Waiver of Interest and Penalty in terms of Section 128A of CGST Act

Section 128A of the CGST Act, effective from November 1, 2024, offers a waiver of interest and penalties for tax demands under Section 73 for specified periods. Taxpayers must file applications and make payments by June 30, 2025, or within six months

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

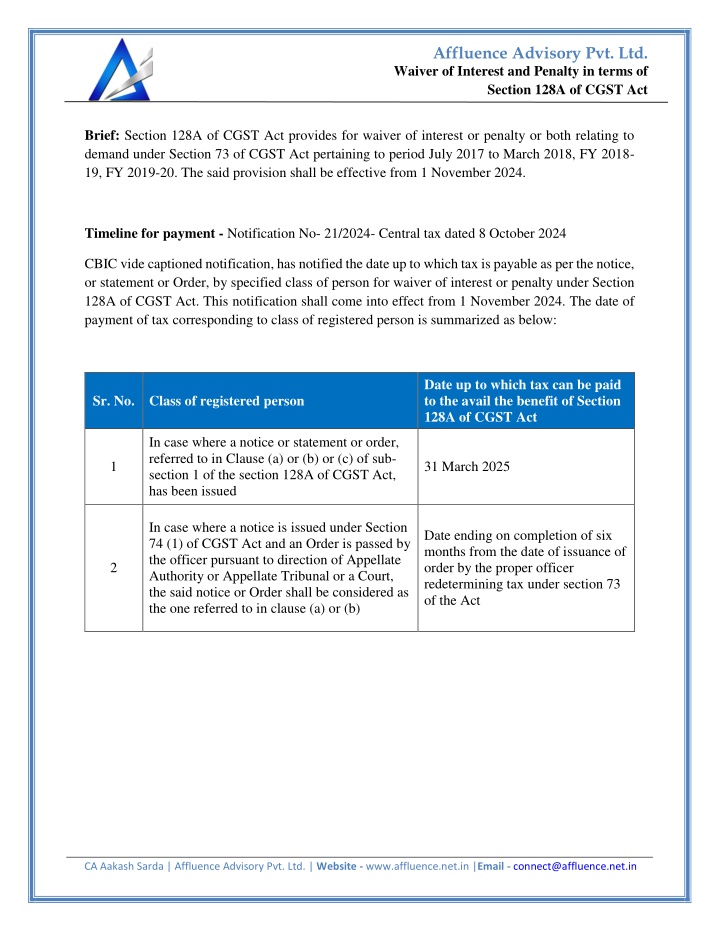

Affluence Advisory Pvt. Ltd. Waiver of Interest and Penalty in terms of Section 128A of CGST Act Brief: Section 128A of CGST Act provides for waiver of interest or penalty or both relating to demand under Section 73 of CGST Act pertaining to period July 2017 to March 2018, FY 2018- 19, FY 2019-20. The said provision shall be effective from 1 November 2024. Timeline for payment - Notification No- 21/2024- Central tax dated 8 October 2024 CBIC vide captioned notification, has notified the date up to which tax is payable as per the notice, or statement or Order, by specified class of person for waiver of interest or penalty under Section 128A of CGST Act. This notification shall come into effect from 1 November 2024. The date of payment of tax corresponding to class of registered person is summarized as below: Date up to which tax can be paid to the avail the benefit of Section 128A of CGST Act Sr. No. Class of registered person In case where a notice or statement or order, referred to in Clause (a) or (b) or (c) of sub- section 1 of the section 128A of CGST Act, has been issued 1 31 March 2025 In case where a notice is issued under Section 74 (1) of CGST Act and an Order is passed by the officer pursuant to direction of Appellate Authority or Appellate Tribunal or a Court, the said notice or Order shall be considered as the one referred to in clause (a) or (b) Date ending on completion of six months from the date of issuance of order by the proper officer redetermining tax under section 73 of the Act 2 CA Aakash Sarda | Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

