Analysis of Manipulated Penny Stocks and SEBI Investigation

Detailed analysis of manipulated penny stocks through day-wise share price data and graph verification in Excel. SEBI's interim order against First Financial Services Ltd for market manipulation and misuse of funds. Investigation revealing misuse of preferential allotment funds leading to a substantial increase in stock price.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

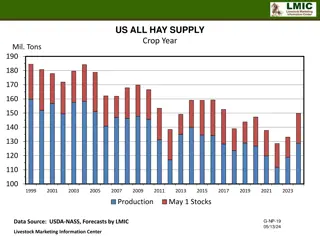

BSE Website Goto the Website - Go to the section - Go to the section - Go to the option - Feed the Security Name and the period for which the daily prices are required The results are provided in CSV file which can be read in Excel utility. From the data of day wise share prices and the number of shares traded, a Graph can be drawn in Excel to verify whether the script falls in the typical category of manipulated share price of penny stock. BSEINDIA.COM Market Historical Data Stock Prices

SEBI Interim Order In Case of First Financial Services Ltd SEBI, vide its ad-interim ex-parte order no. WTM/RKA/ ISD/ 162 /2014 dated December 19, 2014 had inter-alia, restrained the various persons/entities including First Financial Services Ltd from accessing the securities market and buying, selling or dealing in securities, either directly or indirectly, in any manner, till further directions. SEBI, vide its order no. WTM/RKA/ISD/31/2015 dated April 20, 2015 has confirmed the directions contained in the ad interim ex-parte order dated December 19, 2014 as against First Financial Services Ltd.

Result of Investigation of SEBI the fund brought in by way of preferential allotment was utilised for purposes other than those disclosed and extended by way of purported loans to companies through informal arrangements; even when substantial number of shares i.e. 77 lakh shares were locked-in and non transferable / tradable, price of the scrip increased substantially to the extent of 5160% with small chunk of volume / purchases by certain entities; After the expiry of the lock-in period (i.e. in Patch 2), the average volume increased astronomically to the extent of 179256% (1793 times) and average price increased by 197%. Such increase in volume was mainly on account of matched trading amongst First Financial group entities and allottees 80 out of the 83 preferential allottees sold total 6995530 shares allotted to them by First Financial at the price increased on account of the aforesaid manipulative trading in Patch 1; The funds required for purchase of shares by the First Financial group entities had been provided to them through layering of fund transfers.

For the Assessing Officer of Income Tax-1 Sumati Dayal vs Commissioner of Income Tax [214 ITR 801]: Smt Sumati Dayal received a total amount of Rs. 3,11,831 by way of race winnings in jackpots and treble events in races at Turf Clubs in Bangalore, Madras and Hyderabad. The A.O held that the sum of Rs. 3,11,831 is not winnings in races and he treated the said receipts as income from undisclosed sources and assessed the same as income from other sources What is disputed is that were they really the winnings of the appellant from the races. This raises the question whether the apparent can be considered as the real. The apparent must be considered the real until it is shown that there are reasons to believe that the apparent is not the real and that the taxing authorities are entitled to look into the surrounding circumstances to find out the reality and the matter has to be considered by applying the test of human probabilities

For the Assessing Officer of Income Tax-2 If the money trail leading to cash deposit for the purchase of shares sold by the assessee is found, then that is the best evidence to apply as the evidence of human probabilities If the shares were acquired by the assessee through a broker and the evidences in the form of date of corresponding payment, transfer of shares, demata/c credit, statement of the assesseeand broker etc reveal that the purchases of the shares were back dated, then these evidences apply as the evidences of human probabilities. If SEBI and Stock Exchanges such as BSE,CSE etc have suspended the broker, the script or the traders like assessee after a though investigation on penny stock manipulation, then those orders are good evidences to apply as the evidence of human probabilities. While taxing the income u/s 68 or 69, apply 30% flat rate u/s 115BBE for the Assessment Year .2013-14 onwards.