Summary Judgment in Louisiana Courts

Summary judgment is a procedure in Louisiana courts used to resolve legal matters efficiently when there is no genuine issue of material fact. The burden of proof lies with the moving party, who must show the absence of factual support for essential elements of the opposing party's claim. Required documents include a supporting memorandum, a list of legal elements, a statement of material facts, supporting documents, affidavits, and a proposed order. Both parties must present their arguments clearly and reference relevant documents. Collaboration on undisputed facts is encouraged to streamline the process.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

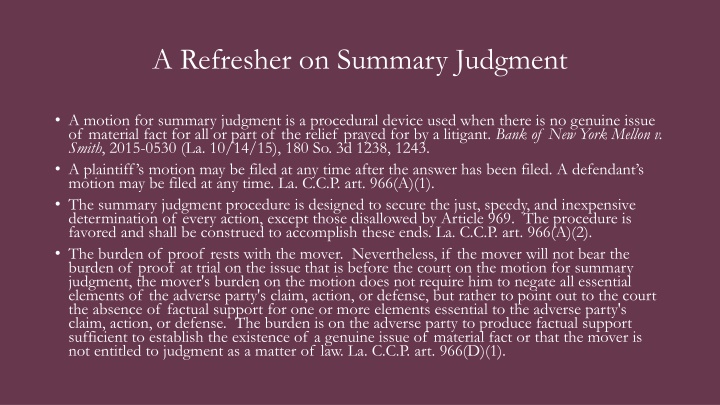

A Refresher on Summary Judgment A motion for summary judgment is a procedural device used when there is no genuine issue of material fact for all or part of the relief prayed for by a litigant. Bank of New York Mellon v. Smith, 2015-0530 (La. 10/14/15), 180 So. 3d 1238, 1243. A plaintiff s motion may be filed at any time after the answer has been filed. A defendant s motion may be filed at any time. La. C.C.P. art. 966(A)(1). The summary judgment procedure is designed to secure the just, speedy, and inexpensive determination of every action, except those disallowed by Article 969. The procedure is favored and shall be construed to accomplish these ends. La. C.C.P. art. 966(A)(2). The burden of proof rests with the mover. Nevertheless, if the mover will not bear the burden of proof at trial on the issue that is before the court on the motion for summary judgment, the mover's burden on the motion does not require him to negate all essential elements of the adverse party's claim, action, or defense, but rather to point out to the court the absence of factual support for one or more elements essential to the adverse party's claim, action, or defense. The burden is on the adverse party to produce factual support sufficient to establish the existence of a genuine issue of material fact or that the mover is not entitled to judgment as a matter of law. La. C.C.P. art. 966(D)(1).

Documents Required for a Motion for Summary Judgment Motion Supporting Memorandum List of Essential Legal Elements Statement of Material Facts Supporting Documents Affidavits Proposed Order

The Motion and Supporting Memorandum Louisiana District Court Rule 9.10: When a party files an exception or motion, that party shall concurrently furnish the trial judge and serve on all other parties a supporting memorandum that cites both the relevant facts and applicable law. Louisiana District Court Rule 9.8(a): To assist the court in scheduling the hearing, the exception or motion, and any opposition thereto, shall state: (1) whether or not the case is set for trial and, if so, the trial date; and (2) whether testimony will be offered at the hearing.

List of Essential Legal Elements and Statement of Material Facts Louisiana District Court Rule 9.10: (a) A memorandum in support of a motion for summary judgment shall contain: (1) A list of the essential legal elements necessary for the mover to be entitled to judgment; (2) A list of the material facts that the mover contends are not genuinely disputed; and (3) A reference to the document proving each such fact, with the pertinent part containing proof of the fact designated. (b) A memorandum in opposition to a motion for summary judgment shall contain: (1) A list of the material facts that the opponent contends are genuinely disputed; and (2) A reference to the document proving that each such fact is genuinely disputed, with the pertinent part designated. The Parties are encouraged to enter into a joint stipulation of undisputed facts.

