Understanding Capital Structure, Game Theory, and Competition in Financial Strategy

Exploring the concepts of capital structure, game theory, and competition in financial decision-making. Discusses equilibria, information asymmetry, and the relevance of game theory in predicting outcomes. Provides an example scenario involving outside equity and differential information to illustrate the importance of precise formulations of equilibrium.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

CAPITAL STRUCTURE, GAME THEORY AND COMPETITION P.V. Viswanath FIN 663, Financial Strategy and Business Decisions

EQUILIBRIA We saw previously (in the module on Capital Structure and Stockholder Incentives) that the existence of debt could cause debt overhang and consequent underinvestment. In those cases, we saw that inside equityholders may not be willing to invest even in NPV > 0 projects because they have to share the benefits with existing debtholders. In those examples, in order to reach a conclusion as to what would happen, we had each party (e.g. bondholders and the firm) make assumptions about the actions of the other party and then decide what to do, based on those assumptions. The conclusions that we came to about what was going to happen were situations where the expectations of each party were fulfilled and none of the parties wish to alter their choices. This is what is known as equilibrium. Think, for example, of a standard supply-demand diagram, where the quantity/price pair where the supply and demand curves meet is considered to be the equilibrium because at that price, nobody wishes to supply more or less of the good, and nobody wishes to demand more or less of the good.

EQUILIBRIA AND GAME THEORY We only accept equilibrium outcomes as being acceptable predictions of what will happen in reality. Often, though, what we should accept as being an equilibrium is unclear, as we will see going ahead. Another situation where we need more precise formulations of equilibrium is where the parties have differential information. Debt, we have seen, could lead to underinvestment. However, sometimes, even in the absence of debt, the need to obtain outside equity could lead to the rejection of profitable projects because of information asymmetry that is, each party has different information about the facts. In such situations, we need to be precise about what constitutes equilibrium. This is where game theory comes in. Game theory allows us to be more precise as to what is an equilibrium is when agents actions depend upon their beliefs as to what other agents will do. We now look at an example of information asymmetry to see why we need game theory.

OUTSIDE EQUITY: AN EXAMPLE Consider the following problem. Suppose outside investors are unsure whether a firm s assets are worth $100 or $200. They believe either possibility is equally likely. Insiders, however, know exactly what the value of the firm is. The market value of the firm will be $150 ((100+200/2) (reflecting public information). Suppose this firm also has a project that it can invest in, which requires an investment of $60 and has a PV of $70 (i.e. an NPV of $10). Now the firm is potentially worth $160 (150+10)

OUTSIDE EQUITY: AN EXAMPLE Let s assume the firm has no debt and wants to issue new equity to raise the $60 for the project. Together with the new funds to be raised, outside investors will expect the firm to be worth $220 (160+60). In order to get shares worth $60 in return for the $60 they are investing, they will ask for 27.27% (60/220) of the new firm. Inside investors know the real value of the firm. If the firm is undervalued in the market (the true value is $210, while the market value is $160), by giving up 27.27% of the firm, they will actually be giving up 0.2727(270) or $73.64 and will be left with 270-73.64 or $196.36. If they did not issue equity and did not invest in the project, they would have a firm worth $200. Since 200 > 196.36, they would be indifferent about the project. The result, again, is underinvestment as before under the debt overhang situation, but now for a different reason: information asymmetry.

OUTSIDE EQUITY AND GAME THEORY So far so good. We see here that outside investors react to the attempt by inside investors to raise capital. Inside investors then respond, based on the reaction of the outside investors. But what about the outside investors? Why is their behavior not conditioned on the expected behavior of the insiders? How can we analyze that? Do we need to look at how outsiders react to the insider reaction and then how insiders react to the outsiders reaction to the insiders reaction and on and on and on? Game Theory creates us a framework to analyze such questions. But let s start from the beginning. What is Game Theory?

GAME THEORY Game theory is the study of strategic decision making. It is the study of mathematical models of conflict and cooperation between intelligent rational decision-makers. It is a branch of applied mathematics that provides tools for analyzing situations in which parties make decisions that are interdependent. This interdependence causes each player to consider the other player's possible decisions, or strategies, in formulating strategy. (Britannica) We will use Game Theory to analyze how firms interact, but it has many other applications. Including modeling the relationship between human beings and God! See Steven Brams Biblical Games: Game Theory and the Hebrew Bible. https://mitpress.mit.edu/books/biblical-games. We first start with some definitions and examples. (Some slides taken from Michael Conlin, online and Mike Shor.)

