Spring 2022 Commodity Update: Energy, Labour, and Market Insights

The Spring 2022 Commodity Update provides an overview of the current market conditions including energy and fuel price challenges, labor shortages in the UK food sector, and the impact on supply chains. Rising energy costs, particularly gas, and labor scarcity due to Brexit and Covid-19 are significant factors affecting various commodities. Stay informed on the latest developments in the global commodity market landscape.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Commodity Update Spring 2022 Please note all information is correct at the time of writing (February 2022)

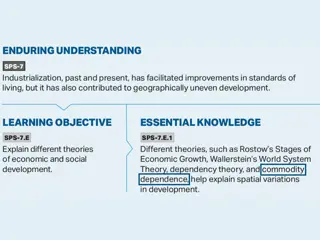

Contents Contents See colours for market changes, green (prices down/improved), red (prices up) and yellow (stable or mixed) since the last report: - -Energy / Fuel Energy / Fuel - -Potatoes Potatoes - -Coffee Coffee - -Labour Labour - -Pulses Pulses - -Tea Tea - -Shipping Shipping - -Canned Goods Canned Goods - -Cocoa Cocoa - -Exchange Rates Exchange Rates - -Wheat Wheat - -Non Non- -Food Food - -Milk Prices Milk Prices - -Durum Wheat Durum Wheat - -Inflation Report Inflation Report - -Butter/Cream/Milk Powder Butter/Cream/Milk Powder - -Cornflour Cornflour - -Inflation Levels Inflation Levels - -Cheddar/Mozzarella Cheddar/Mozzarella - -Rice Rice - -Commodity Outlook Commodity Outlook (Grocer) (Grocer) - -Chicken Chicken - -Herbs and Spices Herbs and Spices - -Justification Letters Justification Letters - -Pork Pork - -Dried Fruit and Nuts Dried Fruit and Nuts - -Russia/Ukraine Russia/Ukraine - -Salmon/Tuna Salmon/Tuna - -Juices Juices - -Outlook Outlook - -Cod/Haddock Cod/Haddock - -Oils Oils Please note all information is correct at the time of writing (February 2022)

Energy / Fuel Update Energy / Fuel Update Well documented rising energy prices (particularly gas) are contributing to increased costs in the supply chain, from harvesting, to processing/manufacturing and supply to end users. Many of these costs have not been factored into costings as they simply weren t expected. Business are also not protected by the energy price cap. Fuel prices are also through the roof, with diesel at record UK levels and petrol not far behind. Global oil prices are now $105 per barrel as a result of the geo-political situation involving Russia and Ukraine, the impact of which will be felt across Western Europe with higher prices. The production of oil hasn t been able to keep up with the demand post Covid-19 lockdowns and Russia/Ukraine escalations have added further pressure into Global Markets in what is a very fluid situation. Please note all information is correct at the time of writing (February 2022)

Labour Labour Market Market In general, the UK food sector is still struggling with access to labour following Brexit and Covid-19. Roles in agriculture and food production facilities have long since relied on access to European workers. This labour pool has been reduced dramatically with many workers opting not to return post Covid-19. This was proven, as only around 100 skilled butchers took up the temporary visa option in the pork sector, out of the 800 visas available. As well as affecting production capabilities and service, it means the salaries for workers who do take up these roles, is increasing pretty significantly, adding to overall production costs. Please note all information is correct at the time of writing (February 2022)

Shipping Shipping Liner Industry Appears Set for Another Record Quarter Shipping prices do not appear to be falling and the shipping companies are making record profits, with no sign to it ending anytime soon. Japanese carrier ONE released its Q3 earnings for the period to 31 December 2021 and has upgraded its financial year profit forecast by $3.6bn, ONE said at the end of October it expected its full-year earnings to come in at $11.8bn, but three months later it has been obliged to upgrade that to $15.4bn. It s clear that shipping companies are enjoying the situation at the moment and with no regulator in what is essentially a free market, they are trying to keep it that way. Hapag-Lloyd, released its preliminary 2021 full-year results, coming in at the top end of its October upgraded forecast for an ebitda of $11.1bn. Hapag-Lloyd CEO Rolf Habben Jansen said: Our extraordinarily strong results are due to significantly improved freight rates, while total transported volume was roughly at the same level as the previous year. Please note all information is correct at the time of writing (February 2022)

