Understanding the Economic Crisis of 1929-33 in the USA

Explore the factors contributing to the economic crisis in America between 1929-1933, including Republican policies, overproduction, banking system weaknesses, international economic problems, and the Wall Street Crash. The stock market boom of the 1920s, driven by easy credit availability, ultimately led to the inevitable crash. Learn how speculative buying and overvaluation of stocks set the stage for the Great Depression.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

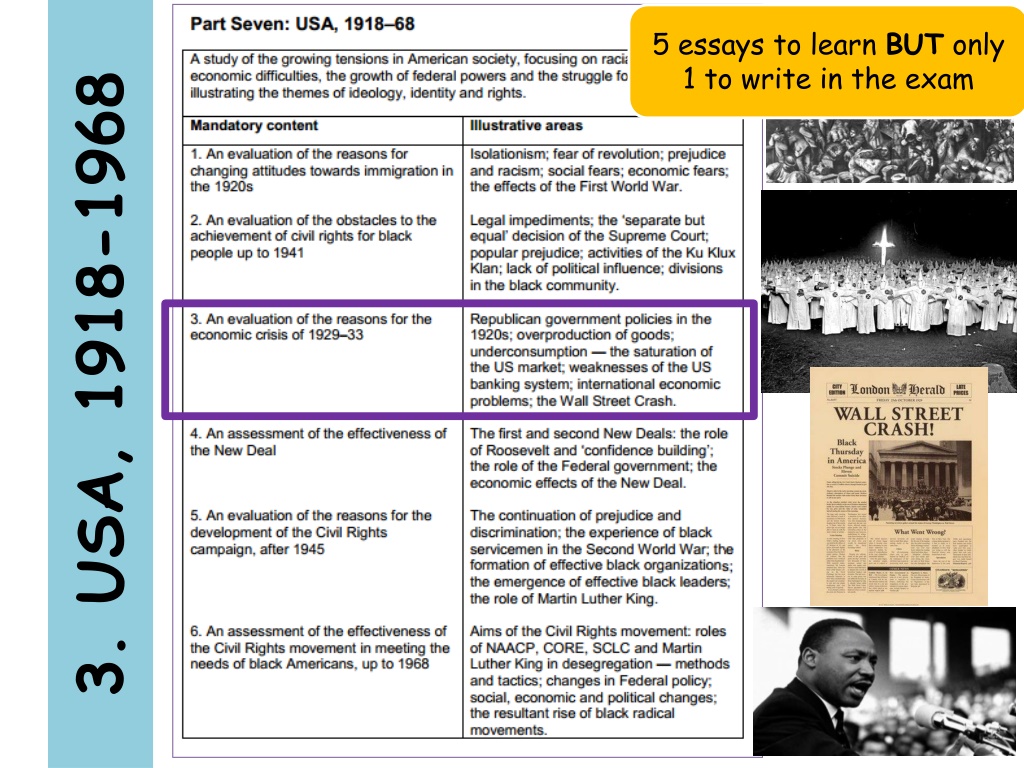

5 essays to learn BUT only 1 to write in the exam 3. USA, 1918-1968

Issue 3 An Evaluation Of The Reasons For The Economic Crisis 1929-33: Factor 1: Republican Governments Policies Factor 2: Overproduction & Under-consumption Factor 3: Weaknesses Of The Banking System Factor 4: International Economic Problems Factor 5: Wall Street Crash AIMS OF ESSAY: To Be Able To Discuss the factors which contributed to the economic (financial) crisis in American between 1929 & 1933

Aims Paragraph 5: To Understand That The Stock Market Boom Of The 1920s Was Never Going To Last To Explain How The Stock Market Was Linked To Banks & The Crashed Can Be Blamed On The Republican Policies Have The Background Knowledge & Argument To Write Your Last Paragraph For Essay 3

PLAN FOR PARAGRAPH Wall Street Crash 1. Start with an Opening Argument e.g. state there is a link between the isolated factor & the question 2. Put in Knowledge describe what the easy availability of credit led to 3. Put in Analysis explain the problem with the soaring shock prices 4. Knowledge describe the impact of the crash had on the value of share & on the banks 5. Analysis explain what savers & banks did in the panic 6. Evaluation make an evaluation, how can you link this to Republican polices? Read Through Paragraph 5 On Handout

