Urea Market

The global Urea Market size is expected to be worth around USD 99.3 billion by 2033, from USD 72.5 billion in 2023, growing at a CAGR of 3.2% during the forecast period from 2023 to 2033.nClick here for request a sample : //market.us/report/urea

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

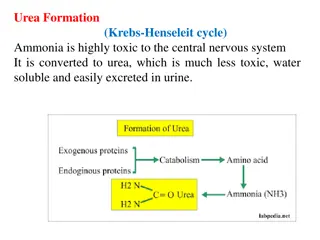

The global Urea Market size is expected to be worth around USD 99.3 billion by 2033, from USD 72.5 billion in 2023, growing at a CAGR of 3.2% during the forecast period from 2023 to 2033. The urea market encompasses the production, distribution, and use of urea, a nitrogen-rich compound widely used as a fertilizer in agriculture due to its high nitrogen content, which is essential for plant growth. Urea is also used in various industrial applications, including the production of resins, adhesives, and pharmaceuticals. The market is driven by the increasing demand for food production, which necessitates efficient fertilizers, and the expanding industrial applications of urea. Additionally, advancements in urea production technologies and the development of more sustainable agricultural practices influence market dynamics. The Asia-Pacific region is the largest consumer of urea, primarily due to its extensive agricultural activities. Market Key Players: Yara International ASA SABIC Qatar Fertiliser Company OCI NV CF Industries Holdings, Inc. EuroChem Group AG Nutrien AG Koch Fertilizer, LLC Coromandel International Limited Acron Group Chambal Fertilisers and Chemicals Ltd Uralchem Group Others Click here for request a sample : https://market.us/report/urea-market/request-sample/ By Purity:

In 2023, urea with above 95% purity dominated the market, capturing over a 42.2% share. This high-purity urea is preferred in agriculture for its efficiency and effectiveness in enhancing crop growth and yield, while also minimizing impurities that can harm crops and soil. Urea with 90-95% purity is widely used in industrial applications, such as resins and adhesives, due to its balance of cost and performance. Urea below 90% purity is used in specific industrial processes and lower-grade fertilizers where high purity is not crucial. By Grade: In 2023, fertilizer-grade urea held the largest market share at 48.6%, driven by its crucial role in agriculture for promoting plant growth and increasing crop yields. This grade dissolves easily, making it efficient for farming applications. Technical-grade urea, important for industrial uses, is utilized in manufacturing plastics, adhesives, and chemicals, where high purity and specific chemical properties are required. Feed-grade urea is used as a non-protein nitrogen supplement in animal feed, aiding in the cost-effective nourishment of livestock. By Application: In 2023, agriculture dominated the urea market, accounting for 68.2% of the share, underscoring its role as a vital nitrogen fertilizer for enhancing crop productivity. Urea's high nitrogen content and cost-effectiveness make it a preferred choice for farmers. The chemical synthesis segment, though smaller, is essential for producing plastics, resins, and adhesives, particularly urea-formaldehyde used in composite wood products. Urea is also used in animal feed to increase the protein content for ruminants, supporting livestock nutrition economically. By End-Use: In 2023, the fertilizer segment captured 65.5% of the urea market, emphasizing its importance in agriculture for improving crop yields and soil health. Urea is popular for its cost-effectiveness and ease of application. The urea-formaldehyde resin segment, while smaller, is critical in producing composite wood products, adhesives, and coatings, driven by demand in construction and furniture industries for its strength and water resistance. Key Market Segments: By Purity

Below 90% 90-95% Above 95% By Grade Technical Grade Fertilizer Grade Feed Grade Urea By Application Agriculture Chemical Synthesis Animal Feed Others By End-Use Fertilizer Urea Formaldehyde Resin Others Drivers: The urea market is driven by the rising global agricultural demand, fueled by the need to increase crop yields to feed a growing population projected to reach nearly 10 billion by 2050. Urea, as a high-nitrogen fertilizer, enhances crop growth and health, making it essential for meeting food production needs. Its high nitrogen content supports protein synthesis in plants, leading to better yields. Urea s ease of application and cost-effectiveness further boost its widespread use, particularly in intensive farming practices aimed at maximizing arable land use. This demand is especially significant in developing countries where agriculture is crucial for the economy and food security. Restraints:

The urea market faces restraints due to environmental concerns and regulatory restrictions related to nitrogen runoff and emissions. Unabsorbed nitrogen from urea can lead to water contamination and air pollution, prompting stricter regulations on fertilizer use. Governments and environmental organizations are imposing limits on nitrogen application rates, and promoting best management practices to minimize nitrogen losses. The push for organic farming, which excludes synthetic fertilizers like urea, and the development of alternative sustainable fertilizers, also challenge the market. Increasing public awareness and advocacy for environmental protection further pressure policymakers to enforce stricter controls on urea use. Opportunity: The development and expansion of enhanced-efficiency fertilizers (EEFs) present significant opportunities in the urea market. EEFs are designed to reduce nitrogen losses and improve nutrient uptake efficiency through technologies like urease and nitrification inhibitors. These advanced products address environmental concerns while boosting crop productivity. As regulatory pressures and sustainability goals grow, the demand for EEFs increases. Technological advancements in fertilizer production allow for more stable and effective formulations, expanding their applications. Companies investing in EEFs can capture substantial market share by offering solutions that meet both agricultural and environmental needs. Trends: The urea market is influenced by the growing adoption of precision agriculture, which optimizes fertilizer application using technologies like GPS, sensors, drones, and data analytics. Precision agriculture enhances urea efficiency by ensuring precise application, reducing waste, and maximizing crop productivity. Tools like variable rate technology adjust urea application based on real-time field data, improving effectiveness and minimizing environmental impact. Sensor technology and data analytics monitor soil health and plant needs, enabling targeted urea usage. As smart farming technologies become more widespread and affordable, the demand for judicious urea use aligned with sustainable practices is expected to rise.