Supporting Documents After an opportunity for adequate discovery, a motion for summary judgment shall be granted if the motion, memorandum, and supporting documents show that there is no genuine issue as to material fact and that the mover is entitled to judgment as a matter of law. La. C.C.P. art. 966(A)(3). The only documents that may be filed in support of or in opposition to the motion are pleadings, memoranda, affidavits, depositions, answers to interrogatories, certified medical records, written stipulations, and admissions. The court may permit documents to be filed in any electronically stored format authorized by court rules or approved by the clerk of the court. La. C.C.P. art. 966(A)(4).

Supporting Documents: Affidavits Supporting and opposing affidavits shall be made on personal knowledge, shall set forth such facts as would be admissible in evidence, and shall show affirmatively that the affiant is competent to testify to the matters stated therein. The supporting and opposing affidavits of experts may set forth such experts opinions on the facts as would be admissible in evidence under Louisiana Code of Evidence Article 702, and shall show affirmatively that the affiant is competent to testify to the matters stated therein. Sworn or certified copies of all papers or parts thereof referred to in an affidavit shall be attached thereto or served therewith. The court may permit affidavits to be supplemented or opposed by depositions, answers to interrogatories, or by further affidavits. La. C.C.P. art. 967(A).

Affidavits, continued It is insufficient for an affiant to merely declare that he has personal knowledge of a fact. The affidavit must affirmatively establish that the affiant is competent to testify as to the matter by a factual averment showing how he came by the knowledge. Chanler v. Jamestown Ins. Co., 51,320 (La.App. 2 Cir. 5/17/17), 223 So. 3d 614, 623, reh'g denied (June 15, 2017) [internal citations omitted]. Personal knowledge means something which a witness actually saw or heard, as distinguished from something a witness learned from some other person or source . [P]ersonal knowledge is information which is obtained by the affiant through the use of his or her senses. Id.

Proposed Order Louisiana District Court Rule 9.8(a): Contradictory Exceptions and Motions. All exceptions and motions, including those incorporated into an answer, shall be accompanied by a proposed order requesting that the exception or motion be set for hearing. If the exceptor or mover fails to comply with this requirement, the court may strike the exception or motion, may set the matter for hearing on its own motion, or take other action as the court deems appropriate.

Constitutional Limits on Sales Tax Due Process Clause, 14thAmendment [N]or shall any State deprive any person of life, liberty, or property without due process of law Commerce Clause, U.S. Const., Art. I, Section 8, Clause 3: The Congress shall have the power to regulate commerce among the several States

Appellate Case Update Appellate Case Update Jazz Casino v. Bridges, Docket No. 2016-C-1663 (La. 5/3/17) Jazz Casino Company, LLC VS Department of Revenue, State of Louisiana, Docket No. 2016-CA-0180 (La. App. 1stCir. 2/7/17) Red River Parish Tax Agency v. SWEPI, LP, Docket No. 51, 244 CA (La. App. 2ndCir. 4/5/17) Security Plan Fire Insurance Company VS James L. Donelon, Commissioner of Insurance, Department of Insurance, State of Louisiana, BTA Docket No. 2016-CA-0814 (La. App. 1stCir. 5/10/17) Pending: Duncan Oil; Camex; Crotwell; Bannister/Southold

BTA Case Update: 301(10)(g) Cajun Industries, LLC and Cajun Construction, Inc v. Secretary Department of Revenue, BTA Docket No 9247 (La. Bd. Tax App. 4-12-17)(sales tax refund under 301(10)(g)) Cajun Industries, LLC and Cajun Construction Inc v Secretary Department of Revenue, BTA Docket No. 9898D (La. Bd. Tax App. 4-12-17)(prescription) Odebrecht Johnson Brothers JV v. Newell D. Normand, Sheriff of Jefferson Parish, Docket No. L00142 (La. Bd. Tax App. 4-11-17) Odebrecht Construction Inc v. Newell D. Normand, Sheriff of Jefferson Parish, Docket No. L00141 (La. Bd. Tax App. 4-11-17) Willow Bend Ventures LLC v. St. John the Baptist Parish Sales and Use Tax Office, BTA Docket No. L00003 (La. Bd. Tax App 4-11-17) Odebrecht Johnson Brothers JV v. Barfield, BTA Docket No. 9059 (La. Bd. Tax App. 4-11- 17) Odebrecht Construction Inc v. Barfield, BTA Docket No 9058 (La. Bd. Tax App. 4-11-17)

