Investing in Education for a Lifetime of Earnings

Explore the value of going to college, the affordability of higher education, and the financial benefits of investing in your future through education. Discover how the choice of college and field of study can impact your lifetime earnings. Calculate the difference in earning potential across various salary levels and consider the long-term benefits of education.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

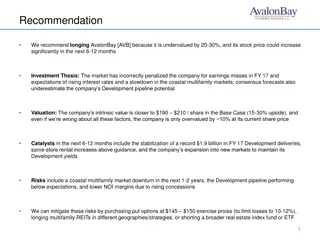

Yields Dividends For A Lifetime 1. Do you want to go to college? Why or why not? 2. Some people might say college is too expensive. Why might the cost of college not really be that expensive? 3. What college(s) do you want to attend? If college isn t in your future, what do you want to do with your future?

Yields Dividends For A Lifetime How many years do you plan to work between the age of 18 and 65? Objective: To demonstrate the financial payoff- over a lifetime-of an investment in education.

An Investment in Education An investment in your future begins with education. Taking math and science courses in high school, can give you more options concerning where you will go to college and what you will major in. Reading and writing skills are also essential in most career fields. College means more time commitment to your education for a career. Review the chart on Page 116 in your textbook. It demonstrates post high school education can lead to financial reward.

Determining Lifetime Earnings Activity 117 How many years do you want to work for? Multiply the following salary by those years to equal your lifetime earnings. $20,000 x _____ years in workforce = _______ $30,000 x _____ years in workforce = _______ $50,000 x _____ years in workforce = _______ $75,000 x _____ years in workforce = _______ $100,000 x _____ years in workforce = ______

Lifetime Earnings (Answers) $20,000 x 43 years in workforce = $860,000. $30,000 x 43 years in workforce = $1,290,000. $50,000 x 43 years in workforce = $2,150,000. $75,000 x 43 years in workforce = $3,225,000. $100,000 x 43 years in workforce = $4,300,000.

You do the Math! What is the difference between a $20,000 and $30,000 salary? What is the difference between a $20,000 and $50,000 salary? What is the difference between a $20,000 and $75,000 salary? What is the difference between a $20,000 and $100,000 salary?

You do the Math Answers! What is the difference between a $20,000 and $30,000 salary? $430,000! What is the difference between a $20,000 and $50,000 salary? $1,290,000! What is the difference between a $20,000 and $75,000 salary? $2,365,000! What is the difference between a $20,000 and $100,000 salary? $3,440,000!

Minimum Wage in California $10.00 per hour. $10.00 X 8 hours = $80.00 a day $80.00 X 5 days per week = $400.00 50 weeks in a year (standard two week vacation.) $400.00 x 50 weeks = $20,000 for the year. Total: $20,000.00 Lifetime Total 43 years = $860,000

Activity 118 Let s look at your lifespan. The horizontal bar represents the average lifespan of 78 years. Already filling in time for your schooling to this point, you will have 60 years to play with. Envision your ideal future. How will you spend your time? Think about the job you would most like to have REGARDLESS OF HOW MUCH TRAINING AND SCHOOLING IT TAKES TO GET THERE.

Activity 118 Continued Using polka dots, fill in and label the years you will be in college or training. Using horizontal stripes, fill in time for full time work. Using diagonal stripes, fill in time for part-time work. Using stars, fill in and label the time outside the workforce for raising a family or retirement.

Activity 119 How many years of post-high school training will you complete? (A) 4 or 5 years? How many years do you think you will work full- time? (B) 43 or 47 years? How many years do you think you will work part- time? (C) 4 or 5 years?

Activity 119 Multiply 2,080 x (b) 40 years. This will be your answer for (f) 83,200 hours. Multiply 1,000 x (c) 5 years. This will be your answer for (g) 5,000 hours. Add (f) + (g) together = 88,200 hours. This is how many hours you will work in your lifetime. Look at the formula at the bottom of the page in your workbook. Then write this total on the line above it. For every year of post-high school education, you will work 11 years 3 months. Schooling isn t all that bad after all is it?