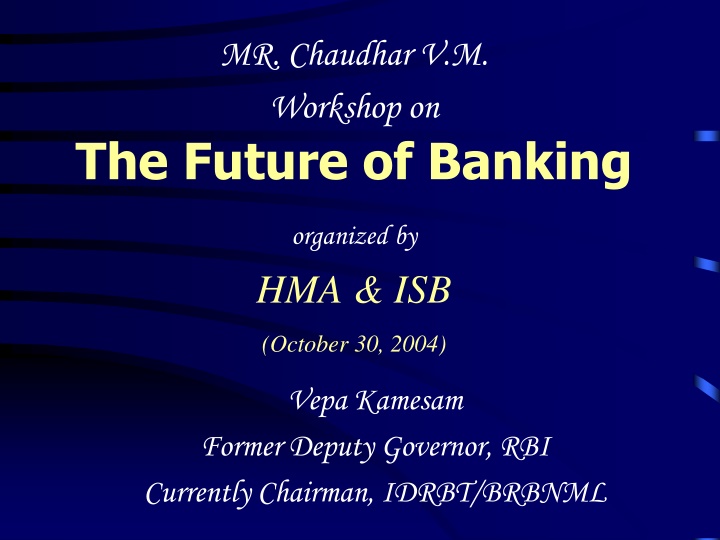

Future of Banking Workshop Highlights

The Future of Banking workshop organized by HMA & ISB in 2004, featuring Vepa Kamesam, discussed the harmonization of banking with technology, innovative risk management, benefits of technology in banking, and focus areas in commercial banking. The event emphasized the integration of technology for enhanced operational efficiency, profitability, and customer service in the banking sector.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

MR. Chaudhar V.M. Workshop on The Future of Banking organized by HMA & ISB (October 30, 2004) Vepa Kamesam Former Deputy Governor, RBI Currently Chairman, IDRBT/BRBNML

Technology and Banking The Quintessence Nature of Banking harmonizes closely with Technology Tasks Common to Both Information Storage Processing Transmission Technology Banking INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

Innovative Risk Management Complex Credit Calculations Global Operations Pervasive Branch Network Mass Transaction & Items Processing INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

Many Benefits of Technology Increased operational efficiency, profitability & productivity Superior customer service Multi-channel, real-time transaction processing Better cross-selling ability Improved management and accountability Efficient NPA and risk management Minimal transaction costs Improved financial analyses capabilities INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

Focus aspects of Commercial Banking now are: BANK S BUSINESS LOANS & MISC. SERVICES ATMs Core MIS & Intranet RAISING DEPOSITS Banking (CBS) POS Terminals and Cash dispenser Electronic Banking Card Corporate Network Management Any Branch Banking Document Management Risk Resource Management CRM Management BANK S BUSINESS INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

Financial Technology Infrastructure Data Center to host servers for: CBS ATM/Financial Switch Internet Banking DW/DM/CRM/MIS etc. Back-office Application E-mail Servers, Internet Server, Enterprise-wide Network & Networking Equipment Security Systems Systems at Branches/RO/ZO/CO Depts. Supporting Systems Disaster Recovery Site & Business Continuity INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

Technology A Differentiator Technology is indeed a differentiator not only in terms of competitive advantage, but also in terms of administrative and back-end processes . But due to rapid technology deployment in Indian banking sector, the haves and have- nots gap is all set to narrow quickly. INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

Technology Differentiation Fades Gradually. INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

How Long a Differentiator? Then .can technology be enough of a differentiator? Any new technology or technology-enabled process can act as a differentiator or a competitive edge for some level of time. After that time, the technology still has to be adopted as a necessity and as a cost of doing business Thanks to shortening technology life cycles, it would be short sighted to assume that technology would be a long term differentiator INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

For Long-Term Differentiation Elements of Technology as a Differentiator Efficient utilisation, mgmt Scalability & Flexibility Process enabling Utility to customer Support Skills INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

Issues with Customers Not only employees, there are problems for customers too when a new technology arrives The major challenges Comfort levels Security and trust issues Convenience factor Getting rid of myths Migration from existing to new systems Changing the habits INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

POS Terminal and Cash Dispenser POS Terminal Connected to Cash dispenser INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

ATM Electronic Banking Branch Banking Branch 3 Branch 2 Branch 1 Head Office Branch 4 Branch n Branch 5 Branch 6 INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

Technology Acquisition Inappropriate technology purchases can be the root of all problems The Bank management has to: Give thought to the utilization rate Avoid knee-jerk reactions ( they have done it I should also do it ) Be impartial in technology decisions ( I like that technology I want it ) Understand where the solution will fit AND where it won t! Assess the strengths & weakness of solution And seek answer to are we ready for it? INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

