Pet Insurance Market

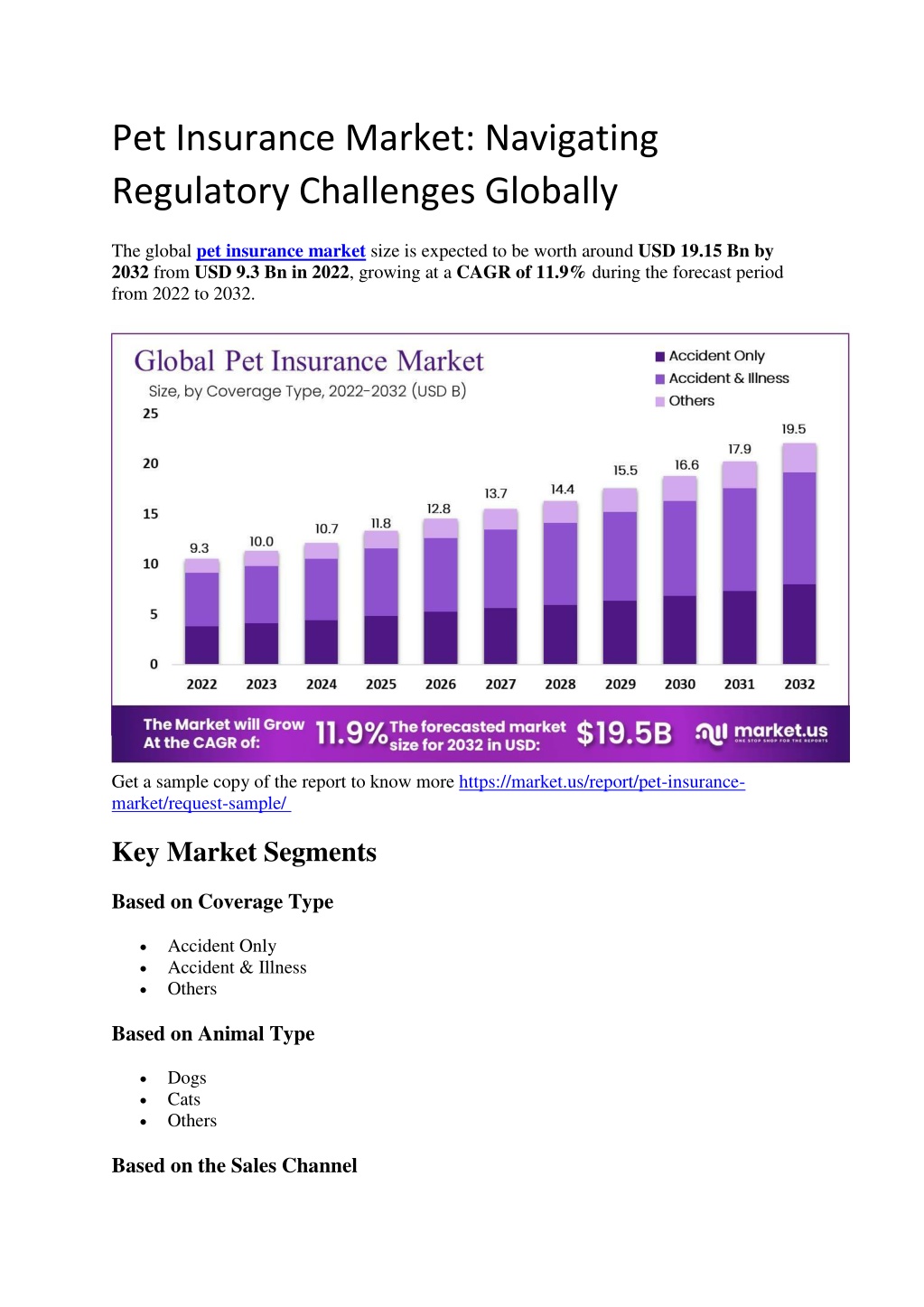

The globalu00a0pet insurance marketu00a0size is expected to be worth aroundu00a0USD 19.15 Bn by 2032u00a0fromu00a0USD 9.3 Bn in 2022, growing at au00a0CAGR of 11.9%u00a0during the forecast period from 2022 to 2032.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Pet Insurance Market: Navigating Regulatory Challenges Globally The global pet insurance market size is expected to be worth around USD 19.15 Bn by 2032 from USD 9.3 Bn in 2022, growing at a CAGR of 11.9% during the forecast period from 2022 to 2032. Get a sample copy of the report to know more https://market.us/report/pet-insurance- market/request-sample/ Key Market Segments Based on Coverage Type Accident Only Accident & Illness Others Based on Animal Type Dogs Cats Others Based on the Sales Channel

Broker Direct Agency Bancassurance Based on Provider Public Private Key Regions North America (The US, Canada, Mexico) Western Europe (Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, Rest of Western Europe) Eastern Europe (Russia, Poland, The Czech Republic, Greece, Rest of Eastern Europe) APAC (China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC) Latin America (Brazil, Colombia, Chile, Argentina, Costa Rica, Rest of Latin America) Middle East & Africa (Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, Rest of MEA) Market Key Players Trupanion Nationwide Mutual Insurance Company Healthy Paws Pet Insurance, LLC Embrace Pet Insurance Agency, LLC Anicom Holdings Figo Pet Insurance LLC. Agria Pet Insurance Ltd. 24 Pet Watch Pets Best Insurance Services, LLC ASPCA Pet Plan Insurance MetLife Services and Solutions LLC Petfirst Healthcare LLC Ipet Insurance Co, Ltd. Hartville Group ASPCA Pet Insurance Animals Friends Insurance Services Limited Progressive Casualty Insurance Company Other Key Players If You Have Any Questions About This Report, Please Reach Out to Us @ https://market.us/report/home-healthcare-market/#inquiry

