Innovative Loan App Solutions for Modern Financial Needs

Explore Finsta Software, a leading Banking Loan Software Provider in Mumbai, Delhi, Kolkata, Pune, Chennai, Bengaluru, Rajasthan, Punjab. Offering Reliable Loan Management Solutions.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

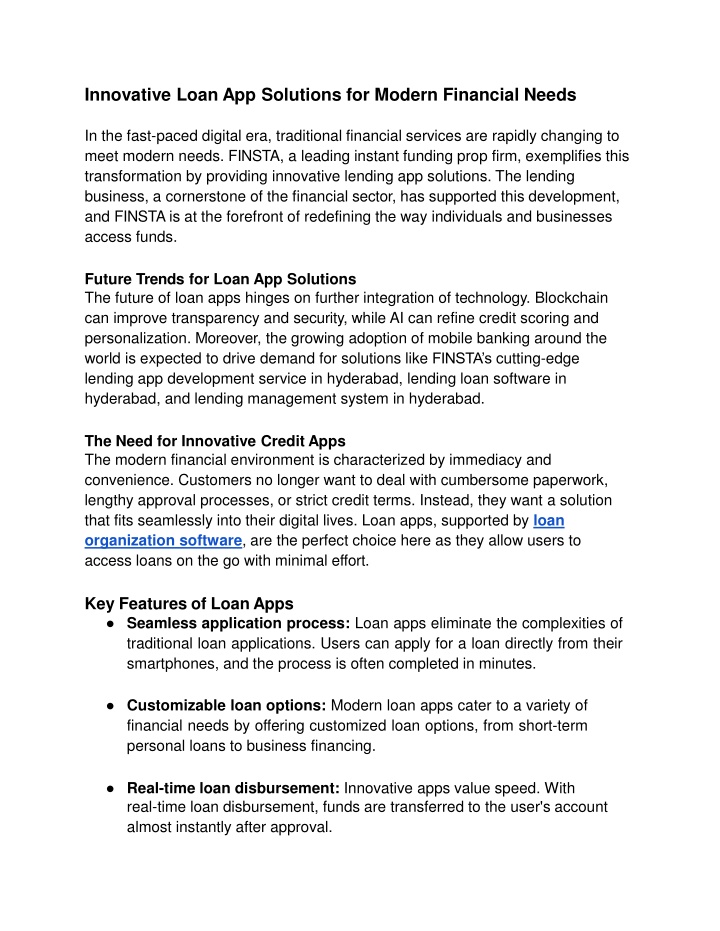

Innovative Loan App Solutions for Modern Financial Needs In the fast-paced digital era, traditional financial services are rapidly changing to meet modern needs. FINSTA, a leading instant funding prop firm, exemplifies this transformation by providing innovative lending app solutions. The lending business, a cornerstone of the financial sector, has supported this development, and FINSTA is at the forefront of redefining the way individuals and businesses access funds. Future Trends for Loan App Solutions The future of loan apps hinges on further integration of technology. Blockchain can improve transparency and security, while AI can refine credit scoring and personalization. Moreover, the growing adoption of mobile banking around the world is expected to drive demand for solutions like FINSTA s cutting-edge lending app development service in hyderabad, lending loan software in hyderabad, and lending management system in hyderabad. The Need for Innovative Credit Apps The modern financial environment is characterized by immediacy and convenience. Customers no longer want to deal with cumbersome paperwork, lengthy approval processes, or strict credit terms. Instead, they want a solution that fits seamlessly into their digital lives. Loan apps, supported by loan organization software, are the perfect choice here as they allow users to access loans on the go with minimal effort. Key Features of LoanApps Seamless application process: Loan apps eliminate the complexities of traditional loan applications. Users can apply for a loan directly from their smartphones, and the process is often completed in minutes. Customizable loan options: Modern loan apps cater to a variety of financial needs by offering customized loan options, from short-term personal loans to business financing. Real-time loan disbursement: Innovative apps value speed. With real-time loan disbursement, funds are transferred to the user's account almost instantly after approval.

Enhanced security measures: To build trust, loan apps are equipped with robust encryption, multi-factor authentication, and fraud detection mechanisms. Benefits of LendingApps for Modern Financial Needs 1.Accessibility: Loan apps bridge the gap between traditional banking and the underserved. They provide access to credit to those without a solid banking history or collateral. 2.Flexibility: Users can borrow a specific amount tailored to their needs and repay it at flexible intervals. 3.Transparency: Modern loan apps emphasize transparency by offering clear terms, interest rates, and repayment plans, which increases trust. Integration with the financial ecosystem: Many apps, supported by lending software providers in hyderabad and lending software solutions in hyderabad, are integrated with digital wallets, e-commerce platforms, and other financial services, creating a seamless ecosystem for users. Industries That Benefit from Lending Apps Small and medium-sized businesses: Entrepreneurs use loan apps to get quick funding to expand their business or manage cash flow. Gig economy workers: Freelancers and gig workers turn to these apps for instant loans when their income fluctuates. Personal loan borrowers: From medical emergencies to travel, personal loan apps cover a wide range of personal needs.

Businesses leveraging loan management software companies and digital lending software in hyderabad are creating new opportunities in these areas. Conclusion Innovative loan app solutions are not just a convenience; they are a necessity in today's digital world. FINSTA, an instant funding prop firm, offers an agile, efficient, and customer-centric approach to credit that addresses the modern financial needs of both individuals and businesses. Organizations like loan software for lenders in hyderabad, best lending loan software providers in hyderabad, and lending app development companies in Hyderabad are leading this transformation. As technology continues to evolve, there's no doubt that solutions from lending mobile app providers in hyderabad and loan organization software firms will play a key role in shaping the future of finance. Improve your financial operations today with a cutting-edge loan app solution tailored to your needs.