Labor Super-Exploitation and Value Transfer in Global Economy

Original research explores how labor super-exploitation and transformation drive international value transfer in the capitalist system. The study bridges orthodox Marxist and Ricardian perspectives, offering new insights into unequal exchange and imperialism.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Labour super-exploitation plus transformation makes for international value transfer Andy Higginbottom Kingston University, London

Intro a new theoretical path out of the stalemate between the orthodox Marxist (Palloix) and the Ricardian (Emmanuel) explanations of unequal exchange path is prompted by the original work of Marini, developed by Smith, on labour super- exploitation as the essential social relation at the base of value transfer.

Overall Positioning super-exploitation requires a re-dimensioning of surplus value to take account of specific oppressions that are driven by capital to appropriate extra surplus-value. This change of essence follows through into the systemic contradictions In Capital Volumes 1, 2 and 3

As regards Volume 3 Transformation of simple values into prices of production based on the contradiction between the cost and value of capitalist commodity. posits sector rate of profit as the product of the rate of surplus- value and the inverse of the sector organic composition. only varies organic composition, holding surplus-value at a presumed common rate within one country. The variation of the rate of surplus-value is a real factor conditioning both value composition and the mass of surplus value. Taking such variation by social region into account - commodities produced under more or less oppressive conditions of exploitation - requires a further modification to the concept of price of production, and with that a basis for the analysis of imperial relations as internal to capitalist produced commodities

Paper Steps In HM2018, I argued that Marx s solution to the transformation of simple exchange value to price of production is widely misinterpreted by the commentary literature. Positioning within structure of Capital. Presentation HM 2015, anticipates the results of the analysis I am about to give, which hopefully bridges the gap between these two.

Three theses: The transformation should be more clearly positioned within the arc of Volume 3, especially parts 1, 2 and 3. have an internal unity between them which is the actual realisation of value and surplus- value in a system of industrial capitals. Marx s solution is partial and limited against the premise of the problem he posited Necessary to include different rates of surplus-value in a reworking of the transformation solution, that modifies the price of production in a second dimension. Worked examples, re-dimensioned transformation provides a starting point for a theory of unequal exchange, super-profits and imperialism.

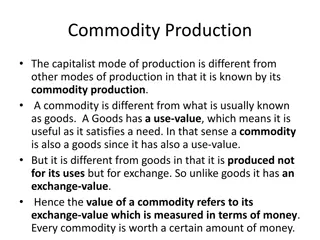

Vol 3 Ch1: Contradiction starts with the difference between the cost and value of a commodity. this could be pushed further as a full contradiction. Whereas Volume 1 opens with the simple commodity as a contradiction between use-value and exchange-value, the commodity that we start with is already explicitly a capitalist commodity and the contradiction is it as the product of labour and the product (in a different sense) of capital.

Ch 2: Profit as value-form explains the rate of profit as a form of appearance of an essence in which the origins are inverted and hidden. Profit does not appear as particularly arising from living labour, nor even labour-power, but in an undifferentiated way from all the elements of the process brought together by the genius of capital. profit is an addition to cost.

Ch 3: Rate of Profit Variables Formula for the rate of profit of (NB) an individual capital p = s . v / C or p = s . v / (v+c) where p is the rate of profit s is the rate of surplus-value (s/v) v is variable capital c is constant capital C is total capital advanced

More on Ch 3 Looks the possible determinants of s as four variables (wages, intensity, duration, productivity) rather than just the latter three in Chapter 17 of Volume 1. The level of wages clearly affects the rate of surplus value. Marx points out that in terms of all the possible ways that the rate of profit might rise or fall, certain differences may be logically possible but unlikely in terms of real content.

Chapter 4: Turnover Inserted by Engels to include the effect of the turnover period on the rate of profit summarising the analysis from Volume 2 the mediating concept of annual rate of surplus- value, which increases the more turnovers there are per year, given by the formula s.n/v , where n is the number of turnovers (Engels makes a mistake) Outcome: p = s . n . v / C Rate of surplus value x number of turnovers x variable capital in proportion to total capital.

Chapters 5 and 6: Cost Reduction economies in constant capital Use of, effect on workers of cost cutting variations in the price of the elements of constant capital, attention to raw materials perceived as a result of increased productivity rather than economies arising from greater exploitation, even in the leading example of cotton. Labour as cost but not value.

Summarising Part One A change in form but not a change in magnitude, surplus-value becomes profit, each individual capital realises the same profit as the surplus- value produced by the workers they exploit. the individual capital as the unit of analysis representing capital as such, or capital in general. But Marx suggests a limitation of this approach, in his early discussion of commodity chains Marx opens the possibility of certain capitals profiting from the exploitation of workers by other capitals.

