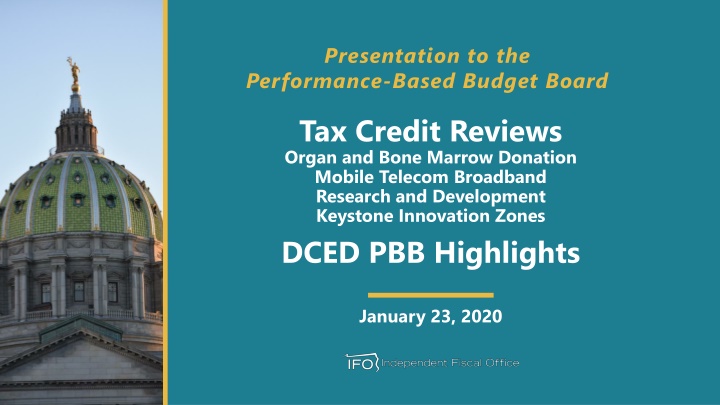

Performance-Based Budget Board Tax Credit Reviews & Innovation Zones Presentation

The presentation on Tax Credit Reviews highlights objectives, performance metrics, and specific recommendations for improvement. It focuses on job creation in high-tech sectors, infrastructure upgrades, and encouraging innovation through programs like Keystone Innovation Zones and Organ/Bone Marrow Donation. Economic metrics are used to assess progress, analyze spending impacts, and estimate ROI. Recommendations for expanding the Organ/Bone Marrow Donation program are also provided.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

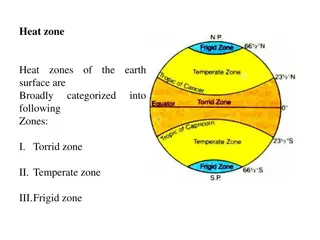

Presentation to the Performance-Based Budget Board Tax Credit Reviews Organ and Bone Marrow Donation Mobile Telecom Broadband Research and Development Keystone Innovation Zones DCED PBB Highlights January 23, 2020

Tax Credit Reviews - Overview Tax credit reviews have four objectives Identify the purpose for which the tax credit was established Is the credit accomplishing its legislative intent? Could it be more effectively implemented by other methods? Costs to provide the tax credit Reviews should include a Tax Credit Plan Include performance metrics (outcome, efficiency) Benchmarks against programs in other states Specific recommendations to improve operation and efficiency January 23, 2020 1

Tax Credit Reviews for Year 2 Theme: jobs creation for high-tech sectors MTBI increase and upgrade wireless broadband infrastructure R&D incentivize high tech and R&D investments KIZ encourage entrepreneurs and incubate young firms OBMD living organ and bone marrow donation Unique features of high-tech sectors Computer design | internet publishing | engineers | manufacturing Wages pay far above average | many are export based Positive synergies, spillovers, clustering and agglomeration effects January 23, 2020 2

Using Economic Metrics to Assess Progress Economic impact analysis has 3 steps Determine the amount/share of spending incentivized Determine type of spending and industries affected Use IMPLAN to estimate multiplier effects, jobs, tax revenues Economic metrics for MTBI, RDTC and KIZ Gross ROI and net ROI (deducts alternative use of monies) GDP | labor earnings | number of jobs Not possible to estimate certain spillover effects and synergies Key: incentivization parameter | use consensus of existing research January 23, 2020 3

Organ and Bone Marrow Donation Tax credit for paid leave due to a living donation by employee Employee compensation paid up to 5 days Also cost of replacement help + qualified misc expenses tied to leave No firm has claimed the credit since 2014 Firms not aware of it | neither are advocacy groups Organ/bone marrow donation usually requires 2 to 8 weeks of leave Recommendations Extend covered leave (e.g.,10 days) | max dollar amount (e.g., $10,000) Expand program to provide direct support to donors | more outreach January 23, 2020 4