BTA Case Update Newman Holdings LLC v. Secretary Department of Revenue, BTA Docket No. 7578 (La. Bd. Tax App. 10-11-16) (sales tax motor home) Metals USA Plates & Shapes Southeast Inc v. Louisiana Dept. of Revenue, BTA Docket No. 9342D (La. Bd. Tax App. 5-10-17) (exclusion under 301(10)(x)) Dragna v. Secretary, Department of Revenue, BTA Docket No. 9551D (La. Bd. Tax App. 7- 12-17)(Prescription) Judith and Stephen Smith v. Secretary, Dept.of Revenue, BTA Docket No. 9437C (La. Bd. Tax App. 7-11-17)(PIT Exemption for out of state retirement income) Bannister Properties, Inc. v. State of Louisiana, BTA Docket No. 7585 (La. Bd. Tax App. 9- 12-17)(scope of La. R.S. 47:1621(F) exception on refund restriction) Majestic Medical Solutions, LLC v. Secretary, Louisiana Dept. of Revenue BTA Docket No. 9449C (La. Bd. Tax App. 10-10-2017) (refund after final assessment)

BTA Pending Cases Valero Woods AMC Bluestreak Northeast Louisiana Cancer Institute Willis Knighton VCS/Zelia Avanti

Quill Corp. v. North Dakota, 504 U.S. 298 (1992) Established the nexus standard for sales tax A seller must have substantial nexus with a state Physical presence required

States Reconciliation of Quill Broad Interpretations of Quill s Physical Presence Click-Through Affiliate Nexus Marketplace Provider Legislation Fulfillment by Amazon Economic Nexus Notice and Reporting Laws Federal Legislation

Federal Legislation Early Attempts Remote Transactions Parity Act of 2015 Marketplace Fairness Act of 2015 Online Sales Simplification Act of 2016 Allows for states to impose origin-based sourcing on remote sales if the state: (1) is the origin state for the remote sale, and (2) agrees to be a part of a Distribution Agreement that collects sales tax on remote sales calculated by the origin state s tax rate and base

State Updates Alabama Promulgated Regulation 810-6-2-.90.03 Requires reporting and remitting requirements on out-of-state sellers regardless of physical presence when at least $250,000 in retail sales of tangible personal property are made in the prior calendar year

State Updates Maine L. 2017, S483 (c. 245), effective 10/1/2017 Requires remote sellers to collect and remit sales and use tax when $100,000 in revenue or 200 separate transactions into the state. North Dakota S.B. 2298, Laws 2017 Law pending a Quill overturn which requires remote sellers to remit tax on items delivered into the state if $100,000 in revenue or 200 separate transactions into the state

State Updates Tennessee Tenn. Comp. Regs. 1320-05-010.129 requiring the collection and remittance of sales tax regardless of physical presence when sales into the state exceed $500,000. Currently unenforced pendings its challenge in Am. Caatalog Mailers Ass n v. Gerlach, Tenn. Ch. Ct. dkt. 7-0307-IV. Vermont H.B. 873 Delayed until Quill is overturned Must collect and remit regardless of physical presence if more than 200 sales per year are made into the sate or is total sales exceed $200,000 during prior year.

State Updates Washington H.B. 2163 Remit or Report law applicable when gross receipts into the state exceed $10,000. Referrers who receive at least $267,000 of gross income from referral sources within the state are also subject to the reporting requirement. Wyoming H.B. 19 Requires collection and remittance when 200 separate transactions are made into the state or sales exceed $100,000 Currently being challenged in American Catalog Mailers Ass n v. Krupp, No. 49D01-1706-PF- 025964

State Updates Rhode Island R.I. Laws 2017, HB 5157, effective 8/17/17 Includes various nexus standards such as click-through nexus, economic nexus, and SaaS Additionally includes notification requirements for remote sellers. Indiana H.B. 1129 $100,000 in revenue or 200 separate transactions into the state Challenged under American Catalog Mailers Ass n v. Noble, No. 188-137. Mississippi (this week)

