polyamide market

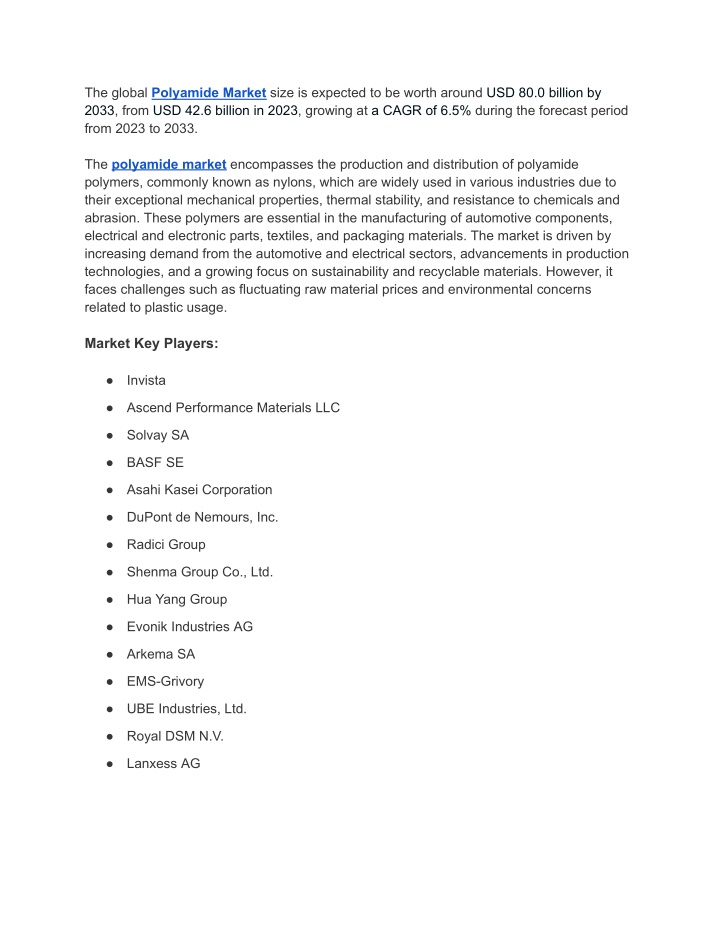

The global Polyamide Market size is expected to be worth around USD 80.0 billion by 2033, from USD 42.6 billion in 2023, growing at a CAGR of 6.5% during the forecast period from 2023 to 2033.nClick here for request a sample : //market.us/report

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

The global Polyamide Market size is expected to be worth around USD 80.0 billion by 2033, from USD 42.6 billion in 2023, growing at a CAGR of 6.5% during the forecast period from 2023 to 2033. The polyamide market encompasses the production and distribution of polyamide polymers, commonly known as nylons, which are widely used in various industries due to their exceptional mechanical properties, thermal stability, and resistance to chemicals and abrasion. These polymers are essential in the manufacturing of automotive components, electrical and electronic parts, textiles, and packaging materials. The market is driven by increasing demand from the automotive and electrical sectors, advancements in production technologies, and a growing focus on sustainability and recyclable materials. However, it faces challenges such as fluctuating raw material prices and environmental concerns related to plastic usage. Market Key Players: Invista Ascend Performance Materials LLC Solvay SA BASF SE Asahi Kasei Corporation DuPont de Nemours, Inc. Radici Group Shenma Group Co., Ltd. Hua Yang Group Evonik Industries AG Arkema SA EMS-Grivory UBE Industries, Ltd. Royal DSM N.V. Lanxess AG

Click here for request a sample : https://market.us/report/polyamide-market/request-sample/ By Type: In 2023, Aliphatic Polyamides, such as Nylon 6 and Nylon 66, dominated the market with an 84.6% share due to their excellent mechanical properties, heat resistance, and versatility, making them ideal for automotive, textile, and consumer goods applications. Aromatic Polyamides (Aramids) held a smaller share but are crucial for high-heat and strength applications in aerospace, military, and firefighting gear. By Product Type: Polyamide 6 led the market with a 52.4% share in 2023, favored for its strength, durability, and cost-effectiveness, making it popular in automotive, electrical, and consumer goods. Polyamide 66, known for enhanced heat resistance, is valued in high-stress engineering applications. Bio-based Polyamides are gaining traction for their sustainability, while Specialty Polyamides cater to high-performance needs in aerospace, electronics, and advanced automotive sectors. By Application: In 2023, Engineering Plastics captured a 48.6% market share, driven by the use of polyamides in automotive, electronics, and industrial applications due to their strength and thermal stability. Polyamide fibers are extensively used in textiles for their durability and elasticity, ideal for sportswear, casual wear, and industrial textiles. By End-Use: The Automotive sector dominated the polyamide market in 2023 with a 39.7% share, using polyamides for their heat resistance and durability in various components, aiding in weight reduction and fuel efficiency. The Electrical & Electronics sector relies on polyamides for insulation and heat resistance. In textiles, polyamides are valued for their strength and elasticity. The Construction sector uses polyamides for their chemical resistance and durability, while in Packaging, they provide excellent barrier properties. Polyamides are also essential in Consumer Goods for their strength and flexibility.

Key Market Segments: By Type Aliphatic Polyamides Aromatic Polyamides By Product Type Polyamide 6 Polyamide 66 Bio-based Polyamide Specialty Polyamides By Application Engineering Plastics Fibers Others By End-Use Automotive Electrical & Electronics Textile Construction Packaging Consumer Goods Others

Drivers: The increasing demand for lightweight automotive components is a significant driver for the polyamide market. Polyamides are favored in the automotive industry due to their excellent strength-to-weight ratios, high thermal resistance, mechanical strength, and chemical stability, which help reduce vehicle weight and improve fuel efficiency. The shift towards electric vehicles (EVs) also boosts polyamide demand, as these materials are used in battery packs, electrical insulation, and structural components to extend battery life and enhance energy efficiency. Polyamides' recyclability supports the automotive industry's sustainability goals, further driving their adoption. Restraints: Environmental concerns and regulatory challenges significantly impact the polyamide market. Polyamides are derived from petrochemicals, contributing to their environmental footprint through resource extraction and end-of-life disposal. The production process is energy-intensive and releases significant pollutants. Low recycling rates and long-term landfill pollution exacerbate these issues. Stricter regulations and consumer demand for sustainable materials push manufacturers to adopt more sustainable practices, incurring additional costs and operational complexities, potentially limiting market growth. Opportunity: The development of bio-based polyamides presents a significant opportunity in the market. Made from renewable resources like castor oil, these eco-friendly polyamides reduce reliance on fossil fuels and lower carbon footprints. Bio-based polyamides retain the advantageous properties of traditional polyamides and are suitable for automotive parts, electronic components, textiles, and packaging. The growing demand for sustainable products, advancements in biotechnology, and material science make bio-based polyamides a competitive and scalable alternative, aligning with global sustainability trends. Trends: A prominent trend in the polyamide market is the increasing adoption of polyamides in electric vehicles (EVs). Polyamides' high strength, stiffness, and lightweight properties are crucial for improving battery efficiency and driving range. They are used in battery packs, connectors, thermal management systems, and structural components of EVs. Advancements in polymer technology enhance polyamides' properties, making them

suitable for complex EV applications. The growth of the EV market, supported by government incentives and regulations, further drives the demand for polyamides.