Tax implications and strategic insights on Slump Sale

"Explore the world of Slump Sale transactions and their tax implications with our concise guide. Learn about computation methods, capital gains tax rates, GST considerations, and strategic tips for successful business transfers.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

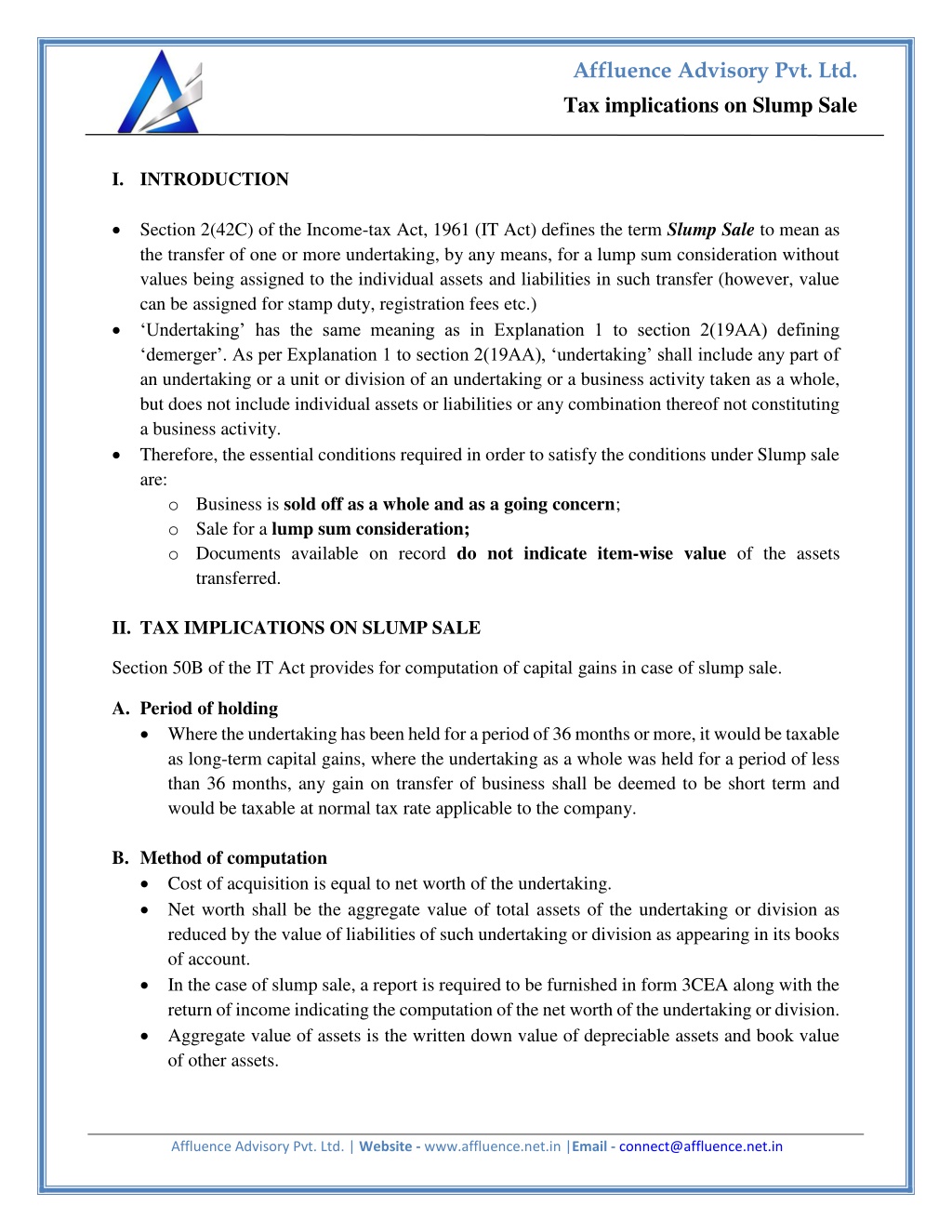

Affluence Advisory Pvt. Ltd. Tax implications on Slump Sale I.INTRODUCTION Section 2(42C) of the Income-tax Act, 1961 (IT Act) defines the term Slump Sale to mean as the transfer of one or more undertaking, by any means, for a lump sum consideration without values being assigned to the individual assets and liabilities in such transfer (however, value can be assigned for stamp duty, registration fees etc.) Undertaking has the same meaning as in Explanation 1 to section 2(19AA) defining demerger . As per Explanation 1 to section 2(19AA), undertaking shall include any part of an undertaking or a unit or division of an undertaking or a business activity taken as a whole, but does not include individual assets or liabilities or any combination thereof not constituting a business activity. Therefore, the essential conditions required in order to satisfy the conditions under Slump sale are: oBusiness is sold off as a whole and as a going concern; oSale for a lump sum consideration; oDocuments available on record do not indicate item-wise value of the assets transferred. II.TAX IMPLICATIONS ON SLUMP SALE Section 50B of the IT Act provides for computation of capital gains in case of slump sale. A.Period of holding Where the undertaking has been held for a period of 36 months or more, it would be taxable as long-term capital gains, where the undertaking as a whole was held for a period of less than 36 months, any gain on transfer of business shall be deemed to be short term and would be taxable at normal tax rate applicable to the company. B.Method of computation Cost of acquisition is equal to net worth of the undertaking. Net worth shall be the aggregate value of total assets of the undertaking or division as reduced by the value of liabilities of such undertaking or division as appearing in its books of account. In the case of slump sale, a report is required to be furnished in form 3CEA along with the return of income indicating the computation of the net worth of the undertaking or division. Aggregate value of assets is the written down value of depreciable assets and book value of other assets. Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

Affluence Advisory Pvt. Ltd. Tax implications on Slump Sale Actual consideration received or the fair market value of the capital assets as on the date of transfer, whichever is higher shall be deemed to be the full value of the consideration received or accruing as a result of the transfer of such capital asset. The method to determine fair market value has been provided in Rule 11UAE of the Income-tax Rules, 1962 (IT Rules). C.Rate of capital gains tax Short term: The short-term capital gains of a company are taxable at the normal tax rate applicable to the company. Long term: Long-term capital gains are taxed at 20%. D.Indexation benefit not available E.Carry forward of losses losses cannot be carried forward. F.Depreciation - Total depreciation of the year to be apportioned between transferor and transferee based on number of days usage. G.Goods and Service Taxes (GST) - Sale of a business under slump sale does not tantamount to "supply of goods", GST is not attracted in case of a slump sale. H.It would also be pertinent for the parties to ensure that the terms of succession of business are covered holistically in accordance with Section 170 of the Income-tax Act. III. OUR COMMENTS Slump sale, amongst other methods, is one common method followed by various business entities in case of structuring / restructuring, primarily due to its simplicity. Though all the assets and liabilities forming part of the business proposed to be sold needs to be transferred to the buyer in a slump sale, however, judicial precedents indicate that exclusion of certain assets and liabilities could be permitted. It is essential that the assets being transferred hold the capability to become an undertaking in itself, and can function without any interruption. Hence, while the layman understanding of slump sale is to transfer all the asset and liabilities, precedents have been laid down that certain assets and liabilities excluded from the transaction does not take the colour of slump sale away. Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

Affluence Advisory Pvt. Ltd. Tax implications on Slump Sale Disclaimer:This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement. Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)