Enhancing International Tax Treaty Rules for Transport Sector

Explore the complexities of international tax treaty rules related to the transport sector, focusing on the challenges in applying tax treaties to various modes of transportation. Issues such as the scope of income coverage, domestic privileged tax regimes, and treaty relief formalities are discussed, with a comparison of selected treaty provisions among Silk Road countries.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

BRITACOM Virtual Seminar Improving and expanding tax treaty rules on international transport June, 24 2021 Guglielmo Maisto BRITACOM Advisory Board Professor of International and Comparative Tax Law Universit Cattolica di Piacenza Founding Partner of Maisto e Associati

The international transport tax landscape The key role of transport within the Belt and Road Initiative (BRI) - Six Economic transport corridors connecting Asia with Europe - Investment in roads, railways, ports and other infrastructures - Taxation of transport and the impact on supply chains - Difficulty of apportioning income from international transportation Special domestic tax regimes Tax treaties rules (Art. 8 OECD and UN Model Tax Conventions) Exception to the general distributive rule on business profits 2

Issues arising under article 8 of the OECD and UN Model Conventions Taxation of transportation by railway and road not covered by tax treaties Income from intermodal transportation (i.e. derived from the combined use of different means of transport) not covered Multilateral transport situations are not covered Scope of transportation income covered by treaties is either unclear or not consistent (e.g. leasing of containers) 3

Issues arising under article 8 of the OECD and UN Model Conventions Domestic privileged tax regimes are generally limited to shipping and not applied to road or railway transport Privileged tax regimes may prevent treaty eligibility ( liability to tax condition) Treaty relief may be subject to burdensome formalities 4

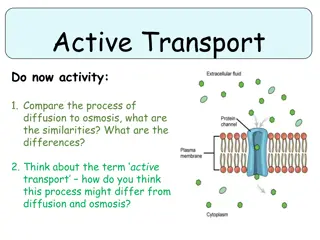

States Date of conclusion 12 Sept. 2001 Full Exemption / 50% Exemption Road and railway transport road vehicles Leasing of containers China- Kazakhstan China-Pakistan Exemption not specified 15 Nov. 1989 Exemption not covered not specified China-Vietnam 17 May 1995 exemption not covered not specified India-Kenya 11 July 2016 50% rule for shipping/exemption for aircraft not covered covered to the extent they are supplementary or incidental covered to the extent they are incidental not specified India-Sri Lanka 22 Jan. 2013 50% rule for shipping/exemption for aircraft 50% rule for shipping/exemption for aircraft exemption not covered Selected treaty comparison Silk Road countries Indonesia-Sri Lanka Kazakhstan- Uzbekistan Kyrgyzstan-Iran 3 Feb. 1993 not covered 12 June 1996 railway and road vehicles railway and road vehicles railway and road vehicles not covered covered 29 Apr. 2002 exemption not specified Kyrgyzstan- Uzbekistan Malaysia- Indonesia Malaysia-Sri Lanka States 24 Dec. 1996 exemption covered 12 Sept. 1991 50% rule for shipping/exemption for aircraft 50% rule for shipping/exemption for aircraft Exemption/50% not specified 16 Sept. 1997 not covered not specified Date of conclusion 7 Sept. 1995 Road and railway transport not covered Leasing of containers Malaysia- Vietnam Turkey-Iran exemption not specified 17 June 2002 exemption road vehicles not specified Turkey-Ukraine 27 Nov. 1996 exemption road vehicles covered to the extent they are incidental 5

Proposals for improvement Administrative Cooperation - board set up by BRITACOM (i) to address treaty issues relating to international transportation (ii) to provide a platform for implementing dispute resolutions mechanisms including mediation 6

Proposals for improvement Revision of Model Conventions and bilateral treaties Include income from rail and road transport Extend them to intermodal transport Cover other taxes and charges which affect transportation (especially by road and railway) which impact on the cost of transport and create disincentives to the growth of the business activities 7

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)