Smart Spending & Saving: Financial Survival & Thriving in College

Dr. Margaret Fitzgerald, in her presentation, shares insights on financial management strategies for college students, emphasizing activities for effective future planning. Drawing from student reflections and teaching experiences, she discusses practical approaches for enhancing financial skills. With a focus on personal finance basics, student interests, investments, debt awareness, and the influence of Behavioral Economics, the session explores the intersection of learning and real-world financial challenges.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Smart Spending and Saving: What I've Learned from Students on How to Financially Survive and Thrive During the College Years North Dakota Association of Financial Aid Administrators Spring Conference April 11, 2024 Margaret Fitzgerald, Ph.D. Dr. Anne StegnerEndowed Professor Department of Human Development & Family Science College of Health and Human Sciences North Dakota State University Margaret.Fitzgerald@ndsu.edu

OVERVIEW This session will describe various activities or methods students can and do use to manage their finances during their college years with an emphasis on developing effective strategies for the future.

Presentation is Based on an integration of the ideas or concepts I use to teach HDFS 186 Smart Spending & Saving, and also what I've learned from student reflections on their assignments regarding their actual behavior--especially the strategies they use or plan to use to improve their financial situation going forward. Present for about 20 minutes; questions and discussion to follow.

Background & Experience 36 years at NDSU Faculty, administration, now back to faculty and teaching again for the first time in a long time

That was then. Upper division & graduate courses in financial planning & public policy

This is now Asked to develop a 100-level General Education course Smart Spending and Saving Students wanting and needing something before our 357 Personal and Family Finance Course On-line, Fall Semester, 2023, 100+ students Will teach again next fall Also teaching HDFS 357 Personal & Family Finance, in-person and on-line

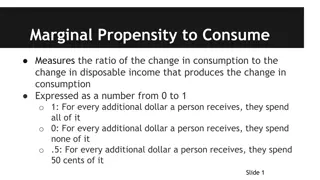

What Im seeing. Good news: Greater interest in personal finance (course enrollments up) Concerns: Desire to invest before covering the basics (emergency fund; necessary insurance coverage etc.) but receptive to learning about sequencing Cognizant of the importance of building these life-skills; emergency savings, retirement savings, when to start investing, etc. Frauds affecting young adults on-line sales; financial frauds Attracting a variety of majors; genuine interest in financial planning Sports betting Some students are somewhat surprised to learn about their actual debt load and implications of this debt for the future Banking and other apps keep students up-to- date in real time & they enjoy using them Influence of Behavioral Economics on personal finance literature & practices (nudging savings; awareness of biases that influence spending) Realizations re: social customs--the cost of weddings, bachelor/bachelorette trips, costs of being in a wedding Appreciation for OER text; inclusive access materials, easy to read/easy to understand materials Mental health, peer pressure and the fear of missing out So little income so many responsibilities

Realizations from student reflections: Assignment: Tracking Their Spending Expense of eating out, especially when already on a meal contract Amounts spent on alcohol and entertainment (e.g. streaming services, automatic renewals) Increased awareness of impulse spending and identification of triggers: also reflect on expenses related to gift giving Ease of on-line shopping Influence that peer groups & social media on their behavior Assignment: Reputable websites Wealth of information available on reputable sites (list of > 50 sites to select from for assignment) Options for repaying student loans https://studentaid.gov/ Future educators like sites on how to teach money management to students Health insurance is on their minds https://www.healthcare.gov Assignment: Rent Wise Course University of Minnesota Extension Rental Condition Checklist Housing affordability Communicating with landlord, roommates, etc.

Appreciation NDSU Financial Aid & Scholarships created a document for me to use on what students need to know about financial aid NDSU Learning and Applied Innovation Center; assistance from instructional designers

HOW DO MY OBSERVATIONS COMPARE WITH YOUR OBSERVATIONS AND EXPERIENCES?

WHAT DO YOU THINK WE SHOULD BE DOING, OR DOING MORE OF, TO HELP STUDENTS BE FINANCIALLY SUCCESSFUL?