How to Backtest a Trading Strategy in Algo Backtesting Guidance

Algo trading is becoming popular among traders due to unlimited number of Algo trading software introduced in the market. These Algo trading software are equipped with all types of trading strategies from simple intraday to complex option strategies.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

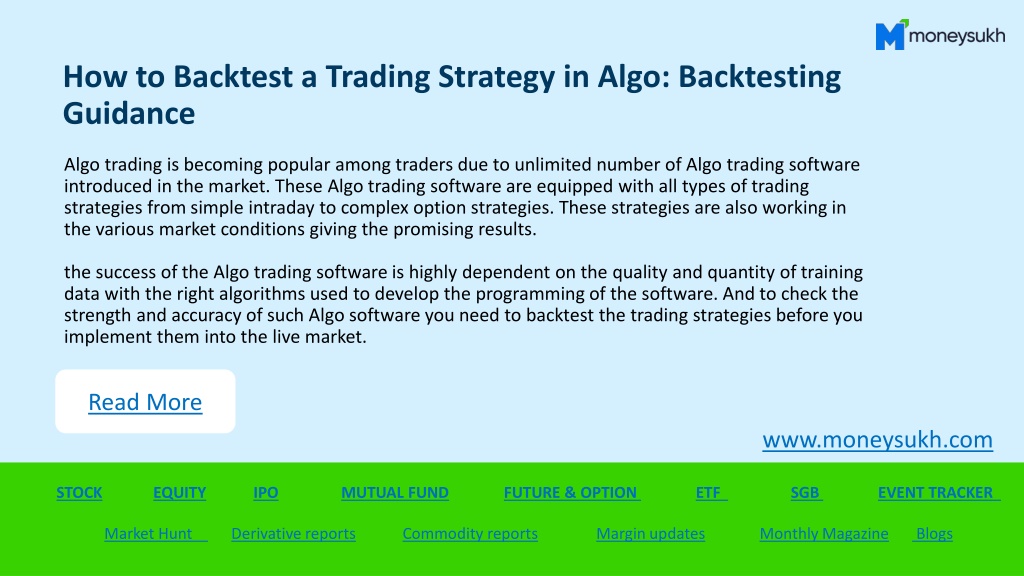

How to Backtest a Trading Strategy in Algo: Backtesting Guidance Algo trading is becoming popular among traders due to unlimited number of Algo trading software introduced in the market. These Algo trading software are equipped with all types of trading strategies from simple intraday to complex option strategies. These strategies are also working in the various market conditions giving the promising results. the success of the Algo trading software is highly dependent on the quality and quantity of training data with the right algorithms used to develop the programming of the software. And to check the strength and accuracy of such Algo software you need to backtest the trading strategies before you implement them into the live market. Read More www.moneysukh.com STOCK EQUITY IPO MUTUAL FUND FUTURE & OPTION ETF SGB EVENT TRACKER Market Hunt Derivative reports Commodity reports Margin updates Monthly Magazine Blogs

What Does it Mean to Backtest a Trading Strategy? Backtesting of a trading strategy in the stock market, especially of an automated software is the process of evaluating the performance of the trading strategies, how it would have been performed in past. The historical data is used to determine the potential and accuracy of the strategy in various market conditions giving valuable insights into Algo's performance. Read More www.moneysukh.com STOCK EQUITY IPO MUTUAL FUND FUTURE & OPTION ETF SGB EVENT TRACKER Market Hunt Derivative reports Commodity reports Margin updates Monthly Magazine Blogs

Why Backtesting is Important in Algo Trading? The backtesting of such automated trading software is very important to evaluate the performance of Algo in various market conditions. Based on outperform or underperform, you can adjust the parameters or modify the other strategy as per the desired outputs. You can adjust the trading rules or change the entry and exit points to improve the returns and reduce the risks Read More www.moneysukh.com STOCK EQUITY IPO MUTUAL FUND FUTURE & OPTION ETF SGB EVENT TRACKER Market Hunt Derivative reports Commodity reports Margin updates Monthly Magazine Blogs

How to Backtest a Trading Strategy in Algo? The backtesting process of trading strategy might differ from Algo to Algo trading software, but in all the cases, you have to use the historical data and backtest the strategy as per the market conditions and your risk profile and trading goals. However, for a common understanding, you can follow the guidance given below to backtest any Algo trading software. Read More www.moneysukh.com STOCK EQUITY IPO MUTUAL FUND FUTURE & OPTION ETF SGB EVENT TRACKER Market Hunt Derivative reports Commodity reports Margin updates Monthly Magazine Blogs

