Understanding the Environment and Importance of Politics in Strategic Management

Explore the significance of political stability, changes in regulations, and economic impact in strategic management. Learn how competition fosters innovation, growth, and customer service. Delve into the global business environment and the long-term developments shaping our world. Understand the components of the internal and external environment and factors influencing the political and economic landscape.

- Strategic Management

- Political Environment

- Competition Benefits

- Global Business

- Environmental Factors

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

ENVIRONMENT OF STRATEGIC MANAGEMENT.

IMPORTANCE OF POLITICS IN STRATEGIC MANAGEMENT: (1) Political Stability. (2) Changes in Government Regulations. (3) Impact on Economy. (4) Campaign Finance. (5) Lobbying or Legislative Advocacy. (6) Helps in Risk Mitigation. * Impacts of Organizational Politics.

ROLE OF COMPETITION: (*) The following are some of the important benefits of competition: (1) Growth of Business. (2) Better service to the customers. (3) Provides opportunities for creative thinking and innovation. (4) Stops complacency. (5) Triggers economic growth. (6) Helps in identification of strengths and weakness. (7) Helps in identification of potential threats. (8) Helps business to raise their standards of service.

NATIONAL AND GLOBAL BUSINESS ENVIRONMENT: 1) Global Concentration. 2) Global Synergies. 3) Global Strategic Motivation.

(*) Some of the long-term developments that are shaping our world: (1) Emerging markets increase their global power. (2) Green marketing is becoming a competitive advantage. (3) Global banking seek recovery through transformation. (4) Governments enhance ties with the private sector. (5) Rapid technology innovation creating a smart, mobile world. (6) Demographic shifts transform the global workforce.

COMPONENTS OF ENVIRONMENT: (1) Internal Environment. (2) External Environment. (A) Micro/Operating Environment. (a) Suppliers. (b) Customers. (c) Market Intermediaries. (d) Competitors. (e) Public.

(B) Macro/General Environment: (a) Political Environment Welfare activities of the government Political ideology of the government Political Environmen t Political Stability Center state relationship Relation of government with other countries

* Factors of the Political Environment: * Political System. * Political Industry. * Political Philosophy. (b) Economic Environment: * The economic structure adopted by the country (capitalist, socialist or mixed economy). * The economic policies (Industrial policy, Fiscal policy, Monetary policy). * Economic planning (five year plan, annual budgets etc). * Infrastructural facilities like banks, Insurance companies . * Economic indices like money supply , disposable personal income,saving rate, income distribution etc.

* Economic environment is composed of Mixed economy Socialism Economic condition Income level Capitalism Distribution of income Economic Environment Economic system Trade cycle Economic policies Market share Rate of capital Price level Industrial growth formation

(c) Social Environment: Attitude of people towards work Business ethics Family system Customs and traditions Socio- cultural environment Caste system Languages Religion Habits and preference Education

(d) Technological Environment Research and development Technologica l environment Modernization Innovation Product technology

*Impact of technology in banking and insurance: * Faster Remittance Facilities. * Automated Teller Machine. * Telephone Banking/ Mobile Banking. * Home Banking. * Credit Card Facility. * Personal Loans. * Internet Banking/ NRI Services.

* Advantages of Technology to Business: 1) Cost Efficiency. 2) Security System. 3) Improved Customer Relationship. 4) Better Presentation of Financial Results. 5) Emphasis of Research and Development.

* Challenges posed by use of Technology: 1) Fear of New Responsibilities. 2) Fear of Losing Job. 3) Fear of Losing Customer Relationship. 4) Lack of Strategic Information Technology Plan. 5) Lack of Training. 6) Compatibility. 7) Complexity. 8) Confidentiality and privacy. 9) Lack of Appropriate Technical Knowledge amongst Bank Staff.

e) Legal Environment: 1) Consumer Laws: * Weight and Measures Act. * Trade Description Act. * Consumer Credit Act. * Sale of Goods Act.

2)Employee protection laws: There are various legislations for health and safety of workers at work. This is done: * To protect workers from dangerous machinery. * Workers should be provided with proper safety, equipment and clothing. * A reasonable work temperature is maintained for workers. * Proper hygienic conditions and washing facilities are provided. * Workers get adequate breaks between shifts.

