Payroll Load Rates Calculation and 2018 Projections

This document presents the calculation of payroll load rates and benefit costs for the years 2014 to 2016 at the University of Washington. It includes details on healthcare, Social Security, retirement benefits, and other components. The high-level description of the payroll load rate as well as the core components are outlined, offering insight into how employee benefits impact payroll expenses. Additionally, projections for 2018 are provided based on forecasted benefit costs and salaries. The information is crucial for understanding and budgeting employee-related expenses within an organization.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

PAYROLL LOAD RATES CALCULATION AND 2018 PROJECTIONS JANUARY 9TH, 2017

UW BENEFIT COSTS FOR 2015 UW Cost 2015 (In Millions) Healthcare & GAIP $31.4 5% $33.6 5% Social Security (Federal) $86.5 12% $267.2 39% UWRP and UWSRP Retirement (UW Retirement Plan) $139.1 20% PERS Retirement (Department of Retirement Systems) $132.2 19% Medicare (Federal) Work Comp, Unemployment, Separation Leave, etc 2

UW BENEFIT COSTS FOR 2016 UW Cost 2016 (In Millions) Healthcare & GAIP $32.7 4% $35.7 4% Social Security (Federal) $112.1 14% $345.0 43% UWRP and UWSRP Retirement (UW Retirement Plan) $145.4 18% PERS Retirement (Department of Retirement Systems) $140.3 17% Medicare (Federal) Work Comp, Unemployment, Separation Leave, etc 3

UW BENEFIT COSTS (2014 - 2016) Benefit Costs as a % of Total 50% 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% Healthcare & GAIP Social Security UWRP and UWSRP PERS Medicare Work Comp, Unemp, Separation Leave, etc. 2014 (% of Total) 2015 (% of Total) 2016 (% of Total) 4

PAYROLL LOAD RATE HIGH LEVEL DESCRIPTION Description: The payroll load rate is the rate applied to all salary dollars in FAS which is intended to charge departments for the cost of employee benefits earned by their employees during that period. The Formula: The formula for calculating the payroll load rate is dictated by the Cost Allocation Services (CAS) of the Department of Health and Human Services. The rate is calculated separately for eight different salary classes, in order to recognize the differing basket of benefits which are earned by various employee groups. The payroll load rate is comprised of two components: "Core" Rate Intended to charge out the estimated cost of employee benefits earned during a given pay period "Prior Year Over/Under The add/subtract from the "core" rate that is intended to adjust for prior year over/under recoveries 5

PAYROLL LOAD RATE "CORE" COMPONENT OF THE RATE Actual salaries and benefit costs from two years prior (and any other available information) are used to forecast salaries and benefit costs to be incurred during the payroll load period. Forecast Benefits / Forecast Salaries = Payroll Load Rate For example (Professional Staff): Type of Benefit Basis 2016 Actual Dollars 2018 Forecast Dollars Healthcare Contribution per FTE $102,827,000 $131,831,000 Social Security Percent of Salary 46,513,000 53,237,000 UWRP Retirement Percent of Salary 49,234,000 56,351,000 UWRP Supplemental Annual required funding 17,904,000 17,904,000 PERS Retirement Percent of Salary 18,113,000 23,596,000 Medicare Percent of Salary 11,477,000 13,136,000 Unemployment, Workers Compensation, etc. Percent of Salary 13,918,000 15,930,000 Total Benefit Dollars 259,986,000 311,985,000 Total Salaries 820,328,000 938,921,000 Professional Core Rate= 33.2% 6

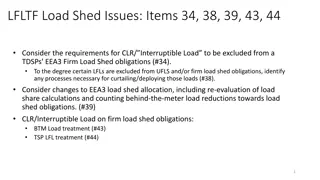

PAYROLL LOAD RATE "PRIOR YEAR OVER/UNDER" COMPONENT OF THE RATE The purpose of the prior year over/under is to adjust current period rates for over/under recoveries experienced TWO years prior. To the extent that the prior year difference relates to an adjustment to the rates intended to recover a prior year difference, the impact is eliminated by bringing in the over/under from FOUR years prior. Total "prior year over/under" impact on payroll load rates is the combination of these two items. For example: 7

PAYROLL LOAD RATE IMPACT ON 2018 ESTIMATED RATES Change in Assumptions Healthcare 2018 Healthcare 2018 PERS 2018 PERS 2018 Salary 2018 Total Load Rate 2018 (estimate) Classified Professional Faculty 41.4% 40.0 42.0 40.9 41.9 42.0 34.1% 33.1 34.5 34.0 34.2 34.6 25.4% 24.8 25.7 25.4 25.5 25.8 Cost Drivers 2018 (estimate) 2018 2018 2018 2018 2018 Health Care Premium/FTE $ 970 900 1000 970 970 970 PERS Retirement - % of Salary 12.52% 12.52% 12.52% 12.0% 13.0% 12.52% Salary Assumption Average 3% 3.0% 3.0% 3.0% 3.0% Flat 8