Guidelines for Direct Costs in H2020 Funding

Direct costs in Horizon 2020 funding must be accurately measured and attributed only to the specific action being funded. Costs must be directly linked to the implementation of the action and supported with sufficient evidence. It is crucial to avoid errors in other direct costs, ensure proper recor

0 views • 26 slides

Cost Accounting Standards for Determining Transportation Costs

Understanding the importance of transportation costs in procurement and distribution, this guide outlines the standards for determining average costs, separation of transportation costs in accounting records, objectives for maintaining cost uniformity, components of transportation costs, and treatme

0 views • 11 slides

Streamlining Healthcare Revenue Cycle Management with MCBS Services

Our services at MCBS are designed to provide healthcare providers with comprehensive solutions for managing revenue cycle and administrative tasks effectively. By partnering with us, practitioners can focus more on patient care as we handle billing procedures, coding assistance, and administrative t

3 views • 7 slides

Grant Management Flexibility under Horizon 2020 During COVID-19

Grant management under Horizon 2020 during COVID-19 requires maximum flexibility with eligibility of costs incurred, force majeure clause usage, and flexibility in actual personnel costs. Teleworking costs are eligible, and personnel costs can be adjusted for exceptional circumstances. Travel costs

1 views • 12 slides

Overview of Administrative Law and Agencies in 2014-2021

This content provides an in-depth look at Administrative Law and Administrative Agencies from 2014 to June 2021. It covers the definition of Administrative Law, classifications, the role of Administrative Agencies, their creation, and examples of governing bodies. The material delves into the powers

1 views • 74 slides

Understanding Administrative Costs in Grant Management

Administrative costs are essential for managing grants effectively. Learn about the difference between direct and indirect costs, and why tracking and reporting accurately is crucial to avoid disallowed costs. Explore the definition, classification, and significance of administrative costs in grant

0 views • 22 slides

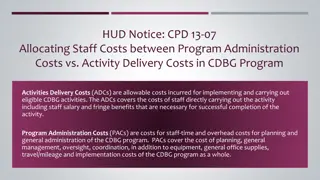

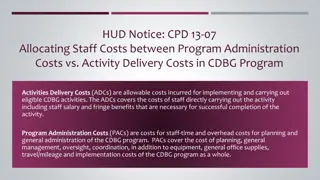

Understanding Activities Delivery Costs and Program Administrative Costs in CDBG Programs

Exploring the allocation of staff costs between Activities Delivery Costs (ADCs) and Program Administrative Costs (PACs) in Community Development Block Grant (CDBG) programs. ADCs cover non-profit staff expenses for carrying out eligible activities, while PACs include costs for planning, general adm

1 views • 10 slides

Understanding the Costs of Inflation and Its Impact on Purchasing Power

Inflation is a crucial economic phenomenon with both winners and losers. While inflation itself doesn't necessarily reduce real purchasing power, it leads to various costs such as shoeleather costs, menu costs, and unit of account costs. These costs emerge due to the changing dynamics of prices, wag

0 views • 16 slides

Understanding Costs for Defendants in Legal Proceedings

This article provides detailed information on the costs involved for defendants in legal cases, including the starting point for cost allocation, costs at different stages of the legal process, and considerations for recovery of costs. It covers aspects such as costs at the pre-action stage, costs a

2 views • 54 slides

Understanding Facilities and Administration (F&A) Costs in Research Grants

Universities have a long history of partnering with the federal government in conducting research. This partnership incurs various costs known as Facilities and Administration (F&A) costs, which cover infrastructure, administrative, and compliance expenses. F&A costs are essential for supporting res

0 views • 28 slides

Overview of New Civil Procedure Rules on Costs: CPR Parts 58 & 59

The new Civil Procedure Rules (CPR) Parts 58 & 59 introduce changes in the assessment and taxation of costs in legal proceedings. Detailed assessment replaces taxation, standard basis, fixed costs, and more defined, with new definitions and procedures outlined. Order 59 expands the powers to tax cos

0 views • 22 slides

Understanding Engineering Costs and Estimation Methods

This informative content delves into the concept of engineering costs and estimations, covering important aspects such as fixed costs, variable costs, semi-variable costs, total costs, average costs, marginal costs, and profit-loss breakeven charts. It provides clear explanations and examples to hel

