UC Merced Entertainment Policy Overview for Catering Recharges

University of California, Merced's entertainment policy (BUS-79) outlines expenditures for business meetings, entertainment, and other occasions, including guidelines for catering recharges. The policy covers purposes, maximum rates, general limitations, approval of expenditures, exceptions, business justifications, required documentation for online recharges, and more. It emphasizes compliance with IRS regulations regarding business meals and entertainment expenses. The policy defines entertainment expenses, business meetings, and the necessary criteria for conducting such events within the university's guidelines.

Uploaded on Sep 15, 2024 | 0 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

UC Merced Entertainment Policy Overview for Catering Recharges BUS-79 Expenditures for Business Meetings, Entertainment, and Other Occasions On-line Catering Recharges

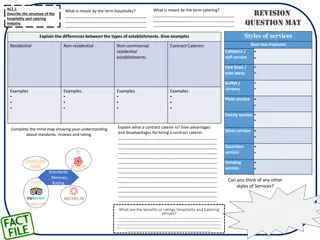

ENTERTAINMENT POLICY BUS-79 Expenditures for Business Meetings, Entertainment, and other Occasions PURPOSE ENTERTAINMENT EXPENSES MEALS OR LIGHT REFRESHMENTS MAXIMUM RATES ENTERTAINMENT GENERAL LIMITATIONS APPROVAL OF EXPENDITURES EXCEPTIONS BUSINESS JUSTIFICATIONS LUNCH MEETINGS FREQUENCY INFORMATION/BACKUP DOCUMENTATION REQUIRED FOR ON-LINE RECHARGES University of California Policy BUS-79: Expenditures for Business Meetings, Entertainment, and Other Occasions https://policy.ucop.edu/doc/3420364/BFB-BUS-79

ENTERTAINMENT POLICY PURPOSE It is the policy of the University to comply with IRS regulations regarding the provision or reimbursement of business meals and entertainment. Taxable if: Activity not related to job Expense is lavish or extravagant under circumstances Official host (or designated employee) is not present Expenses is not substantiated with supporting documentation Clear business purpose Business meals provided to an employee on a routine or frequent basis is treated by the IRS as personal expenses included in an employee s gross income (section V.B.4).

Catering - Entertainment Expenditures Entertainment expenses are expenditures for meals or light refreshments and related services (e.g. labor charges, room rental, equipment rental, decorations, flowers, and similar expenditures) incurred in connection with events that are primarily social or recreational activities in support of the University s mission (promote goodwill, donor cultivation, etc.). Business Meetings Programmatic Activities Recruitment Employee Morale-Building Activities On-the-Job Meals Entertainment

BUSINESS MEETINGS Include meetings of The Regents, University-wide meetings of functional offices, campus meetings of deans and directors, meetings of the Academic Senate, extended formal training sessions, conferences, and meetings of University-appointed committees. Business meetings also include University-hosted or sponsored meetings of a learned society, a professional association, or another external organization. In addition, business meetings may include less formally organized meetings such as extended planning meetings and work groups. At least one University employee or other individual representing the University must be present. Expenses should occur infrequently (Section V.B.4) Meals for visitors, guests & volunteers if necessary to the conduct of the University business

PROGRAMMATIC ACTIVITIES & RECRUITMENT Meals furnished to students and other individuals in support of the University s educational programs. Athletic team activities in accordance with NCAA rules Study hall, class, or other academic-based activity that occurs on an infrequent basis Student orientation programs, commencement exercises Student meetings, (government, association, other) Continuing education programs, includes speaker Campus, location volunteers, and research subjects Meals furnished for recruitment Prospective employees Student athletes & student scholars

EMPLOYEE MORAL-BUILDING ACTIVITIES The University may pay for or reimburse costs for meals or light refreshments associated with official employee moral-building and appreciation activities that serve a University purpose. Honor a departing employee who is retired or who is separating from employment with University after at least 5 years of service, Employee recognition receptions, Annual faculty/staff picnics, New employee receptions, Under no circumstances may University funds be used for occasions such as employee birthdays, weddings, anniversaries, or other occasions of a personal natures.