Differentiation is attained not Differentiation is attained not achieved just through technology, it is gained in the way the technology is selected, technology, it is gained in the way the technology is selected, implemented and utilised implemented and utilised achieved just through Goal definition Integrating business & technology goals Solution features Vendor selection Business process re-engineering Change management Efficient utilisation Customer utility Technology Management Support functions Maintenance Back-ups and Disaster Recovery Scalability & flexibility Learning & evolution Technology Technology For Sustained For Sustained Differentiation Differentiation INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

Regulation and Supervision The Challenge Challenge of Technology: New markets, products, services, delivery channels Opened up a market for risks derivatives Challenge of financing tech firms & IT innovation all have implications for the stability of banks and of the economy The Opportunity Regulators have new tools Focus of all recent financial sector reforms Emergence of non-intrusive, focused supervision with a view to prevent frauds and disturbances to financial stability INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

Technology and Banking Supervision THE RBI RESPONSE Offsite Supervision & Monitoring OSMOS COSMOS (Non banking Financial Companies / Development Financial Institutions) UBD Soft Credit Information Bureau (A joint venture between Housing Development Finance Corporation Ltd., State Bank of India, Trans Union International Inc. & Dun & Bradstreet Information Services India Pvt. Ltd.) Will be covered in detail by Speaker Dr. T.V. Gopalakrishnan INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

Currency Management and Technology Opportunities Galore Currency Management - a formidable task in India given the geographical size, the volume and value of notes and coins in circulation, preference for cash and currency handling practices ...but technology offers immense opportunities to improve performance RBI s The Clean Note Policy (1999) Establishment of 2 state of the art currency presses Technology driven anti counterfeit measures 48 fully automated Currency Verification & Processing Systems 21 Shredding and Briquetting Machines INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

Technology & Monetary Systems Technology has: Transformed the conduct of the payment and settlement system Set the stage for an unprecedented growth in financial activity across the globe Rendered more vulnerable the domestic payment system and financial stability to international shocks making the conduct of monetary policy more complex and prone to implementation and operational risks INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

Technology & Monetary Systems The Opportunities The proliferation of IT has also set the stage for improving and managing risks in payment systems Electronic Trading Systems DVP/PVP RTGS Secured Netting Systems The growth of the Central Counterparty (CCP) Continuous Linked Settlement INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

IT and Payment and Settlement Systems Real Time Gross Settlement Electronic Dealing Platforms Delivery Versus Payments INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

NFS/IBPG CFMS NEFT RTGS PKI-based Security RBI INITIATIVES IN PAYMENT & SETTLEMENT SYSTEMS PDO-NDS & SSS SFMS Compliance with BIS Core Principles INFINE T Clearing Corporation of India IDRBT INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

RBI Initiatives in Payment and Settlement Systems (1) The IDRBT Network Externalities The Indian Financial Network (INFINET) Messaging Solutions The Structured Financial Messaging System (SFMS) Security Public Key Infrastructure IDRBT CA National Financial Switch Inter Bank Payment Gateway INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

Financial Networks Reuters Network SWIFT Network NSE Gateways and Integration with Other Financial Network Services Network G1 - SWIFT Network G2 - Reuters Network G3 - Stock Exchange Network G4 - Inter Banks/FIs G5 - Shared ATMs G6 - Clearing Operations Network G7 - Internet G2 G3 G3 G2 G1 G1 Corporate Network G1G2G3 G1G2G3 INFINET G1G2G3 Inter Banks/FIs Network G4 Shared ATMs Network G5 G4 G4 Clearing Operations Network G5 G6 G5 Internet G7 INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

Structured Financial Messaging System Central Server at IDRBT Bank Bank- -1 Gateway 1 Gateway Bank Bank- -2 Gateway 2 Gateway Bank Bank- -n Gateway n Gateway .. . . .. .. . .. . . Branch Branch- -1 1 Branch Branch- -2 2 Branch Branch- -n n Branch Branch- -1 1 Branch Branch- -2 2 Branch Branch- -n n Branch Branch- -1 1 Branch Branch- -2 2 Branch-n INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

PKI Hierarchy CCA IDRBT CA IDRBT CA Repository RA RA RA Subscriber Subscriber Subscriber Subscriber Subscriber Subscriber INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

NFS CONNECTIVITY with Existing Consortiums & Individual Banks National Financial Switch & E- Payment Gateway ISDN ISDN Leased Line Leased Line Bank 2 Bank 1 ISDN INFINET Leased Line Bank N Broad Band VSAT Leased Line ISDN ISDN Leased Line ISDN CashNet BANCS & Cashtree Location: Mumbai IP Address:202.138.123.68 MITR Subnet Mask: 255.255.255.254 Location: Chennai Primary Link Location: Mumbai Backup Link INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

