Union Budget 2022 Presentation Highlights for National Youth Parliament

The Union Budget 2022 presentation by Eshanvi, Nandeesh, and Preetham focused on key growth ideas for the youth parliament, including promoting electronics and telecom manufacturing, enhancing online education, and emphasizing youth affairs. It proposed schemes for scholarships in cultural arts, export of Swadeshi goods for rural development, and industry-university collaboration for skill development. The budget aims to boost entrepreneurship, employment opportunities, and overall national development.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

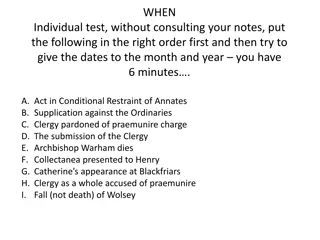

Presentation Transcript

Union Budget 2022 Eshanvi Nandeesh Preetham Finance Minister Presentation for National Youth Parliament | Budget Session 2022 | 11th Jan 2022

Table of Contents 1. Introduction 2. Ideas for Growth 3. Fiscal Position 4. Direct Tax Proposals 5. Indirect Tax Proposals 6. Annual Financial Statement U N I O N BU D G E T 2 0 2 2 F O R N A T I O N A L YO U T H PA R L I A M E N T

Introduction ESHANVI NANDEESH PREETHAM MYSURU KARNATAKA EXCEL PUBLIC SCHOOL U N I O N BU D G E T 2 0 2 2 F O R N A T I O N A L YO U T H PA R L I A M E N T

Ideas for Growth IT, Electronics, communication and IB The PLI scheme coupled with the Make In India scheme should allot funds to promote the manufacture of electronics(and components) and telecom equipment in India. This would not only lead to affordability but it would also make India the global hub of manufacturing and provide entrepreneurial and employment opportunities. A joint venture between the education and IT sector to streamline and enhance, online education, should also be given primary importance considering the current state of the pandemic. U N I O N BU D G E T 2 0 2 2 F O R N A T I O N A L YO U T H PA R L I A M E N T

Ideas for Growth Youth Affairs Indian cultural music, dance, art. Etc. must be given primary importance in this ministry. This can be done by providing a scheme for students to apply scholarships on the basis of any of these cultural arts. The scholarship programme will be aimed to provide for students to learn in a good college, applicable for certain fields. U N I O N BU D G E T 2 0 2 2 F O R N A T I O N A L YO U T H PA R L I A M E N T

Ideas for Growth Rural development I would propose that more importance be given to the export of Swadeshi goods made from the skilled ARTISANS of the rural areas. This would ensure capital which will be generated by the tax collected while exporting these goods and this capital should be aimed at the rural development of India. The goods should be exported through a government channel to ensure more profit and value that the artisans will receive as well as the government. U N I O N BU D G E T 2 0 2 2 F O R N A T I O N A L YO U T H PA R L I A M E N T

Ideas for Growth Industries and education industry-university collaboration: In today s fiercely competitive world, there is a need to refine our skill development courses and bring them at par with the recent developments. So, this policy will facilitate the collaboration between the industries and the universities so that they can together work to co-create the best and the most relevant skill development curriculum for students. This will allow students to gain more practical experience in the field they wish to pursue and will succeed, adding growth to the economy. U N I O N BU D G E T 2 0 2 2 F O R N A T I O N A L YO U T H PA R L I A M E N T

Ideas for Growth Agriculture Scheme providing subsidy on modern agricultural machines to make farming easier and to increase yield. Subsidy for new boat, engine for development of Marine Fisheries. Re-examination of chemical fertilizers and pesticides must be conducted in order to check their result with High Yielding variety seeds . The government must start to invest its capital on producing efficient and effective natural pesticides and distributing them to farmers. U N I O N BU D G E T 2 0 2 2 F O R N A T I O N A L YO U T H PA R L I A M E N T

Summary table of Expenditure Budget (all figures in INR lakh crore) FY20-21 Actuals BE21-22 Actuals up to Nov 21 (CGA) NYP - RE for FY21-22 NYP - BE for FY22-23 Revenue Expenditure (ex. Interest) 24.02 21.20 13.41 21.1 21.1 Interest Payments 6.82 8.09 4.60 8.1 8.1 Capital Expenditure 4.25 5.54 2.73 4.2 4.2 Total Expenditure 35.11 34.83 20.74 33.4 33.4 U N I O N BU D G E T 2 0 2 2 F O R N A T I O N A L YO U T H PA R L I A M E N T

