Share Ownership and Dividend Yields in Equities

Owners of shares in companies receive dividend yields as part of their investment return, which are typically paid annually. Shareholders also benefit from perks like voting rights and trade discounts. However, there are risks involved, such as difficulties in selling shares at a reasonable price and potential capital loss during economic downturns. Evaluating dividend yields and understanding the risks associated with share ownership are crucial for investors.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

CISI Financial Products, Markets & Services Topic Equities (4.1.4 and 4.1.3) Owning shares and Dividend Yields cisi.org

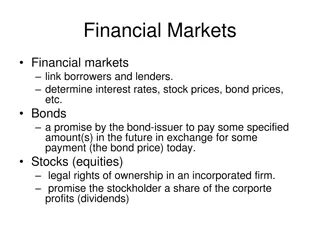

Part of the return for the risk capital This is made on shares if their prices increase over time. Typically paid annually (or semi-annually). Paid out of the company s profits which forms part of their distributable reserves (profits after tax and dividend payment). If profits for a particular year are low, a company can use it s undistributed profits to pay dividends Naked or Uncovered dividend Companies aim to pay steadily growing dividends. A fall in dividends can lead to negativity and shares may be sold. Shares need to be sold to realise any capital gains. If shares are not sold then the capital gains are Unrealised . If capital gains are realised, then capital gains have been banked . Benefits of Share Ownership Entitlements for shareholders Perks given to shareholders Pre-emptive rights to subscribe for new shares if the company wants to issue more. This can de one through a rights issue. Voting rights on matters at company meetings (Normally One share = One vote). They can vote by proxy. Trade benefits e.g. discounts on products and services. Nice bonus but not normally a major factor made in investment decision-making cisi.org

Shares may be difficult to sell at a reasonable price or sold quickly enough to prevent a loss Share prices may fall investors can lose capital even when dividends are paid Economic downturn Domino effect of collapsing markets in one country. When a company discloses bad news. Price risk varies between companies defensive shares hold less price risk e.g. utility companies and general retailers Typically occurs to the shares of thinly traded companies (Ltd companies not often bought or sold or listed plcs where there is not much trading activity.) Can occur when share prices in general fall. Risks of Share Ownership Currency price movements Issuing company may collapse ordinary share become worthless Risk less significant with large companies but some recent high profile cases. Risk higher with shares in newer companies (Not yet reported profits). This can have a negative effect on the value of an investment. Wipe out or reduce a gain. Could enhance a gain if the movement is in the opposite direction. cisi.org

Benefits of share ownership Focus on Dividends Comparing dividends with other potential investments Potential shareholders will compare the dividend paid on a company s shares with alternative investments e.g. other shares, bonds and bank deposits. Calculating the Dividend Yield: Dividend X 100 Dividend Yield = Market Capitalisation (Total value of the company s shares) Example: BT has 20 million ordinary shares, each trading at 2.50. BT pays out a total of 1m in dividends. 1m Dividend Yield = X 100 20m x 2.50 1m Dividend Yield = X 100 50m cisi.org Dividend Yield = 2%

Benefits of share ownership Focus on Dividends Calculating the Dividend Yield on a per share basis: (Dividends / No. of shares) X 100 Dividend Yield per share = Share price Example: BT has 20 million ordinary shares, each trading at 2.50. BT pays out a total of 1m in dividends. ( 1m/20m shares) Dividend Yield = X 100 2.50 0.05 Dividend Yield = X 100 2.50 Dividend Yield per share = 2% cisi.org

Benefits of share ownership Focus on Dividends Higher than average yields: Company is mature generates healthy levels of cash but limited growth potential. Company has a low share price for another reason expected to be unsuccessful. A high dividend is not expected to be sustained. For example: Utility suppliers (water and electricity companies)have their prices regulated by the government and demand for water and electricity tends to grow at a steady but low rate. Lower than average yields: High share price company is viewed by investors as having strong growth prospects. A large proportion of profits are being put back into the business rather than paid out in dividends. cisi.org

Benefits of share ownership Focus on Dividends Estimated Dividend Yield Rankings of FTSE 100 Companies in 2012 Taken from: Bloomberg Business The average estimated yield is 3.99%. Cairn Energy Plc offered the highest estimated yield at 29.49% Shire Plc provided the lowest at 0.62% cisi.org