MBA Student Investment Management Fund

Explore the historical performance of Book-to-Market ratios in stock returns from various decades, comparing outcomes and insights. Understand the evolving relevance of this metric in investment decision-making.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

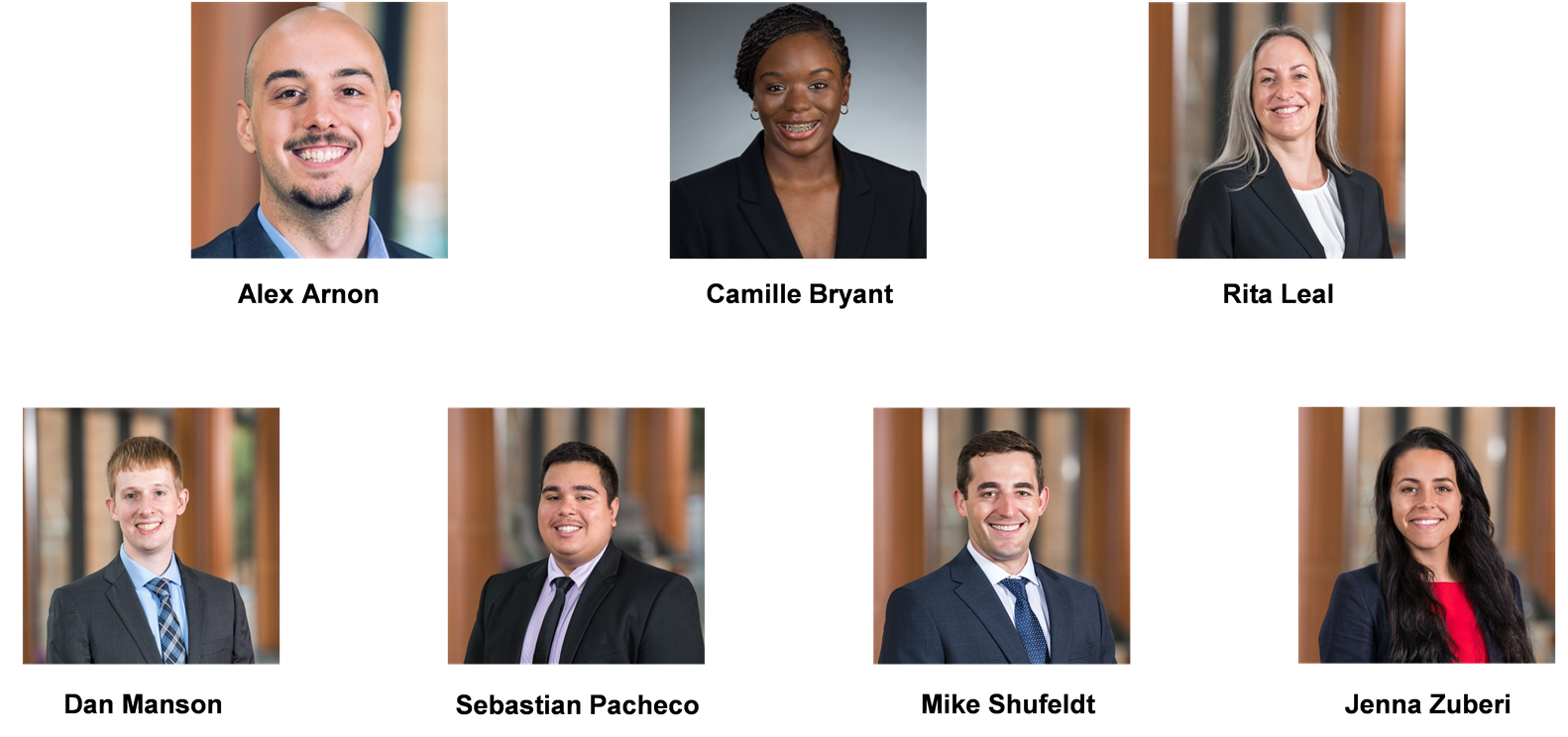

MBA Student Investment Management Fund Semi-Annual Presentation December 2022 MBA Student Investment Management Fund Arizona State University

MBA SIM Fund Team Camille Bryant Alex Arnon Rita Leal Dan Manson Mike Shufeldt Jenna Zuberi Sebastian Pacheco MBA Student Investment Management Fund Arizona State University 2

