Inconsistent Tax Treatment of Liability Assumptions

The discussion revolves around the inconsistent tax treatment of liability assumptions in a federal tax conference at the University of Chicago. It includes a case study on the transfer of assets and liabilities involving nonqualified deferred compensation and debates on Section 404(a)(5) implications. Various legal perspectives are presented by experts from reputable law firms and academia, addressing the complexities and implications for taxpayers.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

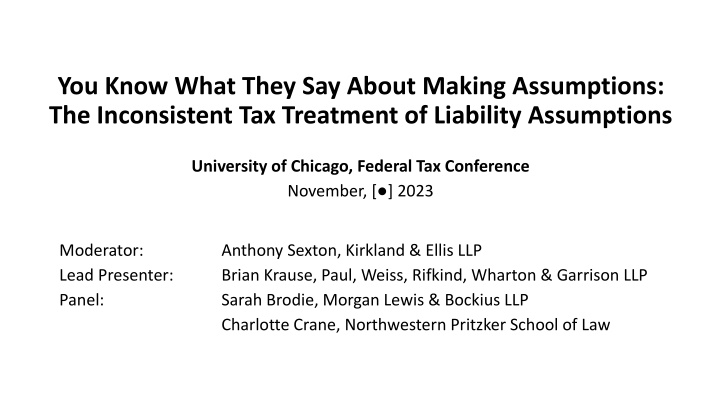

You Know What They Say About Making Assumptions: The Inconsistent Tax Treatment of Liability Assumptions University of Chicago, Federal Tax Conference November, [ ] 2023 Moderator: Lead Presenter: Panel: Anthony Sexton, Kirkland & Ellis LLP Brian Krause, Paul, Weiss, Rifkind, Wharton & Garrison LLP Sarah Brodie, Morgan Lewis & Bockius LLP Charlotte Crane, Northwestern Pritzker School of Law

Jumping Through Hoops Jumping Through Hoops Facts Hoops, LP ( Hoops ), an accrual-method partnership, owned the Memphis Grizzlies. In 2012, Hoops transferred its assets and liabilities to Memphis Basketball Partners, LP ( Memphis Basketball ) in a taxable transaction. Liabilities included nonqualified deferred compensation payable after 2012 to Zach Randolph and Mike Conley. Deferred compensation was approximately ~$12.7 million (which the parties agreed had an approximately ~$10.7 million present value as of the date of the sale). Hoops included the ~$10.7 million assumed liability when calculating its gain from the sale, but claimed an offsetting deduction of ~$10.7 million for the compensation expense. The Service disallowed the deduction on the basis that, under Section 404(a)(5), an employer may not deduct nonqualified deferred compensation until included in the income of the employees (which would generally be when paid) and maintained that the assumed liability of ~$10.7 million should have been included in Hoops s amount realized on the sale. 2

Jumping Through Hoops (Contd) Jumping Through Hoops (Cont d) A. First Argument: Section 404(a)(5) and Economic Performance The deduction timing rule of Section 404(a)(5) is incorporated into the economic performance rule of Section 461(h) and, therefore, is accelerated on the sale to Memphis Basketball. Section 404(a)(5): If contributions are paid by an employer to or under a stock bonus, pension, profit-sharing, or annuity plan, or if compensation is paid or accrued on account of any employee under a plan deferring the receipt of such compensation, such contributions or compensation shall not be deductible under this chapter; but, if they would otherwise be deductible, they shall be deductible under this section, subject, however, to the following limitations as to the amounts deductible in any year:... in the taxable year in which an amount attributable to the contribution is includible in the gross income of employees participating in the plan... Section 461: Test for determining when an expense of an accrual method taxpayer may be deducted (i) all events must have occurred that established the existence of the liability, (ii) the amount of the liability must be able to be determined with reasonable accuracy, and (iii) economic performance has occurred. Treas. Reg. Section 1.461-4(d)(5)(i): If, in connection with the sale or exchange of a trade or business by a taxpayer, the purchaser expressly assumes a liability arising out of the trade or business that the taxpayer but for the economic performance requirement would have been entitled to incur as of the date of the sale, economic performance with respect to that liability occurs as the amount of the liability is properly included in the amount realized on the transaction by the taxpayer... 3

