Understanding CRSC and CRDP Programs for Military Retirees

Learn about Combat-Related Special Compensation (CRSC) and Concurrent Retirement Disability Pay (CRDP) programs established by Congress to provide additional entitlements to eligible military retirees. CRSC is non-taxable and requires an application, while CRDP automatically restores retired pay for those with service-connected disabilities. Explore eligibility criteria, application processes, and retroactive payment options.

Uploaded on | 0 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

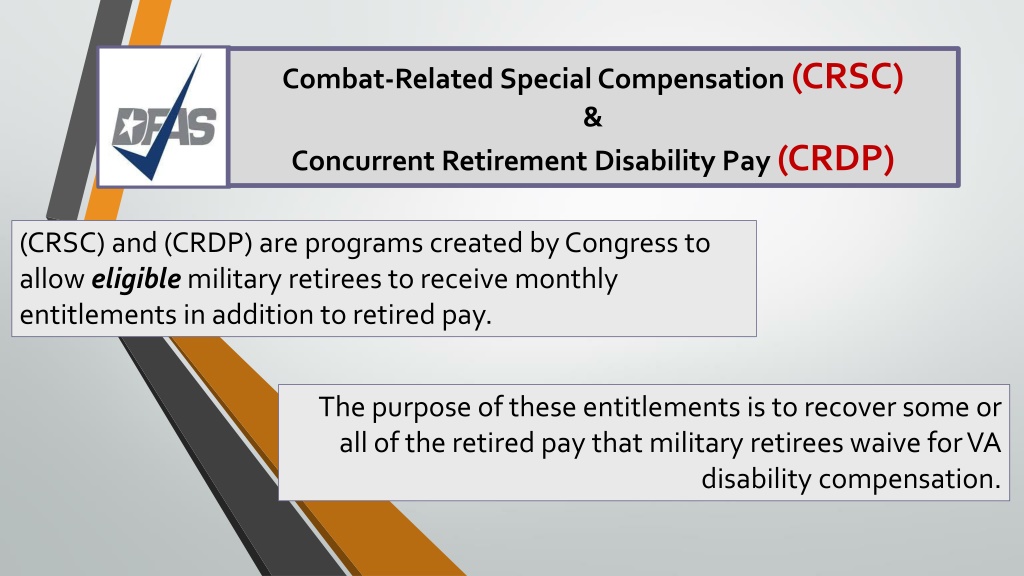

Combat-Related Special Compensation (CRSC) & Concurrent Retirement Disability Pay (CRDP) (CRSC) and (CRDP) are programs created by Congress to allow eligible military retirees to receive monthly entitlements in addition to retired pay. The purpose of these entitlements is to recover some or all of the retired pay that military retirees waive for VA disability compensation.

(CRSC) & (CRDP) CRSC is a special compensation for combat-related disabilities. It is non- taxable, and retirees must apply to their Branch of Service to receive it. Eligible retirees must apply to receive CRSC. CRDP is a restoration of retired pay for retirees with service-connected disabilities. It is taxed in the same manner as your retired pay, and it is normally considered taxable income. No application is required. Eligible retirees receive CRDP automatically.

(CRSC) & (CRDP) Where do I find this info?

(CRSC) Combat Related Special Compensation (CRSC) Eligibility To qualify for CRSC you must: Be entitled to and/or receiving military retired pay Be rated at least 10 percent by the Department of Veteran s Affairs (VA) Waive your VA pay from your retired pay File a CRSC application with your Branch of Service Disabilities that may be considered combat related include injuries incurred as a direct result of: Armed Conflict Hazardous Duty An Instrumentality of War Simulated War More Qualifications and Details:

(CRDP) Concurrent Retirement and Disability Pay (CRDP) -- Eligibility: Must be *eligible for retired pay (AD & Reserve) to qualify for CRDP. *eligible for retired pay due to length of service OR Retired under Temporary Early Retirement Act (TERA) AND have a VA disability rating of 50 percent or greater. May become eligible for CRDP at the time the veteran becomes eligible for retired pay. More Qualifications and Details:

(CRSC) & (CRDP) Retroactive Payment Both (CRSC) & (CRDP) recipients may be eligible for Retroactive Payment on their benefit. DFAS will audit the account to determine whether or not retroactive payment is due . An audit of an account requires researching pay information from both DFAS and VA. Specific Details ON Retroactive Payments:

(CRSC) & (CRDP) Q & A