0 views • 33 slides

Comparative Administrative Law: Remedies in French Administrative Law

The administrative justice system in France has evolved over the years, with various remedies available to challenge the lawfulness of administrative acts. The remedies are classified into formal and material categories based on historical developments and legal principles. Citizens can seek redress

1 views • 8 slides

Understanding Cost Allocation in CDBG Program: ADCs vs. PACs

Activities Delivery Costs (ADCs) in the CDBG program cover non-profit staff expenses related to implementing eligible activities, while Program Administrative Costs (PACs) encompass planning and general administration expenses. ADCs include salaries and benefits for staff directly involved in activi

0 views • 10 slides

Understanding Budget Basics for Comprehensive Budget Development

Components necessary for comprehensive budget development include categories of spending like direct costs, personnel costs, and facilities & administrative costs. Budget construction may vary by sponsor, but a detailed budget is required at submission. Personnel costs cover various types of employe

1 views • 19 slides

Understanding Doctrine of Primary Jurisdiction in Comparative Administrative Law

The doctrine of primary jurisdiction plays a crucial role in determining whether a court should yield to an administrative agency for certain issues. It helps in deciding which tribunal should take the initial action, especially in cases involving administrative discretion. This doctrine allows cour

1 views • 14 slides

Understanding Costs in Business: Types and Significance

Costs in business play a crucial role in determining profitability and decision-making. This article explores various types of costs such as direct, indirect, fixed, and variable costs, along with their definitions, uses, and impact on business operations. Understanding these costs is essential for

0 views • 13 slides

Understanding Marginal Costing in Cost Accounting

Marginal Costing is a cost analysis technique that helps management control costs and make informed decisions. It involves dividing total costs into fixed and variable components, with fixed costs remaining constant and variable costs changing per unit of output. In Marginal Costing, only variable c

1 views • 7 slides

Understanding Judicial Review of Administrative Discretion

Judicial review of administrative discretion aims to ensure that public authorities act within the bounds of their statutory powers and in the public interest. Courts do not act as appellate bodies but review decisions to ascertain proper consideration of relevant facts and absence of extraneous inf

0 views • 9 slides

Doctrine of Exhaustion of Administrative Remedies in Comparative Administrative Law

The doctrine of exhaustion of administrative remedies requires litigants to pursue all available remedies with administrative authorities before seeking judicial review. Originating from the case of Myers v. Bethlehem Shipbuilding Corp, this doctrine aims to respect congressional intent and promote

1 views • 12 slides

Understanding Administrative Law: Scope and Nature

Administrative law is a branch of public law that governs the relationship between the state and its citizens, regulating how power is exercised by the executive branch and administrative agencies. It sets legal limits to ensure protection against abuse of power and arbitrariness, focusing on the or

0 views • 26 slides

Enhancing Data Quality through Administrative Records in American Community Survey

This presentation discusses the potential of using administrative records to improve data quality and reduce respondent burden in the American Community Survey. It explores key priorities, research findings, data source evaluation, and the process of simulating housing estimates using administrative

0 views • 19 slides

Facilities & Administrative Costs and Recoveries Overview

Facilities & Administrative (F&A) costs are essential expenses in reconciling audited financial statements, with recoveries generated to reimburse the University for a portion of these costs. The negotiation process for F&A rates involves formal preparation and proposal every 3-4 years, aligning wit

0 views • 12 slides

Understanding Overhead Costs and Their Importance in Business

Overhead costs play a crucial role in cost allocation and management within an organization. These costs, which include indirect expenses such as labor, materials, and services, cannot be directly linked to specific units of production. Instead, overhead costs are apportioned and absorbed using vari

0 views • 16 slides

Overview of Administrative Services Overhead Charge (ASO)

The Administrative Services Overhead Charge (ASO) allows central administration to recover costs for support services by allocating them to separately funded areas of the campus. Various costs are charged through ASO, with a focus on administrative, environmental health, personnel, and other service

0 views • 11 slides

Understanding Migration Costs in Low-skilled Labor Migration

This content delves into the work of KNOMAD and The World Bank in measuring migration costs for low-skilled labor migration. It outlines the objectives, phases, and methodologies used to assess various costs incurred throughout the migration cycle, such as compliance costs, transportation expenses,

