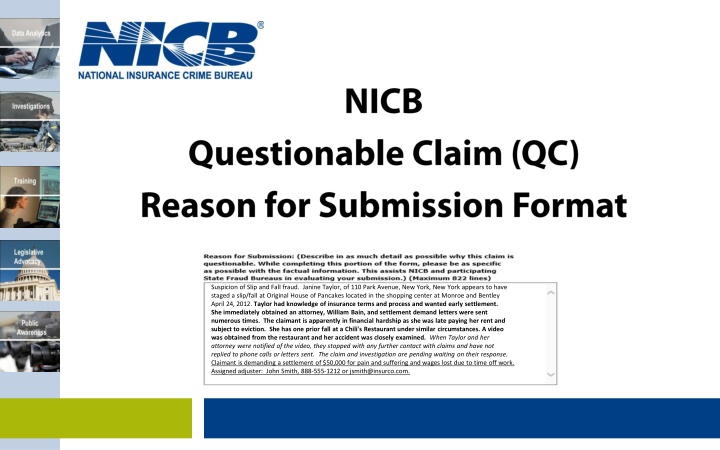

Suspicion of Slip and Fall Fraud: Janine Taylor Investigation

Janine Taylor is suspected of staging a slip and fall incident at a restaurant for insurance settlement. Despite demanding $50,000, she and her attorney stopped cooperation when presented with incriminating evidence. The investigation is ongoing to determine the validity of her claim.

Uploaded on Sep 15, 2024 | 4 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Suspicion of Slip and Fall fraud. Janine Taylor, of 110 Park Avenue, New York, New York appears to have staged a slip/fall at Original House of Pancakes located in the shopping center at Monroe and Bentley April 24, 2012. Taylor had knowledge of insurance terms and process and wanted early settlement. She immediately obtained an attorney, William Bain, and settlement demand letters were sent numerous times. The claimant is apparently in financial hardship as she was late paying her rent and subject to eviction. She has one prior fall at a Chili's Restaurant under similar circumstances. A video was obtained from the restaurant and her accident was closely examined.When Taylor and her attorney were notified of the video, they stopped with any further contact with claims and have not replied to phone calls or letters sent.The claim and investigation are pending waiting on their response. Claimant is demanding a settlement of $50,000 for pain and suffering and wages lost due to time off work. Assigned adjuster: John Smith, 888-555-1212 or jsmith@insurco.com.

The following font types are used to highlight the four focus areas

Suspicion of Slip and Fall fraud. Janine Taylor, of 110 Park Avenue, New York, New York appears to have staged a slip/fall at Original House of Pancakes located in the shopping center at Monroe and Bentley April 24, 2012. Taylor had knowledge of insurance terms and process and wanted early settlement. She immediately obtained an attorney, William Bain, and settlement demand letters were sent numerous times. The claimant is apparently in financial hardship as she was late paying her rent and subject to eviction. She has one prior fall at a Chili's Restaurant under similar circumstances. A video was obtained from the restaurant and her accident was closely examined.When Taylor and her attorney were notified of the video, they stopped with any further contact with claims and have not replied to phone calls or letters sent.The claim and investigation are pending waiting on their response. Claimant is demanding a settlement of $50,000 for pain and suffering and wages lost due to time off work. Assigned adjuster: John Smith, 888-555-1212 or jsmith@insurco.com. Synopsis Investigation Findings Status Exposure

Suspicion of medical billing fraud. Doctor Smith is suspected of upcoding modalities to procedures (e.g. 97034 Contrast Bath to 97113 Aquatic Therapy) and is using unlicensed personnel (John Jones) to provide therapies. Over the last 12 months the aquatic therapy has been billed for 90% of Dr. Smith s patients in his clinic in Des Plaines, IL at 1111 E. Main Street and his clinic in Palos Hills, IL. A patient, Jane Doe, called the claim adjuster refuting the number of treatments her explanation of benefits reflected and during the discussion stated the aquatic therapy consisted of being in a whirlpool run by a John Jones who is a current college student. The SIU investigation consisted of interviewing multiple patients whose medical bills to us reflected the aquatic therapy procedure. In every instance the interview revealed the therapy was conducted in a whirlpool which does not qualify as the aquatic therapy procedure. Clinic inspections revealed the facilities do not have the necessary equipment (e.g. a pool) to conduct aquatic therapy. An interview was conducted with John Jones who acknowledged he has no prior medical training and was provided on the job training by Dr. Smith. It is suspected that Dr. Smith is upcoding other therapies repeatedly.All inappropriate bills will be denied based on the investigation determining his clinics do not have the proper equipment and an unlicensed person was conducting the procedures. The SIU investigation has been referred to our major case unit and to the fraud bureau. The amount paid on previous suspicious billings is being determined. Current claims totaling $2014.00 have been denied. As there is additional suspected fraud existing in multiple bills for multiple patients the overall exposure has not been determined but will probably be in the tens of thousands of dollars. Assigned SIU: John Jones, 888-555-1313 or jjones@insurco.com. Synopsis Investigation Findings Status Exposure