Exchange Rates Exchange Rates Pound Sterling Trading at Multiyear Highs The British Pound has been riding high on the back of the Bank of England interest rate hike on February 3rd and a further expected rise being announced in the next month, taking it to multi-year highs. The current Euro exchange rate is around 1.193 (25/02) however it is as yet unknown what impact the escalation of conflict in Ukraine will mean to financial markets longer term. Dollar exchange rate stifled Inflation is still expected to exceed 7.0% in the first half of the year following a sharp rise in utility bills in April. The Pound to Dollar exchange rate stands at $1.34 (as of 25/02). The IMF said in its January 2022 World Economic Outlook that UK average GDP growth for 2021-22 was 5.95%, stronger than all other major advanced economies covered by the IMF. With the UK top of global growth, the approximate mid year forecast for the Pound to Dollar exchange rate is at $1.3580 and $1.3890, however this may be adjusted dependent on how the Pound reacts to the Ukraine conflict. Initially it has taken a drop, as can be seen on the graph. Please note all information is correct at the time of writing (February 2022)

Milk Milk Prices Prices Milk prices in the UK continue to rise sharply with the vast majority of processors increasing their prices paid to their farmers by between 1ppl and 1.5ppl for next month. These increases are on top of the previous round of price increases a month or so ago (approx. 2-3ppl). This is a far cry from early Covid-19 times, where the memorable reports of milk being poured down the drain were reported. Spot milk is down ever so slightly, but at 45-47ppl, nobody is getting excited about the prospects of lower prices just yet. Overall UK milk volumes are down 1.8% versus last year (with EU volumes down by a similar amount) and 1% down versus the longer term average, in recent weeks. Prospects are confusing to say the least, a combination of Corrie, Dudley, Eunice and Franklin in short succession have wreaked havoc on fields across the UK, with the true extent of the damage probably yet to be determined. Milk prices will almost certainly be affected by rising energy costs and rising fuel costs in the coming weeks. Please note all information is correct at the time of writing (February 2022)

Butter, Cream and Milk Powder Butter, Cream and Milk Powder Butter Prices are high and remain high. Prices have hit the 6000 per tonne mark in Europe and further increases have been seen in the UK. How much further there is to go is a bit of a guessing game, not least with milk prices still seemingly moving in one direction. Cream Whilst prices are slightly higher in Europe, UK cream prices currently sit around 2.33/kg, up marginally in recent weeks, but certainly at the higher end of historical cream prices. Skimmed Milk Powder Bulk prices are currently around 3100 per tonne with European prices reflected in a similar way at around 3700. France, Germany and Holland have all increased over the past 2-3 weeks. The table (bottom right) shows the most recent GDT (Global Dairy Trade) auction prices, versus the previous auction, note the stark contrast versus the prices last year. Please note all information is correct at the time of writing (February 2022)

Cheddar / Mozzarella Cheddar / Mozzarella Both cheddar and mozzarella have risen significantly since Q4 last year. There isn t a lot of stock around and of course where there is, it is being sold at a premium. In what was almost a running joke, prices had been stable for a very long time (note graphs below for the last 3 years), but things have very much changed and prices on both cheddar and mozzarella are at record highs now. Low milk volumes and ongoing strong demand are the main contributors to these unprecedented prices. Please note all information is correct at the time of writing (February 2022)

Chicken Chicken Global chicken supply remains a real balancing act, at the moment. With the vast majority of frozen chicken imported from Thailand, Brazil and China, the supply chains from these countries is proving difficult. More and more manufacturers are looking to European supply to meet their needs. On the supply side, factors such as short term unforeseen shutdowns (i.e. Thailand), Avian Flu (cases in over 40 countries in the last 6 months) and logistics costs (2 or 3 price increases from shippers, in the past 3 months) are all adding to the rising costs. The fresh chicken market has also seen price increases in recent weeks. The Avian Flu situation in Poland is a severe one, meaning that factories in other countries who would normally import cheaper Polish raw material, are not able to do so. This is keeping the whole market firm and this is expected to last at least a couple of weeks more yet. The fear is that overall out of home demand remains quite weak, improved demand in line with tight supply could see further pressure. Please note all information is correct at the time of writing (February 2022)

Pork Pork Pork prices are pretty supressed at the moment. Recent import bans in China have meant backlogs in many countries but especially in the UK where the backlog of pigs now stretches to 200,000 pigs. Naturally, the pork market is a global one and therefore whilst prices have seen a slight upturn over the past week or so, in general prices are lower than they have been for the majority of 2021. Please note all information is correct at the time of writing (February 2022)