Affluence Advisory Pvt. Ltd. Waiver of Interest and Penalty in terms of Section 128A of CGST Act Rule prescribing procedure- Notification No. 20/2024 -Central Tax dated 8 October 2024: CBIC vide captioned notification introduced Rule 164 of CGST Rules wherein the procedure for filing application and conditions for closure of proceedings under Section 128A of CGST Act has been laid down. A summary of the same is as below: Form and due date of filing Particulars Mode of Payment Waiver of interest or penalty or both in respect of a Notice or a Statement- Section 128(1)(a) of CGST Act GST SPL-01 on or before 30 June 2025 DRC-03 Crediting the amount in Electronic liability register i.e. the procedure similar to payment of pre-deposit for filing appeal before tribunal In case payment is already made through DRC-03, an application in DRC-03A is to be filed Waiver of interest or penalty or both in respect of Order passed by the officer under Sec 73(9) of CGST Act or Order passed by first appellate authority- Section 128(1)(b) & (c) of CGST Act GST SPL-02 on or before 30 June 2025 Waiver of interest or penalty or both in case where initially notice was issued u/s 74 of CGST Act. However, Appellate Authority or Tribunal or Court has directed the officer to redetermine the tax as if demand notice is issued u/s 73 of CGST Act GST SPL-02 within 6 months from the date of communication of Order redetermining tax u/s 73 of CGST Act Same as mentioned for Sec 128(1)(b) &(c) of CGST Act Remarks: 1.Separate application needs to be filed against each Statement, Notice or Order 2.The amount of ITC denied on account of Section 16(4) of CGST Act, which is now available in terms of Section 16(5) or (6) of CGST Act is to be deducted while filing application under captioned section. Also, a separate application for rectification is not required to be filed 3.At the time of filing the application, document evidencing withdrawal of appeal or writ petition, if any filed before any Appellate Authority, or Tribunal or Court, as the case may be needs to be uploaded. In case, the order for withdrawal has not been issued by the concerned authority till the date of filing of the application, applicant is required to upload copy of application for withdrawal of appeal or writ petition. Subsequently, copy of Order is required to be uploaded within 1 month of issuance of Order of withdrawal by concerned authority CA Aakash Sarda | Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

Affluence Advisory Pvt. Ltd. Waiver of Interest and Penalty in terms of Section 128A of CGST Act Key points: 1.In case where a statement, SCN or Order involves multiple period, including the period covered under Section 128A, in order to file the application under captioned Section, the tax demand as per the said statement, SCN or Order has to be completely discharged before the date mentioned above. Further, the interest or penalty or both pertaining to the period other than covered under captioned Section, will be required to be discharged within 3 months from the date of issuance of Order in Form GST SPL-05 or Form GST SPL-06. 2.In case officer is of the view that the application in Form GST SPL-01 or Form GST SPL-02, is liable to be rejected, he shall be issuing a notice in Form GST SPL-03 within 3 months from date of receipt of application. Further, an opportunity of being heard is to be provided before issuance of notice. 3.A reply against the notice in Form SPL-03 is to be filed within 1 month from the date of receipt of notice in Form GST SPL-04. 4.In case the reply is found satisfactory, the officer shall issue an Order in Form GST SPL-05. If the same is found unsatisfactory, the officer shall issue an Order in Form GST SPL-07 rejecting the application. The timeline to issue Order by officer is 3 months from the date of receipt of reply in Form GST SPL-04. In case reply is not filed by the taxpayer, the Order is to be issued within 4 months from the date of issuance of notice in Form GST SPL-03. 5.If an Order in Form GST SPL-05 or Form GST SPL-07 is not issued within the timeline discussed above, the application shall be deemed to be approved and the proceedings shall be deemed to be concluded. 6.In case an appeal has not been filed against the Order passed in Form GST SPL-07 within 3 months from the date on which such Order is communicated, the original appeal filed by applicant (which are earlier withdrawn for filing application in Form GST SPL-02) against the Order mentioned in Clause (b) or (c) of Section 128(1A) shall stand restored. 7.Appeal can be filed against the Order in Form GST SPL-07 rejecting the application for waiver, within 3 months from the date of communication of Order in terms of Section 107 (1) of CGST Act. However, the subject matter of such appeal shall be restricted to applicability of waiver of interest or penalty under Section 128A and not the merits of original notice/statement/Order. CA Aakash Sarda | Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