Easy Availability of Loans As the 1920s was a fairly wealthy and prosperous time for the Americans, shares began to rise and were worth a lot of money It was seen as a quick money-making scheme and after a while it wasn t just companies that were involved in it, it was individuals People would borrow money so that they could buy shares, this was called buying on the margin Then when the stick prices were high enough they would sell them, pay money back to the bank and keep the small fortune they had made It can be argued that the speculative buying in the 1920s led to the Depression of the 1930s Historian Piers Brendon said in The Dark Valley that Wall Street inspired visions of boundless wealth. Confidence blossomed & buying stocks on margin (credit) became at first a fashion then a frenzy It can be argued that this get rich quick scheme would only work if the market continued to rise The soaring prices of shares did not reflect their true value - this showed the lack of understanding existed AND that a crash was inevitable

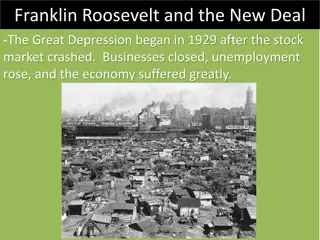

Crashing Of The Banks Nearly everyone in America had invested in shares and the stock market was huge However in October 1929 things started to go wrong A few of the smarter people and companies began selling their shares in fear of them going bust This was when everyone else began to panic and started selling - this led to the run on the banks trying desperately to retain some of their finances This was known As Black Tuesday & $14 million were wiped off the value of shares Their shares were now worthless & many people had lost all their money They could not repay bank loans as they had lost everything Banks were forced to shut as they had no money and people who had had nothing to do with the stock market but had put their money in banks to save up and keep safe lost it all as the banks could not give it back as they d lent it to other people Jobs, homes, possessions were all lost because of the Wall Street Crash People even took their own lives because the pressure was too much for them Some historians argue that the Wall Street Crash was a symptom, not the disease and that it was a symbol of how unstable the economy had become during the boom period of the 1920s The crash was an economic disaster for the US; it represented the end of the boom years of the 1920s and the start of the Depression Between 1929-32, 100,000 businesses collapsed and 15 million became unemployed; millions lost their savings and pensions as banks went out of business

Background Questions Q1. What were stock and shares seen as? Q2. What does buying on the margin means? Q3. What was the idea behind making money fast? How was it meant to work? Q4.What was the problems with the soaring prices? Q5. What did people begin to do in October 1929? Q6. What did this create among other share holders? Q7. How much was lost on Black Tuesday? Q8. Why did this cause problems for the banks? Q9. How were ordinary people affected? Those who did not even invest in stocks & shares Q10. What were the consequences for Americans? Q11. An Historian said the crash was of a symptom, not the disease what was meant by this?

SUM UP: Wall Street Crash Over-confidence in the stock market: Many believed the stock market would continue to increase and sank their life savings into stocks and shares; Banks and private investors gambledwith people s savings in the hope of achieving a big return and making substantial profits This eventually stopped People lost everything

PLAN FOR PARAGRAPH Wall Street Crash 1. Start with an Opening Argument e.g. state there is a link between the isolated factor & the question 2. Put in Knowledge describe what the easy availability of credit led to 3. Put in Analysis explain the problem with the soaring stock prices 4. Knowledge describe the impact of the crash had on the value of share & on the banks 5. Analysis explain what savers & banks did in the panic 6. Evaluation make an evaluation, how can you link this to Republican polices? Read Through Paragraph 5 On Handout

OPENING ARGUMENT Wall Street Crash Another factor which contributed to the economic crisis of the 1930s & acted as a trigger was Wall Street Crash

Wall Street Crash KNOWLEDGE 1 ARGUMENT 1 Due to easy availability of credit, borrowed money had been used by many investors to speculate shares It can be argued that This led to soaring prices of shares which did not reflect their true value This is known as buying shares on the margin e.g. using borrowed money This showed the lack of understanding existed And a crash was inevitable

Wall Street Crash KNOWLEDGE 2 ARGUMENT 2 October 1929 Black Tuesday saw $14 million lost in the value of shares It can be argued Savers panicked and this led to the run on the banks & banks themselves desperately called back in their loans as they had also invested in the shares losing millions and could not replay their clients Investors were now unable to ever repay the loans to the banks as the money they had borrowed had disappeared Many people lost their homes, possessions & life savings as banks tried to reclaim their lost millions

Wall Street Crash EVALUATION: Overall, the crash is important in causing the banks to collapse which massively damaged the economy. By itself however it was not a sufficient cause of the depression as it could not have done so much damage if the banks were not in such poor health due to the upregulation of the Republicans policies