Some of labour laws in India are: * Employees State InsuranceAct, 1948. * Employees Provident Fund and Misc. Provisions Act, 1952. * The Employment Exchange ( Compulsory Notification of Vacancies) Act, 1959. * The Factories Act, 1948. * The Industrial Disputes Act, 1947. 3) Competition Laws:

f) Ecological Environment: * Reduce carbon emissions. * Produce or use lead free fuels and other 'greener' sources of energy incorporating cleaner production methods in new building, plants etc. * Improve industry re-cycling programmes. * Encourage energy management schemes. * Offer free long-life shopping bags or other bio- sensitive packaging of products.

* Consideration of Ecological Factors in Banks: 1) Sustainable Operations. 2) Sustainable Lending. 3) Green product and services. 4) Community activities.

ENVIRONMENTAL SCANNING: Environmental scanning is a process that systematically surveys and interprets relevant data to identify external opportunities and threats. An organization gathers information about the external world, it's competitors and itself. * The following is the need and importance of environmental scanning: 1) Identification of strength. 2) Identification of weakness. 3) Identification of opportunities. 4) Identification of threat. 5) Optimum use of resources. 6) Survival and growth. 7) To plan long- term business strategy. 8) Aids decision-making.

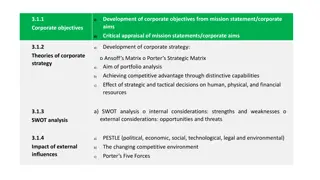

ANALYSIS OF STRATEGIES AND CHOICE OF STRATEGY: Strategic analysis is all about analysing the strength of business' position and understanding the important external factors that may influence that position. * Factors taken into consideration for strategic analysis and choice: - Five Forces Analysis. - PEST Analysis ( Political, Economic, Social and Technological Analysis). - Market segmentation. - Scenario planning. - Competitor analysis. - Directional policy matrix. - SWOT Analysis ( Strength, Weakness, Opportunities, and Threats Analysis). - Critical Sucess Factor Analysis.

* Strategic Choice: Strategic choice involves understanding the nature of stakeholders expectations, identifying the strategic option and evaluating and selecting the best/optimal choice amongst all. 1) Focus on alternatives. 2) Evaluation of the strategic alternatives. 3) Consideration of Decision factors. i) Objective Factors: * Strategic Intent. * SWOT Analysis.

ii) Personal Factors: * Personal preferences and aspirations. * Value system. * Attitude towards Risks. * Internal political consideration. iii) Other Factors: * Nature of environment. * Internal Realities of the firm. * Ambition of owners. * Company culture. * Firm's capacity to execute the strategy. * Resource allocation.

4) Making Choice of strategy: * Alignment with the objectives of the organization. * Consistency with internal strengths and policies. * Ensures availability of resources to implement the strategy. * Risk associated with the strategies. * Ensure it does not conflict with other strategies. * Consistency of the strategy with the environment.

ETHICS: Ethics refer to a system of moral principles - a sense of right and wrong and goodness and badness of actions and their motives and consequences. Some of the important factors which highlight the importance of business ethics are: 1) Long-term growth. 2) Public Image. 3) Cost and Risk Reduction. Ethical behaviour and corporate social responsibility can bring significant benefits to a business. Some of the benefits are: * Attract more customers, thereby boosting sales and profits. * Reduce labour turnover and therefore increase productivity. * Attract investors and keep the company's share price high, thereby protecting the business from takeover.

SOCIAL RESPONSIBILITY: social responsibility of business is the continuing commitment by business to behave ethically and contribute to economic development while improving the quality of life of the workforce and their families as well as the local community and society at large. SOCIAL RESPONSIBILITIES OF BUSINESS TOWARDS DIFFERENT STAKEHOLDERS: TOWARDS SHAREHOLDERS: 1) To ensure safety of investment. 2) To ensure fair and regular return on investment. 3) To give complete information regarding the financial position of the business. 4) To give them opportunities to participate in decision making. 5) To ensure appreciation of investment by proper utilization of resources. 6) To make proper use of funds of shareholders.

7) To take R and D activities for diversification of product line and also for facing market completions effectively. 8) To improve the prestige of the company though growth and expansion and to give safety to the investments of shareholders. TOWARDS GOVERNMENT: 1) Payment of regular taxes to the government. 2) To follow the relevant laws, rules and regulations relating to licensing, pollution control. 3) To avoid the use of corrupt and unethical means to seek favours from government and politicians. 4) To avoid influencing political leadership for personal gains through bribes and immoral practices. 5) To follow fair trade practices and raise social welfare. 6) To avoid tax evasion and avoid tax evasion at all the levels.

