Decision Making Under Uncertainty Using Decision Trees

In this scenario, Colaco faces the decision of whether to conduct a market study for their product, Chocola. The decision involves potential national success or failure outcomes, along with the consequences of a local success or failure from the market study. By utilizing decision trees, this complex decision problem can be broken down into smaller manageable components, helping Colaco optimize their expected final asset position.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Decision Tree Decision making under uncertainty Operation Research December 29, 2014 RS and GISc, IST, Karachi

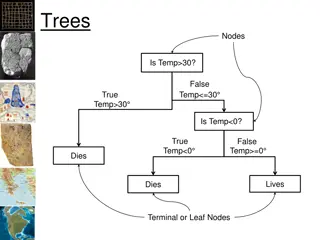

Decision Tree When a series of decisions at different points in time are made A decision tree enables a decision maker to decompose a large complex decision problem into several smaller problems

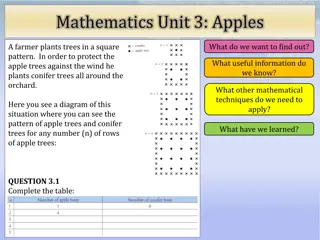

In the absence of a market study, Colaco believes that Chocola has a 55% chance of being a national success and a 45% chance of being a national failure. If Chocola is a national success, Colaco s asset position will increase by $300,000, and if Chocola is a national failure, Colaco s asset position will decrease by $100,000 If Colaco performs a market study (at a cost of $30,000), there is a 60% chance that the study will yield favorable results (referred to as a local success) and a 40% chance that the study will yield unfavorable results (referred to as a local failure). If a local success is observed, there is an 85% chance that Chocola will be a national success. If a local failure is observed, there is only a 10% chance that Chocola will be a national success. If Colaco is risk-neutral (wants to maximize its expected final asset position), what strategy should the company follow?

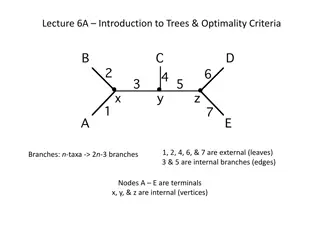

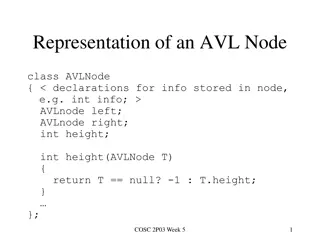

Decision Tree: Decision Fork The decision tree is constructed with two kinds of forks: decision forks (denoted by ) and event forks (denoted by ). A decision fork represents a point in time when Colaco has to make a decision. Each branch emanating from a decision fork represents a possible decision

Decision Tree: Event Fork An event fork is drawn when outside forces determine which of several random events will occur Each branch of an event fork represents a possible outcome, and the number on each branch represents the probability that the event will occur

Decision Tree: Terminal Branch A branch of a decision tree is a terminal branch if no forks emanate from the branch