JMP as a FinTech Robo: Portfolio Visualization & Rebalancing Advisor

"Explore how JMP can be utilized as a FinTech Robo Advisor for portfolio visualization and automatic rebalancing. Discover the importance of rebalancing portfolios annually to protect investments and potentially enhance returns. Dive into the advantages of maintaining a balanced portfolio and the steps involved in rebalancing for lower volatility. Gain insights into navigating complex debt situations and the psychological impact of financial stress. Utilize historical data analysis in JMP to make informed decisions for financial management."

Uploaded on Sep 30, 2024 | 0 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Use JMP as a FinTech Robo: Portfolio Visualization and Automatically Rebalance Advisor Hui Di Sept. 11 2017

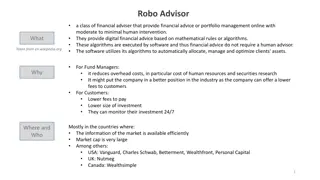

Background FinTech Robo Advisor Rebalancing among different financial institutes/accounts becomes a challenge JMP as a FinTech Robo Advisor Choose this topic because of easily understandable context Potentially use for other Robots, such as Student Debt Management Advisor, etc. Complex debt situations: debts from credit cards, student loans, mortgages, etc. Navigating through debt is overwhelmingly a concern for the majority. Apart from financial stress, debt also creates a psychological strain which serves to compound the problem. 9/19/2017 2

Rebalancing is necessary to protect your portfolio Historical Data for SP500 and Bond http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/hist retSP.html Historical Data analysis in JMP to see why Balanced Portfolio has advantages 9/19/2017 3

Rebalancing is necessary to protect your portfolio Advantages of rebalancing portfolio annually o Potential additional return (2002 - 2016) 9/19/2017 4

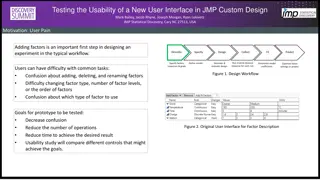

Advantages of rebalancing portfolio annually -- Potentially lower volatility Step 1: Study distribution and fit distribution 9/19/2017 5

Rebalancing is necessary to protect your portfolio Advantages of rebalancing portfolio annually -- Potentially lower volatility Step 2: Create random formula from step 1. 9/19/2017 6

Rebalancing is necessary to protect your portfolio Advantages of rebalancing portfolio annually -- Potentially lower volatility Step 3: Create column Fixed 60-40 end year total and Fixed 60-40 portfolio return and their formulas(Initial $100) Create column Balanced 60-40 end year total and Balanced 60-40 portfolio return and their formulas(Initial $100) (see JSL ) Add 1000 rows 9/19/2017 7

Rebalancing is necessary to protect your portfolio Advantages of rebalancing portfolio annually -- Potentially lower volatility Step 4: Launch Distributions from step 3 Notice that the standard deviation is reduced From the data table, notice that the after 100 samples, the none balanced portfolio has about 100% stocks. 9/19/2017 8

Use JMP as a FinTech Robo Portfolio Rebalance Advisor Step 1 : Know your goal/risk and understand composition of your current Funds/ETFS o Assets category from Charles Schwab, for an example, for a diversified portfolio (left) o Composition info of current funds from morning star(right) 9/19/2017 9

Use JMP as a FinTech Robo Portfolio Rebalance Advisor Step 2 : Import assets from accounts of different Institutes into JMP to create a master data table oFidelity and Charles Schwab allow users to download to .cvs files 9/19/2017 10

Use JMP as a FinTech Robo Portfolio Rebalance Advisor Step 3 : Add some detailed information on funds to create your master data table according to asset category from step 1 9/19/2017 11

Use JMP as a FinTech Robo Portfolio Rebalance Advisor Step 4: Visualize asset allocation for current assets Question: some funds or ETFs are not 100% stock. 9/19/2017 12

Use JMP as a FinTech Robo Portfolio Rebalance Advisor Step 4 : More on asset allocation for current assets Set up a new data table to collect funds profile. Look into details on funds composition (step 1) Get all assets information using virtual join to make a master data table. 9/19/2017 13

Use JMP as a FinTech Robo Portfolio Rebalance Advisor Step 4 : continued Set Linked ID and link reference 9/19/2017 14

Use JMP as a FinTech Robo Portfolio Rebalance Advisor Step 4 : continued Actual Asset allocation among domestic equity, foreign equity, cash, bond, and others. Notice that the equity is 76% instead of 85% from slide 12. When looking into detailed composition, the portion may differ. 9/19/2017 15

Use JMP as a FinTech Robo Portfolio Rebalance Advisor Step 5: - Review of customer s risk tolerance and bench mark - Rebalance using master data table and bench data table (UI or JSL) 9/19/2017 16

Use JMP as a FinTech Robo Portfolio Rebalance Advisor - Rebalance Summary Report in HTML5 - Clients can share this from different devices and drill down to see information 9/19/2017 17

Conclusion The broad diversified funds or ETFs from different accounts up to 20 asset classes in any account means that implementing rebalancing process could be complex and challenging for an individual investor trying to manually manage his or her portfolio. JMP allow us to simplify the portfolio management process and make rebalancing more efficient. The re-usable script make the next rebalancing easier 9/19/2017 18