Understanding Financial Statements and Profit Analysis

Explore the importance of financial statements like profit and loss, learn how to calculate profit, and decipher business profitability through different profit types. Discover why these documents are crucial for managerial decisions and attracting potential investors.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

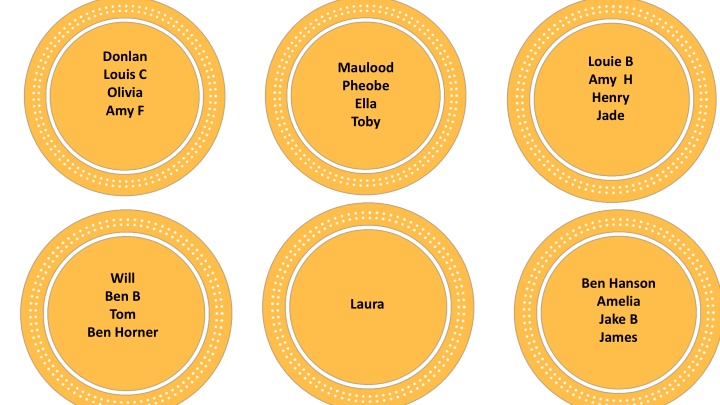

Donlan Louis C Olivia Amy F Louie B Amy H Henry Jade Maulood Pheobe Ella Toby Will Ben B Tom Ben Horner Ben Hanson Amelia Jake B James Laura

Draw the table in your book and state whether it would make the contribution per unit and effect of break even high, lower or stay the same. End 10 minute timer

Profit is the difference between revenue and the costs involved in generating revenue. Revenue cost of sales Gross profit fixed overheads Operating profit financing and tax Revenue Total Costs (the first way we learnt how) (other expenses)

What is a statement of comprehensive income What is a statement of comprehensive income (profit and loss)? (profit and loss)? At the end of the year businesses produce documents that show key information relating to their financial performance. One of these documents is the statement of income (profit and loss) As such this financial document will show business owners and managers whether the business is profitable.

Clearing up confusing Clearing up confusing Accountants enjoy acronyms and numerous labels. Profit and loss, income statement and statement of comprehensive income are the same thing!!!

Why is it important? Why is it important? The data is used to make managerial decisions Companies use their profit and loss tables to make themselves more attractive to potential capital sources.

Why make it so difficult? Can we not just calculate Why make it so difficult? Can we not just calculate profit by sales revenue profit by sales revenue total costs or total contribution total contribution fixed cost? total costs or fixed cost? The different types of profit allow businesses to identify step by step whether they are profitable or not. If gross profit is negative then the firm knows that they are making a loss. Differentiating between gross and operating profit allows firms to decipher where issues are in their profitability as it helps them determine whether the problem is their fixed or variable cost.

Item Figures ( s) Calculation Notes Revenue 220,000 Selling price x quantity sold The value of all the sales to customers Variable costs Cost of sales 70,000 150,000 Revenue cost of sales Gross Profit Fixed overheads 100,000 Fixed costs 50,000 Gross profit Fixed overheads Operating profit Interest paid on bank loan Net financing cost 5,000 . Small firms pay 20% corporation (profit) tax Corporation tax 9,000 36,000 Operating profit financing and tax (other costs) Net profit End 5 minute timer 5 minute timer

In 2104 HLDs turnover was 46 million. Its cost of sales was 23.5 million, operating expenses 12.4 million and interest paid 2.1 million. What was the gross profit? = Revenue Cost of sales = 46 million - 23.5 million = 22.5 million End 1 minute bar timer

In 2104 HLDs turnover was 46 million. Its cost of sales was 23.5 million, operating expenses 12.4 million and interest paid 2.1 million. What was the operating profit? Gross profit Operating expenses = 22.5 million - 12.4 million = 10.1 million End 1 minute bar timer

In 2104 HLDs turnover was 46 million. Its cost of sales was 23.5 million, operating expenses 12.4 million and interest paid 2.1 million. What was the net profit? = Operating profit Interest (and any exceptional items) = 10.1 million - 2.1 million = 8 million End 1 minute bar timer

A. Gross profit 2014 2015 Revenue - cost of sales = Gross Profit Revenue - cost of sales = Gross Profit 2,341,700 - 1,090,000 = 1,251,700 2,600,700 - 980,500 = 1,620,200 End 4 minute timer

B. Operating Profit 2014 2015 Gross Profit Fixed overheads = Operating profit Gross Profit Fixed overheads = Operating profit 1,251,700 - 399,100 = 852,600 1,620,200 - 388,900 = 1,231,300 End 4 minute timer

C. Net Profit (profit for the year) 2014 2015 Operating profit financing and tax = Net profit Operating profit financing and tax = Net profit 852,600 21,000 = 831,600 1,231,300 - 19,300 = 1,212,000 End 4 minute timer

2. Calculate the percentage change in net profit between 2014 and 20015. 2014 2015 Operating profit financing and tax = Net profit Operating profit financing and tax = Net profit 852,600 21,000 = 831,600 1,231,300 - 19,300 = 1,212,000 Percentage change = difference/original x 100 Difference = 831,600 1,212,000 = 380,400 X 100 = 45.74% increase net profit Original = 831,600 End 4 minute timer

2014 2015 Revenue - cost of sales = Gross Profit Revenue - cost of sales = Gross Profit 2,341,700 - 1,090,000 = 1,251,700 2,600,700 - 980,500 = 1,620,200 2015 2014 Gross Profit Fixed overheads = Operating profit Gross Profit Fixed overheads = Operating profit 1,251,700 - 399,100 = 852,600 1,620,200 - 388,900 = 1,231,300 2014 2015 Operating profit financing and tax = Net profit Operating profit financing and tax = Net profit 639,700 - 19,300 = 620,400 852,600 21,000 = 831,600

There are two ways to analyse profit There are two ways to analyse profit Analysing the raw data 20,000 profit Analysing using a ratio 20,000 profit from 200,000 sales is 20,000/ 200,000 x 100 = x %

Measuring profitability Profit margins measure profitability in a more meaningful way as they measure the size of profit in relation to revenue/turnover. Company 1 = net profit = 100,000 Which is the most profitable company? Company 2 = net profit = 50,000 Company 1 = Revenue = 200,000 Company 2 = Revenue = 60,000

2014 2015 40.99% 35.34% GP margin % 11.08% 7.04% OP margin % 7.14% 2.83% NP margin % Gross profit margin Gross profit/revenue x 100 Operating profit margin Operating profit/revenue x 100 Net profit margin Net profit/revenue x 100 End 5 minute timer 5 minute timer

The Importance of Comparison Which company is most successful?

Complete questions 2 and 3 in the blue boxes on Complete questions 2 and 3 in the blue boxes on page 192 and 193 of the text book. page 192 and 193 of the text book. Once you have completed that put all of your Once you have completed that put all of your resources away and attempt the work sheet. resources away and attempt the work sheet.