Jumping Through Hoops (Contd) Jumping Through Hoops (Cont d) B. Second Argument: Excluding the Liability from Amount Realized Hoops argued it should be entitled to exclude the deferred compensation liabilities from its amount realized, since liabilities should only be included in the amount realized if such liabilities were previously deducted or gave rise to tax basis. See Tufts, 461 U.S. 300 (1983). According to the Tax Court, however, since Hoops was discharged from its obligation to pay the nonqualified deferred compensation as a result of the sale, Hoops was required to take into account such lability in computing its gain or loss under Section 1001 (citing Commercial Security Bank v. Commissioner, 77 T.C. 145, 148-49 (1981) (citing Crane v. Commissioner, 331 U.S. 1 (1947)). Alternatively, even if Hoops were required to include the assumed liability in amount realized, Hoops should be entitled to offset or reduce its amount realized by the same amount. See James M. Pierce Corp. v. Commissioner, 326 F.2d 67 (8th Cir. 1964). Tax Court: Pierce is distinguishable didn t involve Section 404(a)(5) expenses. 4

II. Defensive Rebound II. Defensive Rebound Would Hoops, or its partners, be entitled to a deduction in a future year when Memphis Basketball actually pays the deferred compensation and such payments were included in the players income? Or would the deduction be permanently lost? According to the Service s brief on appeal, Hoops is certainly entitled to a deduction in later years when the deferred compensation is actually paid See also TAM 8939002 ( the deductibility of these amounts, therefore, is subject to the deduction timing rules of Section 404(a)(5) of the Code ). Seventh Circuit also stated Hoops would be entitled to a deduction once the compensation is actually paid. 5

II. Defensive Rebound (Contd) II. Defensive Rebound (Cont d) Deductibility would key on whether the future payment of the deferred compensation by Memphis Basketball would be considered both: (i) paid or incurred by during the taxable year; and (ii) in connection with a trade or business? 6

II. Defensive Rebound (Contd) II. Defensive Rebound (Cont d) Paid or incurred by during the taxable year? Pierce deems the seller to have paid the liability, but the deemed payment occurs in the year of sale. Section 162(a) is written in the passive tense it doesn t say who must make the payment. 7

II. Defensive Rebound (Contd) II. Defensive Rebound (Cont d) In connection with a trade or business If the business were discontinued in the year of sale, would Hoops be prevented from claiming a deduction in a subsequent year? See Rev. Rul. 67-12. If Hoops were dissolved after the sale, would it be prevented from claiming a deduction? See Flood v. U.S., 133 F.2d 173, (1st Cir. 1943); Ward v. Commissioner, 20 T.C. 332 (1953), aff'd 224 F.2d 547 (9th Cir. 1955). What if Hoops were a corporation? See Rev. Rul. 75-223, Dover Corporation and Subsidiaries v. Commissioner, 122 T.C. 324 (2004). 8

III. Changing the Hoops Playbook III. Changing the Hoops Playbook Option 1: Payment Slam Dunk : Hoops pays the players their deferred compensation contemporaneously with closing. Buyer Partners Seller Partners Assets & Liabilities (Excluding Employment Contract Liability) Purchase Price Memphis Basketball Partners, LP Hoops, LP ~$12.7 million Players Employment Contract 9

III. Changing the Hoops Playbook (Contd) III. Changing the Hoops Playbook (Cont d) Option 1: Payment Slam Dunk : Hoops pays the players their nonqualified deferred compensation contemporaneously with closing. Ensures Hoops s partners would receive deduction attributable to deferred compensation liability. Consider countervailing business reasons. 10

III. Changing the Hoops Playbook (Contd) III. Changing the Hoops Playbook (Cont d) Option 2: Liability Alley-oop : Hoops retains the deferred compensation liability; Memphis Basketball pays Hoops an additional ~$12.7 million of purchase price in the year of the sale. Buyer Partners Seller Partners Assets & Liabilities (Excluding Employment Contract Liability) Purchase Price + ~$12.7 million Memphis Basketball Partners, LP Hoops, LP Players Employment Contract 11

