Evolution of IT in Banking Sector: The Role of CIO in the New Financial Environment

The role of Chief Information Officer (CIO) in the banking sector has evolved over the years, from data consolidation and management support in the 1980s to a focus on customer relationships, process automation, and IT innovation in recent times. With technology now driving the most change in organizations, banks are investing in mobile financial services, online platforms, and self-service capabilities to enhance customer convenience. It is crucial for banks to prioritize user experience, architecture, analytics, and security mechanisms in developing new solutions. The intersection of technology, business, and customer experience continues to shape the digital transformation of the financial industry.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Organized by: THE CIO ROLE ON THE NEW FINANCIAL ENVIRONMENT Gustavo de Souza Fosse Banco do Brasil Board of Technology

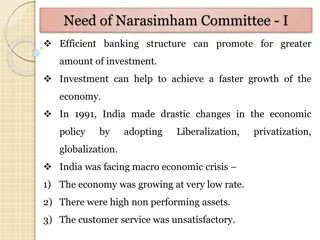

Process Automation Closer to the business Great Evolution of IT Services 1990 Customer relationship Business on Virtual Places Governance 2000 Efficiency Delivering Value Regulation 2010 Data Consolidation Management Support 1980 EVOLUTION OF IT ON THE BANKS

The entertainment industry and financial are the greatest examples of digital companies . MIT/CISR (Center of Information Systems Research) EVEN MORE SOPHISTICATED IT USAGE BUSINESS RELIES ENTIRELY ON IT

The world's 30 largest (by assets) banks continue to fund initiatives in mobile financial services while increasing investment emphasis on online for retail and commercial customers, and physical customer touchpoints to facilitate more self-service capabilities . Gartner : Top Banks and Their IT Plans and Investments, 2H11 MOBILITY IS INCREASINGLY SIGNIFICANT CUSTOMER CONVENIENCE AND DEMANDS NOT ACCEPT WAIT.

For the first time since this CEO Study series began in 2004, technology now tops the list of external forces impacting organizations. Above any other external factor even the economy CEOs expect technology to drive the most change in their organizations over the next three to five years. . IBM Leading Through Connections Insights from the Global CEO Study May 2012 IT HAS A ROLE PLAYER IN GROWING BUSINESS

Banks need to put the user experience at the center of discussions. It is essential to have a good architecture for developing new solutions, in addition to the heavy use of analytical tools and building security mechanisms and that this can be clearly communicated to the user . Nilton Omura - Ernst & Young Terco, CIAB Day 2012 COMPANIES DIFFER IN CUSTOMER EXPERIENCE IT IS AN ESSENTIAL PART OF THAT EXPERIENCE.

Internet of Things Lifecycle decrease Mobility and Convenience Efficiency Spreads decrease Y Generation Big Data Quick Emergence of New Technologies IT Innovation SCENARIOS AND PROSPECTS

PRESSURE ON THE EFFICIENCY * Deployment of Strategic Projects Long term Maturation Internal Factors External Factors Efficiency Loss Changes in economic and regulatory scenery and internal environment of banks... Growth Trends of Administrative Expenses

EFFICIENCY* STANDING OPTIMIZATION OF AVAILABLE RESOURCES TO VALUE CREATION FOR EVERYONE WHO HAS RELATIONSHIP WITH THE BANK.

THE ROLE OF IT* Define Define Strategy Build Capabilities Operate Reliability Exploit Value Creation Exploit Build Operate

THE ROLE OF IT* Define Define, Build and Operate - Traditional role - Expense reduction - IT productivity Exploit Build Operate

THE ROLE OF IT* Define Exploit - Greater effect on the operating result - Business Productivity - Require new skills Exploit Build Operate

Ruled by constantly adapting to new realities; Strategic vision, innovative and transformative; Understand the business, its key drivers, and influence or even change the way future of organizations; Position themselves as business partners of their peers and ever deeper the analysis as a way to predict the future technological trends. THE CIO ROLE*

Shareholder Satisfaction Sustainable Results Contribution to Society RESULTS

Organized by: Gustavo de Souza Fosse +55 61 3104 6001 fosse@bb.com.br