Understanding the Negotiable Instruments Act, 1881: Types of Instruments and Holders

The Negotiable Instruments Act, 1881 was enacted to provide legal recognition to credit instruments easily transferable as money. It defines negotiable instruments like promissory notes, bills of exchange, and cheques, including local usages. Instruments can be negotiated multiple times until maturity. Specific criteria for promissory notes and bills of exchange are outlined. The Act involves parties like makers, payees, drawers, and drawees, each with distinct roles. Acceptance by the drawee is crucial for the instrument's validity.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

THE NEGOTIABLE INSTRUMENTS ACT, 1881 Topic 6 (KINDS OF NI) and Topic 7(HOLDER & HOLDER IN DUE COURSE By- Carishma Singh

Why was it enacted? To give legal recognition to instruments of credit deemed to be convertible to money and easily transferable from one person to another

What is a Negotiable Instrument Acc to the preamble of the Act as well as s.13 a negotiable instrument is Promissory note Bill of Exchange Cheque But can also include local usages/ instruments (eg. Hundi) which specifically indicate through words in the body of the instrument, an intention that legal relations between the parties are to be governed by the NI Act (s.1)

How many times can an instrument be negotiated? n number of times until maturity.

PROMISSORY NOTE (S.4) In writing Not a bank/ currency note (s. 31 RBI Act) Unconditional undertaking to pay (certain event can be an exception- s.5) Signed by maker (along with stamp duty) Certain sum Payable to a certain person/ or order/ or bearer

CASES Ponnuswami Chettiar v. P Vellaimuthu Chettiar Mohammad Akbar Khan v. Attar Singh Bachan Singh v. Ram Avadh (1949) Surjit Singh and Others v. Ram Rattan Sharma (1975) Roberts v. Peeke (1757)

BILL OF EXCHANGE (s. 5) In writing Unconditional Order Signed by maker (drawer) Directing a certain person (drawee) To pay a certain sum of money To a certain person/order of/ bearer (payee)

Parties involved In a Promissory note- 2 (Maker and Payee) In a BOE- 3 (can also be 2) including- DRAWER DRAWEE- [Has to accept] PAYEE Drawer and Payee can be the same in BOE not in PN

ACCEPTANCE OF A DRAWEE The drawee needs to accept the instrument for it to be binding This acceptance can not be oral as stated in Panna Lal v. Hargopal Khubi Ram (1919) Jagjivan Ram Mavji v.Ranchordas (1954 SC) states that once the drawee signs his assent, he becomes the acceptor.

CHEQUE (s.6) Is a BOE Drawn on a specified banker Payable only on demand (s.19) Includes- electronic image of a truncated cheque and a cheque in the electronic form- 2015 Amendment) Does not need acceptance like a BOE

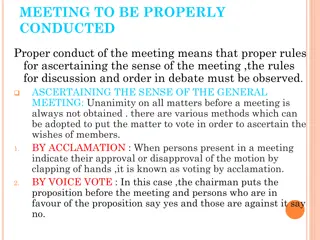

S.17- Ambiguous instruments (PN or BOE) S.18- Amount stated differently in figures and words S.19- Payable on demand (no time specified) S.20- Inchoate stamped instruments(signs, stamps, delivers) S.21- At sight, on presentment, after sight S.22- maturity (and days of grace) S.23- calculation S.24- calculation S.25- when day of maturity is a holiday (next preceding business day)

VALIDITY OF POST DATED CHEQUES- they remain to be categorized as BOE until the date mentioned on the face of the instrument is reached. Thereupon, they are categorized as cheque under s. 6 Ashok Yeshwant Badave v. Surendra M. Nighojakar [2001 (3) SCC 726]

ON THE BASIS OF VALIDITY Inchoate (incomplete, s. 20) [H. Maregowda v. Thippamma] Ambiguous (BOE or PN) ON THE BASIS OF PAYMENT Demand (cheque always on demand, BOE and PN may or may not be) Time (after 3months, on death (certain event), on 31 July, 2020) ON THE BASIS OF PAYEE Bearer (self cheque) : can a BOE or promissory note be a BI? (s.31 RBI Act) Order (person named or his order- eg. pay XYZ) ON THE BASIS OF LOCATION Inland (s.11) Foreign (s.12)