Amazon (Non Direct) MTC Voluntary Disclosure Initiative Program for online sellers in programs such as Fulfilment by Amazon Currently includes 24 states Massachusetts Regulation 830 CMR 64H.1.7 Imposes sales tax on sellers that have an excess of $500,000 of sales and 100 or more transactions into the state within the calendar year. Targets, in part, contracts or other relationships with online marketplace facilitators or delivery companies South Carolina $12.5 million dollar assessment against Amazon for sales made into the state by third party sellers. Amazon Services LLC v. South Carolina Department of Revenue, No. 17-ALJ-17-0238- CC

Supreme Court Rejects Quill Challenges Brohl v. Direct Marketing Association, US Supreme Court Dkt. 15-267 and 16-458, conditional cross-petition. (cert. denied Dec. 12, 2016) AmericanBusiness USA Corp. v. Florida Dept. of Revenue, U.S. Sup. Ct., Dkt. 16-567 (cert. denied Feb. 21, 2017) Steager v. CSX Transportation, Inc., US Sup. Ct. Dkt. 16-1251 (cert. denied Oct 2, 2017)

Wayfair: The Next Quill? South Dakota S.B. 106 Requires remote sellers to collect and remit regardless of physical presence when over $100,000 in revenue or 200 separate transactions are made into the state within a calendar year. State v. Wayfair Inc., 2017 S.D. 56, 901 N.W.2d 754 (Sept. 13, 2017) Holding: Sellers cannot be required to collect and remit when they do not have physical presence within a state. Petition for Cert. Filed October 2, 2017 South Dakota v. Wayfair, Inc., Et Al., 17-494

Justice Kennedy on Quill (in DMA) [a] case questionable even when decided, Quill now harms States to a degree far greater than could have been anticipated earlier. 135 S. Ct. at 1135 (Kennedy, J., concurring). In light of these undeniable changes, it is unwise to delay any longer a reconsideration of the Court s holding in Quill.

Justice Gorsuch on Quill (in DMA: 10thCir) precedential island[] surrounded by a sea of contrary law. If anything, by asking us to strike down Colorado s law, out-of-state mail order and internet retailers don t seek comparable treatment to their in-state brick-and-mortar rivals, they seek more favorable treatment, a competitive advantage, a sort of judicially sponsored arbitrage opportunity or tax shelter, attached an expiration date

SCOTUS: Cert Application Activity Date Proceedings and Orders Oct 02 2017 Petition for a writ of certiorari filed. (Response due November 2, 2017) Oct 16 2017 Blanket Consent filed by Petitioner, South Dakota Oct 19 2017 Blanket Consent filed by Respondents, Wayfair, Inc., et al., et al. Oct 23 2017 Brief amicus curiae IS of National Association of Wholesaler-Distributors Oct 24 2017 Order extending time to file response to petition to and including December 7, 2017. Nov 01 2017 Brief amicus curiae IS of Retail Litigation Center, Inc. filed. Nov 02 2017 Brief amicus curiae IS of Tax Foundation filed. Nov 02 2017 Brief amicus curiae IS of Streamlined Sales Tax Governing Board, Inc. filed. Nov 02 2017 Brief amicus curiae IS of American Booksellers Association filed.

Tax Foundation Brief supporting South Dakota The South Dakota law should be upheld as constitutional because: (1) the state taxes nearly all other goods and services under its sales tax except internet-based transactions, demonstrating no discriminatory intent or purpose; (2) the state has minimized the costs of sales tax collection to the extent practicable, by adhering to interstate standards of sales tax administration, maximizing statewide sales tax uniformity, and adopting a de minimis threshold likely to exclude interstate activity where state burdens exceed state benefits; (3) the state law bars retroactive collection; and (4) the state law limits the scope of its tax liability to taxpayers present in the state (residents who purchase goods and services online), keeping with the spirit of physical presence as the basis of taxation.

What Replaces Quill: Back to Complete Auto Substantial nexus - connection between a state and a potential taxpayer clear enough to impose a tax. Nondiscrimination - interstate and intrastate taxes should not favor one over the other. Fair apportionment - taxation of only the apportionment of activity that transpires within the taxing jurisdiction. Fair relationship to services provided by the state - company enjoys services such as police protection while in a state.