III. Changing the Hoops Playbook (Contd) III. Changing the Hoops Playbook (Cont d) Option 2: Liability Alley-oop : Hoops retains the deferred compensation liability; Memphis Basketball pays Hoops an additional ~$12.7 million of purchase price in the year of the sale. Hoops recognizes additional capital gain (and possibly ordinary income to the extent of any Section 751(a) gain). When the nonqualified deferred compensation comes due, Hoops, or its partners, makes made a ~$12.7 million payment to Memphis Basketball to fund the liability. Consider whether Hoops, under Arrowsmith principles, would have claimed a capital loss in the subsequent year creating a timing mismatch. The loss would also be of a different character than the deduction under Section 404(a)(5). 12

III. Changing the Hoops Playbook (Contd) III. Changing the Hoops Playbook (Cont d) Option 3: Partnership Layup : Partners of Hoops sell all of their equity in Hoops to Memphis Basketball. See Rev. Rul. 99-6, Situation 2. Purchase Price Buyer Partners Seller Partners Hoops, LP Equity Memphis Basketball Partners, LP Hoops, LP Players Employment Contract 13

III. Changing the Hoops Playbook (Contd) III. Changing the Hoops Playbook (Cont d) Option 3: Partnership Layup : Partners of Hoops sell all of their equity in Hoops to Memphis Basketball. See Rev. Rul. 99-6, Situation 2. Sellers perspective: Sellers are treated as selling partnership interests in a transaction governed by Section 741. Buyer s perspective: Hoops is deemed to make a liquidating distribution of its assets to the selling partners, and Memphis Basketball is then deemed to have purchased the assets from the selling partners. Same treatment whether the nonqualified deferred compensation was a liability under Section 752 or not. 14

III. Changing the Hoops Playbook (Contd) III. Changing the Hoops Playbook (Cont d) Option 1: Payment Slam Dunk Option 2: Liability Alley-oop Option 3: Partnership Layup Description Hoops pays the players their nonqualified deferred compensation contemporaneously with closing. Hoops retains the nonqualified deferred compensation liability; Memphis Basketball pays Hoops an additional ~$12.7 million of purchase price in the year of the sale. Partners of Hoops sell all of their equity in Hoops to Memphis Basketball. See Rev. Rul. 99-6, Situation 2. Pros [+] Hoops s partners receive the deduction in the year of sale. Hoops s partners receive the deduction in a post-sale year. Lower capital gain to Hoops partners in the year of sale. Cons [-] Business reasons, including accelerating payments of future liabilities. Possible lack of income to offset the deduction in post-sale year. Memphis Basketball receives deduction in a post-sale year. 15

IV. Did the Courts Shoot an Airball? IV. Did the Courts Shoot an Airball? Revisiting Hoops s Arguments: Offsetting or Reducing the Amount Realized under Pierce: Piercestated that the taxpayer s deemed payment of the liability either would constitute a deductible business expense under 162(a) or it would operate in reduction, and here, by reason of identity of amounts, in elimination, of the income includable with the cessation of the need for the reserves (emphasis added). Section 404(a)(5) relates to the deduction for compensation expense, it does not address its treatment as an amount realized. No subsequent judicial authorities cite Pierce for allowing an offset to the amount realized, and this likely goes too far as it would allow a seller to exclude from its amount realized liabilities that have previously provided a tax benefit. 16

IV. Did the Courts Shoot an Airball? (Contd) IV. Did the Courts Shoot an Airball? (Cont d) Revisiting Hoops s Arguments: Excluding the Liability from the Amount Realized Treas. Reg. Section 1.1001-2(a)(1) and (2) do not reference whether the liability created any tax benefit. See also United States v. Hendler, 303 U.S. 564 (1938). However, other authorities seem to justify including certain types of liability in the transferor s amount realized due to previous tax benefits (see Tufts, Section 752, Section 357(c), and Section 108(e)(2)). Treas. Reg. Section 1.1001-2(a)(3) provides that a seller s amount realized on the sale of property does not include a liability incurred by reason of the acquisition of the property sold, except to the extent the liability was not taken into account in determining the seller s basis in the assets sold. This would seem to protect Memphis Basketball on a subsequent transfer, but it s unclear why it shouldn t protect Hoops as well. Intended to address Estate of Franklin v. Commissioner, 544 F.2d 1045 (9th Cir. 1976)? Treasury should consider modifying Treasury Regulations Section 1.461-4(d)(5)(i) and Treas. Reg. Section 1.1001-2(a)(3). 17

