Indian Banking Sector Overview and History

Explore the history and evolution of the Indian banking sector, from its origins during the British era to the establishment of prominent banks and key milestones such as nationalization. Learn about the types of banks in India, including central, public sector, private sector, cooperative, and development banks. Discover a list of private sector banks and the role of cooperative banks in financing rural and urban areas.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

HISTORY OF BANKING SECTOR Developed during the Britishera. British East India Company established three banks. Bank of Bengal-1809 Bank of Bombay-1840 Bank of Madras 1843 These three banks were later amalgamated and called Imperial Bank Taken over by State Bank of India in1955

The Reserve Bank Of India was established in 1935 Followed by Punjab National Bank, Bank Of India, Canara Bank and Indian Bank. In 1969, 14 major banks were nationalized and in 1980, 6 major private sector banks were taken over by the government.

TYPES OF BANKS Central Bank The Reserve Bank of India Public Sector Banks State Bank of India and its associate banks called the State Bank Group. 20 nationalized banks. Regional rural banks mainly sponsored by public sector banks.

Private SectorBanks Private Banks Foreign banks operating in India. Scheduled co-operative banks. Non-scheduled banks Co-operativeSector The co-operative sector is very much useful for rural people. State co-operative Banks Central co-operativebanks Primary Agriculture CreditSocieties

Development Banks/FinancialInstitutions IFCI IDBI ICICI IIBI NABARD Export Import Bank ofIndia National Housing Bank

LIST OF PRIVATE SECTOR BANKS Bank of Punjab Bank of Rajasthan Catholic Syrian Bank Centurion Bank City Union Bank Dhanalakshmi Bank Development Credit Bank Federal Bank HDFC Bank ICICI Bank

CO-OPERATIVE BANKS IN INDIA Cooperative banks in India finance rural areas under: Farming Cattle Milk Hatchery Personal Finance

COOPERATIVE BANKS IN INDIA FINANCEURBAN AREAS UNDER: Self-employment Industries Small scale units Home Finance Consumer finance Personal finance

FOREIGN BANKS IN INDIA ABN-AMRO Bank Abu Dhabi Commercial Bank Bank of Ceylon BNP Paribas Bank Citi Bank China Trust Commercial Bank Deutsche Bank HSBC JPMorgan Chase Bank Standard Chartered Bank Scotia Bank Taib Bank

UPCOMING FOREIGN BANKS IN INDIA Royal Bank of Scotland Switzerland's UBS US-based GE Capital Credit Suisse Group Industrial and Commercial Bank of China

REGIONAL RURAL BANKS Haryana State Cooperative Apex Bank Limited NABARD National Bank for Agriculture and Rural Development. Sindhanur Urban Souharda Co-operative Bank United Bank of India

RBI Central Bank of the Country Established on April 1, 1934

PREAMBLE To regulate issue of Bank notes, to keep the reserves with a view to securing monetary stability in India and generally to operate the currency and credit system of the country to its advantage

ROLE OF RESERVE BANK 1. Issue of Notes 2. Banker, Agent and advisor to the government 3. Banker s Bank & Lender of Last Resort 4. Custodian of Foreign Exchange Reserves 5. Regulation of Banking System 6. Clearing House Functions 7. Credit control

HISTORY OF BANKING IN INDIA The first bank in India was established in 1786. From 1786 till today it has gone through three distinct phases Phase1: Early phase from 1786 to 1969 Phase2: Nationalization of Indian Banks and up to 1991prior to Indian banking reforms Phase3: New phase of Indian Banking system with the advent of the Indian Financial Banking sector reforms after 1991

The General Bank of India was PHASE1 established in 1786. Then came the Bank of Hindustan and Bengal Bank. The East India company established Bank of Bengal (1809), Bank of Bombay (1840), Bank of Madras (1843) and these banks called as Presidency Bank. These three banks were amalgamated in 1920 and named as the Imperial Bank of India, which was started as the as the private shareholder bank mostly European shareholder .

