Comprehensive Course on Indian Banking System and Asset/Liability Management

This course covers various aspects of the Indian banking system, including functions of commercial banks, bank regulatory environment, product and services provided by commercial banks, bank performance evaluation, asset/liability management, and techniques for managing risks. Participants will gain insights into financial statements, credit management, liquidity management, and capital adequacy, among other critical topics.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Presented By: Commercial Banking and ALM Code: CUTM1227 Credit: 4+0+2 J Anil Kumar Associate Dean, MS Swaminathan School of Agriculture Coordinator, MBA (ABM)-School of Management Coordinator, Centre for Drones Coordinator, ABM Domain Accountable Manager, Remote Pilot Training Organization

Course Outline Module: I Indian Banking System Banks: Meaning, nature, characteristic of Indian banking system, functions of commercial banks primary functions; secondary functions; agency functions and general utility functions, Structure of banking sector in India, role of banks in the development of economy, Reserve Bank of India, Bank Regulatory Environment. Module: II Product and Services Provided by Commercial Banks. Type of Deposit Account: Types of deposits, process of opening bank accounts, pay in slip, Cheque book, passbook, ATM cum Debit card, Credit Card, advantages of bank account, Loan and Advances: Introduction, classification of loans, principles of good lending, loan procedure followed by banks, evaluating consumer and commercial loans; core banking solution, Capital Adequacy, Non-Performing Assets.

Course Outline Module: III Bank Performance and Evaluation Financial statements of commercial banks, evaluation measures, valuation of bank stocks. Bank Management: Credit Management, Investment Management, Liquidity Management, Liabilities Management, Capital Management, Management of Off-Balance Sheet Activities. Module: IV Asset/ Liability Management An Overview of Asset/Liability Management (ALM), Risk in bank: credit risk, interest rate risk, market risk, operational risk, liquidity risk, solvency risk, legal risk. Techniques of Liquidity: gaps analysis, sensitivity analysis and use of derivatives in ALM. of bank performance Asset/Liability Management: analysis, duration

Session Plan # Topic 1 Indian Banking System Banks: Meaning, nature, characteristic of Indian banking system Functions of commercial banks primary functions; secondary functions; agency functions and general utility functions 3 Structure of banking sector in India, role of banks in the development of economy 4 Reserve Bank of India, Bank Regulatory Environment. 5 Product and Services Provided by Commercial Banks. Type of Deposit Account: Types of deposits 6 Process of opening bank accounts, pay in slip, Cheque book, passbook, ATM cum Debit card 7 Credit Card, advantages of bank account, Loan and Advances: Introduction, classification of loans 8 Principles of good lending, loan procedure followed by banks, 9 Evaluating consumer and commercial loans; core banking solution 10 Capital Adequacy, Non-Performing Assets. 2

Session Plan # Topic 11 Bank Performance and Evaluation Financial statements of commercial banks 12 Evaluation of bank performance measures, valuation of bank stocks 13 Bank Management: Credit Management, Investment Management 14 Liquidity Management, Liabilities Management 15 Capital Management, Management of Off-Balance Sheet Activities 16 Asset/ Liability Management An Overview of Asset/Liability Management (ALM), 17 Risk in bank: credit risk, Interest rate risk 18 Market risk, operational risk, liquidity risk 19 Solvency risk, legal risk 20 Techniques of Asset/ Liability Management: Liquidity gap analysis 21 Sensitivity analysis 22 Duration analysis and use of derivatives in ALM

Evaluation System- Pass Criteria 1. Theory Component 2. Project/ Practice Components

Evaluation System- Evaluation Criteria I. Evaluation of Theory Papers (T, TP, TPP) 1. End Semester Theory Exam (50% Weightage) 2. Continuous Assessment (100% weightage)

Evaluation System- Evaluation Criteria II. Evaluation of Practice/ Laboratory/ Project Components Internal (100% weightage) External (100% weightage)

Reference Textbooks: Banking Theory and Practice by K.C. Shekhar & Lekshmy Shekar: Vikas Publishing House (P) Ltd., 21st Edition 2013. Risk Management In Indian Banks by Dr. K.M. Bhattacharya: Himalaya Publishing House Pvt. Ltd. Reference Book: Banking Theory And Practice by E. Gordon & Dr. K. Natarajan: Himalaya Publishing House Pvt. Ltd. Risk Management in Banking by Joel Bessis : John Wiley & Sons- Fourth Edition Risk Management (CAIIB 2018) by Indian Institute of Banking & Finance (IIBF): Macmillan Education.

Bank is a financial institution licensed to receive deposits and give loans. Banks are very important part of the economy providing essential services to consumers and businesses. Banks provide a variety of accounts like current and saving accounts, recurring and fixed deposits. Bank Routine transactions like deposits, withdrawals, transfers, cheque/bill payments can be done in a bank. Money stored in most bank accounts is federally insured by DICGC up to Rs 5 Lakhs.

