Funeral Industry Trends and Insights

The funeral industry is experiencing shifts with fewer funeral homes but increased revenues. Cremation rates are rising, while more consumers seek personalized services and alternative memorial options. Insights into evolving consumer preferences and job opportunities for funeral service workers are also highlighted.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

More Revenues for Fewer Funeral Homes According to the National Funeral Directors Association (NFDA), the number of funeral homes decreased from 19,352 during 2016 to 19,322 for 2017 (a decrease of 0.16%). Industry revenue increased, however, 5.1% to $14.476 billion from 2014 to 2015. For 2016, the US Census Bureau counted 15,611 funeral home and services companies. Most were small, with 49.2% having 1 4 employees; 29.7%, 5 9 employees; 16.4%, 10 19 employees; 4.2%, 20 49 employees; and 0.45%, 50 or more. A 2017 consumer survey from the NFDA found only 18.9% of respondents contacted more than one funeral home. Of those who contacted more than one, 52.3% did so to compare prices.

Tracking the Inevitable The latest death data from the Centers for Disease Control show a rate of 844 per 100,000 population and a life expectancy of 78.8 years. The death rate increased for younger age groups and decreased for older age groups. Death rates are highest for African American males, followed by Caucasian American males, African American females and Caucasian American females. There were more deaths from unintentional injuries and suicide and fewer from diseases, such as cancer. People between the ages of 65 and 79 years account for 27.7% of the funeral service market, and those 80 and older are 46.1% of the market.

Cremation Is an Increasing Alternative A slight majority of families, or 50.2%, opted for cremation of their deceased during 2016, compared to 48.5% for 2015. Fewer chose burial during 2016 than 2015, or 43.5% and 45.4%, respectively. The NFDA expects the cremation trend to continue, with the cremation rate reaching 78.8% of deaths by 2035. It predicts that the cremation rate will exceed 50% in 44 states by 2025, increasing from 16 states during 2010. Almost 30% of funeral homes operate their own crematories and an additional 9.4% plan to add one by 2023. Americans 80 years of age and older are less likely to choose cremation and are more likely to be buried.

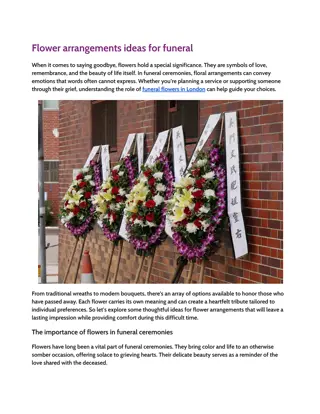

Consumers Evolving Perspectives and Attitudes More people are choosing to hold memorial services outside the traditional funeral home setting and more want personalized ways to honor the deceased. More than a third (34.5%) were interested in having a therapy dog present during the funeral service. Religious observances are less important than during the past, decreasing from 49.5% during 2012 to 39.5% for 2017. This has driven increased interest in cremations. Telling stories about the departed and green funerals are also trends. As the cremation rate has increased, more consumers want to hold a memorial service with the cremation (40.4% for 2017 compared to 35.1% for 2015). More are aware they can have a viewing before a cremation (47.8% vs. 39.7% for 2015).

Funeral Directors Insights According to the US Bureau of Labor Statistics, there were 54,400 funeral service worker jobs during 2016 and jobs are forecasted to increase by 5% (average) through 2026. The 2017 median annual wage was $56,850, and $78,040 for funeral service managers. There are a variety of technology tools for the funeral industry, including an app from ASD, a funeral home answering service, which allows funeral directors to access, return calls and track calls, and Everdays, which notifies friends/family members of a death. Changes in the public s attitude toward funerals are challenging for funeral directors, as only 51.9% of the public agrees funerals are an important tradition and 71% of families do not want a traditional funeral.

Marketing a Necessary Service Funeral marketing tends to be haphazard: only 41% of funeral homes have a defined business plan, and 38% a defined marketing plan. Fewer than half (48%) of funeral homes use a marketing company. Incoming calls account for a significant amount of funeral home business. While almost a third (31%) say that shopper calls contribute less than 10% of their business, 33% said 10 20%; 19%, 20 30%, 8%, 30 40%; and 9%, more than 40%. More families are opting to have a party to celebrate the deceased s life, rather than a somber funeral. To capture that market, some funeral homes are shifting to become more like event spaces and are even obtaining liquor licenses.

Advertising Strategies For those funeral homes with an adequate advertising budget and want to market themselves aggressively, TV and direct mail is an excellent combination. TV spots can communicate the sending of a direct mail piece and with a possible offer. You may find that funeral homes offering more progressive services, such as green funerals and celebratory party services, will be better prospects because they are able to differentiate themselves from the traditional home. Advise funeral home directors to offer to be a speaker at community organizations, churches and other local clubs and forums, especially to speak to middle-aged adults with parents or grandparents about funeral choices, types of services they offer, etc.

New Media Strategies Offer a special service to families of heartwarming, or even humorous, obituaries or obituary poems. Post these on Facebook with photos or even videos as a creative method to honor the deceased person and showcasing your creativity. Advertise grief support groups on Facebook, Twitter and other social media platforms, with written and/or video comments from participants about how much the group helped them. Create a memorial video, including snippets from the deceased s life, his or her family members/friends explaining his or her strengths and/or how he or she contributed to the family and community. Post on your Website and YouTube (with the family s permission).