PHASE1 (CONT) In 1865 Allahabad Bank was established and first time exclusively by Indians, Punjab National Bank Ltd was setup in 1894 with headquarter in Lahore. Between 1906 to 1913 many banks were established namely Canara bank, Central bank, Bank of India, Bank of Baroda, Indian Bank, Bank of Mysore were established. There were approximately 1100 banks mostly small was established. To streamline the banks and to gain control over the banks Govt. of India came up with The Banking Companies Act in 1949 which was later changed to Banking Regulation Act 1949.

PHASE2 Govt. took some major steps to bring reforms in the Indian banking sector after independence. In 1955, it nationalized The Imperial Bank of India with extensive banking facilities on a large scale especially in rural and Semi-urban areas. It form SBI to act as the principal agent of RBI. In 1969 late Prime Minister Mrs. Indira Gandhi nationalized 14 commercial banks.

PHASE2 (CONT) In 1980 seven more banks were nationalized which brings around 80% banks under the control of Govt. Govt. took the following steps:- 1949: Enactment of Banking Regulation Act 1955: Nationalization of SBI 1959: Nationalization of SBI Subsidiaries 1961: Insurance cover extended to deposits 1969:Nationalization of 14 commercial banks 1971:Creation of credit guarantee corporation 1975:Creation of Regional Rural Banks (RRB) 1980:Nationalization of banks with deposits over 200 crore

PHASE3 This phase brought many more facilities in the banking sector. In 1991, under the chairmanship of Mr. M Narasimham, a committee was set up which work for the liberalization of banks in India During this country is flooded with the Foreign banks and ATMs. Phone Baking and Net banking was introduced

BEGINNING OF MODERN BANKING IN INDIA In 1786, English Agency House had established The General Bank of India. This was the beginning of the modern banking in India.

NATIONALIZATION OF BANKS In July 1969 Govt. of India nationalized 14 major scheduled commercial banks, each having the minimum deposit of Rs 500 million.

RATIONAL FOR NATIONALIZATION Removal of control of few large Industrial and Business houses Provision for adequate credit for Agriculture, Small Industries, exports etc Giving Professional bent to management Encouraging a new class of entrepreneurs Change over from class banking to mass banking

IMPACT OF NATIONALIZATION Unprecedented growth in the branch network of the commercial banks Rapid growth in deposit mobilization and expansion of credit However commercial banks faces decline in profitability Directed lending and less flexibility Increase cost of operations

FORMATION OF REGIONAL RURAL BANKS Formation of Regional Rural Banks under the act of RRB 1976 These are state sponsored, Region based, Rural based, Rural oriented, commercial banks Under this approach 196 RRBs were setup

PROCESSES OF REFORMS On all important issues, workings group are constituted or technical reports are prepared Resource Management Discussions meetings are held by the RBI with select commercial banks, prior to the policy announcements To form a Technical Advisory Committee on Money, Foreign Exchange and Government Securities Markets (TAC)

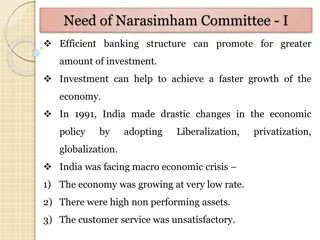

NARSIMHAM COMMITTEE I (1991) Reduction of SLR and CRR Minimum Capital Adequacy Ratio Prudential norms Disclosure norms Rationalization of foreign operations in India Special tribunals and Asset Reconstruction fund

CONT Reduction of government stake in PSB s Deregulation of interest rates

NARSIMHAM COMMITTEE II Focus on technological upgradation in Banking sector Mergers of banks need to be encouraged Reorganizing of banks into global, national and regional banks Autonomy of banks Capital Adequacy requirement

INITIATIVES TAKEN BY GOVERNMENT National Electronic Clearing Service (NECS) : the core banking solutions Reduction in the Reserve Bank's policy rates and easy liquidity conditions Cutting down of repo and reverse repo rates Tax free cash withdrawals from banks Inter-ATM usage transaction

CHALLENGES Globalisation Enhancement of customer service: demand for new products, particularly derivatives Application of technology Implementation of Basel II Implementation of new accounting standards Compliance with KYC aspects Interest rate risk Interest rates and non-performing assets Competition in retail banking The urge to merge