Affluence Advisory Pvt. Ltd. Waiver of Interest and Penalty in terms of Section 128A of CGST Act 8.If the appellate authority held that the officer has wrongly rejected the application, the said appellate authority shall pass an Order in Form GST SPL-06. However, if the appellate authority held that the application was rightly rejected, the applicant has to file an undertaking in Form GST SPL-08 stating that he has neither filed nor intends to file appeal against the order of appellate authority in APL-04, within 3 months from the date of issuance of order in form GST APL-04. 9.In case wherein any additional amount of tax becomes payable in light of the appeal filed by department, and if the said additional tax is not paid within 3 months from the date of Order passed by Appellate Authority or Tribunal or Revisional authority, as the case may be, the Order passed in Form GST SPL-05 or Form GST SPL-06 shall become void. 10.If the taxpayer is required to pay any amount of interest or penalty or both on account of demand pertaining to the period other than the period covered under the captioned section and the details of the same is mentioned in form GST SPL-05 or 06 (Column 19 and 20), the same shall be paid within 3 months from the date of issuance of Order in Form GST SPL-5 or 06, else the said Order shall become void. Circular: CBIC has issued the circular No. 238/32/2024-GST dated 15 October 2024 to clarify on certain aspects related to waiver of interest or penalty under captioned section. Key clarifications are captured below: Sr No. Issue Clarification As long as the amount has been paid on or before or the notified date i.e.31 March 2025, the said payment of tax shall be considered for benefit under captioned section Whether benefit under captioned section shall be available, wherein the tax component has been paid before the date on which said section has come into effect 1 Whether amount recovered by tax officers as tax due from any person on behalf of taxpayer, against a particular demand can be considered as tax paid under captioned. Yes subject to the recovery being made on or before the notified date i.e. 31 March 2025. 2 Whether interest or penalty or both recovered by the officer towards the demand under section 73 pertaining to the period covered under section 128A can be adjusted against the tax amount payable under captioned section No. Since the refund of interest or penalty is not available, the same cannot be adjusted towards tax payable under captioned section. 3 CA Aakash Sarda | Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

Affluence Advisory Pvt. Ltd. Waiver of Interest and Penalty in terms of Section 128A of CGST Act Whether the benefit under captioned section will be applicable in cases where tax amount has already been paid and the notice or order is for interest and/or penalty involved Whether the benefit under captioned section can be availed if the taxpayer intends to avail partial waiver of interest or penalty or both, by making part payment of amount demanded in notice/statement/order and opts to litigate for remaining issues Yes. However, the said interest and/or penalty shall not be related to delay filling of returns or delay in reporting of any supply. 4 No. The benefit can only be availed if the full amount of tax demanded in the Notices/statement/order is paid. 5 Yes, the benefit can be availed provided the taxpayer makes the full payment of tax demanded in the notice/statement/order. Further, the benefit of waiver of interest & penalty shall be available only for the period covered under captioned section. With respect to payment of interest or penalty or both for tax period not covered under captioned section, the same is to be paid with 3 months from the date of issuance of order in Form GST SPL-05 or 06 Yes subject to full payment of tax which includes the payment of IGST, CGST, SGST and Compensation Cess demanded in the notice/statement/Order Late fee, redemption fine etc. are not eligible for waiver under Section 128A Whether taxpayer can apply for the benefit under captioned section where the notice or order involves multiple periods including the period for which benefit is available. 6 Whether the benefit under captioned section is available for matters involving IGST and compensation Cess 7 Whether the benefit under captioned section will cover waiver of penalties under other provisions, late fee, redemption fine etc 8 Yes. However, in case where demand is pertaining to RCM liability or by the Ecommerce operator under Sec 9(5) of CGST Act, demand is to be paid by debiting electronic cash ledger Whether payment to avail waiver under captioned section can be made by utilizing ITC 9 Whether the benefit of captioned section can be availed qua import IGST payable under the Customs Act, 1962? No, since in such cases demand would have been raised under Customs Act and not under Sec 73 of CGST Act 10 CA Aakash Sarda | Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

Affluence Advisory Pvt. Ltd. Waiver of Interest and Penalty in terms of Section 128A of CGST Act Disclaimer:This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement CA Aakash Sarda | Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in