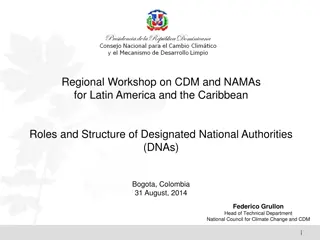

Transfer Pricing Practice and Legislation in Dominican Republic

Explore the transfer pricing practices and legislation in the Dominican Republic, focusing on the tourism industry, all-inclusive hotels, legal framework, sector audits, and sources of capital for multinational enterprises. The content delves into key facts, statistics, and strategies shaping the transfer pricing landscape in the country.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Practice and legislation on Transfer Pricing in Dominican Republic Wanda M. Montero Oslo, Norway

Outline 0 Some Tourism Industry Facts 0 Some All Inclusive Hotels Facts 0 Legal Framework 0 Sector Audits Strategy 0 Tax Base 0 Procedure 0 Results 0 Future of Transfer Pricing

Source of Capital MNEs 16.8% Panam 13.5% Estados Unidos 12.9% Islas V rgenes Brit nicas 12.8% Espa a 4.5% Paises Bajos 4.0% Reino Unido 3.3% M xico 2.2% Venezuela 1.9% Canad 1.9% Suiza 1.9% Colombia 1.8% Francia 1.7% Islas Cayman 1.5% Alemania 1.3% Bahamas 1.2% Italia 1.1% Costa Rica 1.1% Dinamarca 1.0% Bermudas

Sector Audits

Tourism Industry Facts 0 Dominican Republic is the 4th Tourism exporter in Latin America and the Caribbean (Surpassed by Brazil, Mexico and Argentina) 0 The Foreign Direct Investment is around 1/4 of the total FDI 0 As a percentage of the GDP, the tourism industry represent about 10% of the GDP

Tourism Industry Facts Tourism Value Added as a percentage of GDP 10.7 10.1 9.5 9.2 9.1 2007 2008 2009 2010 2011

All Inclusive Hotels Facts 0 93% of companies its capital comes from foreign investments 0 Tax incentives regime (Import IVA, Local taxes, IVA, etc) 0 At least 80% of the hotel room are sell to a related party located in a tax heaven. 0 The unit income (per room price) lower than the unit cost. 0 Per room rate lower than the one published in many booking webpage and Tour Operator catalog.

Legal Framework 1992 Arm s Length Principle 2012 0 Related Party definition 0 Comparability Analysis Criteria 0 Methods 0 Adjustment to comparable transaction 0 APA 0 Safe Harbours 0 Documentation 0 Others 2006 0 Faculty of the Tax Administration 0 APA s 0 Interest payed and cost distributed between related parties

Sector Audit Strategy Tax Base: based on the hotel rate at which the guest or final consumer overseas pay per night;

Sector Audit Strategy Procedure: 1. Find the Per night rate pay by tourist oversea, in a 7 nights packages, discounting the transportation. 2. The rates were segmented according to the category of the hotel, location and season 0 5 categories were identified in each zone. ASONAHORES submitted these categories. 0 2 Seasons were identified, high and low season. 0 3 different region, A, B, and C. A for the expensive one, C for the cheapest.

Sector Audit Strategy Procedure: 3. 10% of mandatory Tip and 16% of IVA was discounted. 4. The margin of 20 and 25%, as a markup was discounted. This margin is it supposed to be the profit margin the tourism intermediaries get for the commercialization service.

Sector Audit Strategy Results: Fiscal period audited 2005-2010 Audits by fiscal year 2005-2010 Tax Period 2005 2006 2007 2008 2009 2010 Quantity 1 1 16 3 32 20 Audited Periods 1 period 2 periods 3 periods 4 periods Taxpayers 5 14 12 1 Total 33 Total 73

Sector Audits Strategy Results: Judgments from the Supreme Administrative Court, sustains and confirms the action as legal and correct, in both form and substance, and therefore, confirming the amounts of the estimates contained in the resolutions of determination of tax.

Future of TP 0 Around 70% of the audited hotels agreed to rectify their Tax Returns for the period 2007-2010 and 2011 in few cases 0 Since last year, taxpayers began to submit their Transfer Pricing documentation for the 2011 fiscal period. 0 Further Modifications were introduced to the Tax Law this month, eliminating the Sector APA s, instead were included the unilateral and bilateral APA s and Safe Harbours.

undefined

undefined