Understanding Threats and Responses in the Mobile App Market

The study explores the impact of platform-owner entry on complementors in the mobile app market, examining evidence from platforms like Facebook, Uber, Android, Alibaba, iOS, and WeChat. Concerns from complementors about imitation by platform owners are discussed, along with views from platform owners emphasizing collaboration and innovation. Empirical literature shows mixed effects of platform-owner entry on consumers and complementors. The research focuses on innovation incentives and reasons why platform-owner entry may not always be detrimental for complementors, using Android app developers' responses to Google's entry threat and entry as a case study.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

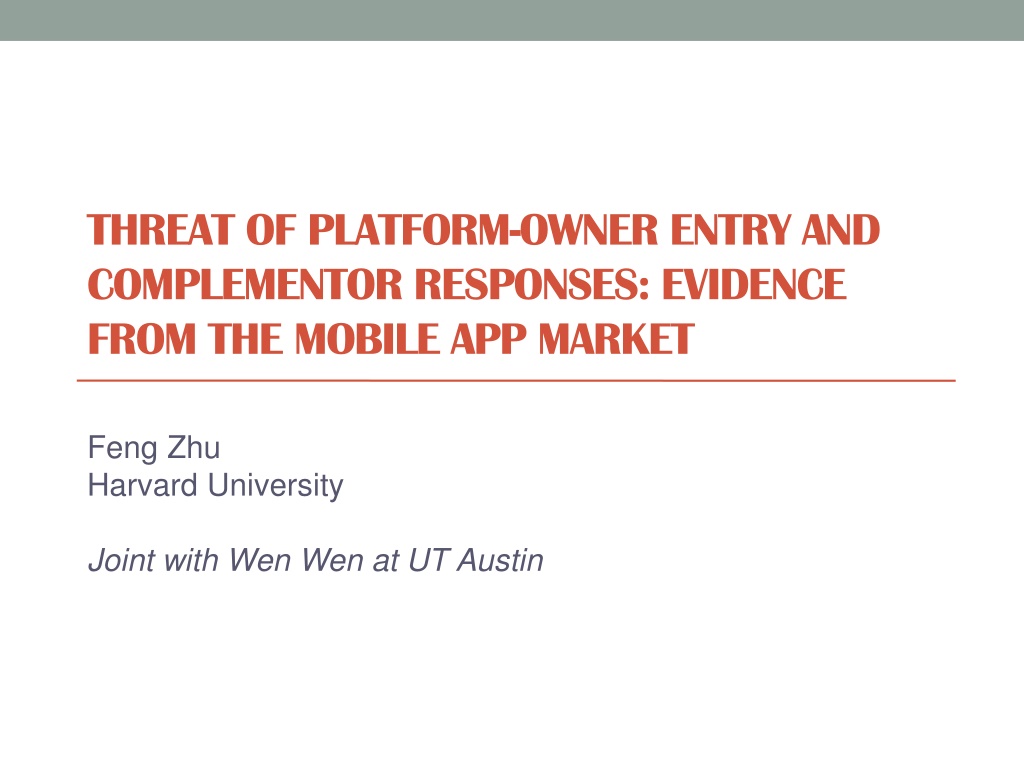

THREAT OF PLATFORM-OWNER ENTRY AND COMPLEMENTOR RESPONSES: EVIDENCE FROM THE MOBILE APP MARKET Feng Zhu Harvard University Joint with Wen Wen at UT Austin

The Age of Platforms 160,000 drivers 7 mill apps and websites Facebook Uber 1.6 mill apps 7 mill sellers Android Alibaba 8 mill public accounts 1.5 mill apps iOS WeChat

Concerns from Complementors Platform owners may imitate and embrace their innovations. vs. vs. Noah Corp. vs.