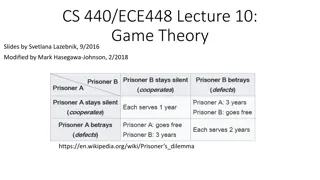

GAME THEORY TERMINOLOGY In game theory, a strategy is a decision rule that describes the actions a player will take at each decision point. A representation of a game indicating the players, their possible strategies, and the payoffs resulting from alternative strategies, called Normal Form Game is usually used to represent simple games. Let s see how this works with a prisoner s dilemma, presented as a normal form game. https://youtu.be/t9Lo2fgxWHw

EXAMPLE 1: PRISONERS DILEMMA (NORMAL FORM OF SIMULTANEOUS MOVE GAME) Blue s options Confess and Implicate B: 0 year R: 3 years Don t Confess B: 1 year R: 1 year Red s Options Don t Confess Confess and Implicate B: 3 years R: 0 years B: 2 years R: 2 years Confess (0<1) Confess (2<3) What is Blue s best option if Red doesn t confess? What is Blue s best option if Red does confess? A dominant strategy that is optimal independent of what the opponent s does

EXAMPLE 2: PRICE SETTING GAME The first entry in a cell usually is the payoff to the player on the left, in this case, to A Firm B s options Low Price High Price Low Price 0 , 0 50 , -10 Firm A s Options High Price -10 , 50 10 , 10 Low Price Low Price Is there a dominant strategy for Firm B? Is there a dominant strategy for Firm A?

EQUILIBRIA What would our predictions be in the two games that we just saw? One definition of equilibrium is a state where there is no incentive for each party to change its behavior. Which of the strategy pairs fits that definition? When we say no incentive for each party to change its behavior, what are we assuming about the other party? Do we need to specify that? If so, what assumptions are appropriate? Here s a solution from the 1994 Economics Nobel Prize winner, John Nash.

NASH EQUILIBRIUM If both players have dominant strategies, then that pair of dominant strategies will most likely be the equilibrium outcome. But what if there are no mutually dominant strategies? For such a case, John Nash, came up with an equilibrium which, he suggested, could describe outcomes. This is called a Nash equilibrium. A Nash equilibrium is a condition describing a set of strategies in which no player can improve her payoff by unilaterally changing her own strategy, given the other player s strategy.

NASH EQUILIBRIUM In other words, every player is doing the best they possibly can given the other player s strategy. If a pair of dominant strategies exist, the equilibrium consisting of those two strategies will also be Nash, but not all Nash equilibria correspond to dominant strategies. Nash equilibria don t always exist for a given game, but if they do, then there is a strong argument that that would describe the actual outcome of the game. (But sometimes there can be more than one Nash equilibrium!)

EXAMPLE OF A NASH EQUILIBRIUM Consider the following 2x2 game with two players A and B. A s possible strategies are M and N, while those of B are K and L. A/B M N K L 20,10 30,3 25,8 25,10 Their payoffs for the different pairs of strategy choices are given as the pairs of numbers in the cells where the first number represents the payoff to A. In this case, we have four candidate equilibria: 1: (M, K), 2: (M, L), 3: (N, K) and 4: (N, L). Since there are two players and each have two possible strategies, there are four combinations and four candidate equilibria. Which of these are Nash and which are not Nash? Let s apply the definition we have already provided.

DEMONSTRATING A NASH EQUILIBRIUM Let us consider whether a proposed equilibrium consisting of the pair of strategies (M,K) (that is where A plays M and B plays K) is Nash. First, we assume A plays M and see if B has an incentive to deviate from her proposed strategy, K. Since B would have the payoff 10 by playing K and 8 by playing L, we see that B will not deviate, since 10>8. Next, we assume that B plays K and check whether A has an incentive to deviate from his proposed strategy M. In this case, M has the payoff 20 by not deviating and 30 by deviating (and playing N). Hence A will deviate and the proposed equilibrium (M,K) is not Nash. Now let us consider whether (N,L) is Nash. If A plays N, B will get 3 by deviating (and playing K) and 10 by not deviating (and playing L). If B plays L, A gets 25 by not deviating (and playing N) and 25 by deviating (and playing K). Hence A has no incentive to deviate. Hence the proposed equilibrium (N,L) is indeed Nash. Let us consider further examples.