Table of Contents I. Investment Thesis II. Portfolio III. Monitoring & Rebalancing MBA Student Investment Management Fund Arizona State University 3

Investment Thesis MBA Student Investment Management Fund Arizona State University

The book-to-market ratio has been widely used to explain the cross-sectional variation in stock returns, but the explanatory power is weaker in recent decades than in the 1970s. Park (2019) MBA Student Investment Management Fund Arizona State University 5

Book-to-Market did perform very well! Book-to-Market Decile Analysis, January 1, 1967, to December 31, 1984 Annual Compound Return Annual Decile Standard Deviation Sharpe Ratio Outperformance 1 (highest B/M) 16.60% 5.43% 20.69% 0.56 2 16.35% 5.18% 18.33% 0.62 3 14.19% 3.02% 17.15% 0.54 4 12.08% 0.91% 17.53% 0.40 5 10.92% (0.25%) 18.40% 0.32 6 10.75% (0.42%) 19.17% 0.30 7 9.05% (2.12%) 19.68% 0.21 8 7.29% (3.88%) 20.76% 0.11 9 6.54% (4.63%) 21.87% 0.07 10 (lowest B/M) 6.90% (4.27%) 24.47% 0.08 Market 11.17% 0.00% 19.29% 0.32 O Shaughnessy, 2012 MBA Student Investment Management Fund Arizona State University 6

But was that just an outlier? Average Annual Compound Rates of Return by Decade 1930s 1940s 1950s 1960s 1970s 1980s 1990s 2000s (10.97%) 17.34% 18.53% 11.34% 13.29% 21.25% 14.68% 9.12% Book-to-Market Decile 1 (0.03%) 11.57% 18.07% 10.72% 7.56% 16.78% 15.35% 4.39% All Stocks (10.94%) 5.77% 0.46% 0.62% 5.43% 4.47% (0.67%) 4.73% Value Outperformance O Shaughnessy, 2012 MBA Student Investment Management Fund Arizona State University 7

We addressed the important issue of mismeasurement of value because of a core failing of book value as a valuation metric. This classic measure of value was designed at a time when the economy was much less reliant on intellectual property and other intangibles. Arnott et al (2021) MBA Student Investment Management Fund Arizona State University 8

Graham (1937) MBA Student Investment Management Fund Arizona State University 9

So why not go straight to earnings? Average Annual Compound Rates of Return by Decade 1960s 1970s 1980s 1990s 2000s 17.68% 13.03% 20.38% 16.02% 14.86% Earnings-to-Price Decile 1 11.34% 13.29% 21.25% 14.68% 9.12% Book-to-Market Decile 1 13.36% 7.56% 16.78% 15.35% 4.39% All Stocks 4.32% 5.47% 3.60% 0.67% 10.47% E/P Outperformance O Shaughnessy, 2012 MBA Student Investment Management Fund Arizona State University 10

But what about cash-based earnings? 2021 2020 2019 2018 2017 Sum Net Income (in Millions) $5,116.23 $2,761.40 $1,866.92 $1,211.24 $558.93 $11,514.71 FCF (in Millions) ($131.98) $1,929.15 ($3,140.36) ($2,893.01) ($2,012.97) ($6,249.16) MBA Student Investment Management Fund Arizona State University 11

Free Cash Flow-to-Price Average Annual Compound Rates of Return by Decade 1960s 1970s 1980s 1990s 2000s 15.86% 13.64% 19.27% 16.62% 15.78% FCF-to-Price Decile 1 17.68% 13.03% 20.83% 16.02% 14.86% Earnings-to-Price Decile 1 11.34% 13.29% 21.25% 14.68% 9.12% Book-to-Market Decile 1 13.36% 7.56% 16.78% 15.35% 4.39% All Stocks 2.50% 6.08% 2.49% 1.27% 11.39% FCF/P Outperformance O Shaughnessy, 2012 MBA Student Investment Management Fund Arizona State University 12

EBITDA-to-EV Average Annual Compound Rates of Return by Decade 1960s 1970s 1980s 1990s 2000s 14.14% 13.82% 19.95% 18.59% 15.55% EBITDA-to-EV Decile 1 15.86% 13.64% 19.27% 16.62% 15.78% FCF-to-Price Decile 1 17.68% 13.03% 20.38% 16.02% 14.86% Earnings-to-Price Decile 1 11.34% 13.29% 21.25% 14.68% 9.12% Book-to-Market Decile 1 13.36% 7.56% 16.78% 15.35% 4.39% All Stocks 0.78% 6.26% 3.17% 3.24% 11.16% EBITDA/EV Outperformance O Shaughnessy, 2012 MBA Student Investment Management Fund Arizona State University 13