Stepwise Guidance to Backtest Algo Trading Strategies Defining the Trading Strategy In Algo trading first of all you have to define the criteria or parameters you want to apply in your strategy. You have to outline the conditions for entering and exiting from a trade position with the risk management strategy like using the stop loss to minimize the impact of losses. For accurate backtesting, a well-defined strategy in Algo is important for further analysis. Read More www.moneysukh.com STOCK EQUITY IPO MUTUAL FUND FUTURE & OPTION ETF SGB EVENT TRACKER Market Hunt Derivative reports Commodity reports Margin updates Monthly Magazine Blogs

Collecting the Historical Data To perform the backtesting you need sufficient data of the market or underlying security on which you want to backtest your strategy. You have to collect the reliable data of the market or the underlying security. In the historical data, you need trading price, volume and trading-related other details that can stimulate your trading strategy. Read More www.moneysukh.com STOCK EQUITY IPO MUTUAL FUND FUTURE & OPTION ETF SGB EVENT TRACKER Market Hunt Derivative reports Commodity reports Margin updates Monthly Magazine Blogs

Selecting the Backtesting Platform Now you have to choose the right Algo trading platform or software where you can run your backtesting strategy. You can choose the Algo Test or any other popular Algo trading platform to use the data and implement your backtesting strategy. But make sure the data you are going to use in the Algo, would be compatible or able to use as per your strategy. Read More www.moneysukh.com STOCK EQUITY IPO MUTUAL FUND FUTURE & OPTION ETF SGB EVENT TRACKER Market Hunt Derivative reports Commodity reports Margin updates Monthly Magazine Blogs

Implementing the Trading Strategy To implement the strategy into Algo you can select the same data here and set the rules and parameters as per your defined trading strategy. To implement the trading strategy in Algo you should have some technical knowledge or programming and coding to set your strategy, define the entry or exit points and set the stop loss points. Read More www.moneysukh.com STOCK EQUITY IPO MUTUAL FUND FUTURE & OPTION ETF SGB EVENT TRACKER Market Hunt Derivative reports Commodity reports Margin updates Monthly Magazine Blogs

Running the Backtesting Process The next step is the execution of your strategy for backtesting as per your defined rules and parameters. Using your historical data the Algo will perform the transaction of buying, selling or exiting from the trade position as per the movement in the price. It creates a hypothetical trading process and based on the conditions it will show you the outcomes. Read More www.moneysukh.com STOCK EQUITY IPO MUTUAL FUND FUTURE & OPTION ETF SGB EVENT TRACKER Market Hunt Derivative reports Commodity reports Margin updates Monthly Magazine Blogs

Thank You Contact us: 96382-37000 Mansukh Securities and Finance Limited: SEBI Registration Number-INZ000164537 ( Members- NSE,BSE,MCX, ),IN-DP-72-2015 ( DP-NSDL, CDSL ) Mansukh Stock Brokers Limited : SEBI Registration Number- INZ000164937 ( Members -BSE ), IN-DP-36-2015 Mansukh Commodity Futures Private Limited : SEBI Registration Number-INZ000063032 ( Members- NCDEX ) Mansukh IFSC Broking Private Limited : SEBI Registration Number- INZ000099432 (Members- NSE IFSC, INDIA INX)Procedure to file a complaint on SEBI SCORES: Register on SCORES portal. Mandatory details for filing complaints on SCORES: Name, PAN, Address, Mobile Number, E-mail ID. Benefits: Effective Communication, Speedy redressal of the grievances Investments in securities market are subject to market risks; read all the related documents carefully before investing. www.moneysukh.com STOCK EQUITY IPO MUTUAL FUND FUTURE & OPTION

Related Resources What Is Short Covering In Stock Market & How To Identify Rally? Importance Of Volume In Technical Analysis: Use & Role In Trading What Is Short Selling & How Does It Work: Is It Good Or Bad? Trading or Investing Which is Better and More Profitable? Best Algo Trading Platform and Trading Strategies Best Intraday Algo Strategy USD INR Options Trading Strategies How to Read, Analyse & Use Candlestick Chart STOCK EQUITY IPO MUTUAL FUND FUTURE & OPTION ETF SGB EVENT TRACKER Market Hunt Derivative reports Commodity reports Margin updates Monthly Magazine Blogs

![Guardians of Collection Enhancing Your Trading Card Experience with the Explorer Sleeve Bundle [4-pack]](/thumb/3698/guardians-of-collection-enhancing-your-trading-card-experience-with-the-explorer-sleeve-bundle-4-pack.jpg)