7) To repay loans taken from public sector banks and financial institutions. 8) To maintain financial transparency by disclosing all the important financial details. TOWARDS CUSTOMER: 1) To provide quality goods and services at reasonable price to the customers. 2) To avoid artificial scarcity of products and ensure equitable distribution. 3) To conduct a survey or research to ensure the customers are happy with the products and services of the bank. 4) To allow for free and fair business competition and avoid the exploitation of the consumers. 5) To maintain a close link with link with the consumers through consumer cells in order to solve their complaints and suggestions. 6) To honour and protect the rights of the customers.

TOWARDS EMPLOYEES: 1) To provide opportunities for meaningful work in the enterprise and to create a sense of loyalty towards the enterprise. 2) To create the conditions in which employees are able to put forward their best efforts for achieving the objectives of enterprise. 3) To introduce code of conduct for workers and proper machinery for maintain cordial relations. 4) To provide security of employment so as to raise the morale and loyalty to the organization. 5) To Provide fair and just wages and allowances, welfare facilities and introduce fair work standards. 6) To introduce schemes of participative management. 7) To introduce impartial promotion and transfer policies for the employee force.

TOWARDS SOCIETY: 1) To ensure protection of environment and that the amenities of the local community are not damaged. 2) To provide better living conditions like housing, transport, canteen, creches etc. 3) To introduce social audit by the professionals. 4) To provide opportunity for better career prospects and rehabilitation of population affected by any operation of the business. 5) To ensure Regular supply of goods and services at reasonable price. 6) To frame policies for conservation of natural resources and wildlife. 7) To contribute to social causes like education and rural development. 8) To provide financial support to cultural activities and thereby repay the social debt. 9) To contribute towards economic, and national growth and stability.

ARGUMENTS FOR SOCIAL RESPONSIBILITY OF BUSINESS: 1) Changed public Expectations of Business. 2) Long run profits. 3) Ethical obligation. 4) Public image. 5) Better environment for business. 6) Avoidance of Government Regulations. 7) Balance of responsibility and power. 8) Stockholder interests. 9) Possession of Resources. 10) Prevention is better than cure.

ARGUMENTS AGAINST SOCIAL RESPONSIBILITY OF BUSINESS: 1) Profit maximization is the Ultimate Goal. 2) Dilution of purpose. 3) Society has to pay the cost. 4) Too much power. 5) Lack of skills. 6) Lack of Accountability. 7)Lack of Broad Support.

GREEN BANKING: * Due to strict environmental disciplines imposed by the competent authorities across the countries, the industries would have to follow certain standards to run their business. * In case of failure, it would lead to closure of the industry leading to a likelihood of default to the bank. * In the recent years the banking industry is focusing on great deal of protecting natural resources and thereby facilitating the green banking and go-green elements in their systems. * The importance of Green Banking is immense for both the banks and economy by avoiding the credit risk and reputation risks involved in banking sector. * Environmental impact might affect the quality of assets and also rate of Return of banks in the long-run. * Thus the banks should go green and Play a pro-active role to take environmental and ecological aspects as part of their lending principle.

IMPACT OF LEGAL FACTORS IN STRATEGIC MANAGEMENT: 1) Pressurizes business to focus on quality of products and services. 2) Adoption of appropriate pricing policies. 3) Emphasis on employee safety. 4) Avoid monopolistic competition. 5) Enhance the competitive edge of the firm. 6) Provides regulatory framework for business activity. 7) Protection of the environment. 8) Social welfare. The following are the importance of legal authority for the banking sector : 1) It fixes the bench mark standard of capital adequacy and prudential norms for key performance areas and thereby ensures the soundness in the system.

2) Formulation of best practices in the areas of risk management, provisioning, disclosures, and credit delivery. 3) Adoption of good corporate governance system. 4) The development of institutional framework for the benefits of the customers. 5) Regulates the entry and exit borders in case of cross border institutions. 6) It helps to integrate the various financial systems and keep the systems contemporary and competitive.

SWOT ANALYSIS : * SWOT analysis is one of the primary steps in strategic management. It is the acronym for explaining strengths, weakness, opportunities, and threats for any specific organization. * SWOT is a structured planning method used to evaluate the strengt, weakness, opportunities, and threats involved in a project or in a business venture. * Some authors call SWOT as SCOT ( Strength, Contains, Opportunities, and Threats) or ETOP ( Environment, Threat, and Opportunities, Profile). - STRENGTH. - WEAKNESS. - OPPORTUNITIES. - THREATS.