EXAMPLE 1: NASH? Blue s options Confess and Implicate Don t Confess 1 year , 1 year 3 years , 0 year Red s Options Don t Confess Confess and Implicate 0 year , 3 years 2 years , 2 years One Nash Equilibrium is: (Confess, Confess) Are there any other Nash equilibria?

EXAMPLE 2: NASH? Firm B s options Low Price High Price Low Price 0 , 0 50 , -10 Firm A s Options High Price -10 , 50 10 , 10 Nash Equilibrium: (Low Price, Low Price) Are there any other Nash equilibria?

PRISONERS DILEMMA GAMES What characterizes Prisoner s Dilemma Games? Outcomes that are not the most-preferred outcome for either candidate. In fact, there are candidate equilibria that are preferred by all participants in the game. What are other examples of prisoner s dilemma games? What about Climate Change? http://webpage.pace.edu/pviswanath/research/papers/environment.pdf What about firms competing against each other? https://youtu.be/t9Lo2fgxWHw?t=110

ZER0-SUM GAMES The next game that we will look at is a zero-sum game. The prisoner s dilemma game is not a zero-sum game. In zero-sum games, the payoff to one party is the negative of the payoff to the second party. Hence, there is no gain to cooperation. The equilibrium outcomes in these zero-sum games do not have the most preferred outcomes of any candidates, just like the Prisoner s Dilemma games. On the other hand, there are no candidate equilibria that are preferred by all game participants.

EXAMPLE 3: NEW TECHNOLOGY Firm B s options New Technology Stay Put New Technology 0 , 0 50 , -50 Firm A s Options Stay Put -50 , 50 0 , 0 Is there more than one Nash equilibrium?

CO-ORDINATION GAME The next two games we will see are called Co-ordination Games. In coordination games, a player earns a higher payoff when they select the same course of action as another player. These will have Nash equilibria usually, but often these are weakly Nash a term that I will not define, but which should be self-explanatory (hopefully), once we look at the games. An example is where two people agree to meet at a street corner in New York, but fail to communicate which street corner? What are the strategies, and what are the candidate equilibria? Are any of them Nash? Is there a strong Nash equilibrium?

EXAMPLE 4: MAKING DEALS Director s options Yes No Movie Star s Options Yes 50 , 50 0 , 0 No 0 , 0 0 , 0 Is there more than one Nash equilibrium?

EXAMPLE 4: VIDEO SYSTEMS Firm 2 s options Betamax VHS Betamax 50 , 50 0 , 0 Firm 1 s Options VHS 0 , 0 40 , 40 Is there more than one Nash equilibrium?

COMMITMENT GAMES We will now look at some more games and examine the role of involvement, commitment, and other devices in the resolution of uncertainty in these games. In these games, there are two stages. In the first stage, the players have the option to make a commitment or not to make a commitment. The second stage is a conventional game with the caveat that the moves that the player makes in the second stage have to be consistent with the commitment made in the first stage. Eventually, we will see how these games are relevant in the context of capital structure decisions.

INVOLVEMENT, COMMITMENT AND STRATEGY Consider the following chicken game: Manny Swerve Tie, Tie Win, Lose Straight Lose, Win Crash, Crash Swerve Straight Danny Because the loss from swerving is so trivial compared to the crash that occurs if nobody swerves, the reasonable strategy would seem to be to swerve before a crash happens. Yet, knowing this, if one believes one's opponent to be reasonable, one may well decide not to swerve at all, in the belief that he will be reasonable and decide to swerve, leaving the other player the winner. This game has no symmetric Nash equilibrium in pure strategies. If Manny is going to swerve, then Danny should go straight. If Manny is going to go straight, then Danny should swerve (assuming losing is better than crashing). In other words, there is unresolvable uncertainty in this game, as currently stated.

COMMITMENT AND STRATEGY Is the uncertainly completely unresolvable? Is commitment a way to resolve the standoff? One tactic in the game is for one party to signal their intentions convincingly before the game begins. For example, if one party, say Danny, were to ostentatiously disable their steering wheel just before the match, the other party would be compelled to swerve. Manny Swerve Straight Danny Straight Win, Lose Crash, Crash This shows that, in some circumstances, reducing one's own options can be a good strategy. Source: Wikipedia

COMMITMENT AND STRATEGY One real-world example is a protester who handcuffs himself to an object, so that no threat can be made which would compel him to move (since he cannot move). Another example, taken from fiction, is found in Stanley Kubrick's Dr. Strangelove. In that film, the Russians sought to deter American attack by building a "doomsday machine," a device that would trigger world annihilation if Russia was hit by nuclear weapons or if any attempt were made to disarm it. However, the Russians failed to signal they deployed their doomsday machine covertly. Obviously, this will not elicit the desired response from the opponent, i.e. backing down. Revelation of the signal is key. Source: Wikipedia

UBER AND COMMITMENT Uber aims to maintain heavy spending to keep rivals at bay Bond, Shannon; Bullock, Nicole; Bradshaw, Tim.FT.com; London (Apr 12, 2019). Uber has spent most of the past two years overhauling its image as a highly aggressive company bent on destroying its rivals.