Fiscal Position 2021-22 1. GST Collection 2. Direct tax Collection % Change Indicators Apr Dec 20 Apr Dec 21 +60.7% Direct Tax Collection (INR 000 crore) 588 945 +36.6% GST Collection (INR 000 crore) 771 1053 U N I O N BU D G E T 2 0 2 2 F O R N A T I O N A L YO U T H PA R L I A M E N T

Direct tax proposals for FY 22-23 Corporation Tax 3 years ago the tax percentage for companies with 400 crores of turnover was reduced from 30% to 22%. This positively impacted the taxpayers, because If tax is reduced people will pay the entire amount without difficulties. So we are proposing to raise the bar from 400 crores to companies with a 1000 crore turnover. We also advise reduction of corporate taxes to 15% for smaller companies with 250 crore turnover. U N I O N BU D G E T 2 0 2 2 F O R N A T I O N A L YO U T H PA R L I A M E N T

Direct tax proposals for FY 22-23 Income tax The income tax collected last year was at an extreme height. Due to the buoyancy, this year we propose that we use last year s excess fund in this year s development U N I O N BU D G E T 2 0 2 2 F O R N A T I O N A L YO U T H PA R L I A M E N T

Indirect tax proposals for FY 22-23 GST GST- the pandemic has left people unemployed and thus are struggling to make ends meet. Keeping in mind of the people of the country we propose to reduce the current 4 slab structure of GST to a 3 slab structure where, 2% 5% 18% are levied on the goods. This structure can improve as and when things start to get better in country. U N I O N BU D G E T 2 0 2 2 F O R N A T I O N A L YO U T H PA R L I A M E N T

Non Tax Revenue proposals for FY 22-23 Railway revenue and capital The railways includes extending of railway lines from one state to another state or in the same state for further development of railways. That is to say broad gauge lines have to be extended from one place to another place in a particular state. There is a lot of comment on introduction of bullet train between Surat and Mumbai which costs 8000 crores but at the same time, the travelling time between Surat and Mumbai will be considerably be reduced and the commuters may prefer to use bullet trains rather than flights. Due to this convenient factor people wont be needing domestic flights, some of which are belonging to private sectors and thus more income will be generated. This income has to be used for repayment of the country s loan but at the long term, Capital generated will be a part of our economy. U N I O N BU D G E T 2 0 2 2 F O R N A T I O N A L YO U T H PA R L I A M E N T

Non Tax Revenue proposals for FY 22-23 Road revenue ROADS-The revenue / money saved from unmanned toll booths can be used to build amenity centers for drivers along main toll booths including hotels , dining , refreshments , auto repairs, hospitals etc. increasing revenue along the national highways U N I O N BU D G E T 2 0 2 2 F O R N A T I O N A L YO U T H PA R L I A M E N T

Non Tax Revenue proposals for FY 22-23 Telecoms The privatization of telecoms would improve the systematic performance of the sector. in telecoms also there are a lot of complaints by the commuters for not providing service in time though they collect huge rent and also the fee for using the telecoms. In the same telecom industry if taken over by the private firm there will be lot of competition between different telecom sectors for example BSNL JIO and AIRTEL as a consequence the commuters may get services at a lesser price and there will be healthy competition there will be lots of income generated U N I O N BU D G E T 2 0 2 2 F O R N A T I O N A L YO U T H PA R L I A M E N T

Transfer to States FY 22-23 The 14th Finance Commission considerably increased the devolution of taxes from the centre to states from 32% to 42%. The Commission had recommended that tax devolution should be the primary source of transfer of funds to states. This would increase the flow of unconditional transfers and give states more flexibility in their spending. However the 15th finance commission (2021-26) recommendation remains same 42 %. U N I O N BU D G E T 2 0 2 2 F O R N A T I O N A L YO U T H PA R L I A M E N T

Actuals for 2020-2021 Grant No Ministry BE22 RE22 BE23 MINISTRY OF AGRICULTURE AND FARMER'S WELFARE Department of Agriculture, Cooperation and Farmers Welfare 0 1,15,822 1,31,531 1,22,847 1,30,217 1 1,08,268 1,23,018 1,11,516 1,18,207 Department of Agricultural Research and Education 2 7,554 8,514 11,331 12,010 0 3 DEPARTMENT OF ATOMIC ENERGY 15,598 18,265 18,898 20,285 MINISTRY OF AYURVEDA, YOGA AND NATURAPATHY,UNANI, SIDDHA AND HOMOEOPATHY(AYUSH) Ministry of Ayurveda, Yoga and Naturopathy,Unani,Siddha and Ho moeopathy (AYUSH) 0 2,126 2,970 2,445 2,690 4 2,126 2,970 2,445 2,690 MINISTRY OF CHEMICALS AND FERTILISERS 0 U N I O N BU D G E T 2 0 2 2 F O R N A T I O N A L YO U T H PA R L I A M E N T 1,29,510 80,715 84,774 89,854