MEALS OR REFRESHMENTS The following cost of meals or refreshments may be paid by the University: When the University is host or sponsor of a meeting of a learned society or organization. When the University is host to official guests or to perspective appointees for positions requiring specialized training, and/or experience of a professional, technical, or administrative nature. When meetings of an administrative nature are held which are directly concerned with the welfare of the University. Where meals are involved, they must be a necessary and integral part of the business meetings, not a matter of convenience. When meetings between faculty or administrators and students are held.

MEALS OR REFRESHMENTS MAXIMUM RATES - ENTERTAINMENT Breakfast --------------- $27 Lunch------------------- $47 Dinner------------------- $81 Light Refreshment---- $19 The maximum per-person expenditures include the cost of the food and beverages, labor, sales tax, delivery charges, and other service fees.

MEALS AND REFRESHMENTS GENERAL LIMITATIONS State Fund: Alcoholic beverages or tobacco purchases may not be charged to State Funds. Expenses requiring exceptional entertainment approval also may not be charged to State Funds. Contract and Grant Fund: May be used to fund entertainment only if such expenses are specifically authorized in the contract or grant, or by agency policy, and only to the extent and for the purpose(s) so authorized. No alcoholic beverage or tobacco purchases may be charged to Federal Funds. Non-State Fund: Various non-State funds controlled by the University may be used to fund official entertainment, but only within the restrictions, if any, governing the use of the fund and within the policy set forth in Bus-79.

APPROVAL OF EXPENDITURES Approval of expenditure for official entertainment must be obtained at the appropriate level prior to incurring the expense. The approving authority must determine that: The expenditure serves as a clear and necessary business purpose or benefit to the University; The expenditures of funds is reasonable, cost effective, and in accordance with the best use of University-administered funds; The expenditure does not create taxable income for an employee or student; Funds are available and the expenditures is allowable under the specified fund source, and Any alternatives that would have been equally effective in accomplishing the desired objectives were considered.

EXCEPTIONS Approval of expenditures and granting of an exception to reimburse expenses at higher per person maximum rates shall be authorized by the appropriate official. Request must document circumstances which are unavoidable or necessary to accomplish a University business purpose (written justification). Exceptions require an Exception to Policy form. Once completed, forms can be submitted to VC Michael Reese for Administrative departments and Provost Gregg Camfield for Academic departments. Requests exceeding 200% of limit must be approved by Chancellor.

APPROVAL Approving authority should be the supervisor. Host cannot approve their own entertainment expenses. Chancellor entertainment expenses submitted to Controller for approval. Expenses requiring additional approval Entertainment of spouse, domestic partner, or family members Employee morale building and recognition events Any exceptions or higher approval received prior to expenditure should be included with supporting documents

ON-LINE RECHARGE PROCESS Department Information For CATERTRAX Request Event, Date, Location Meal Business Justification-Detailed Field has 400 characters available FAU Project & Source field added Check Box for split FAUs Department Approver Catering Processes the On-Line Recharge CATERTRAX information used to process recharge Department s Debit Entry uses object code 3293-Department Support Services Description will show CATER and event date, 121615 Post to ledger as a 59 entry Any use tax on the order will show on a different line PAN Notice Sent To Reviewers Invoice Sent To Department Contact

SUPPORTING DOCUMENTS CATERTRAX Invoice Catering Recharge Summary Form (Includes the following): CATERTRAX Invoice Number Event Name Event Date Meal Type(s) (Breakfast, Lunch, Dinner, Light Refreshments) Purpose/Business Related Nature Actual/Estimated Number Attended Total Invoice Cost Cost per Attendee Attachments Indicator Comments Approval Letter/E-Mail Advertisement Flyer/Agenda Attendee List Exception to Policy Form (if applicable)

ON-LINE PROCESS Department Responsibility Upload Documents In Box within 2 Business Days BOX folder location: [XXXX]-[Department Name] Catering Recharge Supporting Documents -> Fiscal Year [XXXX-XX] Create a new folder named as the CATERTRAX Invoice Number; add Supporting Documents. Mandatory reviewers have 2 business days to perform review of recharges. Retain Originals Per Retention Schedule Four years after close of fiscal year. Accounting Services Completes Audit Of Recharges For Policy Compliance Requests Supporting Documents If Not Uploaded Report Issues To Department MSO

CONTACT INFORMATION UC Merced Recharge Email: recharge@ucmerced.edu