POLL: WHAT KIND OF GAME? Read the following article: https://www.nytimes.com/2021/03/16/us/politics/mcconnell-filibuster- senate.html?searchResultPosition=1 What kind of game is this? A Coordination Game A Commitment Game A Prisoner s Dilemma Game A Zero-Sum Game

COMMITMENT VS. INVOLVEMENT Another game with two firms considering market entry: Market potential is $10 million NPV profits Entry costs $7 million; if both enter, both firms lose because total entry costs ($14m.) is greater than the market potential ($10m.). Them In Out 3 , 0 0 , 0 In Out -2 , -2 0 , 3 Us It is in our best interest to stay out if we think that the other firm will enter. This is similar to the chicken game. Mike Shor Game Theory & Business Strategy

INVOLVEMENT How can we strategically resolve this uncertainty? Consider making a small initial investment: Invest first $1 million to deter entry, which is lost if we then quit. Them In Out 3 , 0 -1 , 0 In Out -2 , -2 -1 , 3 Us It is still in our best interest to stay out if we think that the other firm will enter. This level of involvement is insufficient: we still have uncertainty that remains unresolved . Mike Shor Game Theory & Business Strategy

CREDIBLE COMMITMENT Now suppose we make a larger initial investment: Invest first $3 million to deter entry, which amount is lost if we then quit. Them In Out 3 , 0 -3 , 0 In Out -2 , -2 -3 , 3 Us Now, it is our dominant strategy to enter regardless of what the other firm will do. By reducing our own payoffs from staying out, we have committed to entry. This is like a first-mover advantage. Mike Shor Game Theory & Business Strategy

REDUCING PAYOFFS: CONTRACTING Consider another example of a credible commitment. Suppose the best offer that the target currently has is $200 million. So you can t offer less than $200m. But you don t want to offer more than that either. If the value of the deal to you is more than $200m., you can t credibly threaten to walk away if the target demands more. Let s make the situation more concrete. Suppose the synergies from the merger are $20 million/yr. for 20 years; further, securities providing cashflows with similar risk as these $20 million are traded in the market for an expected return of 7% p.a. Hence the present value of the synergies is $20 million/yr. for 20 years discounted at the rate of 7%. This is the maximum that you, the acquirer, would be willing to pay. Let s assume for convenience that there are only two possible prices -- $200m and $211.88m. How can you hold out for $200m.?

REDUCING PAYOFFS How many Nash equilibria are there in this case? Assume that the game is only played once. Target Demand $200m $11.88, $0 Demand $211.88m $0, $0 Offer $200m Acquirer Offer $211.88m $0, $11.88 $0 , $11.88 Both the (1,1) and the (2,2) cells are Nash equilibria.

REDUCING PAYOFFS: CONTRACTING Suppose you enter into a binding contract with a third party to finance the takeover with a 20-year loan at 7%. But Add penalty: if amount greater than $200 million, +1.5 points on interest rate Price Annual Payments: $200 million: $18.8 million / year $211.88 million: $20.0 million / year still affordable But with penalty: $22.39 million / year -- unaffordable The present value of the higher payments, evaluated at the true discount rate of 7% is $237.195m. So it s clear that the acquirer will not pay more than $200m. This is, therefore, a credible commitment. The normal form game has now changed.

REDUCING PAYOFFS The payoffs now are different. If the acquirer pays more than $200m, the outcome for the acquiring firm is negative. Now, the only Nash equilibrium is where both parties agree on $200m. Target Demand $200m $11.88, $0 Demand $211.88m $0, $0 Offer $200m Acquirer Offer $211.88m -$25.32, $11.88 -$25.32, $11.88 Now, if the acquirer pays $211.88, it will actually cost them 237.19, so it s a net loss of $25.32 for them The (2,2) cell is not Nash, any more because it s optimal for the acquirer to deviate and offer $200m

COMMITMENT AND MANAGERIAL BEHAVIOR Here s another example of how commitment can help. It is well known that managers have an incentive to take negative NPV projects if they have private benefits (from perks) from firm investment. For example, a manager might authorize the purchase of a company jet for business travel, if he himself were using the jet, whereas he might not if it were for the use of other company personnel. Knowing that such incentives for inappropriate use of company resources exist, outside investors, both equity and debt, may be discouraged from putting their money in the firm. Good employees, too, may decide not to work for a firm, where such potential exists; or, at the very least, they may decide not to make any personal sacrifices for the firm. How could a firm solve this problem?

