Understanding Financial Aid Programs for College Expenses

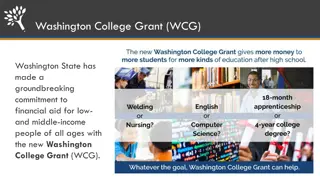

Financial aid plays a crucial role in assisting families with college expenses. It is a combination of federal, state, institutional, and outside programs that help cover costs. This includes grants, work-study programs, and loans. State-specific programs like the HOPE Scholarship in Georgia offer additional opportunities for eligible students. Understanding the eligibility requirements and types of financial aid available can greatly benefit both parents and students in navigating the financial aspect of higher education.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

2024-25 Financial Aid Elizabeth Umberger Fall 2023

Agenda Financial Aid Programs Application Process Next Steps Tips for Success What can you do NOW?? 2

Financial Aid Programs Financial aid is to assist families in paying college expenses. It is not meant to completely cover the cost of education. Financial aid is a family affair both parents and student need to be active participants in the process. Financial aid is a combination of federal, state, institutional and outside programs for which the student qualifies. 4

Financial Aid Programs Federal Aid Pell Grant eligibility determined by FAFSA data. FSEOG college provided funds to award to most Pell eligible students. FWS Work study. NEVER applies to student account. Paid via paycheck. Subsidized Direct Loan government pays interest until repayment begins. Unsubsidized Direct Loan interest begins to accrue as loan disburses. PLUS Loan parent is applicant. Credit worthy loan. 5

Financial Aid Programs State Programs Hope Scholarship Attain eligibility at HS graduation or in college. Zell Miller Scholarship ONLY attain eligibility at HS graduation. Hope Grant certificate and diploma programs at Technical Colleges. Zell Miller Grant students who perform well at Technical Colleges. Tuition Equalization Grant private Georgia colleges. Track Hope/Zell Miller Scholarship eligibility at GAFutures.org. 6

HOPE Program General Eligibility Requirements Be a legal resident of Georgia Be registered with the Selective Service, if required Be in compliance with the Georgia Drug-Free Postsecondary Education Act of 1990 Meet U.S. citizenship or eligible non-citizen requirements Be in good standing on all student loans and other financial aid programs Attend an eligible postsecondary institution Must be working toward the first undergraduate program 7

HOPE Scholarship Students must pursue an associate or bachelor s degree Graduate with a 3.0 high school HOPE GPA After high school graduation, may also be earned in college 4 academically rigorous course credits 8

HOPE Scholarship Courses must be on Academic Rigor Course List. This includes: Advanced Placement (AP) International Baccalaureate (IB) Dual Enrollment in degree level core subjects Advanced math Advanced science Foreign language II or higher 9

HOPE Scholarship Students must maintain 3.0 college HOPE GPA at all checkpoints including: End of every Spring semester/quarter 30/45 attempted semester/quarter hours 60/90 attempted semester/quarter hours 90/135 attempted semester/quarter hours Three-Term Checkpoint, if enrolled less than full time for first three semesters/quarters 10

Zell Miller Scholarship Designated valedictorian or salutatorian and meet minimum HOPE eligibility requirements Minimum 3.7 high school HOPE GPA, as calculated by GSFC, in core curriculum courses AND 1200 SAT total test score OR 26 ACT composite score 11

Zell Miller Scholarship Students must maintain 3.3 college HOPE GPA at following checkpoints: End of every Spring semester/quarter 30/45 attempted semester/quarter hours 60/90 attempted semester/quarter hours 90/135 attempted semester/quarter hours Three-Term Checkpoint, if enrolled less than full time for first three semesters/quarters 12

Maintaining HOPE and Zell Miller Scholarships Students lose eligibility due to one of the following: GPA requirement not met (3.0 for HOPE; 3.3 for Zell Miller) Reaching maximum attempted hours 127 semester 190 quarter Failing to use funds within ten years of high school graduation or equivalent Exception for active duty military service in United States Armed Forces Received bachelor s or first professional degree 13

Tuition Equalization Grant Tuition Equalization Grant Regulations Funds for Georgia Students attending Georgia Private Colleges/Universities Award rate increases Per semester increase from $450 to $500 Per quarter increase from $300 to $333/$333/$334 (per term) 14

HOPE Grant different from Scholarship Eligibility Requirements: Enrolled in certificate or diploma program High school diploma/GED not required High school GPA and/or test scores not considered Maintaining Grant: Students must maintain a 2.0 college cumulative GPA at the following checkpoints: 30 HOPE Grant paid semester hours 60 HOPE Grant paid semester credit hours Maximum 63 paid semester hours 15

Zell Miller Grant Eligibility Requirements: Minimum 3.5 college cumulative GPA Checkpoints occur at the end of every term of enrollment Must be a HOPE Grant recipient initially May be paid retroactively for first term Maximum 63 combined paid hours Zell Miller and HOPE Grants 16

Financial Aid Programs Institutional Aid Individual college scholarships and grants. Some may be merit based. Every college has their own application process. Outside/Private Aid Scholarships from high school check counselor s office. Community organizations. Check with your college to see how the donor gets funds to the school. 19

Application Process 2024-25 FAFSA FAFSA serves as an application for all federal programs and the state HOPE programs. FAFSA is an annual application. The 2024-25 version will use 2022 IRS tax information. Typically FAFSA opens October 1 each year. The 2024-25 FAFSA will open by January stay tuned for more information from your high school. 21

Application Process 2024-25 FAFSA FAFSA is a complete rewrite this year. Still much is unknown. FSA ID is the log in credentials. Every student and every parent on the FAFSA need to create their own FSA ID. Tax filing status matters if married you need to file Married Filing Joint or Married Filing Separate. Not Head of Household you will need to amend. GSFAPPS at GAFutures.org is a secondary way to apply only for HOPE. It is recommended to complete both FAFSA and GSFAPPS. 22

Next Steps Processed FAFSAs may arrive at Financial Aid Office with additional requirements. Some of these notices come in after the original FAFSA is received. Verification additional documents needed to match with information on the FAFSA. The Financial Aid Office is required to resolve any FAFSAs flagged for additional requirements or information that is considered conflicting. Monitor your college email!!!!! Everyday!!! 24

Tips for Success Monitor your college email!!! There are deadlines. Ask questions!! Depending on the college call, email or visit. Prior to July/August. Do NOT wait until July/August to complete financial aid. File should be complete at your college before you graduate from high school. Complete admissions requirements early, register for earliest orientation, complete lawful presence requirements, complete immunization requirements. 26

Tips for Success Be successful academically attend classes!! Seek tutoring it s free. Do not withdraw from a class without speaking with the Financial Aid Office. If eligible, apply for the Honors Program. Get involved in a campus activity. Involved students are academically successful. 27

Tips for Success On campus housing can add significant charges to your student account. Be sure you have enough aid in place/payment out or pocket or a combination that gives you a zero balance well before your move in date. Never ever call the FSA help desk (FAFSA people) for help with your FAFSA or verification questions. They are good for helping you with log in issues. 28

What to do now! Visit colleges make decision! Apply for Admissions use name as it appears on your SSC! Watch for and attend FSA ID creation events. Watch for and attend FAFSA completion events. Be proactive in your planning and actions. 30