Mobile Telecom Broadband Investment Credit 5% of purchase price | $5 million annual cap Qualified broadband equipment | wireless only Purpose: to expand availability and enhance quality No requirement to locate in underserved/unserved areas No requirement on minimum speeds 24 states have a broadband incentive But only 3 use tax credits | most use grants and allow wired investment At most, only 3 firms have claimed in any year Credit not maxed out | FY 19-20: $3 million in awards All credits used against tax liability | cannot be sold January 23, 2020 5

Mobile Telecom Broadband Investment MTBI economic analysis has data and research limitations Does a 5% credit incentivize investment? | very few relevant studies Where is investment located? | data not required to be reported Most economic gains from extension to underserved/unserved areas Modest economic gains | assume 10% is incentivized Gross ROI: 15 cents per dollar | Net ROI: 9 cents per dollar $5.9m GDP | $2.5m labor earnings | 39 FTEs Recommendations If retained, convert to competitive grant program Require investment to underserved/unserved areas Report metrics: location of investment, speeds, existing alternatives January 23, 2020 6

Research and Development Tax Credit Credit 10% / 20% of Qualified Research Expenses (QRE) $11m for small firms | $44m for others Credit has been oversubscribed since FY 2016-17 Partly due to federal R&D credit made permanent Proration factors: small 68% | large 38% Most states offer some type of R&D incentive 3 states dominate: CA ($1,800m), TX ($660m), MA ($242m) PA offers a mid-tier dollar credit ($55m) | typical credit rates All states use federal definitions for QRE Nearly all use a form of an incremental base computation January 23, 2020 7

Research and Development Tax Credit R&D Tax Credit has many impacts Consensus: $1 tax credit increases private R&D spend by $1.00-$1.50 State RDTC: large firms shift R&D spending (wages) into state May increase entrepreneurial activity, but takes long time to show up Significant reduction of CNIT for large firms that claim every year Flows to target industries | pay high wages | many export based Economic impacts Gross ROI: 16 cents per dollar | Net ROI: 12 cents per dollar 915 FTEs | typical salary ranges $80k to $95k Note: some concerns over relabeling issue January 23, 2020 8

R&D Tax Credit Recommendations Make credit refundable for 95 cents per dollar ~25% credits sold for 93-94 cents per dollar | possible 5% transaction fee Potential leakage: ~$1.6 million Simplifies administration | helps small firms | reduces cost to state Address credit oversubscription | anticipate it will continue Tiered rate structure | per firm cap | eliminate contract labor payments Tighten up QRE computation | allows better targeting Enact reforms to deter fraud and abuse (see Appendix) January 23, 2020 9

Keystone Innovation Zone Tax Credit Up to $100,000 credit for qualified activities within zone Must be located in a KIZ (28 zones) Credit = 50% increase in gross revenues from prior year KIZ firms partner with higher education and local businesses Credit is oversubscribed | 84% proration factor | 80-90% are sold Numerous positive indirect effects and benefits Clustering: synergies due to idea sharing, innovation Agglomeration: cost reductions due to physical location Entrepreneurial: provide seed capital and mentoring to start-ups Incubation: provide on-going support up to 7 years Demographic: reduce brain drain ? January 23, 2020 10

KIZ Tax Credit Great potential | critical need for more and better data No data are verified | all self-reported by firm Firms not tracked after program exit | are they viable? Firms do not report wages paid | other state incentives received Economic effects Gross ROI: 32 cents per dollar | Net ROI: 27 cents per dollar 540 FTE on an annual basis | salaries range from $75k to $95k Analysis assumes a permanent gain of 500 jobs in targeted sectors However, long-term viability of KIZ firms unknown January 23, 2020 11

KIZ Recommendations Consider remuneration for KIZ coordinators No direct state compensation currently | many have full-time jobs Increases accountability | possibly expand role as a facilitator Allow coordinator 5% fee (currently paid to facilitator) 80-90% credits sold | 92 cents per dollar | leakage ~$1.5 to $1.8 million Refund for 95 cents per dollar Require more data collection and verification Track outcomes upon exit | report wages paid or total payroll Declare other state incentives received (RDTC, BFTP grants) Change semi-annual reporting to annual to reduce burdens Enact reforms to deter fraud and abuse (see Appendix) January 23, 2020 12