Drivers: 1.Increasing Pet Ownership: The rise in pet adoption rates drives demand for pet insurance globally. 2.Rising Veterinary Costs: Growing veterinary expenses push pet owners to seek insurance to manage unexpected costs. 3.Humanization of Pets: Pets are increasingly seen as family members, leading to higher spending on their health and well-being. 4.Awareness Growth: More pet owners are becoming aware of the benefits of pet insurance. 5.Technological Advancements: Digital platforms make it easier to compare, buy, and manage pet insurance policies. Trends: 1.Customized Insurance Plans: Companies offer tailored policies based on pet breed, age, and health status. 2.Wellness Coverage: There's a growing trend toward policies that include preventive care and wellness benefits. 3.Microchip Integration: Insurance linked with microchips enhances pet identification and recovery, reducing claims. 4.Partnerships with Veterinary Clinics: Insurers are collaborating with clinics to offer integrated services. 5.Telehealth Services: Telemedicine for pets is becoming popular, leading to bundled insurance and telehealth packages. Opportunities: 1.Emerging Markets: Pet insurance is gaining traction in developing regions, offering new growth opportunities. 2.Innovative Products: Introduction of new products like multi-pet insurance plans and senior pet coverage. 3.Increased Online Sales: Digital channels present significant potential for market expansion. 4.Cross-selling: Opportunity to bundle pet insurance with other types of insurance or pet-related services. 5.Expansion of Pet Types Covered: Insurers can explore covering a broader range of pets beyond cats and dogs. Restraints: 1.High Premium Costs: The cost of pet insurance can be prohibitive for some pet owners. 2.Lack of Awareness: In many regions, pet owners are still unaware of the availability and benefits of pet insurance. 3.Limited Coverage Options: Some policies have extensive exclusions, limiting their appeal.

4.Complex Claims Process: Complicated or slow claims processes deter some customers. 5.Regulatory Challenges: Varied regulations across regions can complicate market expansion. Contact Us : 420 Lexington Avenue, Suite 300 New York City, NY 10170, United States Phone:+1 718 618 4351 (International),+91 78878 22626 (Asia) Email: inquiry@market.us