Protecting Seniors from Common Fraud Schemes and Scams

Telemarketing fraud and common criminal schemes targeting seniors include scams related to grandparents, Social Security, Medicare, email imposters, fake charities, and identity theft. Seniors, often polite and trusting, are susceptible to being swindled due to their reluctance to hang up on strangers or report fraud. It is crucial for seniors to verify offers, avoid sharing personal information, and be cautious of unrealistic deals to prevent falling victim to fraudulent activities.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Pete Orput Washington County Attorney Community Thread 2012

Telemarketing fraud and common criminal schemes such as: Rip offs targeting Grandparents Social Security and Medicare scams You have won scams Email imposters Fake Charities Identity theft

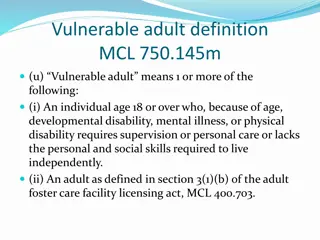

Most seniors have a nest egg, own their home, have excellent credit and savings. Seniors were raised to be polite to strangers, especially phone callers- they can t hang up. Seniors are less likely to report fraud as they don t know who to call or are afraid they will be considered vulnerable and can t handle their own affairs. They may not even know they ve been swindled and make poor witnesses.

Offers too good to be true usually are. Ask to receive the unbelievable deal or the amazing prize offer in writing so you can read it carefully before making a commitment. Never give out your personal information over the phone or Internet unless you have initiated the contact. Legitimate business callers will never ask you for this information over the phone. If a caller asks you to pay for an offer in advance or asks for your credit card number or Social Security number, tell the person you don t give out personal information over the telephone.

You must act now or the offer will expire. You must send in money or have a check picked up by a courier. You can t afford to miss this one-time offer. You don t need to check out this company- we re famous.

Always ask for written materials about any offer or charity. If you get offers for investments check out the offer with a reputable financial advisor. Before giving to a charity, ask what percentage of your donation goes to overhead . Never give out bank account numbers, social security numbers. Never pay for a free prize despite warnings that a deposit or fee is necessary to win.

Scammers sometimes call claiming to represent the National Do Not Call Registry. The calls claim to provide an opportunity to sign up for the Registry. These calls are not coming from the Registry or the Federal Trade Commission, and you should not respond to these calls. To add your number to the Registry call 888-382-1222 from the phone you wish to register. Go to www.donotcall.gov/ if you wish to register your phone number via the internet. Your registration will not expire. Telephone numbers placed on the National Do Not Call Registry will remain on it permanently due to the Do-Not-Call Improvement Act of 2007. Calls from or on behalf of political organizations, charities, and telephone surveyors are still permitted, as are calls from companies with which you have an existing business relationship.

You did not win a sweepstakes prize. You cant win a prize you did not enter. These are always bogus! Lotteries, too! Foreign lotteries are illegal. You will be told you won but need to pay the tax on the prize, etc. Remember, You can t win a prize if you didn t enter. Bogus charities. Be wary of the emotional appeal for a worthy sounding charity. Call 651-296-3353 Minn. Attorney General s Charity watchdog group. www.ag.state.mn.us/Charities/CharitySearch.asp

Watch out for the pump & dump scams where a small over the counter stock is hyped up and you are invited to buy in while the stock price is rising. You will be subject to high pressure sales techniques. Call a reputable broker to ask about the stock before buying stock from someone calling you. Remember to always be wary when someone calls you with an offer that sounds too good to be true.

Free equipment offers. Your insurance company will get billed for the product. Manufacturers offer free use of equipment in exchange for your Medicare #. Schlock doctors either approve the device or the MD signature is forged sticking you with an unnecessary medical device. rolling labs are unnecessary and sometimes fake medical tests are offered at retirement homes, shopping malls, etc. and are billed to your insurance.

You get a call from someone claiming to be from Social Security Administration or Medicare. They advise that new benefit cards are being distributed and your file must be updated to be eligible for new or expanded benefits. Crook asks for your social security number to verify your account or ask for personal banking information, etc.

Medicare and Social Security Administrations NEVER call you to give you a new card or to ask for personal information! Call the Center for Medicare and Medicaid Services at 1-800-633-4227or Social Security Administration at 800-772-1213 or FBI at 763-569-8000

Never sign a blank insurance claim form. Never give blanket authorization to a medical provider to bill for services rendered. Do not do business with door-to-door or phone sales reps who tell you that services or equipment are free. Give your Medicare number or insurance information only to those who have provided you with medical services.

You are offered an extremely high return rate on international bank investments. Scammer claims to have access to bank guarantees that they can buy at a discount and sell at a premium. By reselling the bank guarantees several times, they claim to be able to produce exceptional returns on investment. For example, if $10 million worth of bank guarantees can be sold at a two percent profit on 10 separate occasions or tranches the seller would receive a 20 percent profit. Such a scheme is often referred to as a roll program. The purpose of these frauds is to encourage you to send money to a foreign bank where it is eventually transferred to an off-shore account in the control of the con artist.