Fish Fish Salmon and Tuna Salmon and Tuna Farmed salmon prices are on the rise. Both Scottish prices and Norwegian prices (two key players) are on the increase. The Norwegian export price has hit the highest level since 2017, on the back of global shortages. Chilean (Pacific salmon) is also rising, to compound matters. Whilst tuna prices have eased very slightly in January, mostly currency related, year on year prices show an increase of 20-30% dependent on origin. Higher costs of tinplate and freight costs from the factories are the main contributors to the rising prices. Please note all information is correct at the time of writing (February 2022)

Fish Fish Cod and Haddock Cod and Haddock The price of whitefish in general at the moment is very expensive. A big factor that has led to rising prices is that the port and major processing region of Dalian in China is closed. Dalian processes much of the battered and breaded fish seen in the wholesale sector and has been closed since November 2021. It was expected to re-open following Chinese New Year, as yet this has not happened. To re-open, the processing plants will now also need to undergo further audits (for Covid adherence) and this is keeping the supply situation very precarious at present. Deliveries into the UK are also under pressure due to regular vessel delays or shipments being held up in other ports prior to arriving into the UK. Please note all information is correct at the time of writing (February 2022)

Potatoes Potatoes Potato prices are rising and it is almost certain that potato prices for the new season (July/August onwards) will be significantly more expensive than this current season. Farmers are asking for much higher prices in order to plant potatoes and the demand remains strong in global markets. This means that processors have little choice but to pay farmers more (perhaps up to 20% more is expected), in order to secure potatoes and satisfy the growing demand. Already this year, factories have significantly underestimated the cost of energy, which is the second biggest cost to a chip manufacturer, after the potatoes themselves. This isn t a surprise however as hardly anybody expected energy prices to reach the levels they are now at. Packaging and higher oil costs are also contributing to overall finished costs, which are being passed along the supply chain. Please note all information is correct at the time of writing (February 2022)

Pulses Pulses Both canned and dried pulses are seeing huge increases a the moment, of anything between 25%-50% dependent on the product. Whilst the raw materials are contributing especially on things like chickpeas and red kidney beans, much of the increases are coming from other factors such as freight costs or the increased cost of the cans themselves, in the case of canned pulses. As the cost of goods on these items are relatively low value, any increase in the cost of energy, packaging and freight/transport has a magnifying effect, leading to big percentage price changes. Energy has a big cost to play in the retort process (where cans are heat treated to sterilise the product). Please note all information is correct at the time of writing (February 2022)

Canned Goods Canned Goods All canned goods are being impacted by rising tinplate costs still, with the biggest jump yet coming in December 2021. On top of that, as stated previously, the energy costs associated with producing canned products are significant (retort process, etc). Baked beans have been affected further not only due to the cost of tinplate and energy but also the rising costs of ingredients such as haricot/navy beans and tomato paste, which is currently in very short supply. Other canned goods affected are mushy peas, canned vegetables and fruits, as the tinplate and energy issues are very much global ones. Please note all information is correct at the time of writing (February 2022)

Wheat Wheat Wheat prices are up year on year still but have seen a decline on the back of positive Canadian crop news. However, the current Russia/Ukraine conflict was impacting prices and will now do so further it is feared. Russia and Ukraine are major grain producing and exporting countries, together accounting for almost 30% of global wheat exports, so the potential for problems is causing concerns for the global wheat markets. Economic sanctions on Russia may see retaliation in the form of not only oil and gas, but food exports too. Please note all information is correct at the time of writing (February 2022)

Durum Wheat Durum Wheat Durum Wheat pricing is 78% up year on year, with no sign of a significant drop. The increase was caused primarily by Canadian output in 2021 being 59% lower than the 2020 crop, due to drought conditions. Canadian Durum Wheat is by far the biggest globally. The Italian crop, which is roughly 55% of the total EU crop, was 14% down during 2021. Usage has been at record highs for the last 2 years causing pricing to rise to record highs and reserve stocks to be wiped out. With delayed planting in Italy caused by adverse weather conditions throughout October December last year, this has meant fears of an even lower yield in 2022 than 2021. Added to this, the pressure of energy, fuel and packaging would suggest that we are unlikely to see decreases on pasta, for the rest of the year at least. Please note all information is correct at the time of writing (February 2022)

Cornflour Cornflour Cornflour Prices Remain High 2021 saw record highs of 265 per tonne for maize (now around 250), due to the raw material shortages caused by droughts in key growing regions, added to increased demand. To put these prices into perspective, the average price back in 2020 was around 160 per tonne. Whilst the market is seeing an upsurge in demand for gluten free products in health conscious consumers, it has raised the demand for cornflour based bakery items and as such demand is high and expected to keep increasing. The expectation is the market will remain tight throughout 2022 at least. Please note all information is correct at the time of writing (February 2022)