Department of Community and Economic Development (DCED) January 23, 2020 13

DCED Actual Spend and FTEs (2018-19) FTEs Expenditures Amount $35.9 12.8 175.0 12.5 2.9 1.3 6.9 26.8 97.3 1.8 15.0 22.0 21.1 431.1 Activities Business Attraction and Financing Administration Community and Citizen Development Local Government Operational Support Office of Open Records Tax Credit Administration International Trade and Investment Innovation Economy and Investments Local Infrastructure Small Business Advocate Tourism Attraction and Development Business and Workforce Assistance Site Development Total Number Share 22.5% 21.0% 18.6% 11.3% 6.5% 4.9% 4.7% 3.0% 2.9% 2.8% 1.3% 0.3% 0.2% 100.0% Share 8.3% 3.0% 40.6% 2.9% 0.7% 0.3% 1.6% 6.2% 22.6% 0.4% 3.5% 5.1% 4.9% 100.0% 65 61 54 33 19 14 14 9 8 8 4 1 1 289 Note: Includes all expenditures in $ millions. January 23, 2020 14

General Fund Appropriations (2019-20) Marketing to Attract Tourists $0.0 Local Mun. Emerg. Relief $14.2 Manu- facturing PA $0.0 PA First $0.0 25.0 7.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 32.0 Keystone Communities $21.1 Activities Comm. & Citizen Develop. Bus. Attract. & Financing Bus. & Workforce Assist. Tourism Attract. & Develop. Administration Site Development Local Govt. Op. Support International Trade & Invest. Innovation Econ. & Invest. Office of Open Records Tax Credit Administration Total GGO $0.7 3.5 0.1 0.1 13.4 0.0 0.0 0.1 0.8 0.0 0.9 19.5 Other $1.7 2.0 10.0 0.8 0.0 10.0 7.2 5.9 3.4 3.4 0.1 44.4 Total $37.7 30.6 29.1 18.1 13.4 10.0 7.2 5.9 4.1 3.4 1.2 160.5 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 12.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 12.0 17.2 0.0 0.0 0.0 0.0 0.0 0.0 0.1 17.3 21.1 14.2 Note: Amounts in $ millions. The following activities do not receive any General Fund appropriations in FY 19-20: Local Infrastructure and Small Business Advocate. January 23, 2020 15

DCED Metric Highlights FY 19-20, $231m funding for key development programs PA First ($25m) | Small Bus. First ($15m) | Machinery-Equip Loans ($12m) Job Training: WEDNet, IRC, PREP ($21m) Ben Franklin Technology ($14.5m) | Life Sciences ($3m) KIZ Tax Credit ($15m) | R&D Tax Credit ($55m) | Film Production ($70m) Clear need for more data collection and verification Cost per job created | outcomes from job training Viability of businesses that receive monies | redundant, multiple incentives Difficult to quantify jobs impact from current incentives January 23, 2020 16

DCED Metric Highlights Business Attraction and Financing (PA First, SBF Loans, MEL) Full Compliance Monitoring: 1 in 10 selected for payroll audits Roughly 10% (SBF) to 20% (MEL) of loans default | no method to recoup Cost per job created: $2,000 to $12,000 Business Workforce/Assistance (WEDnetPA, IRCs, PREP) All data reported by third parties Jobs created figures are less useful because there is no verification What are the outcomes from the trainings? | recommended measures Community and Citizen Development (most is CSBG) For 18-19: $141m federal + $24m state | $165m grants to local units $21m for Keystone Communities Activity metrics include impacts from both state and federal funds January 23, 2020 17

