how to file a proof of claim in bankruptcy cases under different chapters such as Chapter 7, 13, and 11. Understand the types of bankruptcy, timing for filing a proof of claim, and how to prepare the claim accurately. Essential information for legal professionals and individuals involved in ba

0 views • 26 slides

Understanding Important Legal Concepts in Bankruptcy Cases

Explore key aspects of bankruptcy law, including time limits for filing supplemental schedules, rescinding reaffirmation agreements, and amending statements of intention. A hypothetical scenario illustrates complexities of cross-collateralized secured claims in Chapter 7 cases. Gain insights from ex

0 views • 56 slides

Understanding Bankruptcy Laws and Processes in Ireland

Explore the legal framework surrounding bankruptcy in Ireland, covering the roles of the Official Assignee, consequences of bankruptcy, and the end-to-end process involving debtors, creditors, and the court system. Learn about key laws, regulations, and procedures governing bankruptcy, including ass

0 views • 22 slides

Understanding the Intersection of Bankruptcy and Family Law in Property Identification

Explore the complexities of estate property identification in bankruptcy proceedings and family law, including what is considered as part of the estate, what is excluded, and the determination of property interests under state law. Learn about community property, sole-managed community property, and

0 views • 20 slides

Ethical Considerations in Involuntary Bankruptcy Cases

This content discusses three scenarios involving ethical dilemmas in the context of involuntary bankruptcy filings. From managers filing against fellow LLC members to lenders initiating bankruptcies for strategic reasons, the scenarios highlight complex issues such as creditor solicitation, usury de

0 views • 6 slides

Understanding Make-Whole Provisions in Chapter 11 Bankruptcy Cases

Make-whole provisions are contractual clauses allowing borrowers to repay debts before maturity, while requiring payment based on future coupon values. This article explores the purpose, definitions, and examples of make-whole provisions in bankruptcy cases, with specific references to relevant lega

0 views • 32 slides

Duty to Disclose Property of the Estate in Chapter 13 Bankruptcy

Chapter 13 debtors have a legal obligation to disclose all assets, including post-petition causes of action, during bankruptcy proceedings. Failing to disclose such assets can result in detrimental consequences, such as being barred from pursuing claims post-bankruptcy. It is crucial for debtors to

1 views • 15 slides