History of Banking in India III Phase (1991 & Beyond) Pre-Independence Stage (Before 1947) II Phase (1947 to 1991) ICICI Bank Imperial Bank (SBI) Nationalization of RBI Kotak Mahindra Bank UTI/ Axis Bank Allahabad Bank Yes Bank HDFC Bank Punjab National Bank Nationalization of Banks Bank of Punjab IndusInd Bank Bank of India Times Bank IDBI Bank Formation of Regional Rural Banks Bank of Baroda Global Trust Bank Central Bank of India

Structure of Banks in India Reserve Bank of India Development Bank Scheduled Non- Scheduled Bank Bank IFCI Small Finance Bank Cooperative Bank Payments Bank Commercial Bank NABARD EXIM BANK NHB Private RRB Foreign Public Sector Sector SIBDBI Urban Co-operative State Co-operative MUDRA

Functions of Commercial Banks Primary: Accepting Deposits, Advancing of Loans Secondary: Overdraft Facility, Discounting Bills of Exchange, Agency Functions (Fund transfer, payments, collection, purchase/sale of forex, securities trading, IT consultancy, etc. General Utility: Locker, Travellers Cheques, Letter of Credit, Underwriting securities, Collection of Statistics

Financing Infrastructure Projects Promoting Financial Inclusion Role of Banks in Development of Economy Supporting International Trade Supporting Farming and Small businesses Encouraging Saving and Investment

Reserve Bank of India The Reserve Bank of India (RBI) was established in 1935 under the Reserve Bank of India Act, 1934 with its headquarters located in Mumbai. The primary functions of the RBI: Overseeing banks for ensuring compliance with regulations and maintaining financial stability. Implementing monetary policy for stabilizing the interest rates, and adequate flow of credit to productive sectors. Regulating money supply in the economy for maintaining liquidity and promoting economic growth.

Supervision and Regulation of Banks by RBI Conducting regular audit and inspections to ensure adherence to laid down guidelines and norms by the banks. Developing and implementing policies to enhance soundness of the banking system and safeguard interests of depositors. Identifying and clearing stress in the loan portfolios to ensure financial stability and minimizing risk in the banking system. Establishing a robust payment infrastructure to facilitate B2B, B2C and P2P transactions while enhancing financial access to all.

Products and Services Provided by Commercial Banks Commercial banks provide a wide range of products and services to cater to the needs of individuals and businesses. This types of deposit accounts, loan and advance facilities, as well as digital banking solutions. Let's explore the key offerings in detail. includes various

Types of Deposit Accounts Savings (Bank) Account Salary Account Non-resident Indian Account (NRE/NRO) Current Accounts Recurring Deposits Fixed/ Time/ Term Deposits Foreign Currency Non-resident Deposits

Opening a Savings Bank Account Online Download YONO App Click New to SBI Open Savings Account Without Branch visit Insta Plus Savings Account Enter your PAN, Aadhaar details Enter OTP sent to Aadhaar registered mobile number. Enter other relevant details and complete your profile. Schedule a Video Call. Login to the YONO App at the scheduled time through Resume and complete the Video KYC process. Your Insta Plus Savings account will be opened, Account will be activated for debit transactions after verification by Bank Officials.

Debit and Credit Card Services ATM cum Debit Card Enabling users to perform transactions and cash withdrawals from ATMs and make purchases at POS terminals. Credit Card Providing the flexibility of making payments for purchases with an option to pay later along with benefits and rewards.

Advantages of Bank Accounts Interest Earning Bank accounts offer the opportunity to earn interest on deposited funds, increasing savings over time. Financial Security Protecting funds from theft, loss, or damage while facilitating safe, secure and seamless transactions.

Types of Loans 1. Based on Purpose: Investment/ Development, Production, Marketing & Consumption 2. Based on Repayment Period: Short Term, Medium Term & Long-term 3. Based on Security: a) Secured Loans: Personal security (promissory note), Collateral security (movable assets like LIC Bonds, Fixed Deposits, Warehouse Receipts, Machinery, Livestock, etc.), Chattel Loans (Jewellery, Utensils), Mortgage Loans-Immovable Properties (Simple and Equitable) & Hypothecation Loans (Key & Open). b) Unsecured Loans: Based on confidence between the borrower and lender, the loan transaction takes place. No security is offered by the borrower to secure the loan.

Types of Loans 4. Based on Liquidity: Self-liquidating credit, Partially liquidating, or Non- liquidating Credit 5. Based on Lender: Institutional and Non-Institutional 6. Based on Use: Single and Composite

Principles of Agricultural Credit Safety: Safety of Funds, borrower should be in position to repay the loan plus interest. Repayment by borrower depends on: a) Borrower s capacity (Tangible Assets) b) Willingness to pay (by honesty & character of the borrower). Liquidity: It means security of assets which are easily marketable without much loss. Bank is comfortable in providing funds for Short-term i.e., for Working Capital, payable on demand. Borrower s Assets such as Goods and Commodities are easily saleable as against Land and Building. Profitability: Banks are giving loans to public to earn profit. Since the loan given by Bank is Depositor s Money, it is to be repaid along with interest. Loan interest is arrived by the bank after adding its expenses as a margin to the deposit interest rate. Bank should not grant advances or loans to unsound parties with a doubtful repaying capacity.