DCED Metric Highlights Innovation Economy (BFTD, Venture Investments, Life Sciences) Metrics reported by third parties | no verification Cost per job created: $7,000 to $11,000 (BFTD) ~1,500 firms assisted | ~$500m funds leveraged per annum (BFTD) Tourism Attraction PA ranks 49 in per capita spend state campaign (9 cents per resident) U.S. average is $1.59 | PA share of U.S. tourism market declines over time Independent Authorities (CFA, PIDA, PEDFA and others) For FY 18-19, $540m in grants, loans, investments and bond deals DCED provides limited administrative support Currently, no metrics reported | no compliance monitoring January 23, 2020 18

Presentation to the Performance-Based Budget Board PBB Highlights Dept of Health Dept of Human Services January 23, 2020

Department of Health (DOH) January 23, 2020 20

DOH Actual Spend and FTE (2018-19) FTEs Expenditures Amount $40.6 111.4 69.5 15.2 42.1 32.9 8.2 165.2 125.3 5.8 14.1 11.2 39.1 680.6 Activities Quality Assurance Ensure Access to Care Disease Prevention and Outreach Vital Statistics Public Health and Emergency Medical Services Maternal and Child Health Administration Women, Infants and Children (WIC) HIV Surveillance, Prevention and Treatment State Laboratory Disease Treatment Drug Surveillance and Misuse Prevention Health Research Total Number 273 196 160 Share 26.4% 19.0% 15.5% 9.4% 7.2% 4.8% 4.4% 4.2% 3.3% 3.3% 1.0% 1.0% 0.4% 100.0% Share 6.0% 16.4% 10.2% 2.2% 6.2% 4.8% 1.2% 24.3% 18.4% 0.9% 2.1% 1.6% 5.7% 100.0% 97 75 50 45 43 35 34 10 10 4 1,032 Note: Includes all expenditures in $ millions. January 23, 2020 21

DOH GF Appropriations (2019-20) Sch. Dist. Health Services $35.6 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 35.6 Local Health Depart. $25.4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 25.4 State AIDS Prog. & Spec. Pharm. Svcs. $0.0 Quality Assurance $0.0 23.5 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 23.5 Health Care Centers $22.5 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 22.5 Activities Ensure Access to Care Quality Assurance Disease Prev. & Outreach Disease Treatment Administration HIV Health Research Maternal & Child Health State Laboratory Drug Surv./Misuse Prev. Pub. Health Emg. Med. Serv. Vital Statistics Total GGO $0.9 1.1 6.4 0.5 13.8 0.4 0.6 0.0 0.0 0.0 1.5 1.1 26.3 Other $10.0 0.0 9.0 13.6 0.0 0.0 8.9 8.6 4.4 3.2 0.0 0.1 57.7 Total $94.5 24.6 15.3 14.0 13.8 12.9 9.5 8.6 4.4 3.2 1.5 1.2 203.4 0.0 0.0 0.0 0.0 12.4 0.0 0.0 0.0 0.0 0.0 0.0 12.4 Note: Amounts in $ millions. The Women, Infants and Children Activity does not receive any General Fund appropriations in FY 19-20. January 23, 2020 22

DOH Metric Highlights Ensuring Access to Care is nearly 50% of GF spend ($95m) State Health Care centers | grants to local and SD health depts Declining share of residents live in a HPSA (primary, dental, mental) More primary care loan repayment program participants in HPSAs Uninsured rate falls from 10.2% (CY 2014) to 6.6% (CY 2017) Disease Prevention and Outreach third largest GF spend ($15m) Uptick in PA obesity rate | same as U.S. average (30.9%) Since 2014: PA up +0.7 ppt | U.S. up +2.0 ppt PA adult smoking rate (18.7%) higher than U.S. average (16.4%) Since 2014: Both have declined by ~-1.0 ppt January 23, 2020 23