COMMITMENT AND MANAGERIAL BEHAVIOR One solution is for the firm to take on debt. The existence of debt means that managers have a greater incentive to choose profitable projects. The reason is that every choice of an unprofitable project increases the probability of bankruptcy to a greater degree for a leveraged firm. Bankruptcy, and possibly liquidation. And in such a case, managers would lose their firm-specific human capital. In brief, Investors/employees have reason to worry about suboptimal actions by management; to counteract this, managers can use debt as a commitment device. By taking on debt, managers commit to take on profitable projects. This is the basis for Michael Jensen s Free Cashflow Hypothesis.

DEBT AND CULTURE AS SOLUTIONS How would you model the case of managerial perks to show that the threat of bankruptcy can eliminate suboptimal (NPV < 0) managerial expenditures? Another solution is to promote a corporate culture where people who are more willing to work for the common good. Hiring only people who buy into such a corporate culture could deliver the same outcome without the costs of excessive leverage. How would you model this?

DEBT, HUMAN CAPITAL AND RISK- TAKING So if debt might cause managers to have a greater preference for positive NPV projects, what about the tendency of firms to take excessive risk? We saw earlier in games between stockholders and bondholders that leveraged firms will take on excessive risk. Is this still true? If we introduce managers as an additional player in the game, will the situation be changed? Improved?

INFORMATIONAL GAMES Now that we know some game theory, we can look at questions of information asymmetry and outside financing in a more sophisticated fashion. We look at a game between inside stockholders (insiders) and outside stockholders (outsiders, potential equity investors). A new element that this game introduces is asymmetry between the two players in terms of their knowledge of the reality. We will see that, in some cases, in equilibrium, the actions of the players can end up revealing the information of one player (insiders) to the other player (outsider). We start with the example introduced earlier.

OUTSIDE EQUITY: AN EXAMPLE Consider the following problem. Suppose outside investors are unsure whether a firm s assets are worth $100 or $200. They believe either possibility is equally likely. Insiders, however, know exactly what the value of the firm is. The market value of the firm will be $150 ((100+200/2) (reflecting public information). Suppose this firm also has a project that it can invest in, which requires an investment of $60 and has a PV of $70 (i.e. an NPV of $10). Now the firm is potentially worth $160 (150+10)

OUTSIDE EQUITY: AN EXAMPLE Let s assume the firm has no debt and wants to issue new equity to raise the $60 for the project. Together with the new funds to be raised, outside investors will expect the firm to be worth $220 (160+60). In order to get shares worth $60 in return for the $60 they are investing, they will ask for 27.27% (60/220) of the new firm. Inside investors know the real value of the firm. If the firm is undervalued in the market (the true value is $210, while the market value is $160), by giving up 27.27% of the firm, they will actually be giving up 0.2727(270) or $73.64 and will be left with 270-73.64 or $196.36. If they did not issue equity and did not invest in the project, they would have a firm worth $200. Since 200 > 196.36, they would forego the project. The result, again, is underinvestment as before under the debt overhang situation, but now for a different reason: information asymmetry.

OUTSIDE EQUITY: INFORMATIONAL ISSUES The insiders have two strategies: 1) issue equity and invest and 2) don t issue equity and forego. However, they also know what the true state is; hence they can condition their strategy on their knowledge. Outsiders have the choice of what terms to offer, but they cannot condition this on the true state, since they do not have the information.

OUTSIDE EQUITY: INFORMATIONAL ISSUES Let s now consider a modified version of the previous game. Suppose all the other data are the same, but the investment required is now not $60, but only $20. Now the total value of the firm including the new investment will be either 130 (100+10+20) or 230 (200+10+20). The outside investors will value it at $180 ((130+230)/2) and demand 20/180. Inside investors in the undervalued state will find themselves in a situation of obtaining (160/180)230 = 204.44 if they issue equity and invest in the new project or $200 if they decide not to invest. They will, therefore, invest.