But combining them has the best results of all! Average Annual Compound Rates of Return by Decade 1960s 1970s 1980s 1990s 2000s 16.84% 14.78% 22.21% 16.34% 15.73% Combined Metric Decile 1 14.14% 13.82% 19.95% 18.59% 15.55% EBITDA-to-EV Decile 1 15.86% 13.64% 19.27% 16.62% 15.78% NOCF-to-Price Decile 1 17.68% 13.03% 20.38% 16.02% 14.86% Earnings-to-Price Decile 1 11.34% 13.29% 21.25% 14.68% 9.12% Book-to-Market 13.36% 7.56% 16.78% 15.35% 4.39% All Stocks Combined Metric Outperformance 3.48% 7.22% 5.43% 0.99% 11.34% O Shaughnessy, 2012 MBA Student Investment Management Fund Arizona State University 14

Our Strategy EBITDA/EV Rank Name E/P Rank FCF/P Rank B/P Rank Score Rank 9 20 3 16 48 1 UNITED STATES STEEL CORP 18 37 22 154 231 2 EAGLE BULK SHIPPING INC 37 2 184 8 231 3 MR COOPER GROUP INC 44 42 124 28 238 4 LUMEN TECHNOLOGIES INC 72 54 31 86 243 5 RESOLUTE FOREST PRODUCTS 45 58 83 63 249 6 TAYLOR MORRISON HOME CORP 38 139 27 54 258 7 GENCO SHIPPING & TRADING LTD 78 77 1 128 284 8 FULGENT GENETICS INC 7 50 13 229 299 9 LAREDO PETROLEUM INC 67 78 24 144 313 10 BERRY CORP MBA Student Investment Management Fund Arizona State University 15

Portfolio MBA Student Investment Management Fund Arizona State University

Portfolio Seeding Python script for sector weight (+/- 7.5% off Russell 3000) News Checks (Per person by sector) Update 50 Securities Equal Weight Seeding (2% per security) MBA Student Investment Management Fund Arizona State University 17

Portfolio Breakdown Average Mkt Cap: $8.65B 50 Securities Current Portfolio Aligned w/ Russell 3000 Sector Weights Sectors Under/Overweight Sectors MBA Student Investment Management Fund Arizona State University 18

Portfolio Breakdown Sector Weighting Analysis MBA Student Investment Management Fund Arizona State University 19

Comparative Metrics Portfolio vs. Ex-Portfolio vs. Bootstrap (1000) MBA Student Investment Management Fund Arizona State University 20

Sector Agnostic Shadow Portfolio Portfolio Breakdown 1. Same Universe (Mkt Cap > $600M) 2. Top 50 Ranked Securities 3. No Cash Holdings MBA Student Investment Management Fund Arizona State University 21

Sector Agnostic Shadow Portfolio Sector Analysis (vs. our Portfolio) MBA Student Investment Management Fund Arizona State University 22

Returns (3-weeks, no rebalances) MBA Student Investment Management Fund Arizona State University 23

Monitoring & Rebalancing MBA Student Investment Management Fund Arizona State University

Monitoring Processes Example News Sources: Bloomberg WSJ Forbes Business Insider Google Alerts News Tracking - Daily Live Google Sheet Tracking Returns Update Portfolio Keywords Example Keywords: Merger Acquisition Fraud Litigation Validate News Source MBA Student Investment Management Fund Arizona State University 25

Rebalancing Plan Pull/ Organize Data Avoid Trigger Companies Pull updated financial data from Bloomberg. Re-rank universe IAW investment criteria. Rebalance Accordingly Execute Rebalance Team will validate new potential securities as described in monitoring plan on previous slide. Rebalance the portfolio using the guide rails described below. Monthly Rebalances - Goal: Minimize Transaction Costs - Considerations: Individual Weights (+/- 2%) Sector Weights (+/- 7.5%) Large Rank Changes MBA Student Investment Management Fund Arizona State University 26

Thank You! Questions? MBA Student Investment Management Fund Arizona State University