Liberia Cigarette Tax Policies 2020: Key Components & Comparisons

Discover the assessment of Liberia's cigarette tax policies in 2020, highlighting key tax components such as cigarette price, affordability, tax share, and structure. Compare Liberia's overall score to averages in its region, income group, globally, and amongst top performers. Explore how Liberia's tax policies have evolved over time, driving improvements in tax revenue and public health.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

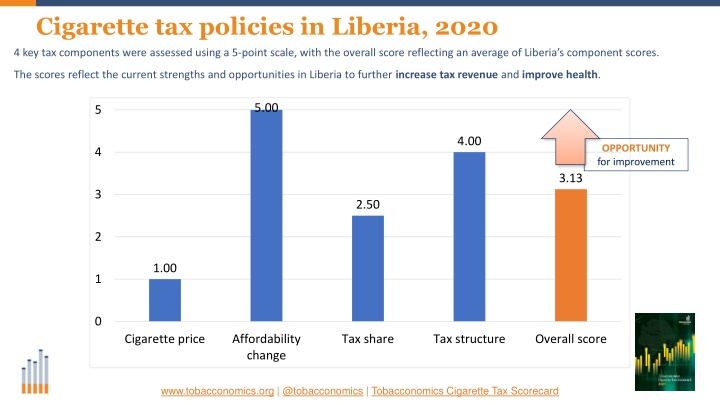

Cigarette tax policies in Liberia, 2020 4 key tax components were assessed using a 5-point scale, with the overall score reflecting an average of Liberia s component scores. The scores reflect the current strengths and opportunities in Liberia to further increase tax revenue and improve health. 5.00 5 4.00 OPPORTUNITY for improvement 4 3.13 3 2.50 2 1.00 1 0 Cigarette price Affordability change Tax share Tax structure Overall score www.tobacconomics.org | @tobacconomics | Tobacconomics Cigarette Tax Scorecard

How does Liberia compare to other countries? Liberia s overall score in 2020 is compared to the average overall scores in its region, income group, the world, and top performers. 5 4.63 4 3.13 3 2.28 2 1.64 1.42 1 0 Liberia Low-income group average African region average Global average Top performing countries www.tobacconomics.org | @tobacconomics | Tobacconomics Cigarette Tax Scorecard

How does Liberia compare to other countries? The components of Liberia s score in 2020 are compared to component scores in the region, income group, world, and top performers. 5.00 5 CIGARETTE PRICE requires the most improvement. 4.00 4 3 2.50 2 1.00 1 0 Cigarette price Affordability change Tax share Tax structure Liberia African region average Low-income group average Global average Top performing country average www.tobacconomics.org | @tobacconomics | Tobacconomics Cigarette Tax Scorecard

Liberias cigarette tax policies over time Liberia s overall score increased significantly between 2018 and 2020 due to an increase in cigarette price, a reduction in the affordability of cigarettes, an increase in tax share of price, and an improvement in tax structure. 5.00 5 4.00 4 3.13 3 2.50 2 1.00 1 0 Cigarette price Affordability change Tax share Tax structure Overall score 2014 2016 2018 2020 www.tobacconomics.org | @tobacconomics | Tobacconomics Cigarette Tax Scorecard