Suspicion of fraudulent theft claim. Insured Kim Morris of Los Angeles, California, alleged her home was broken into (no forced entry) and her five carat engagement ring, worth $32,000, from her ex-husband was stolen. Insured is now going through a divorce with the husband and struggling for money. The insured could not provide any info on when she last wore the ring or how it was stolen from her safe. Under the provisions of the policy it was vaulted (in a safe in the insured s basement). It is unlikely that the thieves would have the knowledge of the location of the ring inside the house. The ex-husband agreed to be interviewed and questioned about the mysterious ring theft. He informed us that they both have been struggling for money with the divorce and that she has repeatedly threatened how she was going sell the ring for money and not share it with him even though he purchased the ring. He stated that she refused to give the ring back to him after they split.The ex-husband showed us a picture on his facebook page when his ex-wife was wearing the ring after the claimed date of loss.Claim was denied and investigation closed.Claim is being referred for prosecution. The ring was covered in her policy and listed as scheduled jewelry. However, Ms. Morris was not paid out on her claim due to inconsistencies with the time of events and stories. Assigned SIU: John Jones, 888-555-1313 or jjones@insurco.com Synopsis Investigation Findings Status Exposure

Synopsis Fraudulent owner give-up claim. After the theft report, a forensic examination of the ignition was conducted by Jones Locksmith and it was determined that the vehicle had last been driven by use of a key. SIU investigation revealed insured was behind on his payments and that he had recently taken the vehicle to Smith Auto Repair for engine trouble. When confronted with this information the insured confessed to the owner give-up. This investigation has been closed. Chicago PD arrested the insured on June 30, 2012 for committing the fraud. He was found guilty, sentenced to 150 hours of community service, 2 years probation and ordered to pay back the $19,000 on the claim that was paid. Assigned SIU: John Jones, 888-555-1313 or jjones@insurco.com Investigation Findings Status Exposure

Synopsis Fraudulent Workers Comp claim. The allegedly injured worker submitted fraudulent and altered photocopies of bills in support of her claim. Law Enforcement was notified and this investigation is closed and/or ongoing. Database has been flagged in system under her name, SS#, address, birth date and phone number. Donna was arrested and charged with the criminal act of fraudulently receiving over $13,000 in unemployment benefits and fraudulently receiving nearly $19,000 in Workers compensation benefits. In addition, she was charged with submitting a fraudulent workers compensation claim. Assigned SIU: John Jones, 888-555-1313 or jjones@insurco.com. Investigation Findings Status Exposure

In compliance with statute. Suspected Owner Give Up. Ben Price, of Charleston, South Carolina, filed an insurance claim on 03/23/2004, stating that his super duty custom 2002 Ford F-150 was stolen from his residence located at 444 Gator Alley in Charleston, South Carolina. Price filed a police report with Charleston PD. In the police report, Price stated he was not home at the time of the incident and that he was with a friend in their car miles away from the location of the theft. When asked what he and his friend were doing or where they were going, the story was not consistent when asked several times. When the Charleston PD asked about keys for the vehicle, Price replied he always left them over the visor in the truck. Price seemed overly pushy when dealing with the insurance company and was nearly demanding compensation for his stolen truck so he could quickly buy a new one. Police quickly discovered it only miles from his house, completely burned. Investigators spoke with the friend who verified the insured s story. The SIU Investigator did discover the owner was behind on his payments, had refinanced the truck twice and had lied about the debt when asked.In spite of the inconsistencies and false information this claim was paid. Mr. Price had a full coverage insurance policy on his vehicle which would cover him fully should anything happen to the vehicle including theft. Fraud is suspected but could not be proven. $42,000.00 was paid on the claim. Assigned SIU: John Jones, 888-555-1313 or jjones@insurco.com. Synopsis Investigation Findings Status Exposure