Views from Platform Owners We started from the point that one company cannot be the best in all areas. So the more partners that we have to innovate around our technology, the more it will be a win/win situation. We have to be extremely clear with our partners about what they can expect. One rule is that we cannot protect the partner forever (we cannot guarantee) that there may not be a time when we are forced to enter his space. Henning Kagermann, former CEO and Chairman of the Executive Board of SAP

Empirical Literature All empirical studies have shown positive benefits of platform- owner entry to consumers (at least in the short term). Mixed evidence on the complementor side Google s prominent placement of its Flight Search service decreases the clicks on organic search listings (Edelman & Lai 2016). Facebook s integration of Instagram has a positive spillover effect on big third- party photo applications and a negative spillover effect on small third-party photo applications in its photo-sharing ecosystem (Li & Agarwal 2017). Google s entry into photo apps increased the demand for third-party photo apps (Foerderer et al. forthcoming).

Our Paper 1. Look at threats of platform-owner entry in multiple entry events 2. Focus on innovation incentives How do complementors adjust their rate and direction of innovation efforts? 3. Provide additional reasons why platform-owner entry may not be bad for complementors

Research Design Use the mobile platform Android as our research setting. We examine how app developers on Android respond to Google s entry threat and its actual entry into the Android app markets. Identify changes in entry threat from Google using Apple s entry into the same product space.

Take the flashlight market as an example: Under Google s entry threat After Google s actual entry t August 2015 November 2014 June 2013 Responded differently during the actual-entry period? Adjusted its innovation/price on this affected app? ANDROID APP DEVELOPER iHandy Adjusted its innovation on this unaffected app (by an affected developer)? Adjusted its innovation on this unaffected app (by an unaffected developer)? ANDROID APP DEVELOPER TWMobile

Research Design Difference-in-differences regressions to compare the outcomes for three groups: Affected Developers Affected Apps (ADAA) Affected Developers Unaffected Apps (ADUA) Unaffected Developers Unaffected Apps (UDUA) control group (they are in the same category as ADAA and released before Apple s entry) Outcomeit= 0*Under Entry Threatit+ 0*Under Actual Entryit + 1*Under Entry Threatit*ADAAi + 1*Under Actual Entryit*ADAAi + 2*Under Entry Threatit*ADUAi + 2*Under Actual Entryit*ADUAi + Controlit + vi + t + it

Data A total of ~200,000 apps in the Google Play store Description, categories, release date, publisher New version release events, price change events, user rating, ranking (for top 500 only) from January 2012 to August 2015 Drop corporate apps Drop apps released after the matched entry threats Manually compile a list of apps and important iOS features released by Apple from 2007 to 2015

31 entry events, of which Google entered 25 of them (81%) In 5 cases, Google entered earlier than Apple.

Identify Affected Apps and Developers Manually identify a few affected Android apps for each Apple s entry event Use Google Play Store s similar apps feature to gather additional affected apps Consider developers of these affected apps as affected developers

Number of Apps in Each Group Guided Access Flashlight Podcasts Total Number of affected apps by affected developers (ADAA) 251 48 79 378 Number of unaffected apps by affected developers (ADUA) 191 53 67 311 Number of unaffected apps by unaffected developers (UDUA) 2,054 432 811 3,297

Robustness Checks Analyze each event separately Analyze pre-trends of treatment and control groups Falsification test using markets where Google entered before Apple Use different control groups Use Flashlight-related apps as the control group for Guided Access- related apps. Use Coarsened Exact Matching (CEM) based on pre-treatment attributes to construct a control group.

App developers release fewer similar apps under entry threats and actual entry

Affected developers release more unrelated apps under entry threat and actual entry Unit of analysis: developer-month level

Summary Complementors are strategic players and they react to platform-owner entry before actual entry takes place. Platform-owner entry does not appear to diminish innovation incentives: Complementors do not abandon the platform after the entry. They adjust their innovation directions and reallocate their innovation efforts. Platform owners may reduce wasteful product development efforts through direct entry.

Thank you! fzhu@hbs.edu