Part Two: Ch 8 Limiting Assumption moves from the individual through the particular to the universal. strong statement against allowing for variation in the rate of surplus-value, consistent with the methodological assumption that the general can be captured at the level of capitalism in one country, no problem in principle in aggregating across countries. The assumption of one rate of surplus-value is undermined by what comes before both in theory, and in terms of the production of raw materials and what comes after in terms of the main counteracting tendencies to the tendency of the rate of profit to fall.

Methodological Comment This is not a level of abstraction issue as is often claimed, it is rather a simplifying assumption issue. Part 2 focuses on one aspect or dimension rather than two, the three (possibly four). This is not another level of abstraction, but a different perspective at the same level of abstraction, or rather similar movement between levels of abstraction.

Movement of contradiction from the individual through particulars to systemic whole (laws) Repeating pattern Volume 1B: Essence /Production Volume 2: Appearance /Circulation Volume 3A: Actualisation of Production and Circulation Transformation Simple reproduction limiting assumptions, contradictions pass over to expanded reproduction, or capital accumulation. Volume 3 Ch 8 Transformation is Simple Transformation First cut at systemic level, but limiting assumptions, then contradictions From simple to ....? expanded, more complex Expansion of Simple Transformation to Expanded Transformation What is particular about the Volume 3 transition? How surplus-value becomes profit in capitalist system. Simple Reproduction Simple Reproduction

Scenario 1: Same Capital Advanced, Rate of Surplus-Value Varies, Value Produced Varies Region c v k=c+v Rate s/v % s Simple value c+v+s Profit Price of production Divergence I II III IV V Totals 80 80 80 80 80 400 20 20 20 20 20 100 100 100 100 100 500 50 10 20 30 60 80 200 40 40 40 40 40 200 140 140 140 140 140 700 +30 +20 +10 -20 -40 110 120 130 160 180 700 100 150 300 400 100 0 The greater the rate of surplus value, the more surplus value produced for a given application of variable capital. The same variable capital will be exchanged for more labour-power. (NB this is already an expansion variable capital in it material form more workers) The average rate of profit is total surplus value / total capital advanced = 200/500 =40% Main result: in regions where workers are exploited at a lower rate of surplus-value, commodities they produce will have a higher price of production than their simple value; and in regions where workers are exploited at a higher rate of surplus-value, the commodities they produce will have a lower price of production than their simple value.

Scenario 2: Organic Composition Same, Rate of Surplus-Value Varies, Capital Advanced Varies Inversely, Value produced same Region c Simple value c+(v+s) v s Rate s/v % k=c+v Profit Price of production Divergence I II III IV V Totals 80 80 80 80 80 80+40 80+40 80+40 80+40 80+40 400+200 20 30 35 10 20 10 100 33.3 14.3 300 700 100 110 115 90 85 500 20 22 23 18 17 120 132 138 108 102 600 0 +12 +18 -12 -18 5 30 35 5 400 100 100 100 0 Average rate of profit is total surplus value / total capital advanced 100/500 = 20% Regions have different value compositions, not due to a change in the organic composition but entirely due to changes in the rate of surplus value In one sense it doesn t matter if the change in value composition is due to different sector variations in organic composition or regional variations in the rate of surplus-value, in that both effect the average rate of profit and both effect the price of production.

Scenario 3: Organic Composition Varies, Rate of Surplus-Value Same, Value Composition Varies duplicating Scenario 2 Outcomes Sector c v s Rate s/v % value c+(v+s) Simple Profit Price of production Diverge nce k=c+v I II III IV V Totals 80 90 95 70 65 20 20 20 20 20 100 20 20 20 20 20 100 100 100 100 100 120 130 135 110 105 600 20 22 23 18 17 120 132 138 108 102 600 0 100 110 115 90 85 500 +12 +18 -12 -18 400 100 100 0 Not only are the aggregated total constant capital, variable capital and surplus value the same in both scenarios, generating the same average rate of profit; but the cost or capital advanced column k = (v+c) column is the same in both scenarios. Scenario 2 changes in v, with c constant, that is variations in the rate of surplus-value by region; here it is due to changes in c with v constant It is against the advance of capital that the profits by sector or region are calculated in all equilibrating scenarios.

One other thing: how does transformation actually take place? Differential realisation: Labour time and surplus labour time give rise (convert) to a different result when considered as simple exchange value and when considered as price of production, the rates of conversion into commodity prices are different. Marx s transformation solution is not about commodity inputs and outputs but a movement from inner to outer, the actualisation of essence in appearance The input is simple exchange value as the inner form and the output is price of production as the outer form the underlying common substance is labour time. (then we bring in commodity movements based on complex/expanded price of production)

Further... A non-linear reworking of Capital 3A offers a new conceptual approach to the conversion of surplus-value into profit, by social region as well as sector. Divergent social regions (economic territories) are imperialist world system dynamics set in motion by capital s search for sources of extra surplus-value. International value transfer is the actualisation in circulation of the differential realisation of surplus- value produced by workers employed by capitals in distinct regions, generated by an oppressive dynamic unleashed within the capitalist mode of production.