You are asked to pay money in anticipation of receiving something of greater value such as a loan, contract, investment, or gift. You will receive little or nothing in return. The variety of advance fee schemes is limited only by the imagination of the con artists who offer them. They may involve the sale of products or services, the offering of investments, lottery winnings, found money, or many other opportunities .

Criminal calls and says Grandma, do you know who this is? Joey? Susie? Yes, Grandma, it s me and I m in some kind of jam in Canada, Mexico or Europe and you need to send me money ASAP and please don t tell mom or dad as I m too embarrassed and you re the only one I can trust . This scam always entails a call or an email from either a crook posing as your grandchild or someone claiming to be helping your grandchild.

This always is about an urgent need for money and is terrifying to hear. Don t fall for this! Ask for a return phone number and other identifying information from the caller and never give out a bank account or credit card number! Verify that it is your grandchild by calling the parents or asking the grandchild questions about the family that only the real person would know. Refuse to send money through wire or overnight delivery. Call the police when you suspect this is a scam

You get a frantic email from a trusted friend telling you they are in dire need of funds as they are in a hospital/jail/custody in another country. Look for a friend s name and an urgent request to wire transfer money to them. Very likely your friend s email was compromised by crooks.

Be safe when ordering on-line. Secure pages begin with https instead of http . A picture of a lock in a locked position should appear in your browser.

You get an email from, what appears to be a company with whom you do business- Wells Fargo, Ebay, Amazon, et. al. You will be asked to update your membership information or your account will be closed. Or , you will be advised that your account has been compromised and you need to verify your account number and password. DON T FALL FOR THIS!

Legitimate reverse mortgages are insured by the Federal Housing Authority. Don t respond to unsolicited offers. Be suspicious of anyone who tells you that you can own a home with nothing down. Don t ever sign anything you do not fully understand. Seek out your own reverse mortgage counselor or the Better Business Bureau or your family to discuss the offer with them before signing anything.

Living trusts organize your finances and living wills declare your health care wishes. Do not confuse the two! Be very careful when a salesperson asks for personal financial information so that they can evaluate whether a living trust is right for you. The sales pitch often claims to avoid probate costs or inheritance taxes. Seek advice from a licensed attorney if you have an interest in one but be very wary of signing anything- especially when you may pay thousands of dollars for nothing more than legal forms.

If you receive a letter from Nigeria (or some other country such as Bulgaria or Albania) asking you to send personal or banking information, do not reply in any manner. Send the letter to the U.S. Secret Service, your local FBI office, or the U.S. Postal Inspection Service. Do not believe the promise of large sums of money for your cooperation. Guard your account information carefully.

occurs when someone gains access to a persons basic information: Name Address Credit card or Social Security numbers Then they open new charge or bank accounts, order merchandise or borrow money, fraudulently use telephone calling cards, etc

They steal your wallets or purses They steal your mail - including bank and credit card statements, pre-approved credit offers, telephone calling cards, etc. They can pull your credit report. They can get it off the internet. Or they dumpster dive to find your discarded mail and information.

Dont have any of the following pre-printed on your checks: Social Security number Driver s License number Date of Birth Phone number This will make merchants ask you for more identification to verify the name on the check. Know when you reorder checks. Make sure you get them or have them sent to your bank to be picked up!

If your bank statements dont come on time- call and inquire why. Limit the number of credit cards you carry. Understand debit cards and consider a cash card instead. Do not pick easy passwords/PIN numbers. Print check ID in the signature box with a permanent marker.

Dont ever carry them with you. Only give the number to your employer or the Social Security Administration - no one else needs it! Immediately contact the Social Security Administration if you believe your number has been compromised and used to obtain goods, services, etc. Do not have your SSN printed on your checks!

Shred all paperwork- this includes junk mail credit card solicitations. Use a cross shredder if you have one. Eliminate junk mail by completing an opt-out form and sending it to the Direct Mail Marketing Assn. Do not send any mail by putting it in your mailbox at the end of your driveway and raising the red flag. Get your mail as soon as it arrives.

Eliminating junk mail Contact the Direct Marketing Association P. O. Box 643 Carmel, NY. 10512 www.dmachoice.org to stop most junk mail and unsolicited offers.

Equifax 1-800-525-6285 www.equifax.com Experian 1-888-397-742 www.experian.com TransUnion 1-800-680-7289 www.tuc.com

The Federal Trade Commission. www.ftc.gov The Social Security Administration www.ssa.gov Internet Fraud Complaint Center www.ic3.gov Identity Theft Resource Center www.idtheftcenter.org Privacy Rights Clearinghouse www.privacyrights.org Washington County Sheriff/ local police- 911 Washington County Attorney s Office 651-430-6115

![101 Reviews How to Recover Lost Bitcoin [Scammed/Stolen Funds]](/thumb/153354/101-reviews-how-to-recover-lost-bitcoin-scammed-stolen-funds.jpg)