Credit Analysis 3 R's Credit Character: The farmer s demand for credit can be accepted only when he will be able to generate returns that will enable him to tide over the costs. Returns depend upon the decision like what to grow, how to grow, how much to grow, whom to sell, where to sell, etc. taken by farmers in their production activities. Repayment Capacity: It means the ability of the farmer to clear off the loan obtained for production purpose within the time fixed by the bank. The loan should not only be profitable but also have potential for effecting repayment. This condition emerges out of the fact that repayment capacity not only depends upon the returns but also on several other qualitative and quantitative factors. Risk Bearing Ability: It is the ability of the farmer to withstand the risks that arise due to financial loss. Risk can be quantified through statistical techniques like coefficient of variation, standard deviation, programming models, etc.

Credit Analysis 5 C's Credit Character: Repayment History, Outstanding Debts, Credit Score, Bankruptcy and foreclosures, legal judgements pending against the customer. Capacity: Cash flows sufficient to repay the debt, positive bank and trade references. Capital: Financial and non-financial assets owned by the applicant. Condition: Current financial condition of the applicant can be assessed by evaluating the financial statements, bank statements, etc. Common Sense: It s the perfect understanding between the lender and the borrower in credit transaction. This is in fact a primary requirement for obtaining credit from a financial institution.

Sources of Finance Non-institutional Agencies Money Lenders Traders and Commission Agents Relatives, Landlords & Others Institutional Agencies Cooperative Banks Scheduled Commercial Banks Regional Rural Banks Small Finance Bank Non-Scheduled Bank Non-Banking Financial Companies (NBFC) Micro finance Institutions (MFI)

Types of Secured Loans Home Loans Commercial Property Purchase Loan Jewel/ Gold Loans Vehicle Loans (New and Used) Loan Against Property Loan Against Securities Loan Against Fixed Deposits Loan Against Insurance Policies Working Capital Loans Equipment Finance

Types of Unsecured Loans Personal Loans Business Loans Education Loans Credit Cards

5Cs of Credit Character: Repayment History, Outstanding Debts, Credit Score, Bankruptcy and foreclosures, legal judgements pending against the customer. Capacity: Cash flows sufficient to repay the debt, positive bank and trade references. Collateral: Assets from high-risk customers as a security against defaults. Capital: Financial and non-financial assets owned by the applicant. Conditions: Current financial condition of the applicant can be assessed by evaluating the financial statements, bank statements, etc.

Returns from the proposed Investment Repaying Capacity Risk-bearing ability of the borrower 3R s of Credit

Capital Adequacy in Banks The capital adequacy ratio (CAR) is a measure of a bank's ability to absorb losses and protect depositors' funds. It is an essential financial metric used to ensure the stability and solvency of banks. Capital Adequacy Ratio (CAR) is the ratio of a bank s capital in relation to its risk weighted assets (considering credit risk, market risk and operational risk) and current liabilities. CAR is decided by central banks and bank regulators to prevent commercial banks from taking excess leverage and becoming insolvent in the process. Capital Adequacy Ratio = (Tier I + Tier II (Capital funds)) /Risk weightedassets

Measure of Stability: The CAR evaluates the bank's resilience to potential financial and economic risks, providing a measure of its overall stability. Importance of Capital Adequacy Protection of Depositors: By maintaining a sufficient CAR, banks safeguard the funds of depositors and minimize the risk of insolvency. Regulatory Requirement: Regulators use the CAR to ensure that banks have adequate capital to cover potential losses, promoting a healthy banking system.

Capital Adequacy as per Basel II and III Tier I Capital: 8%, measuring a bank or NBFC's core equity capital as a percentage of its risk- weighted assets under Basel III. It involves share capital and disclosed reserves. Tier II Capital: 12%, represents the supplementary capital and its proportion to the risk- weighted assets of a bank or NBFC under Basel III. It is less secure than tier I capital that involves undisclosed reserves, revaluation reserves, general provisions and loss reserves, hybrid capital instruments, subordinated debt and investment reserve account, The Basel III norms stipulated a capital to risk weighted assets of 8%. However, as per RBI norms, Indian scheduled commercial banks are required to maintain a CAR of 9% while Indian public sector banks and NBFCs are emphasized to maintain CAR of 12% and 10%, respectively.

Non-Performing Assets (NPA) As per RBI (with effect from March 31, 2004), a non-performing asset (NPA) shall be a loan or an advance where: interest and/ or instalment of principal remain overdue for a period of more than 90 days in respect of a term loan, the account remains out of order for a period of more than 90 days, in respect of an Overdraft/Cash Credit (OD/CC), the bill remains overdue for a period of more than 90 days in the case of bills purchased and discounted, interest and/or instalment of principal remains overdue for two harvest seasons but for a period not exceeding two half years in the case of an advance granted for agricultural purposes, and any amount to be received remains overdue for a period of more than 90 days in respect of other accounts.

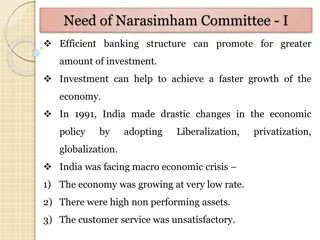

undefined

undefined