How a Second Hand Car Loan Can Turn Your Daydream into Reality

nHave you ever daydreamed about driving your dream automobile but thought it was out of reach? Think again! With a used automobile loan, that goal is closer than you would think.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

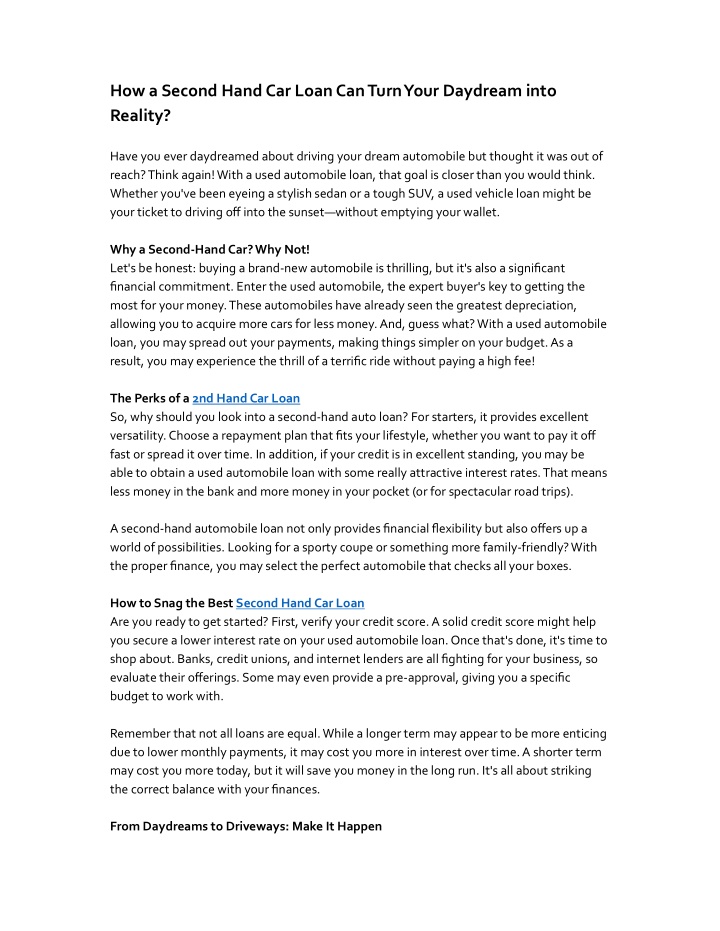

How a Second Hand Car Loan Can Turn Your Daydream into Reality? Have you ever daydreamed about driving your dream automobile but thought it was out of reach? Think again! With a used automobile loan, that goal is closer than you would think. Whether you've been eyeing a stylish sedan or a tough SUV, a used vehicle loan might be your ticket to driving off into the sunset without emptying your wallet. Why a Second-Hand Car? Why Not! Let's be honest: buying a brand-new automobile is thrilling, but it's also a significant financial commitment. Enter the used automobile, the expert buyer's key to getting the most for your money. These automobiles have already seen the greatest depreciation, allowing you to acquire more cars for less money. And, guess what? With a used automobile loan, you may spread out your payments, making things simpler on your budget. As a result, you may experience the thrill of a terrific ride without paying a high fee! The Perks of a 2nd Hand Car Loan So, why should you look into a second-hand auto loan? For starters, it provides excellent versatility. Choose a repayment plan that fits your lifestyle, whether you want to pay it off fast or spread it over time. In addition, if your credit is in excellent standing, you may be able to obtain a used automobile loan with some really attractive interest rates. That means less money in the bank and more money in your pocket (or for spectacular road trips). A second-hand automobile loan not only provides financial flexibility but also offers up a world of possibilities. Looking for a sporty coupe or something more family-friendly? With the proper finance, you may select the perfect automobile that checks all your boxes. How to Snag the Best Second Hand Car Loan Are you ready to get started? First, verify your credit score. A solid credit score might help you secure a lower interest rate on your used automobile loan. Once that's done, it's time to shop about. Banks, credit unions, and internet lenders are all fighting for your business, so evaluate their offerings. Some may even provide a pre-approval, giving you a specific budget to work with. Remember that not all loans are equal. While a longer term may appear to be more enticing due to lower monthly payments, it may cost you more in interest over time. A shorter term may cost you more today, but it will save you money in the long run. It's all about striking the correct balance with your finances. From Daydreams to Driveways: Make It Happen

Now that you've received your used car loan, it's time to go automobile shopping! Look for a vehicle that has been well-kept and has a clear history. Dealership-certified pre-owned vehicles frequently have warranties, providing additional piece of mind. Before signing anything, have it checked out by a mechanic. Once everything checks up, your lender will take care of the rest, and you'll be driving your ideal automobile in no time. Ready to Roll? A used vehicle loan is more than just a financial instrument; it's your ticket to owning your ideal car. With the appropriate financing and some smart purchasing, you'll be behind the wheel of a car you adore without the financial strain. So why keep dreaming? Take the plunge, acquire a used car loan, and transform your daydream into a daily driver. Your ideal vehicle is just a loan away!