RBI Initiatives in Payment and Settlement Systems (2) A Real Time Gross Settlement System Reduction of systemic risk in inter bank payment systems To be implemented by the year end The Centralised Funds Settlement System Facilitating effective liquidity management The Negotiated Dealing System A modern electronic dealing platform for gilts Enabling Straight Through Processing INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

Real Time Gross Settlement CFMS IAS Settlement Accounts Intra Day Liquidity SSS IFTP Processes Strip & Store RBI Payments and Actg. Entry Interface NSS INFINET Participant s Interface Participant s Interface Participant s Interface INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

RTGS Scenario 90 banks have implemented it 3-4 more to implement in a fortnight Customer transactions have already started Total volumes Transactions on average Rs.20,000 crores per day settled continuously from the time of opening of markets Guarantee settlement fund INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

RBI Initiatives in Payment and Settlement Systems (3) The Securities Settlement System Providing centralized depository and settlement services Seamlessly integrated with the NDS and RTGS Systems The Clearing Corporation of India Secured netting services with central counterparty arrangements G-Sec and Forex segments Elimination of settlement risks with liquidity saving elements INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

Smart Cards The Future Multi-application Smart Card Channel of the future Pilot project started Pilot Project funded by MCIT, Govt. of India The project is in progress in partnership with IDRBT, IIT Bombay, and Banks in India INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

RBI and Customer Service(1) Dissemination of information The RBI website Multiple Delivery Channels Coin & Note Dispensing Machines For the general public Interactive Voice Response System For banks and financial institutions Web server For government customers On the anvil . A secured web server SFMS/email based communication with customers INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

RBI and Customer Service...(2) Improvements in payment and settlement systems MICR Clearing Enabling faster clearing of cheques Cheque Truncation & E-Cheques On the drawing board ECS/EFT Enabling T+2 settlement of our equities market National EFT Enabling T+0 settlement of all customer funds transfer transactions INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

Technology Vision of the RBI Desk Top Decision Making Capability Centralised Database Management System Enterprise Knowledge Management System Desk Top Analytical Capability Offsite Supervisory Systems Integrated Forex Management System Human Resource Information System Desk Top Transactional Capability Integrated Accounting System Integrated Government Accounting System Currency Operations System Securities Settlement System Integrated Establishment System INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

Issues in Implementation Less than 10% of failures are due to technical snags Less than 10% of failures are due to technical snags most are due to poor management and implementation poor management and implementation most are due to Resistance to change Overlooking process reengineering Project management Dedicated project teams Change management Policies People Skills & Training Basic Infrastructure telecom, power Security Privacy & confidentiality Legal and regulatory issues INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

Pre-requisites for Technology Human Resource Business Process Re-engineering Empowerment Planning for Disasters INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

The pre-requisites for Technology Planning for disasters Increased operational risk Business Continuity Planning Business Process Re-engineering Human Resource Empowerment INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

Getting Personal with Personnel People represent the most precious asset People represent the most precious asset Large employee base largely untrained. Training scope & methodology? VRS to balance costs. Break even? Down sizing? Bring in young blood Campus recruitment Re-defining & designing jobs. Career paths? Specialist Vs. Generalist Attrition of trained employees to IT industry / other banks. Competitive incentives? Re-location of personnel. Union issues? Retrained personnel. Morale of employees? INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

Need for Training All these developments call for extensive, continuous training Current and future technology implementations call for at least 20% of officers specialise in IT Hence need for specially skilled people a mix of: System administrators Application managers (knowledgeable about both banking and technology) Technology managers (who form the core team of technology professionals). INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

Security Risk Management Security is about cementing the weak link Strong security measures (physical & data security) plus disaster recovery are essential Authentication of e-banking customers and accountability for e-banking transactions Segregation of duties, proper authorization controls etc. Physical security measures - Graded access control, Iris & X-ray scanners, CCTV & detection systems, hotline and wireless links, fingerprint readers, concealed cameras, various sensors, bollards, boom barriers etc. Disaster Management and Disaster Recovery sites INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

How to Ensure Security??-A Framework Assess Respond Protect Detect INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

IDRBTs Solutions for Security Risk Management (SRM) Risk Assessment Gap IS Audit Analysis SRM for Banks Policy & Procedures Development Awareness by Training INFINET PKI Implementation INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

At a Glance. Technology Related Issues People Related Issues Reskilling Monetary systems, Efficient Telecommunication & Infrastructure to Drive Banking on Real-time Basis Risk Management & Physical Security INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004

The future will be not be more of the same we need to be ready.. INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY Vepa Kamesam, Chairman IDRBT October 30, 2004