Rice Rice Indian exports are projected to fall in 2021/22 but are still expected to be the second-largest on record, thus creating higher export demand and supporting Indian rice prices. However, the record domestic production for 2021/22 is likely to limit the rate of the price increases. Thai rice prices fell to pre-pandemic levels in the last six months (Aug 21 Jan 22) by 18%, driven by a weaker Thai Baht and low export demand. Foreign demand was tepid, due to high freight costs and competitive prices from India on white rice. The Grocer article to the right explains that logistics costs are the main cause of the higher prices at the moment. Please note all information is correct at the time of writing (February 2022)

Herbs and Spices Herbs and Spices Black & White Pepper +45/67% Unprecedented growth in global demand for pepper in 2021 coupled with a 10% decline in the crop forecast of Vietnamese and Indonesian product, has impacted the cost significantly. Black Pepper = +45%. White Pepper = +67% Ginger +50% Ginger has been in focus because pesticide detections had taken place in the market, causing ginger prices to spike in June 2020, wiping out reserve stocks and causing prices to increase again in October 2021. Since then pricing has started to move back down to early June prices and is expected on to fall further in the coming months. Star Anise +108% Star Anise has risen dramatically in the last 18 months, due to low harvests in China, who in turn then bought raw material from Vietnam. This caused a 108% increase over the last 18 months and the increases show no signs currently of coming back down this year. Please note all information is correct at the time of writing (February 2022)

Dried Fruit and Nuts Dried Fruit and Nuts Apricots Dried apricots rose by 40% on average in the last six months (Aug 21 - Jan 22), compared to the previous six-month average, to $5,751/tonne. The market has been primarily driven by supply tightness in Turkey, the largest dried apricot producer, following low carry- over inventory from the previous campaign. Walnut The market for Californian walnuts has been relatively quiet recently, with shipments out of California impacted by logistical bottlenecks, causing delayed arrivals to destination ports. Walnut|jumbo|origin: California; United States| The overall demand for US walnuts has been further hindered by solid availability and competitive prices of Chinese walnuts, according to trade sources. Please note all information is correct at the time of writing (February 2022)

Juices Juices Juice prices have been affected by various factors. The key raw material changes are on Orange Juice, Cranberry Juice and Pineapple Juice. Orange juice is in shorter supply globally, in particular because of the situation in the US, where the crop is down by around 16% year on year. Florida, which is the biggest production area has seen the lowest harvest since 1945, which in turn puts pressure on other origins, namely Brazil, who are the largest player on the World market. Other factors weighing on the higher prices are rising cost of cardboard (e.g. Tetrapak) and transport on what are relatively low value products. Please note all information is correct at the time of writing (February 2022)

Oils Oils Please note all information is correct at the time of writing (February 2022)

Oils Oils The Edible Oils markets are arguably the most bullish of all, at the moment. Prices across major oils have continually risen since last year as can be seen from the graphs on the previous page. Rapeseed, Soya and Palm are pretty interlinked and often a spike in one of those can generate the same effect in another. This will impact a good number of manufactured products moving forward. Fats and spreads along with mayonnaise are just some of the products feeling the impact of these high oil prices. Prices have risen a lot in recent days due to political tensions affecting crude oil. Rapeseed Mintec Benchmark Prices (MBP) for EU rapeseed oil reached a record high of 1,680/tonne on 10th January (up 87% y-o-y). Prices for both EU rapeseed oil are thus likely to remain firm in the first half of 2022. Soya Oil Prices for Soya oil are currently around 1500, so not far behind rapeseed with demand reported very strong. Palm Oil palm oil reached new record-highs in January 2022 amid a reduction in output and new palm oil export regulations in Indonesia. Please note all information is correct at the time of writing (February 2022)

Coffee Coffee Coffee prices soften on positive supply expectations but prices still at Decade highs Arabica prices continue to trend around decade-high levels, amid bullish speculation regarding expectations of tighter supply from Brazil during the upcoming 2022/23 season. However, prospects of beneficial rains in Brazil, provides some downside price potential. This depends on the extent to which it boosts the harvest, if at all. Please note all information is correct at the time of writing (February 2022)

Coffee Coffee Please note all information is correct at the time of writing (February 2022)

Tea Tea The cost of Tea spiked during the 2020 pandemic and a few times during country specific lockdowns, but the at origin cost is now coming back to the levels seen in April 2020. However, manufacturers in the UK and elsewhere are passing on increases due to the overall cost involved in transporting the raw tea into the UK along with production costs involved into turning the product into a saleable format. The reason for the increases are as follows: Shipping and distribution increases Packaging Increases - Carboard, foil, paper, film Production staff wage increases Energy increases Please note all information is correct at the time of writing (February 2022)