MINISTRY OF CIVIL AVIATION MINISTRY OF COAL 4,089 572 3,225 535 5,479 772 5,712 849 MINISTRY OF COMMERCE AND INDUSTRY MINISTRY OF COMMUNICATIONS 10,685 60,787 12,768 75,265 16,046 81,679 17,651 89,985 MINISTRY OF CONSUMER AFFAIRS, FOOD AND PUBLIC DISTRIBUTION MINISTRY OF CORPORATE AFFAIRS MINISTRY OF CULTURE MINISTRY OF DEFENCE 5,66,797 2,56,948 2,55,616 2,81,173 653 2,135 4,85,733 712 2,688 653 2,242 716 2,355 5,05,311 4,78,196 4,83,032 MINISTRY OF DEVELOPMENT OF NORTH EASTERN REGION MINISTRY OF EARTH SCIENCES MINISTRY OF EDUCATION 1,854 1,275 84,017 2,658 1,897 93,224 2,176 1,421 89,703 2,317 1,558 95,952 MINISTRY OF ELECTRONICS AND INFORMATION TECHNOLOGY 5,396 9,721 5,719 6,026 MINISTRY OF ENVIRONMENT, FORESTS AND CLIMATE CHANGE 1,967 14,330 2,870 18,155 2,025 12,897 2,158 14,135 U N I O N BU D G E T 2 0 2 2 F O R N A T I O N A L YO U T H PA R L I A M E N T MINISTRY OF EXTERNAL AFFAIRS

MINISTRY OF FINANCE MINISTRY OF FOOD PROCESSING INDUSTRIES 11,44,607 13,86,273 12,99,326 13,43,768 2,291 2,617 2,340 2,443 MINISTRY OF HEALTH AND FAMILY WELFARE 80,694 73,932 72,983 80,102 MINISTRY OF HEAVY INDUSTRIES AND PUBLIC ENTERPRISES MINISTRY OF HOME AFFAIRS 883 1,017 690 724 1,44,258 1,66,547 1,47,706 1,57,093 MINISTRY OF HOUSING AND URBAN AFFAIRS MINISTRY OF INFORMATION AND BROADCASTING MINISTRY OF JAL SHAKTI 46,701 54,581 51,786 55,509 3,377 23,199 4,071 69,053 3,545 31,937 3,722 33,544 MINISTRY OF LABOUR AND EMPLOYMENT MINISTRY OF LAW AND JUSTICE MINISTRY OF MICRO, SMALL AND MEDIUM ENTERPRISES MINISTRY OF MINES 12,920 2,106 13,307 3,230 13,307 3,120 13,707 3,406 5,455 1,348 3,920 15,700 1,467 4,811 11,974 1,413 4,737 13,170 1,482 5,228 U N I O N BU D G E T 2 0 2 2 F O R N A T I O N A L YO U T H PA R L I A M E N T MINISTRY OF MINORITY AFFAIRS

MINISTRY OF NEW AND RENEWABLE ENERGY MINISTRY OF PANCHAYATI RAJ 2,643 686 5,753 913 3,815 892 4,563 981 MINISTRY OF PARLIAMENTARY AFFAIRS MINISTRY OF PERSONNEL, PUBLIC GRIEVANCES & PENSIONS MINISTRY OF PETROLEUM AND NATURAL GAS MINISTRY OF PLANNING MINISTRY OF PORTS, SHIPPING AND WATERWAYS MINISTRY OF POWER 29 65 32 35 1,675 2,097 2,045 2,249 42,190 749 15,944 1,063 16,413 749 17,257 794 1,394 10,582 1,702 15,322 1,700 14,385 1,870 15,824 THE PRESIDENT, PARLIAMENT, UNION PUBLIC SERVICE COMMISSION AND THE SECRETARIAT OF THE VICE-PRESIDENT MINISTRY OF RAILWAYS MINISTRY OF ROAD TRANSPORT AND HIGHWAYS MINISTRY OF RURAL DEVELOPMENT 1,265 1,688 1,392 1,531 1,12,160 1,10,055 1,23,093 1,34,835 97,366 1,97,593 1,18,101 1,33,690 1,15,445 1,38,080 1,26,567 1,46,447 MINISTRY OF SCIENCE AND TECHNOLOGY 11,351 14,794 12,447 13,816 U N I O N BU D G E T 2 0 2 2 F O R N A T I O N A L YO U T H PA R L I A M E N T MINISTRY OF SKILL DEVELOPMENT AND ENTREPRENEURSHIP 2,625 2,785 2,640 2,777