V. The Curious Incident of the (Possibly) Vanishing Basis? V. The Curious Incident of the (Possibly) Vanishing Basis? Background: Tufts and Section 752(c) An overlooked holding in Tufts was that Section 752(c) applies to contributions to, and distributions from, partnerships of property subject to nonrecourse debt in excess of the fair market value of the property. In Tufts, a partnership borrowed money on a nonrecourse basis to purchase an apartment complex. The partners then sold their partnership interests at a time when the fair market value of the property was less than the remaining outstanding amount under the mortgage. Section 752(c) provides that a liability encumbering property is treated as a liability of the owner of the property only to the extent of the fair market value of the property. Accordingly, the taxpayer argued that the excess nonrecourse liability- the portion of the liability in excess of the fair market value of the property- was not treated as its liability under Section 752(d) and therefore was not included in its amount realized. 18

V. The Curious Incident of the (Possibly) Vanishing Basis? (Contd) V. The Curious Incident of the (Possibly) Vanishing Basis? (Cont d) Background: Tufts and Section 752(c) The Court rejected this interpretation of Section 752(c) for several reasons. 1. Treas. Reg. Section 1.752-1(e) (formerly (c)), which states that the fair market value limitation on liability assumptions applies in cases of distributions of property from or contributions of property to a partnership; the regulation makes no mention of sales or exchanges of partnership interests or of Section 752(d) 2. When Congress enacted Section 752(c), it was specifically trying to prevent a partner from inflating their tax basis in their partnership interest in order to have more capacity to utilize allocations of deduction and loss under Section 704(d), without putting more capital at risk in the partnership. For example, under Section 752(a), when a partner assumes the liability of a partnership, it is treated as if it made a contribution of money to the partnership in an amount equal to the assumed liability. That deemed capital contribution would increase the partner s basis in their partnership interest under Section 722. 3. The fact that the full amount of the liability was included by the partnership in its basis in the property, and the partners in their partnership interests. It would have been asymmetrical to then exclude the excess nonrecourse liability from the partners amounts realized. 19

V. The Curious Incident of the (Possibly) Vanishing Basis? (Contd) V. The Curious Incident of the (Possibly) Vanishing Basis? (Cont d) Open Questions: Tufts and Section 752(c) How exactly would Section 752(c) actually apply mechanically to a contribution to or distribution from a partnership of property encumbered by a liability in excess of its value? How does Section 752(c) prevent inflation of basis, and where does excess basis go? McKee has suggested that under Section 752(c) the liability should be bifurcated. 1. A portion of the liability equal to the fair market value of the distributed property is treated as assumed by the distributee partner, the remaining portion of the liability is treated as if it remained a partnership liability. 2. If and when the distributee partner makes payments on the portion of the liability in excess of the property s fair market value, it is treated as if it made a capital contribution to the partnership under Section 752(a), resulting in a basis increase in its partnership interests. The other partners receive an equal and offsetting deemed distribution under Section 752(b). But how would this work when the distribution is a liquidating distribution, and the partnership no longer exists? 20

V. The Curious Incident of the (Possibly) Vanishing Basis? (Contd) V. The Curious Incident of the (Possibly) Vanishing Basis? (Cont d) Application of Section 752(c) to Liquidating Distributions Assume that Partnership AB has two partners, A and B. Partnership AB owns all of the equity of LLC, a single member LLC treated as a disregarded entity for tax purposes that operates an active business. Partnership AB has an adjusted basis in LLC s assets of $1.4 and LLC has incurred third party debt of $1.8, which is considered nonrecourse to Partnership AB and its Partners. The current fair market value of LLC s assets is $1.2. Partnership AB redeems A in exchange for cash, or Partner B purchases Partner A s entire interest. Under Revenue Ruling 99-6, Partnership AB is deemed to liquidate, with Partner B receiving the equity of LLC. What is B s tax basis in the assets of LLC? Under Section 732(b), a partner s basis in property distributed in liquidation of its partnership interest is equal to the partner s adjusted basis in the partnership interest reduced by any money distributed in the same transaction. Under Section 752(b), a decrease in a partner s share of the liabilities of a partnership is treated as if it were a distribution of money to the partner by the partnership. 21

