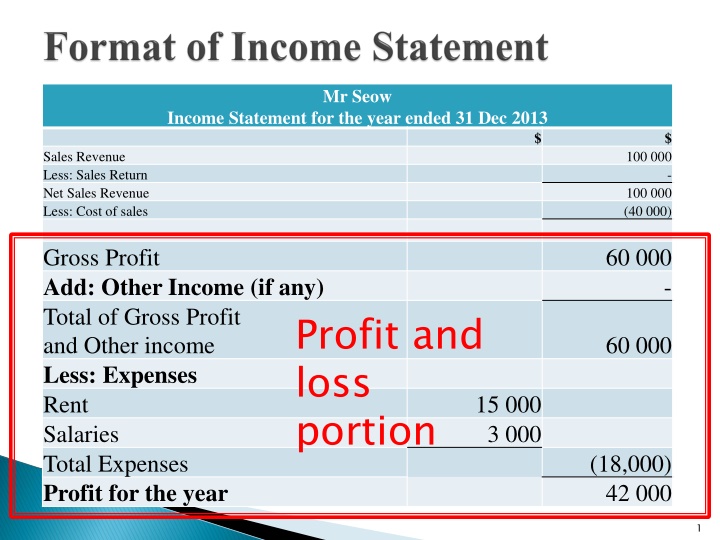

Mr. Seow Income Statement Analysis 2013

Analyze Mr. Seow's income statement for the year ended 31 Dec 2013, including sales revenue, cost of sales, gross profit, expenses, and profit for the year. Understand the trading portion, gross profit/loss, and overall profit/loss. Explore Shaun Stationery and Bob Builders income statements through an income statement worksheet.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Mr Seow Income Statement for the year ended 31 Dec 2013 $ $ Sales Revenue Less: Sales Return Net Sales Revenue Less: Cost of sales 100 000 - 100 000 (40 000) Gross Profit Add: Other Income (if any) Total of Gross Profit and Other income Less: Expenses Rent Salaries Total Expenses Profit for the year 60 000 - Profit and loss portion 60 000 15 000 3 000 (18,000) 42 000 1

Trading portion which shows gross profit/ (loss) from buying and selling goods. Profit and loss portion which shows the overall profit/ (loss) for the period. 2

Trading portion: Sales revenue Sales returns = Net sales revenue Net sales revenue Cost of sales = Gross Profit / (loss) Profit and loss portion: Gross Profit / (loss) + ALL Other income ALL Expenses = Profit / (loss) for the year 3

Complete Q1 (Shaun Stationery) and Q2 (Bob Builders) of the Income Statement Worksheet 4