H. Maregowda v. Thippamma (Inchoate Instrument) The authority implied by a signature to a blank instrument is so wide that the party so signing is bound to be a holder in due course even though the holder was authorized to fill for a certain amount, and he in fact fills a greater amount, but it is necessary that the sum ought not to exceed the amount covered by the stamp".- case refers to s.20

Cont. If there is a blank space left for rate of interest, the holder is entitled to insert the legal rate. However, a pro-note containing blank with regard to rate of interest is not incomplete as Section 80 provides for rate of interest at 6% p.a. (now 18%) where the rate of interest is not specified in the instrument .

Inland Instrument (s.11) NI made or drawn in India AND Drawn on a person resident in India OR Payable in India Eg- BOE made in Delhi and drawn on a resident in Chennai BOE made in Delhi, drawn on a resident of America and payable in Mumbai BOE made in Australia and payable in Delhi (No)

HOLDER (s.8) Any person (payee, transferee- bearer or indorsee as the case may be) ENTITLED in his own name to possession [Benami Transactions (Prohibition) Act] - who is entitled: Benamidar or beneficial owner? And to RECEIVE or RECOVER the amount due (right to sue) thief, forgery, prohibited by court order excluded Does it mean actual possession? - Sarjoo Prasad v. Rampayari Debi (AIR 1950 Pat 493)

Cont. A holder is therefore entitled to legal possession of the instrument and to recover the amount due from the parties to the instrument A thief is not a holder as his possession is not legal.

Sarjoo Prasad v. Rampayari Debi (1950 Pat) Is a case where the HC of Patna rejected the plaintiff s contention to recover as he was not ENTITLED IN HIS OWN NAME on the negotiable instrument. The instrument had been made in the name of another person who was the benamidar or the name lender.

Singheshwar Mandal v Smt. Gita Devi AIR 1975 Pat. 81 S.78 read with s.8 Court held that the definition of holder is clear under s.8 and for valid discharge of liability, payment must be made to the holder (or endorsee) of the instrument by the maker/ acceptor- s.78. A child, as a heir, does not become the holder of an instrument in favor of the father, who is indeed the true holder.

HOLDER IN DUE COURSE (s. 9) Any person Who for lawful consideration became The possessor (payable to bearer) or payee/ indorsee ( payable to order) Of PN, BOE or Cheque Before the amount mentioned became payable (i.e before maturity) In good faith + due care and caution

A person talking the instrument for lawful consideration and in good faith obtains a valid title even if he takes it from a thief or illegal holder in the case of Negotiable instruments. This is in exception to the maxim nemo dat quod non habet and s. 27 of the Sales of Goods Act. S. 58 , s. 36 NI Act read with s. 9 Case law- Diamond v. Graham (1968 2 All ER 909)

Nunna Gopalan v. Vuppuluri Lakshminarasamma [AIR 1940 Mad. 631] o Pro note in favour of Tata o Respondent claims to have paid the amount due two days later but having left the instrument in the hands of the payee. o Payee endorsed the instrument the next day in favour of the petitioner o Present suit instituted by the petitioner.

Cont. o Petitioner- holder in due course s.9 (became possessor for consideration, in good faith, before the amount due became payable-s.22) o S.60- instrument may be negotiated until payment or satisfaction but not after such payment. o District Munsif: decree against respondent and payee o Subordinate judge: confirmed the decree so far as it affected the payee but dismissed the suit so far as it affected the respondent (as the respondent was HDC but his payment discharged him of liability)

Cont. o judgment in present appeal relied upon the principle laid down in Lickbarrow v. Mason stating that whenever one of two innocent persons must suffer by the acts of a third, he who has enabled the third person to occasion the loss must sustain it o Read with s. 81- petition allowed and decree of District Munsif restored.