Cocoa Cocoa Cocoa prices are not expected to ease in 2022. One key factor affecting this is dry conditions in Western Africa, particularly the Ivory Coast, where the season between November and March is currently seeing dryer than expected levels. This is driving futures prices upwards. The deficit of cocoa availability versus demand is widening, which is also compounding the recent price increases. Please note all information is correct at the time of writing (February 2022)

Non Food Non Food Plastic Tax The upcoming plastic tax will be levied on plastic packaging that contains less than 30% recycled plastic. Imports of products in plastic packaging, such as drinks in plastic bottles, will also be affected. Plastic packaging will be classified as such if plastic is the heaviest component. The rate of tax will be 200 per metric tonne of plastic packaging (that contains less than 30% of recycled plastic). It will be charged from 1 April 2022 and the cost may well be passed along the supply chain to the end-consumers. Packaging The UK packaging index is tracking 46% up year on year. Supply chain issues are still causing issues, not helped by factory down time caused by the Omicron Variant. The knock on effect has been lead times on packaging increasing by double or more across numerous products such as Cardboard (boxes), Aluminium (Foils), PET (Plastic Bottles/Jars), all creating price increases as well as delays in products being produced. Please note all information is correct at the time of writing (February 2022)

Inflation Report Inflation Report Inflation highest in almost 30 years The consumer prices index (CPI) measure of inflation surged to 5.5% in the year to January The retail prices index (RPI) measured 7.8% in the year to January The differences in the inflation rates produced by these measures matter because different costs and payments for consumers are linked to them. The government tends to link its own spending, such as benefits and the state pension, to the lower CPI figure, critics call this convenient inflation shopping where the government links expenses to lower CPI (like state pensions & benefits), and income-generators (like car tax & Student Loans) to the higher RPI. Expectations for inflation over the next 6 months is predicted to rise a further 3% - 4.8%, a survey from YouGov and Citi showed. This trend would push overall inflation up to between 7% - 8% year on year (CPI) and around 10% year on year (RPI) by the start of Q3 2022. This will predominantly be driven by the energy crisis across the EU pushing the cost of living up. Petrol prices are keeping transport costs high for both business and personal use. The continued high cost of shipping, increases in the national minimum wage by 6% and a national insurance increase of 1.25 percentage points from April, will drive prices up as business look to pass the additional costs on to their customer. Please note all information is correct at the time of writing (February 2022)

Inflation Levels Inflation Levels Please note all information is correct at the time of writing (February 2022)

The Grocer The Grocer Commodity Outlook Commodity Outlook Please note all information is correct at the time of writing (February 2022)

Justification Letters Justification Letters Please note all information is correct at the time of writing (February 2022)

Justification Letters Justification Letters Please note all information is correct at the time of writing (February 2022)

Justification Letters Justification Letters Please note all information is correct at the time of writing (February 2022)

Justification Letters Justification Letters Please note all information is correct at the time of writing (February 2022)

Russia/ Russia/Ukraine Ukraine Conflict Conflict Please note all information is correct at the time of writing (February 2022)

Russia/Ukraine Conflict Russia/Ukraine Conflict Please note all information is correct at the time of writing (February 2022)

Outlook Outlook The previous outlook was uncertainty and the disastrous events in Ukraine in the recent days, means things are arguably more uncertain now than ever. In what was seemingly a positive outlook around Covid-19 measures being reduced and the expectation of some sort of normality returning, the challenges moving forward are likely to be very different. As alluded to previously, Russia and Ukraine are both big players in certain markets (gas, grains, cereals, edible oils, whitefish, animal feed and fertilisers to name but a few). Whilst the UK doesn t directly buy significant amounts in all of these areas from those countries, the reality is they are all global markets and as such any sanctions would invariably effect the overall pricing of them, with UK businesses feeling the impact of this. Stock markets are look to have fallen due to uncertainty and this can bring about an increase in speculative traders, buying up agricultural commodities, which are seen as a safer bet. Many businesses over the last 12 months have significantly underestimated (with good reason) the unprecedented levels of many of the components that make up finished goods, such as energy, transport and packaging and therefore in many cases there are a round two of price increases taking place. Other factors such as National Insurance increases and a general cost of living crisis are also likely to weigh heavily on costs and potentially demand for certain products as the year progresses. Please note all information is correct at the time of writing (February 2022)