DOH Metric Highlights (cont) Rate of HIV infections has declined From 9.5 per 100,000 (2014) to 7.8 (2018) or 7.5 (using DOH stats) Philadelphia rate remains high at 25.5 (2018) PA lower than all border states except WV | U.S. rate is 11.4 80% receive treatment within one month of diagnosis (up from 70%) Opioid overdose rates decline, but remain far above U.S. avg DOH data: 2017 (38.3 per 100,000) | 2018 (30.6) PA ranked 28th in 14-15 and 12th in 17-18 (using federal data) Opioid dispensations down -29% since 15-16 January 23, 2020 24

Department of Human Services (DHS) Part 1 (2020): MA, SNAP, TANF, Child Support (50%) Part 2 (2021): Mental Health, Institutions, Youth (20%) Part 3 (2022): Long-Term Living, Child Development (30%) January 23, 2020 25

DHS Actual Spend and FTEs (2018-19) FTEs Expenditures Amount Activities (Year 1 Only) Number Share Share Medical Assistance Eligibility SNAP Eligibility and Authorize Benefits Employment Supports TANF Eligibility and Benefits LIHEAP Eligibility and Benefits MA - Physical Health Services Child Support Enforcement MA - Behavioral Health Services Medicaid Management Information System Other Program Eligibility and Benefits Eligibility and Enrollment Systems All Other Total 3,049 2,654 787 394 257 184 39.8% 34.7% 10.3% 5.1% 3.4% 2.4% 1.2% 0.9% 0.7% 0.7% 0.5% 0.3% 100.0% $332 301 135 210 201 15,318 192 4,081 1.6% 1.4% 0.6% 1.0% 0.9% 72.0% 0.9% 19.2% 0.2% 0.7% 0.6% 0.9% 100.0% 89 72 57 51 38 22 42 157 137 183 7,653 21,287 Note: Includes all expenditures in $ millions. Other includes Provider Enrollment, Health Information Exchange and MA Transport Service. January 23, 2020 26

DHS GF Appropriations (2019-20) Medical D Pmt. to Fed. Govt. $776 MA MA Fee- for-Service $381 Supp. Grants DHS Activities MA Physical Health MA Behavioral Health Other Program Elig./Benefits MA Eligibility SNAP Eligibility/Benefits MA Transportation Elig. and Enrollment Systems Medicaid Mgmt. Info. System Employment Supports Child Supp. Enforcement Provider Enrollment TANF and Health Exchange Total Note: Amounts in $ millions. The LIHEAP Eligibility and Benefits Activity does not receive General Fund appropriations in FY 19-20. Capitation $1,831 414 CAOs GGO Other $133 Total $3,121 451 139 137 131 $0 $0 $1 0 0 0 0 0 0 0 0 0 0 0 29 0 0 0 3 0 1 1 0 0 0 0 0 0 0 5 5 0 0 0 0 0 0 0 0 0 0 4 0 0 0 1 124 16 129 123 0 0 0 0 0 0 0 0 0 8 8 0 0 0 3 0 0 1 70 58 70 58 20 19 16 12 14 2 0 0 16 16 11 1 5 0 7 2,270 776 415 255 124 337 4,182 January 23, 2020 27

DHS Metric Highlights Note: $642 million of potential 19-20 supplementals excluded $278m for capitation | $268m for CHC | $96m all other Medicaid Expansion has significant impact on many metrics Number of enrollees up 25% for MA physical health Number receiving services up 13% for MA behavioral health Higher share of new mothers and children receive care Notably shorter processing times due to electronic submissions Nearly one-third reduction for MA application However, PA still lags U.S. average and border states in % electronic Average TANF and SNAP processing times down by one-third too January 23, 2020 28

DHS Metric Highlights Average costs for certain services rise dramatically (14-15 to 18-19) MA transport cost per trip up by one-third Average cost per managed care encounter also up by roughly one-third PA is a leader in Child Support Enforcement Ranks 1st in % of support timely paid and % cases in arrears paying In FFY 2018, $4.87 collected for every dollar spent State Supplemental Payment declines (~$10m) Number receiving payment falls by -5% | due to reduction # disabled Total payments fall by -8% | typical payment is $325 per annum Does the tight labor market reduce caseload? January 23, 2020 29

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)