MINISTRY OF SOCIAL JUSTICE & EMPOWERMENT DEPARTMENT OF SPACE 8,918 9,474 11,689 13,949 6,623 13,949 7,239 13,949 MINISTRY OF STATISTICS AND PROGRAMME IMPLEMENTATION MINISTRY OF STEEL MINISTRY OF TEXTILES MINISTRY OF TOURISM MINISTRY OF TRIBAL AFFAIRS 2,423 1,409 1,409 1,409 74 39 39 39 3,109 1,096 5,495 3,632 2,027 7,525 3,632 2,027 7,525 3,632 2,027 7,525 MINISTRY OF WOMEN AND CHILD DEVELOPMENT 19,231 24,435 24,435 24,435 MINISTRY OF YOUTH AFFAIRS & SPORTS 1,748 2,596 2,596 2,596 Actuals For 2020-21 BE22 RE22 BE22 TOTAL EXPENDITURE Revenue Capital Interest Payments Revenue less Interest 35,10,741 30,86,360 4,24,821 6,82,079 34,82,634 29,29,128 5,54,107 8,09,701 21,19,427 33,30,499 28,25,819 4,95,544 8,11,674 20,14,144 35,16,790 29,73,129 5,39,229 8,11,674 21,61,454 U N I O N BU D G E T 2 0 2 2 F O R N A T I O N A L YO U T H PA R L I A M E N T 24,04,281

Summary Table of Revenue for FY 22-23 (all figures in INR lakh crore) FY20-21 Actuals BE21-22 NYP - RE for FY21-22 NYP - BE for FY22-23 Corporation tax Income Tax GST Customs Excise Gross Tax Revenue Devolution to States Net tax Revenue Non Tax Revenue Total Revenue receipts 4,57,180 4,69,226 5,43,962 1,34,756 3,89,662 20,17,591 5,94,997 14,22,594 2,65,059 16,87,653 5,47,000 5,48,500 6,33,327 1,36,000 3,35,000 22,17,059 6,65,563 15,51,497 5,69,212 21,20,708 6,68,251 5,76,418 6,69,829 1,94,962 3,74,992 24,85,230 7,45,569 17,39,661 3,90,000 21,29,661 7,35,076 6,34,060 7,36,812 2,14,458 4,12,491 27,33,752 8,20,126 19,13,627 4,27,500 23,41,127 U N I O N BU D G E T 2 0 2 2 F O R N A T I O N A L YO U T H PA R L I A M E N T

Annual Financial Statement for FY22-23 (all figures in INR lakh crore) FY20-21 Actuals 4,57,180 4,69,226 5,43,962 1,34,756 3,89,662 20,17,591 5,94,997 14,22,594 2,65,059 16,87,653 24,04,281 6,82,079 4,24,821 35,11,181 -18,23,528 2,04,50,000 8.92% BE21-22 NYP - RE for FY21-22 6,68,251 5,76,418 6,69,829 1,94,962 3,74,992 24,85,230 7,45,569 17,39,661 3,90,000 21,29,661 21,64,144 8,11,674 4,95,544 34,71,363 -13,41,702 2,32,00,000 5.78% NYP - BE for FY22-23 7,35,076 6,34,060 7,36,812 2,14,458 4,12,491 27,33,752 8,20,126 19,13,627 4,27,500 23,41,127 21,61,454 8,11,674 5,39,229 35,12,358 -11,71,231 2,66,80,000 4.39% Corporation tax Income Tax GST Customs Excise Gross Tax Revenue Devolution to States Net tax Revenue Non Tax Revenue Total Revenue receipts Revenue Expenditue (exc Interest) Interest Payments Capital Expenditure Total Expenditure Fiscal deficit GDP (nominal) Fiscal Deficit as a % of GDP 5,47,000 5,48,500 6,33,327 1,36,000 3,35,000 22,17,059 6,65,563 15,51,497 5,69,212 21,20,708 22,69,427 8,09,701 5,54,107 36,33,236 -15,12,528 2,32,00,000 6.52% U N I O N BU D G E T 2 0 2 2 F O R N A T I O N A L YO U T H PA R L I A M E N T

Thank You www.nationalyouthparliament.org U N I O N BU D G E T 2 0 2 2 F O R N A T I O N A L YO U T H PA R L I A M E N T