V. The Curious Incident of the (Possibly) Vanishing Basis? (Contd) V. The Curious Incident of the (Possibly) Vanishing Basis? (Cont d) Application of Section 752(c) to Liquidating Distributions Applying Sections 732(b) and 752(b), in combination with McKee s bifurcation construct, the following would seem to result from the mechanical application of the statutes. B should be treated under Section 752(c) as having assumed only $1.2 of the $1.8 of partnership debt. Under Section 752(b), B is treated as if it received a cash distribution of $1.8 and, under Section 752(a), makes a capital contribution to the partnership of $1.2 since it made a deemed capital contribution to Partnership AB as a result of assuming the liability, resulting in an outside basis of $1.2. Under Section 732(b), B s $1.2 of basis in its partnership interest becomes its basis in the assets of LLC. 22

V. The Curious Incident of the (Possibly) Vanishing Basis? (Contd) V. The Curious Incident of the (Possibly) Vanishing Basis? (Cont d) Application of Section 752(c) to Liquidating Distributions What happens to the $.2 of partnership level basis that has disappeared and the $.6 of the excess nonrecourse liability that B is not treated as assuming due to application of Section 752(c)? In a nonliquidating distribution, McKee posits that the $.6 excess nonrecourse debt that is not treated as assumed by B under Section 752(c) would remain a liability of Partnership AB for purposes of Section 752. When and if B makes payments with respect to this portion of the liability, B would be treated under Section 752(a) as if it made a capital contribution to Partnership AB, increasing its basis in its Partnership AB interest. However, since Partnership AB has liquidated, it is unclear what happens. McKee suggests that any basis associated with this portion of the liability could be lost forever, or this portion of the liability could be deemed assumed by B upon liquidation of the partnership. The latter possibility seems to be inconsistent with the express language of Section 752(c). If the lenders to LLC had foreclosed on the equity or assets of LLC before the liquidation of Partnership AB, then the partnership would have an amount realized of $.4 under Treasury Regulation Section 1.1001-2 and Tufts. If the basis in LLC is adjusted downwards to LLC s $1.2 fair market value, then $.4 of partnership level Tufts gain will have been converted into $.6 of Tufts gain. An additional $.2 of basis has seemingly disappeared without anyone recognizing a loss. 23

V. The Curious Incident of the (Possibly) Vanishing Basis? (Contd) V. The Curious Incident of the (Possibly) Vanishing Basis? (Cont d) Application of Section 752(c) to Liquidating Distributions Treas. Reg. Section 1.1001-2(a)(3) provides that a seller s amount realized on the sale of property does not include a liability incurred by reason of the acquisition of the property sold, except to the extent the liability was taken into account in determining the seller s basis in the assets sold. Arguably, this regulation would permit B to exclude from its amount realized the $.6 of excess nonrecourse liability, since the entire liability was assumed by B as a result of acquiring LLC through a liquidating distribution and the excess nonrecrourse liability was not included in B s basis. If that were the case, then it would appear that B could entirely avoid including the portion of the liability in excess of in its amount realized, regardless of whether its basis in LLC is $1.2, $1.4, or even zero, because the portion of the nonrecourse liability in excess of fair market value would not have been reflected in its basis. In this case, $.4 of partnership level Tufts gain would have been converted into no gain at the partner level. This also is an inappropriate economic result, although on its face there is an argument that Treasury Regulation Section 1.1001-2(a)(3) applies. A strong case can be made from a policy perspective that B s basis in LLC should be a $1.4 carryover basis from Partnership AB. To the extent that B makes any payments on the portion of the nonrecourse liability in excess of the fair market value of LLC, the payment should be added to its basis in LLC s assets. After all, nothing has really changed substantively from an economic standpoint. The debt was nonrecourse to B both before and after the distribution, and no gain or loss was recognized as a result of the distribution. Carryover basis preserves the status quo- it maintains the same amount of built-in gain in LLC s assets. 24

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)