1 views • 21 slides

Resource Analysis Summary Report for Instructional Costs

This Resource Analysis Summary Report analyzes instructional costs for different campuses based on subject code and course level. It outlines how model costs used in the State Share of Instruction (SSI) are calculated by dividing the sum of unrestricted costs by Full-Time Equivalents (FTE). The repo

0 views • 9 slides

Understanding Facilities and Administrative (F&A) Rates in Research Funding

Facilities and Administrative (F&A) rates, also known as indirect costs, are crucial in research projects to cover overhead expenses. The Office of Cost Analysis calculates and negotiates F&A rates with the federal government, ensuring fair cost recovery. This article explains the distinction betwee

0 views • 9 slides

Understanding the Victorian Regulatory Change Measurement (RCM)

The Victorian Regulatory Change Measurement (RCM) methodology introduced in June 2010 aims to measure reductions in regulatory burden through different categories such as administrative costs, substantive compliance costs, delay costs, and more. The RCM formula helps in calculating the total regulat

0 views • 63 slides

Evolution of the French Administrative Judiciary System

Explore the rich historical development of the French Administrative Judiciary system from the pre-revolutionary period to modern times. Learn about key events such as the French Revolution, the creation of specialized courts, and the types of disputes handled by the administrative judiciary. Discov

0 views • 27 slides

Understanding Tariff of Electricity and Principles of Calculation

Electrical energy production involves costs that are shared by consumers based on the amount and nature of electricity consumed. This includes fixed costs for setting up power plants and variable costs for generating electricity, which covers fuel expenses. The calculation of electricity costs is ba

0 views • 18 slides

University at Buffalo Facilities & Administrative Cost Space Survey Overview

Understanding the importance of a space survey for Facilities & Administrative (F&A) cost proposal submission, this overview covers the necessity, process, examples of F&A costs, roles, and responsibilities involved in the survey. It emphasizes the requirement for accurate space categorization to al

0 views • 9 slides

Understanding Accounting for Borrowing Costs in Financial Management

Borrowing costs in financial management refer to interest and other expenses incurred when borrowing funds. These costs are crucial to account for correctly to ensure accurate financial reporting. Borrowing costs directly attributable to acquiring, constructing, or producing a qualifying asset are c

0 views • 8 slides

Utilizing Administrative Data for Census 2021: Insights and Strategies

Providing a comprehensive overview of the historical use of administrative data for census purposes, this content delves into methodologies adopted in previous censuses, such as hand-delivery, online attempts, and administrative data enrichment. It also outlines plans for the 2021 census, focusing o

0 views • 19 slides

Comparative Administrative Law in France: Remedies Available under French Administrative Law

The administrative justice system in France has evolved over the years, balancing classicism and uniqueness. Various remedies are available before the administrative court to challenge the lawfulness of acts adopted by the administration or assert rights against it. Two main classifications of remed

0 views • 8 slides

Analysis of Manufacturing Costs for Trunnion Speaker Production

This analysis breaks down the manufacturing costs for producing Trunnion Speakers, including variable costs, fixed costs, overhead costs, total costs, mark-up values, and break-even points. The detailed breakdown provides insight into cost per unit and helps in pricing decisions for achieving profit

0 views • 8 slides

Understanding Relevant Revenues and Costs in Decision-Making

Explore the concepts of relevant revenues and costs in decision-making, including differential costs, avoidable costs, sunk costs, opportunity costs, and relevant costs. Learn how to analyze costs, make add or drop decisions, and apply these principles through an example scenario with Recovery Sanda

0 views • 16 slides

Enhancing Leasing Success with Administrative Fee Utilization

This webinar focuses on utilizing administrative fees to improve leasing success in the HCV program. It covers topics such as funding determination, best practices in administrative fee usage, and permissible uses of administrative fee funding. Participants can learn about how administrative fees ar

0 views • 29 slides

Challenges and Opportunities in Building Confidence with Administrative Data

This paper discusses the challenges and opportunities in building confidence with administrative-based data, focusing on the case of the United Republic of Tanzania. It covers topics such as the background of administrative data, fundamental principles of official statistics, legal aspects, incomple

0 views • 19 slides

Understanding Administrative Law and Administrative Agencies: A Comprehensive Overview

Administrative law encompasses the regulations governing government administrative agencies, outlining their organization and operations. This includes classifications, roles of administrative agencies, creation process, and examples of creating authorities like Congress, the President, and the Supr

0 views • 75 slides